Today the Federal Reserve (Fed) increased its interest rate target by 75 basis points (bps), the third increase of that size in as many meetings. The magnitude of today’s move was likely determined by the higher-than-expected Consumer Price Index (CPI) data, released last week, which dealt a setback for those anticipating better news on inflation. Indeed, given the Fed’s consistent messaging around its commitment to bring down inflation, there really wasn’t any doubt that it would respond to those data with another “unusually large” hike.

With the size of the rate hike mostly pre-determined, the more interesting discussion at today’s Federal Open Market Committee (FOMC) meeting was likely around whether progress is being made in the fight against inflation. One view, perhaps, was that this hike was broadly the same as the first 75-bp hike in June. Higher-than-expected inflation, viewed alongside a robust labor market, justified a larger rate increase than was anticipated just a few weeks prior. That the monthly rate of core inflation was the same in August as it was in May (0.6% in both months) supports comparisons between the two periods. In short, according to this view, even though the Fed has talked a lot about its determination to fight inflation, not much has really changed in the last three months.

This view strikes us as much too pessimistic, however, as it ignores a number of important ways in which the environment today has changed since June. Indeed, in our view, September is not like June, even though the Fed hiked by 75 bps in both months. In particular, the developments since June suggest progress toward lower inflation. To be sure, future rate hikes will be heavily influenced by the inflation data, as was the case today, rather than by the committee’s sense of progress. Nonetheless, changes in the environment do have implications for both the Fed outlook and the outlook for investors, which we discuss at the end of this blog.

