We have outlined the banks’ bumpy, bondholder-friendly journey back to basics in the decade following the global financial crisis (GFC) in several blogs and papers in recent years. In 2017, we argued that the industry’s dramatic de-risking created a much simpler, safer and stronger business model that would be resilient in the next economic downturn. COVID-19 provided the first real-world test in 2020 and bank fundamentals surpassed even our contrarian, constructive expectations. Importantly, rather than being the key problem as they were during the GFC, banks were a key pillar of the economic solution following the pandemic-induced economic upheaval. Moreover, the negative direct impact of Russia’s invasion of Ukraine was limited to a few banks, and was actually much smaller than expected given both regulatory requirements around the resolution and the impact of prior sanctions following Russia’s takeover of Crimea. We believe that banks will similarly exceed market expectations in the current investment environment dominated by concerns around high inflation and economic contraction.

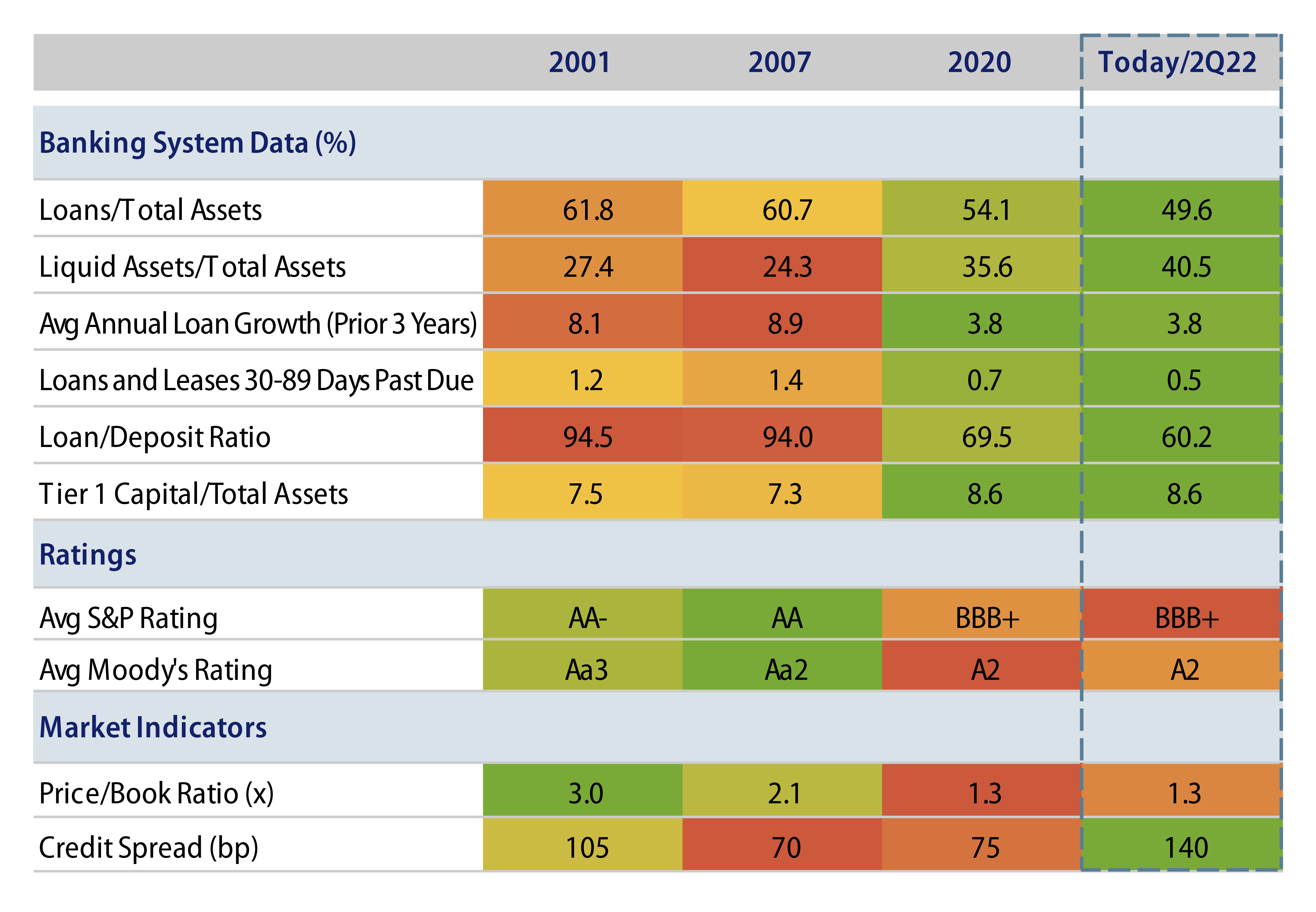

Exhibit 1 highlights key historical metrics of the US banking system since 2001. Our constructive secular view is that the risk profile of banks is much lower now given a new, strict rulebook with extreme fines, improved risk management and supervisory oversight. Our view that banks enter this period of heightened uncertainties with the strongest fundamentals in decades is not shared by sceptical rating agencies and investors, as seen in quite bearish credit ratings, equity valuations and credit spreads.

Bank Fundamentals Remain Strong

The banking sector’s strong fundamentals, given its de-risked profile, support our constructive credit view. We believe market and ratings-agency scepticism create meaningful opportunities across the capital structure for top US banks. In the US, banks are well positioned for likely tougher economic times ahead given: (1) rising rates supporting higher net interest margins; (2) strong loan growth; (3) sound expense controls; (4) near-record-low credit losses (i.e., 23 bps versus a 19-bp all-time low and an 85-bp historical average), and; (5) extremely low-cost funding (average funding cost of 26 bps; 28% of deposits are zero cost). We believe that a near-record-low loan/deposit ratio of 60% (equal to $6.5 billion of excess deposits) will lead to much less deposit repricing versus prior Federal Reserve (Fed) rate-hiking cycles. Asset quality should remain strong and only deteriorate gradually given the combination of tight lending standards, low unemployment rates and high home equity, relatively subdued loan growth prior to 2022, a less risky loan mix since the GFC, and healthy balance sheets for most corporate and household customers.

