KEY TAKEAWAYS

- Western Asset's proprietary liquidity classification system ranks securities into five levels based on their behavior under stressed market conditions. This system helps assess the liquidity of assets and manage portfolio liquidity risk.

- The framework also considers liquidity demand, particularly for collective investment vehicles like mutual funds, by modeling scenarios that include factors such as shareholder redemptions and future payments.

- Extreme redemption scenarios are modeled to ensure portfolios can meet potential demand obligations, taking into account factors like shareholder redemptions and future payments.

- Resilience tests combine liquidity demand and supply modeling to ensure that portfolios can withstand various market conditions. These tests evaluate the ability to meet high redemption thresholds and maintain a minimum level of higher-liquidity assets, ensuring portfolios are prepared for differing market conditions.

Western Asset has developed a proprietary liquidity risk management program, and we have been using and refining it since 2013. Our Firm recently enhanced this program to better account for the liquidity effects of position sizing, trades realized in different time zones and the redemption rules of commingled vehicles held by portfolios, among other improvements. The enhanced program employs a comprehensive set of liquidity risk management processes and procedures to ensure consistency in the investment strategy, liquidity profile and redemption policy of each portfolio we manage.

Our liquidity risk framework incorporates three key components: (1) liquidity supply, (2) liquidity demand and (3) resilience. We will discuss these elements in detail. The metrics we generate by analyzing liquidity supply and demand can be utilized for resilience testing (including stress testing), if appropriate, as part of our portfolio management process.

Asset transactions in liquid markets require a buyer, a seller and an agreed-upon price. While this may sound straightforward, assessing the degree of liquidity can be one of the most challenging tasks for financial market participants.

In financial markets, asset liquidity can be defined as the ability to convert an asset into cash (or vice versa; i.e., the ability to purchase an asset with cash) within a desired timeframe and with minimal price discount (or premium). Aggregating this information across all holdings of a given portfolio is a key part of assessing overall portfolio liquidity.

High (''good'') liquidity is induced by the presence of several market factors at the macro level:

- Large and relatively balanced numbers of buyers and sellers—A market with many participants on both sides is more likely to facilitate easier transactions.

- Transparent and relatively symmetric price discovery—Clear and accessible information about prices helps market participants make informed decisions.

- Efficient matching mechanism—Market structures that facilitate a quick match of buyers and sellers enhance liquidity.

These factors mean that when buyers and sellers are numerous and balanced, transactions are smooth and liquidity is high. Conversely, an imbalance or difficulty in finding counterparts results in lower (''bad'') liquidity.

Moreover, certain specific factors also affect security liquidity during a transaction:

- Security Characteristics: Characteristics can include security type, rating, domicile, issue size and other similar information. For example, the common stock of a large corporation is usually very liquid and daily trades may total billions of dollars. In contrast, a small bond issue of a minor municipality is typically very illiquid.

- Transaction Urgency: The shorter the time available (relative to the average transaction time) to match a buyer with a seller, the higher the anticipated transaction cost.

- Transaction Size: Smaller transactions relative to average trading volumes of a given security type are generally easier to arrange and execute on a timely basis. That said, we should note that very small transactions (odd lots) can also pose difficulties for liquidity.

- Transaction Direction: In less-than-ideal market conditions (in terms of balance of buyers and sellers), the presence and degree of liquidity may depend on whether the transaction is a buy or sell order.

- Current Market Conditions: Market disruptions can severely impact liquidity, as evidenced in the fixed-income market during the late 2008 and early 2009.

- Price History of the Security: Positive or negative momentum can influence a security's liquidity.

The goal of liquidity analysis is either to help predict the cost of a transaction that has not yet occurred or assess the optimal time to close a deal (if a maximum cost is set). Not surprisingly, precise algorithms to predict liquidity are scarce in most fixed-income markets due to sparse data and the fact that market liquidity conditions can often change very quickly.

Based on these constraints, Western Asset's liquidity assessment approach deliberately does not aim at assessing liquidity in real time, as liquidity is known to fluctuate widely from day to day and even hour to hour. Instead, it focuses on classifying assets into a parsimonious set of liquidity buckets based on how these assets behave under relatively stressed market conditions, with some adjustments. This results in more stable bucketing of security liquidity and portfolio liquidity risk assessments. Accordingly, Western Asset's framework avoids micro adjustments based on short-term market developments, average daily volumes and bid-ask spreads. Instead, our models and processes consider the analysis of liquidity over market cycles and under stress conditions.