Progress in the Fight Against Inflation Since June

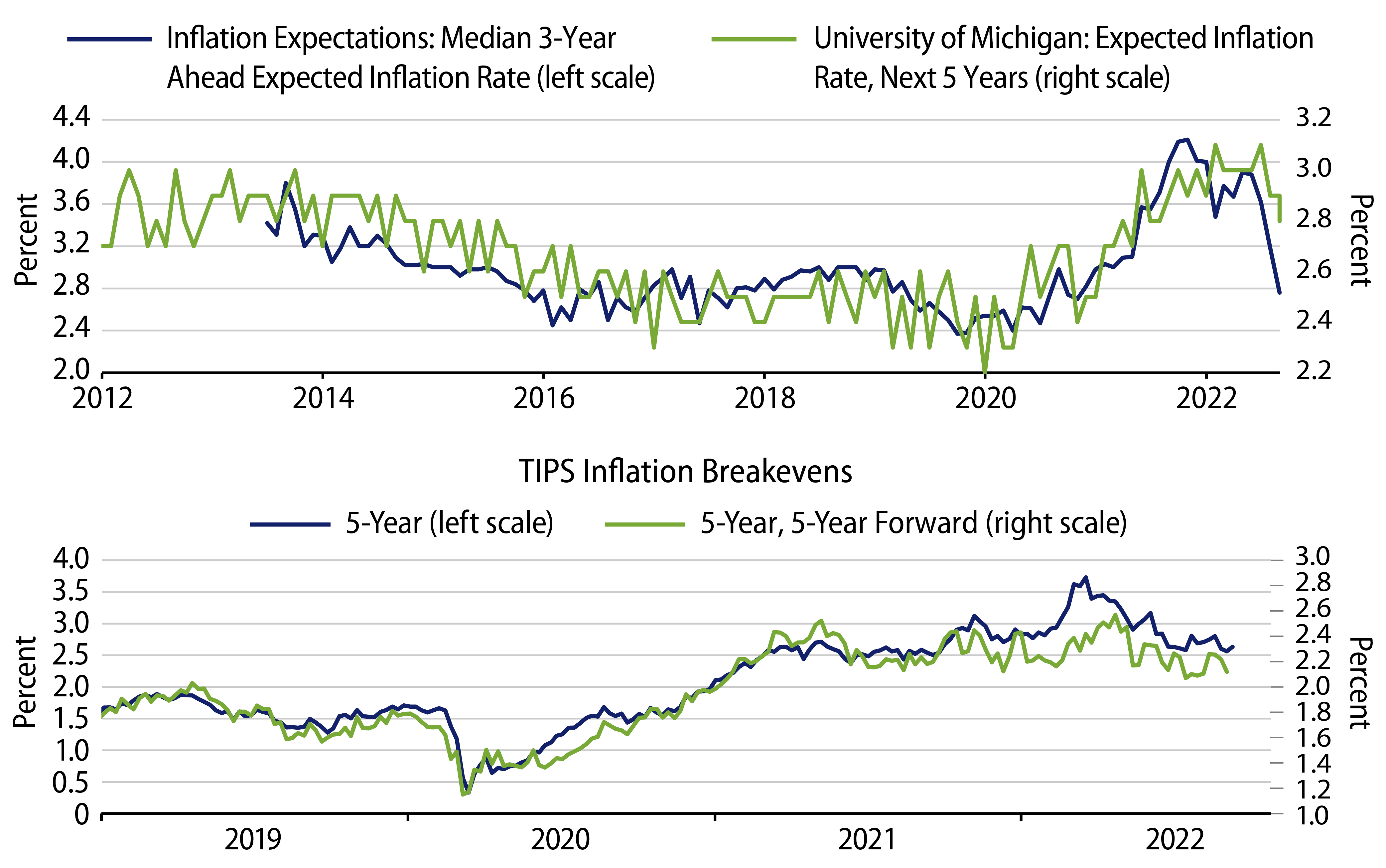

- Inflation expectations have moderated. In justifying the large hike at the June meeting, Fed Chair Jerome Powell noted his particular concern about inflation expectations moving higher. The reason for concern was straightforward: unanchored expectations can, in theory, lead to a self-reinforcing inflation cycle that can be very painful to break. Today Chair Powell has much less reason for concern. The series that was most worrisome in June has since fallen to near its lowest level of the past 18 months. Market-based measures of inflation expectations have similarly moderated (Exhibit 1). The threat posed by unanchored inflation expectations appears to have passed, for the moment.

