Total payrolls rose by 4.800 million in June, with the May estimate revised upward by 90,000. Private-sector payrolls rose by 4.767 million jobs in June, with May revised upward by 27,000. Finally, the “core” jobs measure we focus on, private-sector jobs excluding construction and retailing, rose by 3.869 million in June, with May revised upward by 71,000.

Those May job gains a month ago were startlingly better than consensus estimates, showing gains of around 3 million when the consensus was looking for declines of 8 million. Today’s announced gains for June are almost twice as large as what the consensus was looking for. The “extra” 2.3 million jobs announced today would have been startling just a year ago. That they pale in comparison to last month’s surprise is merely a sign of the times…more on that in a moment.

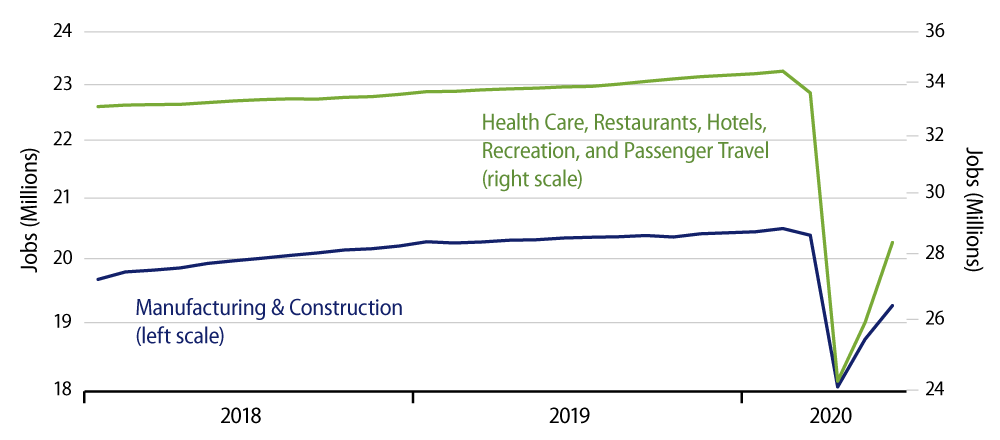

As strong as today’s gains were, they leave job totals far below what we were seeing pre-COVID. Thus, total payrolls declined by 22.1 million in March and April, recouping 7.4 million of those declines in May and June. Private-sector payrolls declined by 21.1 million during the COVID shutdown and have recouped 8.0 million of those losses under the reopening so far.

As expected, gains have been relatively the strongest in goods-producing and construction sectors, while some hard-hit service sectors are only beginning to see a bounce, if that. Thus, for manufacturing, after losses of 1.363 million jobs in March and April, the rebound in May and June amounts to 0.606 million, nearly a halfway retracement. Construction lost 1.083 million jobs in March and April and has recouped 0.612 million jobs in the last two months, for a retracement of more than halfway.

Health care services were devastated by the COVID shutdown, losing 1.557 million jobs (about 10% of the February total). The rebound in the last two months has been 0.673 million, for a decent bounce. Similarly, after a loss of 6.076 million jobs in March and April (down nearly 50%), food service (restaurant) employment has rebounded by 2.945 million jobs in May and June.

In other, leisure-oriented services, however, the rebound is only nascent, if that. Thus, passenger travel sectors continued to lose jobs in recent months, down another 50,000 in May and June, following 290,000 of losses in March and April, for a total decline near 35%. Accommodations (hotels) has recouped only 125,000 of the 912,000 jobs lost (about a 45% drop) during the shutdown. Recreation and spectator sports lost 1.329 million jobs (a decline of more than 50%) during the shutdown and has recouped only 0.42 million of those under the reopening to date.

If there is a consolation in the service sectors’ travails, it is that the sectors still hurting the most are relatively small. The biggest players among services are health care and restaurants, and the rebounds there have been more substantial, though still incomplete.

As you will recall, estimates for 2Q GDP had been in the -40% range. With last month’s consumer spending gains and this month’s job gains, we would expect these estimates to move to the -25% to -30% range, and 3Q could show a gain above 20%. However, because of the arithmetic of percent changes, that combination—along with the -5% decline in 1Q—would still leave the economy way below its pre-COVID levels.

Meanwhile, we have risks of renewed shutdowns in some industries. This economy is reminiscent of a silent-movie-era serial called The Perils of Pauline, where at the end of each episode, the eponymous heroine would be faced with a new threat to her life. Stay tuned to see how we weather the risks of July.