1) Liquidity Supply

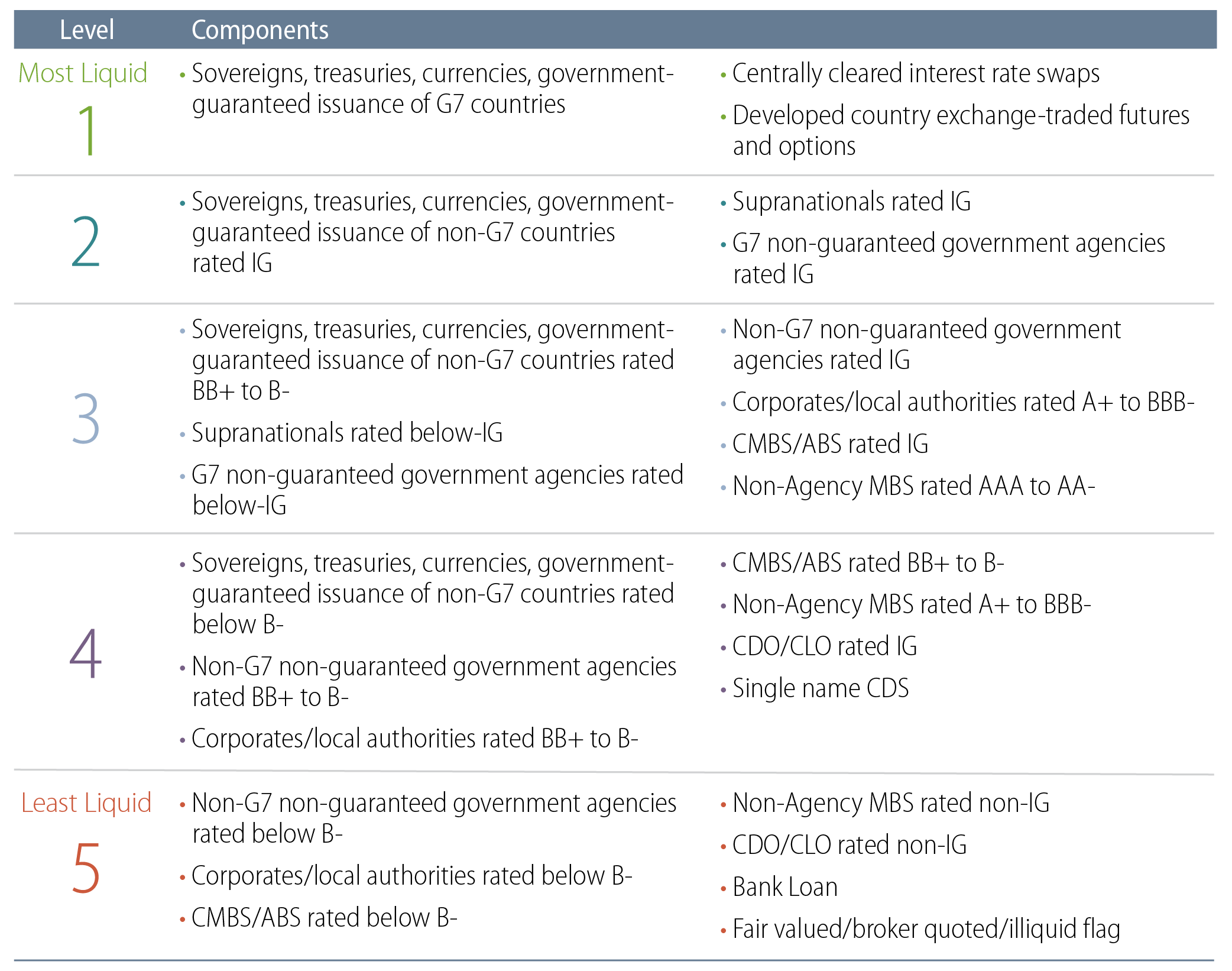

Western Asset's proprietary risk model classifies securities in a portfolio, according to their stressed liquidity behavior, into five liquidity levels. Level 1 consists of securities that are comparatively easy to trade under very stressful market circumstances. These include assets such as US Treasuries, gilts and bunds. On the other hand, Level 5 consists of securities expected to be the most difficult to trade under stress, such as tranches of structured products. Western Asset believes that attempting to differentiate liquidity more finely than within these five levels would just create an illusion of false precision. Furthermore, it is important to note that this bucketing process is not done with specific liquidation horizons in mind.

