Today’s data from the Bureau of Economic Analysis touched on three fronts: the personal income and consumer spending reports detailed those areas for July, and both releases contained information on July inflation.

The income report showed a gain just below 0.2% for personal income and no change in disposable income, so that both measures actually declined net of inflation. Consumption data showed a strong increase in goods spending, but only a slight gain in services spending. Personal Consumption Expenditure (PCE) inflation came in only slightly above the Fed’s target, but that was thanks to a sharp decline in goods prices that offset a bounce in services prices.

This is not a good parlay so far as financial markets are concerned. The soft income data raise warning flags for the economy, even as the bounce in services inflation might stiffen the resolve of those Fed officials thinking that further tightening is necessary.

Getting into the details, while July job growth and wage growth were decent, these were partially offset by declines in workweeks, netting out to a 0.4% increase in private-sector wage income. Half of this income gain was offset by a decline in government benefits (Medicaid and, apparently, less interest relief for student loans), and the rest was offset by an increase in personal tax payments. Again, on net, disposable personal income was unchanged in nominal terms in July.

As for consumer spending, real goods consumption rose a healthy 0.9%. Real services consumption rose 0.4%, but most of this came from health care and utilities—boosted by a hot July. Services spending net of these items was up less than 0.2%.

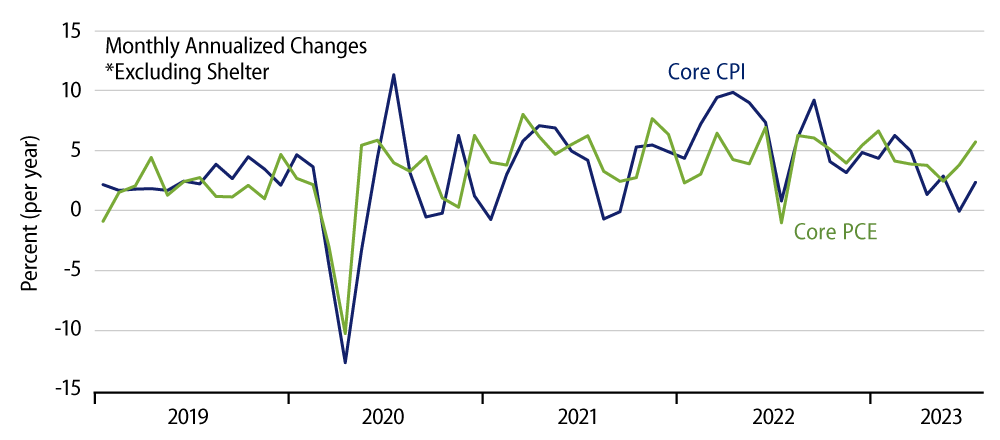

For PCE inflation, headline and core measures both registered monthly annualized rates of 2.6%. While these readings continue the trend of lower inflation this year and while they are only marginally higher than the Fed’s 2% target for core PCE, they are not as benign as the July readings for the CPI. Furthermore, as mentioned above, core goods prices registered a -5.3% annualized rate of decline, while so-called supercore services inflation (services excluding energy and rent of shelter) bounced to a 5.7% annualized rate of increase.

Supercore inflation was singled out earlier this year by Fed Chair Powell as a component of special interest in policy deliberations. Its readings over preceding months had shown an encouraging deceleration, and its opposite number within the CPI showed only a slight July gain, but the PCE measure disappointed with its bounce.

Once again, inflation trends have been encouraging this year, but there is little in today’s PCE news itself to convince the FOMC that it should cease its tightening. Meanwhile, the softer income data raise questions about consumer spending over the rest of this year.