With the government shutdown grinding through its third week, we have no new data to cover in these posts. However, we can use the “down time” to catch up on topics not previously covered.

These posts have talked at length about consumer spending and the state of the housing market. In today’s edition, we’ll work through the data extant concerning the current business investment environment.

Economic data categorize business investment into three components: inventory investment, nonresidential construction and equipment investment. Inventory investment varies wildly from quarter to quarter, and this year it was affected by the huge swings in imports between 1Q and 2Q 2025. Suffice it to say that beneath these swings, not much is going on with businesses’ inventories. The interesting detail lies in the other components: construction and equipment.

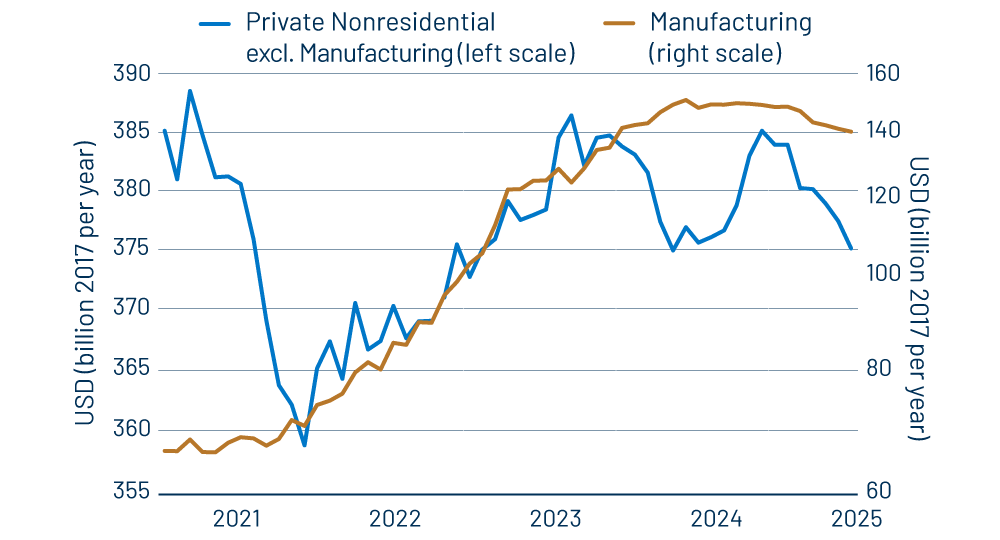

One extraneous factor affecting business construction was the previous Presidential administration’s efforts to stimulate manufacturing activity, as exemplified by the Chips Act and the curiously named Inflation Reduction Act. As you can see in Exhibit 1, presumably in response to these initiatives, construction spending on manufacturing plants exploded over 2022-2024.

Note the magnitudes of the two scales in this chart. While nonresidential construction outside manufacturing is nearly three times the size of manufacturing construction, the increase in manufacturing construction over 2023-2024 is nearly three times the size of the increase in other nonresidential construction. Clearly, the explosion in manufacturing construction was the dominant story for nonresidential construction in recent years.

Well, nothing lasts forever, and as the government funding crested and subsided, so has manufacturing construction. It is interesting, though, that even with the declines of the last 12 months, manufacturing construction remains dramatically elevated compared to the more “normal” levels seen through 2021. Meanwhile, other nonresidential construction has also pulled back over the last year, but only mildly. The bottom line is that while headline nonresidential construction data show a drop over the last year, the absolute level of this activity is quite elevated and, on those grounds, quite strong.

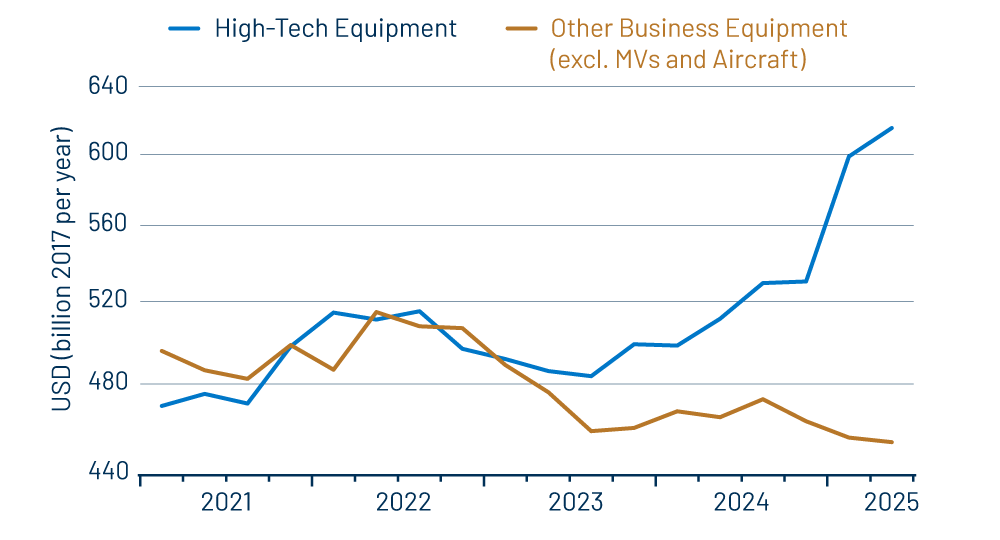

There is a comparable dichotomy within equipment investment. With recent advances in AI research, it is not surprising that business investment in high-tech equipment has risen smartly over the last eight months, as you can see in Exhibit 2. Spending on other equipment has pulled back slightly.

To put these swings in perspective, equipment investment outside the high-tech industry has been essentially flat for the last 10 years. The slight decline seen in recent months is right in line with the experience of recent years. For high-tech equipment investment, the trend has been steadily higher for the last 10 years, but the gains of recent months do mark a decidedly faster pace of growth, likely reflecting, again, the impact of AI. The bottom line for equipment investment too is that while activity levels are decent, investment is not exploding, and the strength is narrowly focused.

Meanwhile, the current administration is reporting commitments by foreign entities to invest tens of trillions of dollars in the US in the months and years ahead. Not surprisingly, this has not yet shown up in the available data, which run only through July, a scant few months after said commitments were made.

It will be interesting to see how much of these commitments become realized and where in the vast US economy the preponderance of such spending is done. In the meantime, again, current business investment overall is merely holding steady, though at quite decent levels.