Lots of data to cover today, with the Bureau of Economic Analysis releasing April estimates for consumer spending, personal income and the Personal Consumption Expenditures (PCE) price index measure that provides the Fed’s inflation target. Generally, the data leaned toward those hawks arguing for more Fed tightening. The one data facet pointing the other way was a very large downward revision to wage income data, so large that it calls into question the supposedly “robust” job growth data of the last six months. We’ll cover consumption and inflation first, then finish up with the income data.

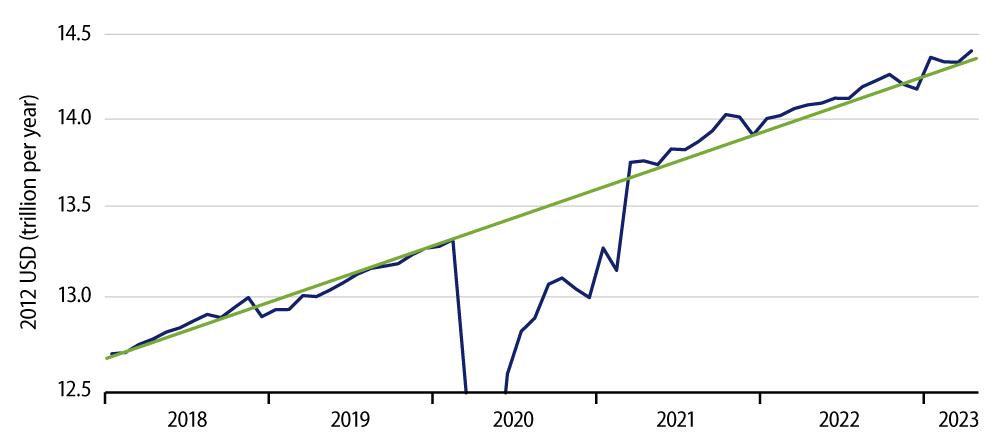

After declining in March, real consumer spending rose 0.5% in April. Through March, it looked as though overall consumption was gradually softening relative to the growth trend that had been in place through early-2022 and that matched the pre-Covid spending trends. There was enough of a spending bounce in April to call into question whether the aforementioned gradual slowing is actually in place. Goods spending bounced and so did spending on various services sectors that looked to be weakening through the March data.

On the inflation front, both the headline and core PCE price indices showed April increases just below 0.4% on a monthly basis, with these annualizing to 4.5% and 4.7%, respectively. This compares to April annualized changes in the headline and core CPI indices of 4.5% and 5.0%, respectively. Obviously, not much difference in the readings of the two index sets. Goods inflation was notably lower in the PCE, while services inflation was notably higher. The Fed’s attention has been focused on services inflation in recent months, so the higher readings there for the PCE make today’s inflation data a negative on net.

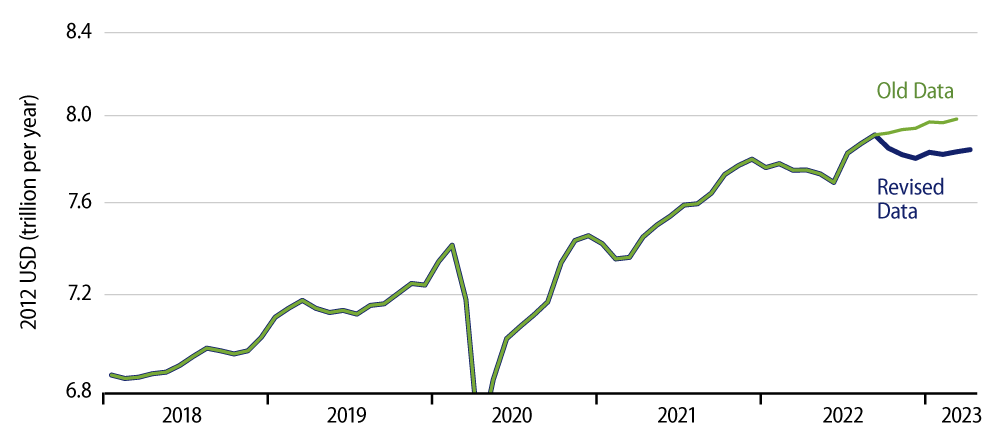

Moving on to income, you can see the effects of the downward revisions today on real private-sector wage income. March wage income was revised downward by -1.9%. This is the largest such change in my memory. The income data revisions utilized the same source data that will ultimately be used to benchmark-revise payroll employment data, though those revisions will not be released until next February. The income data comprise the one indicator for which government agencies perform these quarterly mini-benchmark revisions, utilizing newly available source data from payroll tax returns filed by employers.

I belabor this point because the revisions here are sharp enough to erase all the job growth of the last six months. Some analysts have questioned the recent validity of the “birth-death” models that the government uses to supplement employer surveys in producing the payroll jobs data. Suffice it to say that today’s revisions to the wage income data support those questions.

I should point out that aside from the revisions to past data, total personal income in April rose 0.4%, while private-sector wage income rose 0.6%, so these measures saw a slight decline for real personal income and a decent gain in real wage income (as you can see in Exhibit 2).

So, all in all, today’s data were generally not supportive of folks like me who are thinking the economy and inflation are slowing and the Fed would do well to sustain a pause in its tightening. The only supportive element in the data were those downward revisions to wage income, and revisions are generally esoteric for market pricing and policy deliberations. Today’s revisions might be big enough to be important, and if the much slower income and job growth they suggest is for real, it should be soon reflected in other economic data going forward. For now, we’ll offer that possibility and see if it resonates in the markets and policy halls.