KEY TAKEAWAYS

- Preservation of capital is essential to successful short-term investing, but it is only meaningful when applied to a specific time frame.

- By assigning cash balances to different segments with differing time horizons, an investor is able to determine the appropriate level of risk for the overall investment, thus aiming to generate the highest level of return while still meeting the core objectives.

- The current low interest rate environment presents an opportune time to implement a cash segmentation strategy.

- Proper risk analysis is essential to any investment strategy, and it’s vital to see how a portfolio has performed in the past and how it is expected to perform in the future in times of extreme market stress.

- Western Asset’s short-term investment strategies span the liquidity, maturity and risk spectrums from extremely conservative to those that combine a conservative base with the intention of generating returns incrementally higher than just cash.

At the heart of an investment strategy for traditional cash investors, such as corporate treasurers investing excess balance sheet cash, lie the critical objectives of preserving capital, maintaining adequate liquidity and generating an attractive level of return.

Although these goals will drive cash investment decisions, they often overlook one critical component: time. Only by assigning an investment horizon to balances—or segments—of cash can an investor effectively define what is really meant by these objectives. Preservation of capital is certainly a worthwhile aim, but it is only meaningful when applied to a specific time frame. For instance, the question should be asked whether an investment needs not to lose money from one day to the next, or whether it is more important that the investment not lose money over a rolling time period.

Segmentation Provides the Framework for Cash Investing

Could the need for liquidity occur on any given day without much warning, or will there likely be a notice period? By assigning cash balances to different segments with differing time horizons, an investor is able to determine the appropriate level of risk for the overall investment, thus aiming to generate the highest level of return while still meeting the core objectives.

The current low interest rate environment presents an opportune time to implement such a segmentation strategy. Rates in the US have risen off of their protracted near-zero levels, but still remain low compared with longer-term averages. In other words, liquidity remains expensive. Making an investment with a time horizon that is too constricted for your needs can mean leaving returns on the table at a time when every basis point of yield is important. Similarly, the corporate credit environment remains robust as demonstrated by the current low level of negative rating changes for investment-grade companies. Given this backdrop, investors might want to consider increasing their credit risk at this time.

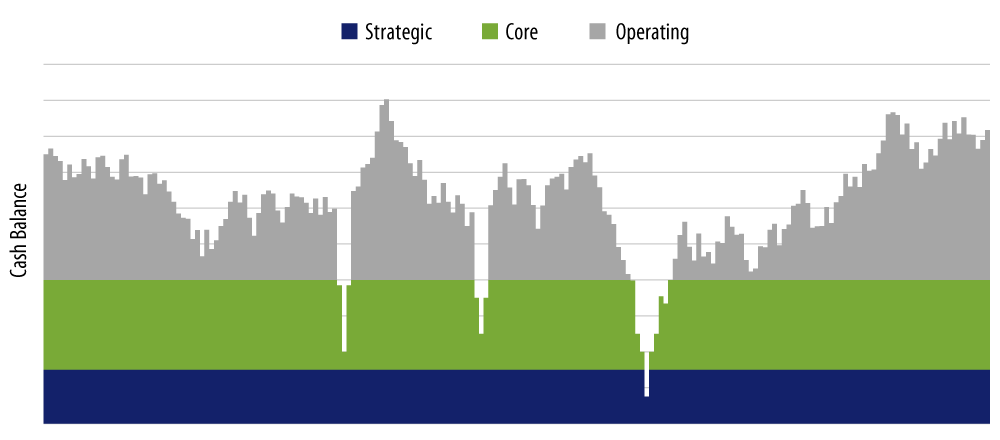

This approach to cash segmentation is only possible with a comprehensive forecast of cash flows. As the total cash balance is expected to fluctuate over time, discrete balances of cash can be aligned to differing investment time horizons with associated risk and return objectives represented by distinct investment strategies (Exhibit 1).

Short-Term Strategies Remain a Crucial Component of a Broader Portfolio

Short-term strategies can be used in a broader portfolio (one that also includes longer-term strategies) to address three significant concerns:

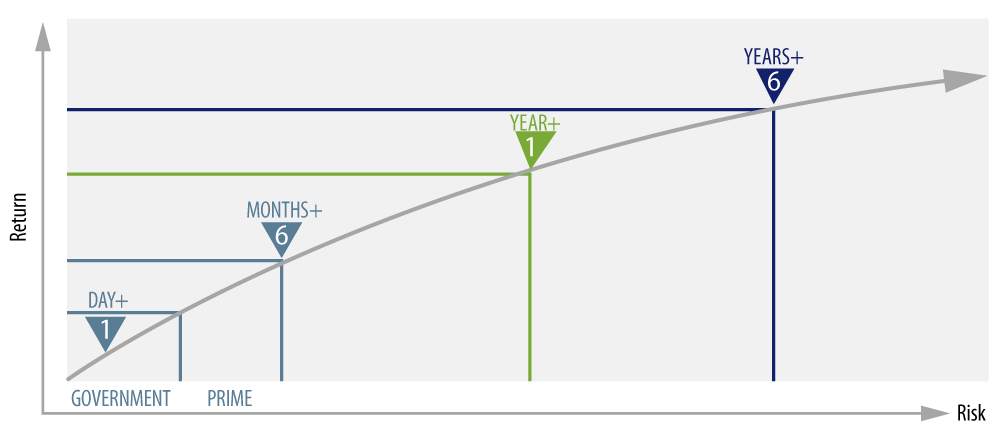

- Meeting minimum return generation requirements. Liquidity and short-duration strategies are both managed with the intent of generating incremental return that beats their benchmarks while appropriately managing risk. At the very short end, money market funds aim to beat a cash-like benchmark such as three-month US Treasury (UST) indices. At the longer end of the short-duration spectrum, a strategy can take on more risk and aim to generate significant annualized outperformance versus a short-duration benchmark such as a 1-3 Year UST index.

