Private-sector payroll jobs rose by 235,000 in November, with the October jobs total revised upward by 73,000. The November gains marked a substantial downshift from the strong gains reported a month ago, and just as ubiquitous was the October strength, so too were more modest gains in November.

Keep in mind that a net change in private-sector jobs of 308,000 from what was reported last month would have been regarded as huge in the pre-Covid economy. Presently, however, with payroll employment 6.5 million jobs lower than before the Covid shutdown, sustaining this rate of gain would offer only an extremely slow recovery road back to pre-shutdown conditions.

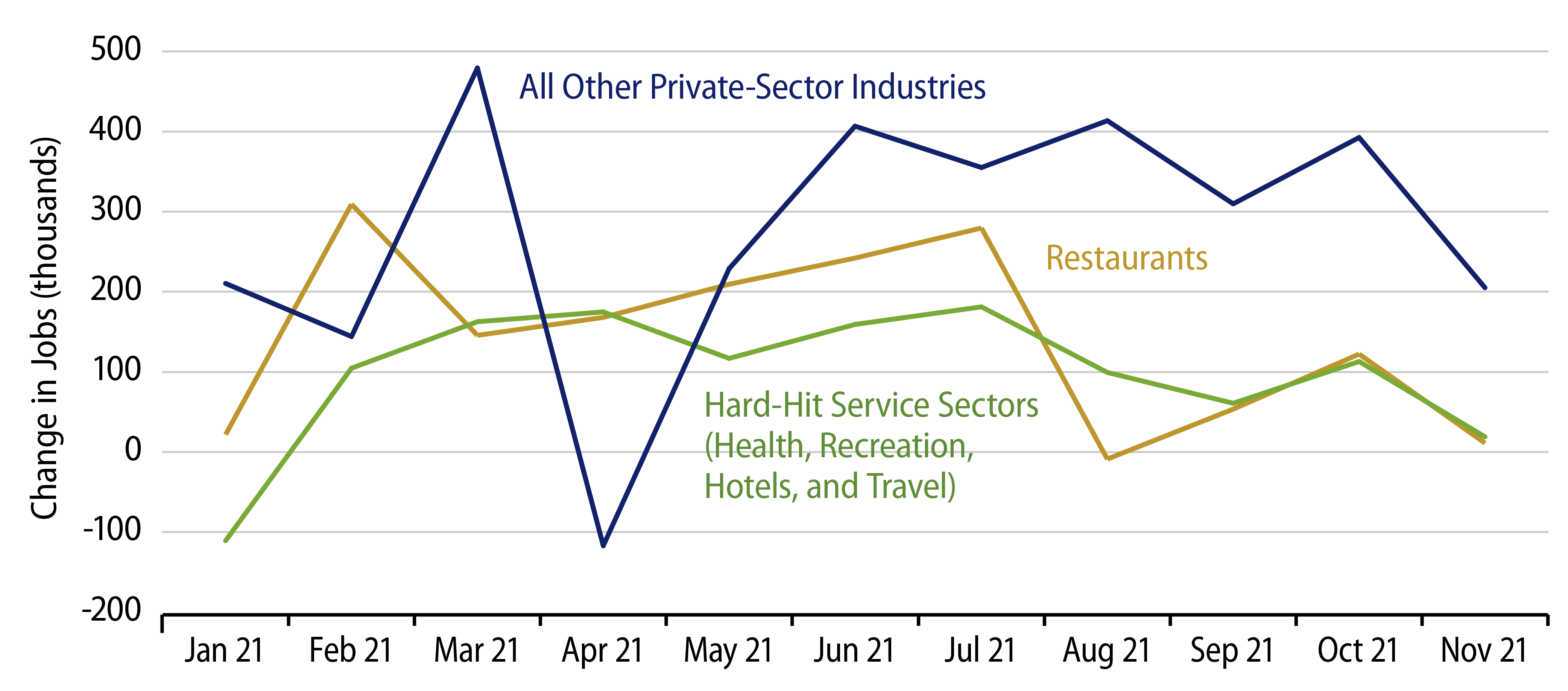

So, what’s the trend, the buoyant pace of October or the more subdued one of November? The decomposition of job gains shown in the chart may provide a telling clue. In the chart, we have split off from the rest of the economy restaurants and other service sectors that were especially hard-hit by the shutdown last year.

Restaurants generally reopened in late-2020 and were relieved of many Covid restrictions earlier this year, when the late-fall Covid wave subsided. They subsequently engaged in a flurry of hiring from February through July. Since July, restaurant sales have leveled off essentially at pre-shutdown norms, so it is not surprising that restaurant job gains have settled down to a roughly stable—but much slower—growth pace since then. We think recent restaurant job gains are more indicative of the future than what was seen over the preceding six months.

For other hard-hit service sectors, there was also a flurry of hiring from February through July. These sectors have also settled down to a more tranquil growth pace in the months since. Sales and activity in these sectors are still severely depressed relative to pre-shutdown norms. However, the combination of remaining restrictions and lingering Covid fears among customers look to be restraining the pace of recovery here. For these sectors to pick up the pace, it is likely that the Covid “cloud” hovering over them will have to lift, and with omicron fears emerging presently, it is hard to see such a lifting occurring soon.

For the rest of the economy, the trends are more ambiguous. Job growth in these other sectors has proceeded at a strong pace over the last six months, but there appears to be some downtrend there. Then again, that appearance of downtrend was only faintly evident through the October data. It seems wise to average together the October and November gains, in which case the apparent slowing trend since June looks more bankable.

Our guess is that these other sectors will plod along with job gains in the 200,000-250,000 per month range in the months ahead, while gains among restaurants and the other hard-hit service sectors will be only slight. Again, this is not the pace of recovery we might hope for, but it is likely the best we can do until Covid is more completely expunged from our minds and our establishments.