The classification process begins with ranking securities by type and credit ratings, informed by liquidity data from prior crises such as the global financial crisis (GFC) and the COVID-19 pandemic. Repo haircut levels during such crisis periods and feedback from trading and investment professionals also guide this first step. Current liquidity level classifications are shown in Exhibit 1.

The initial ranking of securities into liquidity buckets is then adjusted as appropriate based on additional criteria such as:

- Brokerage Coverage: Securities that have a wider coverage tend to be more liquid.

- Age: A security tends to be more liquid the closer it is to its initial issuance, and that liquidity diminishes with time.

- Maturity: Shorter-term securities tend to be more liquid for some asset classes.

- Benchmark Membership: Securities that belong to a widely used market index tend to be more liquid.

- Issue Size: Securities issued in large amounts tend to be distributed across a large set of holders and tend to be more liquid.

- Pricing Sources: Securities valued using readily observable market prices tend to be more liquid compared to those valued using broker quotes or matrix pricing, which rely on less observable inputs and may reflect higher valuation uncertainty.

The final liquidity scores are dynamic over time, reflecting changes in factors affecting a security’s liquidity. Further adjustments are made for encumbered assets like those pledged as margin or collateral in a portfolio or restricted for sale by legal or fiduciary reasons.

Certain instruments are automatically presumed illiquid based on their inherent attributes, such as private placements, fair-valued securities,1 defaulted securities, securities priced below one dollar, whole loans and specific structured products, all of which are assigned to liquidity Level 5 and marked as ''illiquid'' according to the SEC2 '40 ACT3 criteria.

Note that Western Asset uses the classification information to run scenarios to proxy ''days-to-trade'' and ''portfolio liquidity costs'' if or when those metrics are in question. The liquidity category of an asset is an input in the estimation of its days-to-trade timeline (the period from the decision to sell to finding a buyer and closing the deal) and days-to-settle timeline (the period from the decision to sell to receiving the cash from the sale). Other relevant factors include the size of the position in the portfolio being analyzed (large positions may take more time to dispose), the relation between the denomination currency of the security and the country in which the portfolio is managed (foreign transactions require repatriation of the proceedings and may require tax retention) and if the asset is encumbered in that specific portfolio (procedures to unencumber securities may take some days).

Days-to-trade metrics can vary according to market conditions, while the bucketing of securities into specific liquidity levels is rather stable. Western Asset estimates days-to-trade and days-to-settle ''under normal conditions'' and ''under stressed market conditions'' for every security and uses these estimations to perform resilience tests to portfolios (more details to follow in section 3, ''Resilience Metrics and Tests'').

Settlement periods for most asset classes have remained steady, even during crises, often changing only with altered market conventions. For instance, US and Canadian corporate bonds transitioned from T+2 to T+1 settlement (i.e., trade plus two days, to trade plus one day) in May 2024, prompting updates to Western Asset's liquidity modeling. For days-to-settle modeling, special consideration is also given to assets such as bank loans with variable settlement periods requiring complex documentation for ownership transfer. Western Asset uses a statistical approach requiring proprietary realized settlement time information for these cases.

For portfolios investing in pooled vehicles, Western Asset evaluates specific redemption rules and performs a look-through analysis of assets to assess liquidity.

2) Liquidity Demand

Western Asset prioritizes clear, regular communication with clients about liquidity needs and liquidity risk tolerance. Single-client portfolios, such as separate accounts managed for institutional clients, generally do not face unexpected redemption pressures, allowing managers to wait out liquidity storms and potentially benefit client portfolios due to liquidity premiums if the client prefers such a strategy. On the other hand, clients who know they might have liquidity demands on their portfolios might not want to take such risks. If provided, liability schedules can be taken into consideration in our liquidity risk analysis.