- The need for liquidity. As the names suggest, “liquidity” and “short-duration” strategies are generally very liquid, especially those at the very short end of the spectrum. Including an allocation to short-term strategies will increase the average liquidity to an overall portfolio, which may aid future cash flows and rebalancing.

- The potential rise of interest rates. Liquidity and short-duration strategies are generally less sensitive to rising rates. As a result, in a rising rate environment, shorter-duration bonds may outperform longer-duration bonds. Additionally, strategies that also include credit such as corporate bonds will generally offer an attractive tradeoff between yield and interest rate risk when compared with longer-term fixed-income strategies.

Risk Analysis

There are several techniques to help with the future simulation of returns and although many of these are complex, they will normally take one of two forms: stress testing or scenario analysis. Stress testing looks to simulate returns of a portfolio by negatively moving certain key risk characteristics such as credit spreads, interest rates and liquidity. Scenario analysis aims to re-create the environment of historic market stress on a portfolio such as the 2007-2008 global financial crisis.

The Bottom Line

An investment policy comes in two main parts: the objectives of the portfolio and the investment guidelines that must be followed to achieve those objectives. Although written separately, these parts, if chosen correctly, complement each other and are essentially one and the same. The objectives should directly imply the permitted investments and the permitted investments should directly imply the objectives. Achieving both is possible by extending the traditional approach for cash investors with the inclusion of techniques such as setting an investment time horizon, performing cash segmentation and conducting a thorough risk analysis.

Western Asset Offers the Right Short-Term Solution

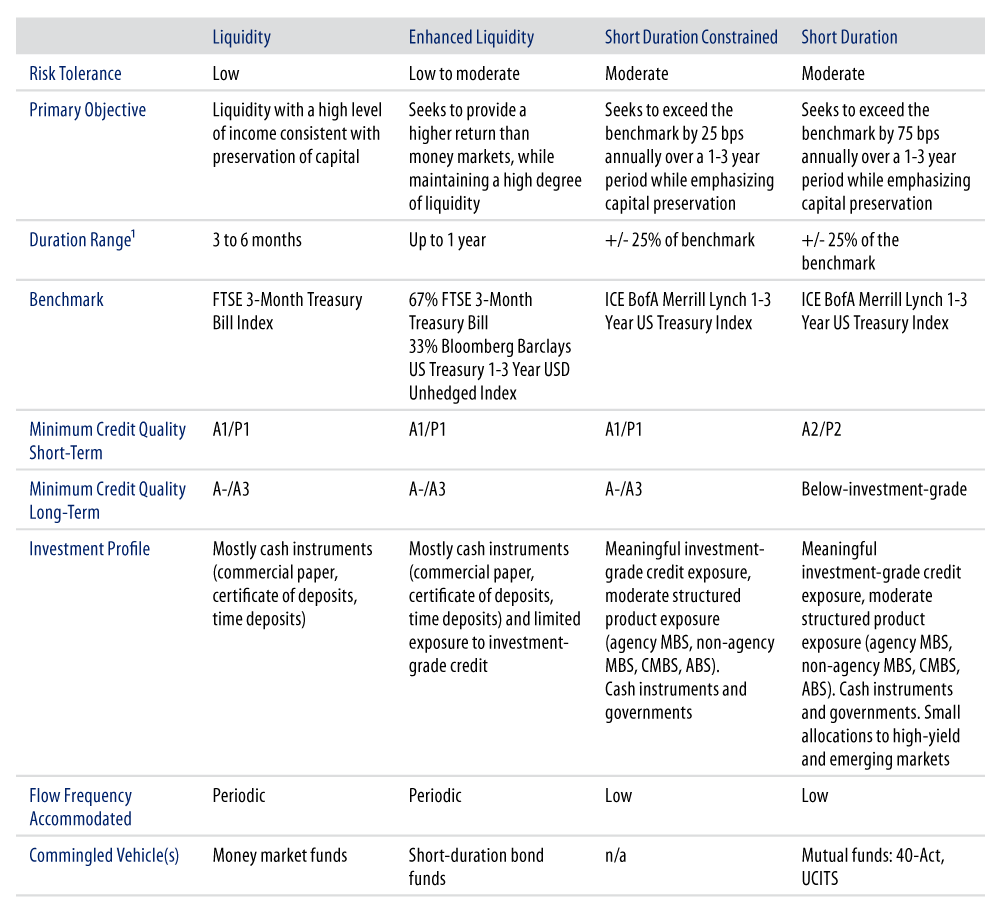

Whether you are a cash investor looking to segment out your cash along short-term strategies or you want to include a short-term strategy as part of your broader longer-term portfolio, we believe we have the right solution for you. At Western Asset, our strategies are backed by our expertise with active, value-driven investing and span the liquidity, maturity and risk spectrums—ranging from extremely conservative (Liquidity and Enhanced Liquidity) to those that combine a conservative base with the intention of generating returns incrementally higher than just cash (Short Duration Constrained and Short Duration). Maturities range from extremely short at 0-3 months out to the 1-3 year range for Short Duration strategies. Whereas the most conservative strategies will mostly be comprised of USTs and government securities, those further out the risk spectrum may utilize a broader investment set.