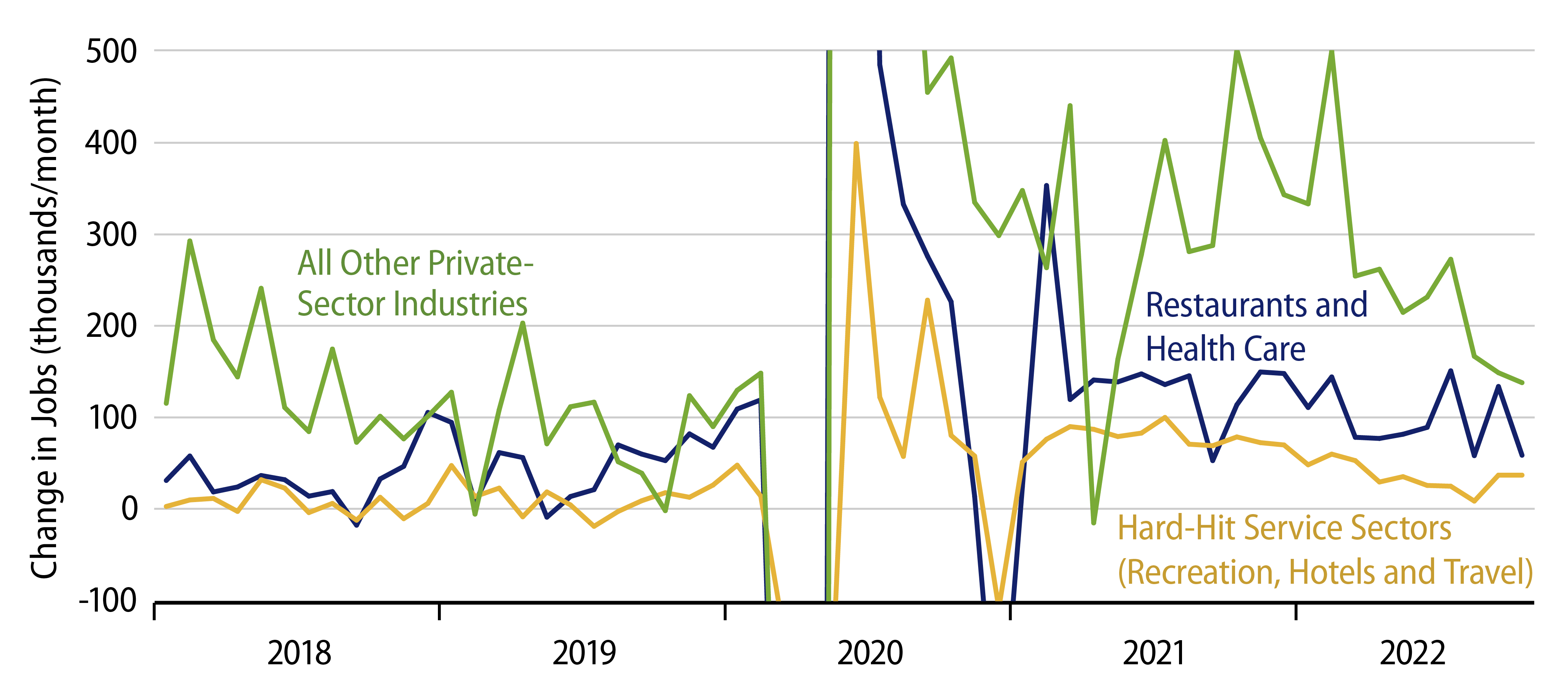

Private-sector payrolls rose by 233,000 jobs in October, diminished only very slightly by a -11,000 revision to September data. If you were looking for any sign of Fed tightening inhibiting job growth, you would have a hard time finding it in these data. Then again, one would not expect Fed tightening to be reflected in hiring until final demand and output have begun to slow, and this has not yet clearly occurred. In the meantime, the dominant theme within the job data is that firms continue to rebuild staffing following Covid shutdown losses. That process is approaching completion, but there is still a ways to go. Thus, consider the accompanying chart.

As we have remarked before, such industries as health care, restaurants, recreation, travel and accommodations were hit hard not just by the spring 2020 shutdown but also by ongoing restrictions in subsequent months. Consumer spending on these services has rebounded as much as it is likely to, but staffing remains somewhat depressed. So, while employment growth has slowed even here in recent months, it maintains a pace notably elevated relative to pre-Covid experience.

For other sectors, as you can see from the green line in the chart, job growth has slowed sharply over the last year and is now proceeding roughly in line with what was seen pre-Covid. To repeat, this slowing has nothing to do with Fed policy or even the ups and downs of economic growth. It is merely a reflection of the waning effects of the Covid experience.

Two sectors worth special notice are construction and manufacturing. Real construction spending has been declining since early-2021, but construction payrolls have yet to decline, holding steady in October, after gaining jobs in preceding months. Manufacturing output has shown signs of stalling recently, but the sector continues to add jobs at a faster pace than was seen pre-Covid. In both these sectors, the contrast between payrolls and production activity would seem to reflect attempts by producers to regain some normalcy in staffing. It is in these sectors where we would expect declining payrolls to show up first, but, again, no sign of that yet.

One piece of good news on the inflation front in this report is that wage growth continues to moderate. Average hourly wages for production workers grew at less than a 4% annualized rate in October, continuing the slowing in wage growth seen throughout this year. Last week’s data for the Employment Cost Index also showed labor costs rising in the 4-handle range in 3Q. This too would seem to be more a reflection of a normalizing labor market following Covid disruptions than a response to Fed policy. Either way, it will work to allay inflation pressures across the economy.