Total housing starts rose by 21.7% in May, and starts of single-family units rose by 18.5%, following slight declines in April. This was a much stronger performance than we were expecting.

While existing homes are said to be in short supply, inventories of new homes are flush, equal to about eight months’ worth of sales, even before the May bounce in starts (compared to four months normally), and we had been expecting starts to decline further in order to begin to address the inventory overhang. That did not occur in May.

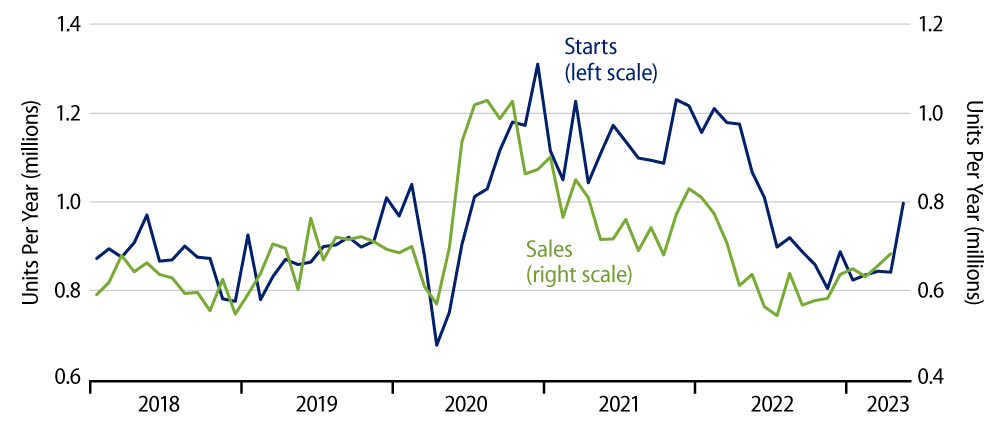

The chart depicts the situation. Single-family housing starts ran way faster than new-home sales over almost all of 2021 and 2022, creating the inventory overhang. (The scales of the chart are adjusted to allow for owner-builds, which show up in housing starts, but not in new-home sales.) Over most of the last six months, single-family starts and new-home sales have been roughly in line with each other, so that the inventory overhang hasn’t grown any worse, but neither has it been getting any better.

Then along comes the sharp increase in May. We’ll get an estimate of May new-home sales a week from today. Barring a sharp May sales gain then, inventories of unsold new homes are going to rise in line with today’s starts estimate.

Various media accounts have lately referred to the “strong” housing market. With both sales and starts still way below early-2021 levels—and ditto for existing-home sales—we think that is an exaggeration. Still, the fact remains that single-family starts have held steady since late-2022 and apparently bounced in May 2023, despite our protestations.

There was an oddity in the data in that while both single-family permits and starts rose by about the same amount in May on a non seasonally adjusted basis—17.7% for permits and 17.5% for starts—the seasonally adjusted data were quite different, with adjusted permits up “only” 4.8% and starts up the aforementioned 18.5%. It is odd that the seasonal adjustment factors for the two series are so different. However, if that merely sounds to you like someone trying to rationalize their forecast miss, then fair enough.