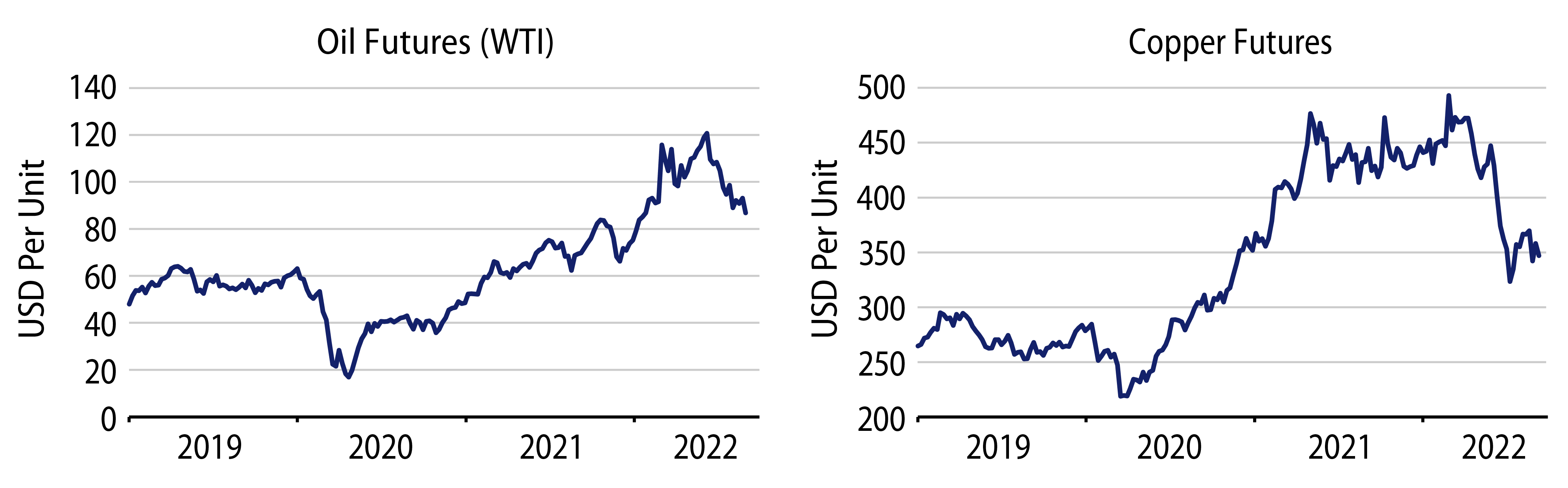

- Commodity prices have moved lower. Substantial declines in commodity prices have contributed to lowering inflation expectations. Crude oil prices are 22% lower than they were at the time of the June FOMC meeting. Copper prices, to choose just one other example, are similarly 15% lower (Exhibit 2). In addition to mattering for expectations, lower commodity prices matter in their own right, especially to the extent they reflect a deterioration in the outlook for global demand.

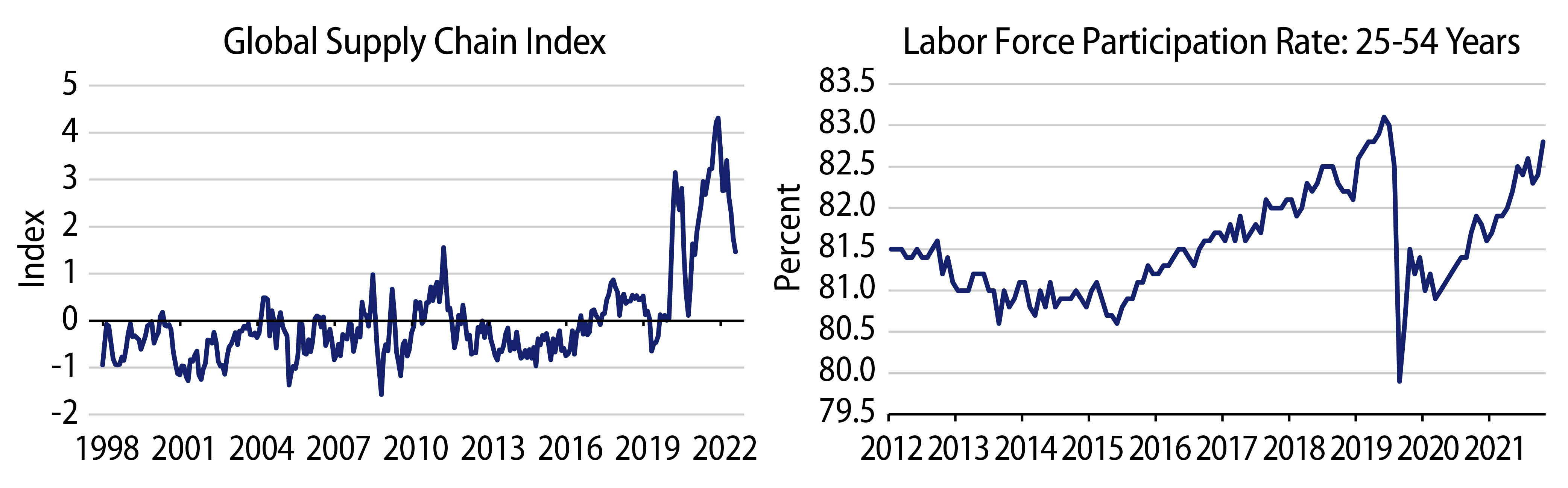

- The Covid supply shock is waning. Covid finally appears to be receding, at least in the US. Supply chains are returning to normal. Labor supply is also recovering (Exhibit 3). Indeed, last month’s uptick in the unemployment rate came entirely from a return of workers to the labor force. It’s unlikely that a recovery in supply will address the entirety of the inflation problem. That said, the waning of the Covid supply shock is a welcome development that may introduce some disinflationary pressures, much needed at the moment, thereby making the Fed’s job a bit easier.

