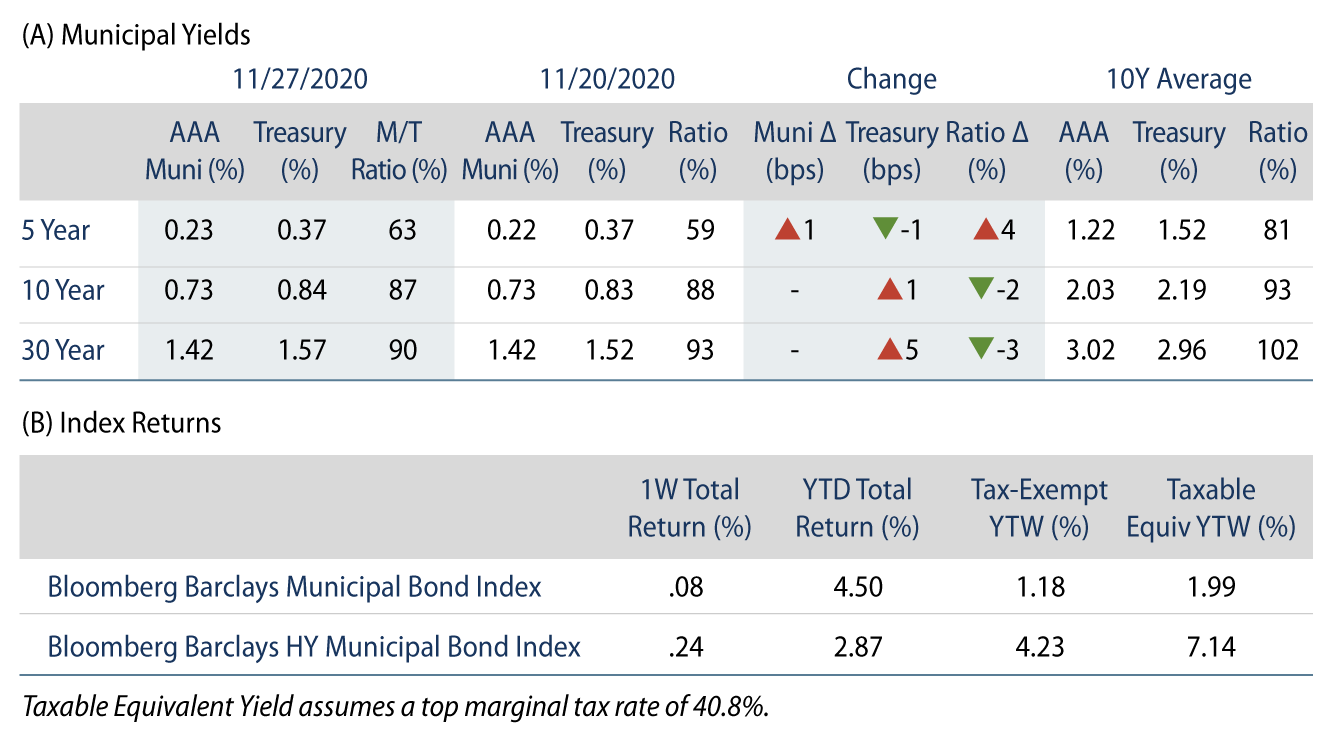

Municipal Yields Unchanged

Municipal yields were generally unchanged during the week. Technicals remained strong amid positive demand and limited new-issue volume. AAA municipal yields also were mostly unchanged, moving just 1 bp higher in short maturities. The Bloomberg Barclays Municipal Index returned 0.08%, while the HY Muni Index returned 0.24%. This week we touch on the apparent end of the Municipal Liquidity Facility (MLF), as issuers have until today (December 1) to alert the Fed of new borrowings.

Municipals Recorded Another Week of Positive Demand Amid Limited New-Issue Volume

Fund Flows: During the week ending November 25, municipal mutual funds recorded $832 million of inflows, according to Lipper. Long-term funds recorded $301 million of inflows, intermediate funds recorded $154 million of inflows and high-yield funds recorded $312 million of outflows. Municipal mutual fund net inflows YTD total $31.9 billion.

Supply: The muni market recorded just $1.8 billion of new-issue volume last week due to the holiday-shortened week. Issuance of $434 billion YTD is 18% above last year’s pace, mostly driven by higher taxable issuance as tax-exempt issuance is 3.2% lower year-over-year. New issuance is expected to ramp back up to $7 billion this week. The largest deals include $1.5 billion New Jersey Transportation Trust Fund and $500 million Illinois Toll Highway Authority transactions.

This Week in Munis: End of the MLF?

While the MLF is slated to expire on December 31, this week marks the deadline for any issuer to alert the Fed of any additional borrowing requests before the expiration of the facility. As a reminder, the MLF allowed municipal issuers to borrow up to $500 billion from the Fed, with up to a three-year term at established rates set by the Fed based on the rating of the underlying issuer.

There were hopes for a further extension of the facility as municipal issuers face unprecedented budgetary conditions, but it appears increasingly likely that the facility will wind down on its original expiration date. Earlier this month, Treasury Secretary Mnuchin sent a letter to the Fed requesting to end the emergency facilities that were established under the CARES Act, including the MLF.

The case can be made that the MLF was a contributor to positive sentiment and lower volatility in the municipal market, as well as driver of the retracement in credit spreads for Illinois and Metropolitan Transit Authority (MTA), the only issuers that found it economical to take advantage of the Fed rates. On the other hand, the reality is that the volume in the MLF was unremarkable. Considering all sides, letting the MLF expire may not be all that important right now as the impact to the broad market will likely be inconsequential, particularly as municipal supply and demand technicals continue to strengthen. The recent strong reception of MTA and NJ new issues in the municipal market provide evidence that access to capital markets remains available to challenged credits. Moreover, the facility could be reconstituted very quickly, too, since precedent is set and the upcoming administration appears more constructive on providing states and localities support to address pandemic-related challenges. Looking ahead, we are focused on short-term opportunities that arise from the expiration of these facilities.