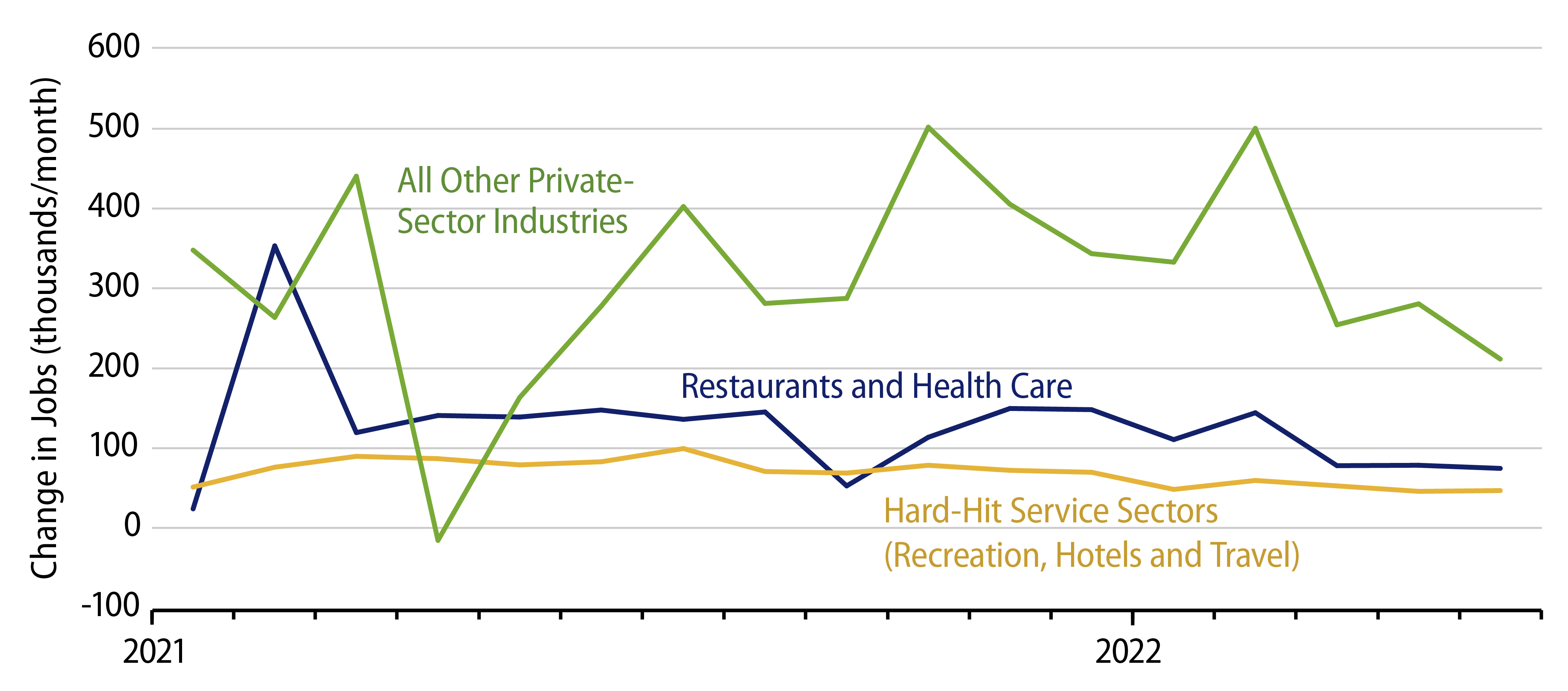

Private-sector payroll jobs rose by 333,000 in May, offset slightly by a revision of -40,000 to the April level. Job gains were widespread, though generally milder than in previous months. This is to be expected as various industries approach full recovery from Covid restrictions and fears.

Of course, full recovery is still quite a ways away for especially hard-hit sectors such as recreation, hotels and travel. For these, fairly rapid job growth is still occurring, but the pace is slower than what we were seeing a year ago, and at recent rates, it will still be more than a year before these sectors have re-attained pre-Covid growth trends.

To put it in context, a monthly gain of 333,000 private-sector jobs would have been very rapid growth prior to the pandemic. Under current circumstances, it is a marked deceleration from the pace of previous months, and it means only a gradual recovery of jobs lost over the past two years plus.

Total payroll jobs rose a bit faster, by 390,000, thanks largely to a reported 51,000 increase in public school jobs. This is almost surely a seasonal anomaly. With schools already operating under Covid restrictions, there weren’t as many closures for the summer as normal, and this was then seasonally adjusted into an increase. We saw the same pattern in May/June 2021 and a reverse of that pattern in September.

Within the household survey, the labor force increased by 330,000 people in May, about matching the 321,000 increase in employment. (Jobs in this survey are tallied and reported differently from what the establishment survey reports for payroll jobs.) The May increase in labor force participation offsets most of the April decline reported a month ago.

Generally, labor force participation has been rising since last October, shortly after the expiration of extended unemployment benefits in August. Over the seven months since then, the participation rate has risen from 61.7% to 62.3%, or by 2.8 million workers, compared to a 1.0 million worker increase in the labor force over the preceding seven months.

Perhaps as a result of this, average hourly earnings continued their more moderate growth path of the last few months. The 3-month annualized growth rate in average hourly earnings through May was 4.5%, compared to a peak rate of 7.6% in December 2021.