US Mortgage Market: Lessons From the Past, Investing for the Future

Executive Summary

- The US mortgage market is markedly stronger, simpler and safer in the aftermath of the subprime credit bubble that led to the financial crisis.

- Borrowers and lenders alike are now held to a higher mortgage-lending standard.

- “Qualified Mortgage” rules, implemented under the Dodd-Frank Act of 2010, strengthened income verification and documentation requirements.

- Traditional 30-year fixed-rate amortizing mortgages are once again the norm.

- The securitization market today is also in better shape, protected by tighter rating agency requirements, easier access to pursue claims against issuers and new risk-retention rules.

- Since 2012, Fannie Mae and Freddie Mac have been able to reduce taxpayers’ risks of loss through a variety of programs mandated by the FHFA.

- The mortgage market is attractive today as a result of greater protections for bondholders, better mortgages backing those bonds and a healthier US housing market and consumer.

2017 versus 2007: What a Difference a Decade Makes

The US mortgage market has evolved significantly in response to the subprime mortgage crisis. The crisis was the direct result of an inflated housing market fueled by a credit bubble in mortgage lending, with subprime lending defining its pinnacle. We see neither of these conditions present today; home prices appear reasonable based on historical averages and lending is tightly constrained. Subprime lending and securitization are relics and what defines the mortgage market now is quite different from what once existed. When we look at the main components of the lending and securitization market today, we can identify key differences at every step along the way. From the origination of the loans all the way through securitization, there are now greater safeguards in place thanks to a healthy mix of regulations both from outside and inside the industry.

Origination

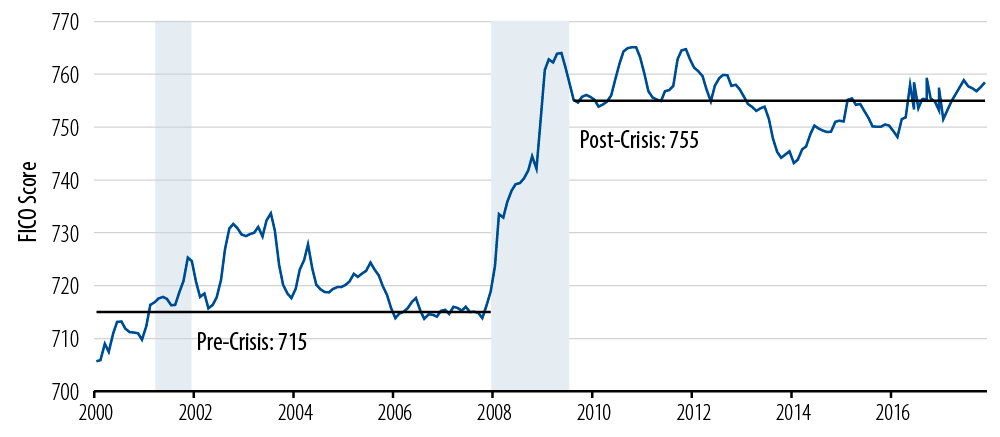

When applying for a mortgage today, both the borrower and lender are held to higher standards than they once were. During the credit bubble there was a prevalence of limited- and no-documentation loans whereby borrowers and lenders could simply invent whatever income the borrower needed in order to qualify for a loan. Today we do not see these types of loans originated. On the contrary, income verification is documented and recorded as is now required by the “Qualified Mortgage” rules, implemented under the Dodd-Frank Act of 2010. These rules require lenders to adhere to a stricter level of income verification as well as to ensure that borrowers can afford the full payment of the mortgage under “ability to repay” rules. The higher quality borrower is further reflected in Exhibit 1, showing the average FICO score at origination of GSE loans which increased from 715 average FICO pre-crisis to 755 average FICO post-crisis. Given the higher standard, lenders are held accountable for their origination practices to a degree that did not exist pre-crisis.

Average FICO Score at Origination of GSE Loans

Mortgage Products

These days when borrowers are seeking mortgages, they are not being offered “affordability” mortgages. Traditional 30-year fixed-rate amortizing mortgages are the norm. During the credit bubble, risks to the lending market were prevalent due to so-called “affordability products” that included a “teaser-rate” low-starting interest that would later jump significantly on the borrower, “negative amortization” loans that masked the true payment amount by increasing the loan balance over time, and second lien products that allowed buyers to purchase homes without any down payment. As of now, all of these affordability products have been banished to history and will not be seen again thanks to increased regulations under the Dodd-Frank Act. Even if these regulations are loosened down the road, we would expect the market to push back on a dramatic return to affordability mortgages, as these types of loans are more difficult to securitize today (which we will discuss in more detail below) and banks are not eager to make these loans while having to retain the long-term risk.

Securitization

The securitization market today is better protected thanks to a combination of tighter ratings agency requirements, greater ability to pursue claims against the issuer and risk retention rules. During the credit bubble era, lenders could act with impunity by offloading risky mortgages into a securitization and walking away. Today lenders are required to put up capital upfront, both in the form of risk retention and also to cover claims of improper documentation. Risk retention acts to better align the interest of the mortgage underwriter with the bondholders in the trust. When it comes to structuring deals, the ratings agencies have significantly increased protections to bondholders by requiring higher levels of structural support. Additional enhancements that were not in the pre-crisis securitization market can include cash reserves to cover mortgage fraud, and automatic reviews of delinquent and defaulted loans by an independent reviewer.

Credit Risk Transfer Market

The primary form of new mortgage securitization has been from Fannie Mae and Freddie Mac, also known as Government Sponsored Enterprises (GSEs). Since 2012, Fannie Mae and Freddie Mac have been able to reduce taxpayers’ risk of loss on GSE portfolios through a variety of programs mandated by the Federal Housing Finance Agency (FHFA), including the issuance of credit risk transfer (CRT) securities and private mortgage insurance agreements. These programs cover mortgages issued since 2012, primarily those that are currently performing. Through these programs, the GSEs have been able to transfer mortgage risk on over $1.4 trillion in unpaid principal balance (UPB) to the private market. As such, Fannie Mae and Freddie Mac are exposed to losses only under a major housing crisis akin to the 2007-2012 period and the Great Depression. Additionally, the GSEs have reduced the overall economy’s mortgage risk by instituting tighter underwriting guidelines and increasing the quality of loans originated. Within these structures, bondholders have the benefits of investing alongside the GSEs, which are conducting extra levels of diligence, policing improper actions by the lenders and monitoring the trusts post-securitization. These structures did not exist in the pre-crisis securitization market, and now satisfy both US and European “risk retention” rules, which were designed to prevent a repeat of the subprime crisis.

Adding It All Up

The mortgage market today is attractive because of how far it has come in the decade since the crisis. We see higher protections for bondholders in place, with better mortgages backing the bonds. Combining these elements with a healthier US housing market and consumer all add up to an attractive asset class with superior investment opportunities available to investors today.