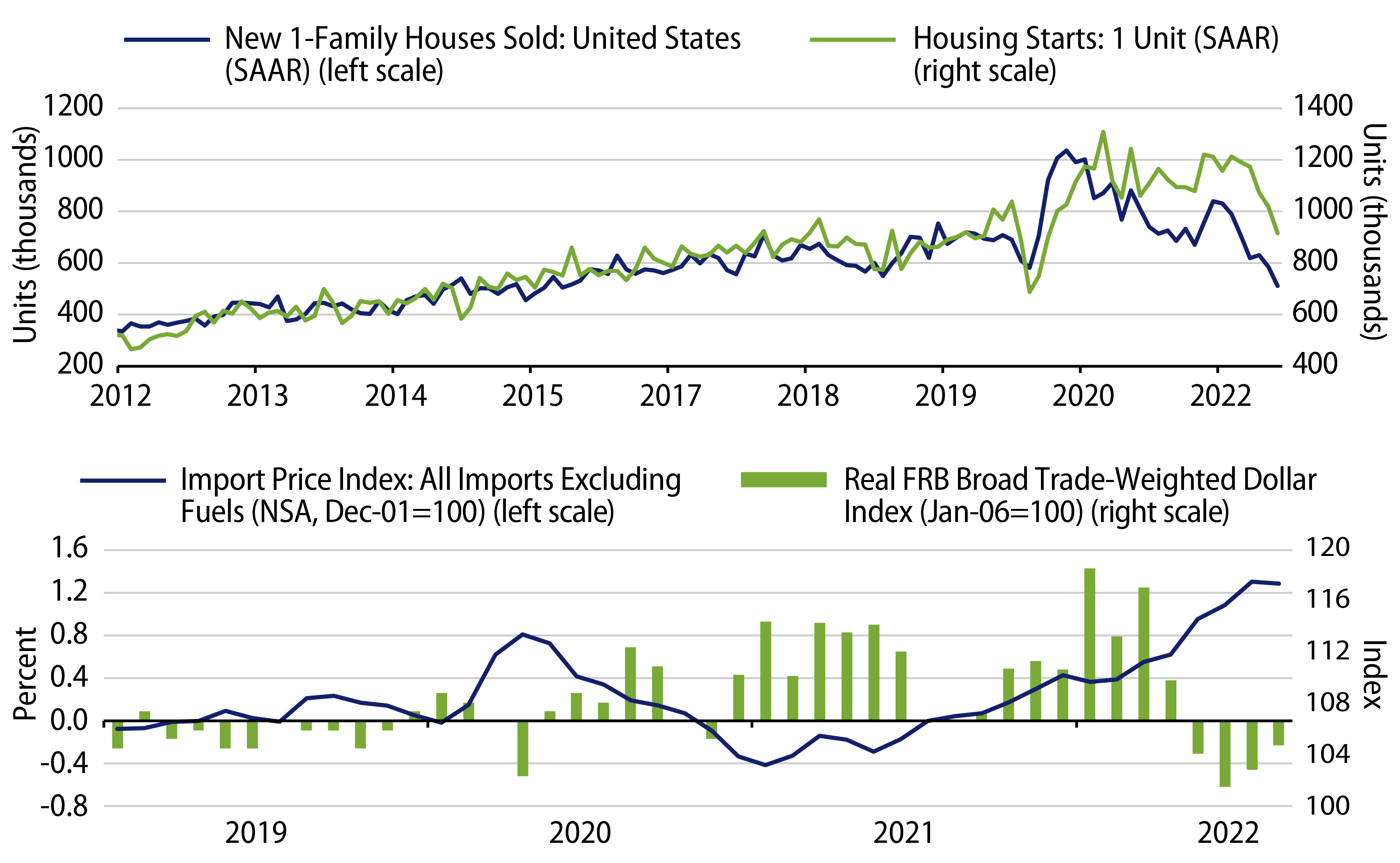

- Tighter monetary policy is having an impact, especially on the housing market. A final change in the environment is that the Fed has been tightening monetary policy for a few months now. The impacts vary by sector of the economy, but they are increasingly noticeable in the data. The housing market, for example, is very sensitive to mortgage rates, and, unsurprisingly, activity there has already contracted meaningfully. Imports are similarly sensitive to the value of the US dollar, and, accordingly, the price of imports appears to be falling as the dollar has been appreciating. These movements are likely just the start. Over the coming months and quarters the impact of tighter monetary policy will likely continue to show up in various ways.