Today’s less risky banking business model continues to remain out of favor historically in terms of credit ratings (ratings are four notches below their 2007 peak). Equity valuations remain below historical averages and credit spreads have underperformed the credit index in 2022 given misplaced fears related to the highly unusual GFC period and negative investor sentiment based on a potential near-term recession. For example, Bank of America 10-year senior debt (+202 bps) currently trades +70 bps wide of the Bloomberg US Credit Index (+131 bps), compared with +15 bps at the beginning of the year. Based on our fundamental sector view, we have high conviction that it can trade through the index in the future.

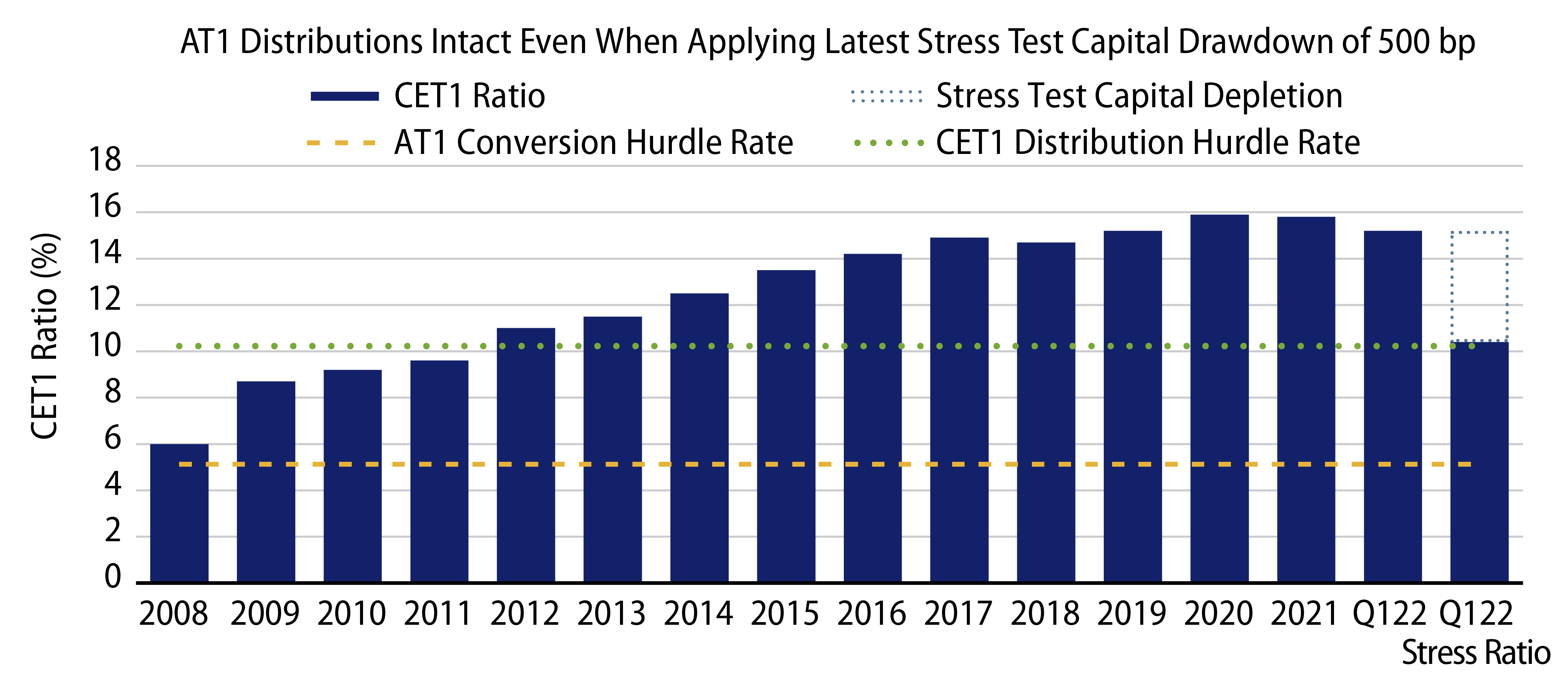

In Europe, we see similarly strong fundamental starting points against an arguably more difficult geopolitical and economic backdrop. Like their US bank peers, European banks should benefit from central bank rate hikes and asset quality should be supported by likely future fiscal support measures. European bank bondholders fared extremely well under very conservative stress test assumptions in the most recent test. For example, the banking system’s average Common Equity Tier-1 Capital Ratio would be sufficiently above the level where institutions’ most junior debt (AT1) would face coupon non-payments even with the modelled 500 bps capital drawdown in the latest stress test. For investors to suffer losses on the principal of these most junior securities the capital drawdown would have to double the stress test impact (close to €1 trillion, equivalent to 1.2x sector market capitalization).

De-Risked Banks Should Remain Resilient

We are constructive on the banking sector due to its fundamental resilience against economic and geopolitical uncertainties. In our view,valuations have moved from “reasonable” to “attractive” in 2022. It’s important to note that “de-risked” does not mean “no-risk,” and we continue to view unexpected economic recessions as the biggest risk to banks. Our highly selective and conservative bank investment thesis focuses on only 75 banks across the 20 lowest-risk countries. We are constructive on the highest quality US and European banks across the capital structure given our healthy fundamental assessment of the sector combined with attractive valuations and generally benign technicals.