In collective investment vehicles such as US mutual funds and European undertakings for collective investment in transferable securities (UCITS) funds, liquidity demand can vary among investors: some may redeem shares (demand liquidity), while others may invest (supply liquidity) or stay invested. For mutual funds, Western Asset considers shareholder redemptions to be the primary liquidity demand factor, but also accounts for future payments, asset purchase settlements, derivatives initial margin deposits, assets pledged as collateral4 and other encumbered assets. We also consider potential future margin calls, when relevant, as they may represent important portfolio liquidity demands during crisis periods.

For relevant mutual funds, Western Asset's process includes modeling extreme redemption scenarios informed by historical extreme net outflows such as those seen during the GFC. The severity of some of these scenarios is proportional to the client concentration in the fund being analyzed, recognizing higher liquidity risk with concentrated fund shares.

3) Resilience Metrics and Tests

Resilience tests combine liquidity demand and supply modeling to ensure that portfolios can meet potential obligations. Our Risk Management and Quantitative Solutions Team conducts these tests regularly, including under normal and stressed market conditions.

Under normal conditions, resilience tests assess whether portfolios maintain a minimum level of higher liquidity assets (classified as Level 1 to Level 3) to endure redemptions of established percentages of market value (e.g., 10% or 15%) or the 99th percentile of the portfolio’s historical daily net outflows. Resilience levels can be expressed as a liquidity surplus metric (e.g., the percentage of Level 1-3 assets available post-redemption) or coverage ratios (how many times potential redemptions could be met by Level 1-3 assets). The thresholds are determined by strategy, respecting differences in composition, objectives and client risk tolerance.

For some funds, a key coverage ratio metric compares the percentage of assets deemed able to be liquidated within seven days (which generally correspond to assets classified as Level 1-4 under normal conditions) to the weekly expected redemption size (WERS) calculated in line with International Organization of Securities Commissions (IOSCO) recommendations.5 In-scope portfolios are flagged if this ratio falls below 2.

When relevant, Western Asset conducts formal tests of resilience under stress (liquidity stress tests) on portfolios. These tests evaluate if funds can meet high redemption thresholds, such as:

- 75% net redemption

- A full stake redemption by the top shareholder

- A 50% stake redemption by the top three shareholders

- Redemption equal to the worst 21-day 99th-percentile historical outflow

For these resilience stress tests, Western Asset assumes that liquidation periods are longer, that the cash obtained from asset sales is reduced by value losses and increased liquidation costs, and that derivatives positions may incur additional margin calls impacting portfolio liquidity. We may also include the utilization of a fund's credit facilities and gating mechanisms in the analysis.

Fund characteristics such as dealing frequency, gating schemes, pre-notice, custodian overdraft facilities, liquidity lines, reverse repo capabilities, client concentration and historical behaviors make the tests relevant to each fund. Western Asset's comprehensive liquidity risk management program helps to ensure that portfolios are prepared to meet liquidity demands under various market conditions. This process entails detailed liquidity supply and demand analyses, a proprietary classification system and rigorous resilience testing. The framework was developed so that it can be used for mutual funds and separate portfolios, respecting the specific characteristics and challenges of each type of client and vehicle. Western Asset's new and enhanced approach also considers transaction complexity as well as the difficulties and limitations of measuring and managing liquidity in fixed-income markets. This thoughtful and pragmatic framework helps avoid overreliance on coincidental risk metrics and false precision and is calibrated using extreme market conditions and the extensive experience of Western Asset investment and risk professionals.

- Fair-valued securities are priced with an internal model due to the lack of an available public price.

- US Securities and Exchange Commission.

- The US Investment Company Act of 1940 is an act of Congress which regulates investment funds. It is the primary source of regulation for mutual funds and closed-end funds in the US.

- Western Asset views assets pledged as collateral as less illiquid due to the fact that the Investment Management Team would need to first unwind the derivatives being collateralized if redemptions need to be met.

- WERS = [(1+r)√5]-1, where r=average of the 99th percentile net daily outflows over the past three years. A minimum threshold of 2% is applied should the expected redemption size be lower than that number.