Of course, not all of the developments over the last three months are consequences of the Fed’s actions. The waning of the Covid shock, for example, has nothing to do with monetary policy. Similarly, commodity prices have declined for a wide range of reasons, with tighter monetary policy being just one of many contributors. In the end, it may not matter all that much whether or not the Fed is responsible for the progress. What matters is whether the developments point to lower future inflation, and based on that criteria, it does appear that progress has been made.

Implications for the Fed Outlook

In today’s press conference Chair Powell demurred from emphasizing these changes in the environment. Similar to his speech at Jackson Hole, Chair Powell stuck to a short and simple message of determination in bringing down inflation. Any mention of progress was in passing, at best, and quickly followed by a statement that the Fed wanted to see more evidence. It would be wrong, however, to conclude that the changes in the environment don’t matter. To the contrary, to the extent that these changes do in fact constitute progress toward lower inflation, we think there are two immediate implications for the outlook for Fed policy.

First, and most importantly, the moderation in inflation expectations means that the Fed may not need to further surprise markets. If inflation expectations are rising uncomfortably, surprises are a ready tool to draw attention to Fed policy, and by doing so to change sentiment. If inflation expectations remain contained, on the other hand, then the Fed can proceed with its plan of bringing down inflation gradually through moderately restrictive policy. This plan is already discounted in forward interest rate markets. And while restrictive rates may not be conducive to a buoyant economy, neither is it obvious that they will be all that disruptive for markets. In many cases it is the surprises that matter most for investors, and conversely, an absence of surprises may be a welcome development, especially after such a turbulent and volatile year.

Second, and admittedly a bit more speculatively, the progress in the broader environment could lower the bar, so to speak, in terms of what the Fed needs to see in the realized inflation data. As recently as a few weeks ago, Chair Powell and other Fed officials were intimating plans to downshift the pace of hikes. The progress discussed earlier likely played a part in this plan, and appropriately so, as each one of these developments is relevant for the inflation outlook. While the recent inflation data has delayed the downshift, much of the progress remains intact, and, accordingly, it may not take much to bring the previous plans back to the fore.

Conclusion: Implications for Markets

The data last week on consumer price inflation was a setback for the Fed. It was also a setback for financial markets, as subsequently yields have risen and risk asset prices have fallen. For the Fed, the extent of the setback has been fairly clear: today’s hike was 75 bps (rather than 50 bps) and target interest rates are now expected to peak at 4.625% (rather than 3.875% previously). The extent of the setback for markets has been commensurate, and financial conditions have returned to the tightest levels of the year.

Both of these things—the implications for the Fed and the implications for markets—were known before this afternoon’s announcement. The more interesting discussion at today’s Fed meeting, and also ongoing for investors, is to what degree things have changed over the past three months. Markets seem to suggest a discouraging answer. Yields on long-term Treasury bonds are similar to where they were at the time of the June meeting, as are spreads on corporate bonds. The US dollar is stronger. In this sense, markets seem to reflect a pessimistic view that not much has changed over the past three months with regard to the inflation outlook.

We think this view is unnecessarily pessimistic. On a number of fronts there has been notable progress. Inflation expectations have moderated, commodity prices are lower, the Covid shock is waning and the economy is responding to Fed tightening. Each of these developments is material in its own right, and together they suggest a marked improvement. We expect the broader progress will make future Fed surprises less likely and may lower the bar for an eventual downshift in the pace of hikes.

Finally, with regard to the path forward for markets, the realized inflation data will continue to play an outsized role. It is still the case that lower inflation is likely to benefit all financial assets. It is not only realized inflation data that matters, however, as we expect markets will also be affected by the other developments discussed here. An environment of broad progress toward lower inflation is one in which markets can respond sharply to good news, as they did earlier this summer, especially should that good news be validated by an eventual downshift in the pace of Fed hiking. This still appears to be the most likely outcome. Accordingly, we expect that ongoing progress toward lower inflation will continue to support longer-dated bonds and corporate spreads.