Executive Summary

- Western Asset believes the US dollar will weaken due to a variety of market forces as well as the Trump Administration’s protectionist leanings.

- The factors that influence the strength of the US dollar vary based on a myriad of market conditions, such as central bank actions.

- Past explanations for US dollar weakness cite: the steady decline in US long-term interest rates, the soaring US trade deficit and the decreasing share of the US dollar in the world’s stock of foreign reserves, among other factors.

- We view the primary drivers of US dollar weakness as follows: it is currently overvalued, there are more attractive currency markets, it is currently decoupled from key interest rate differentials and the rise in protectionist rhetoric.

- Western Asset does not view recent periods of US dollar strength as the start of something more permanent. Rather, we see the US dollar succumbing to the gravitational pull of cyclical and technical forces that should bolster the appeal of non-US currencies.

A key question asked by many clients today—aside from where bond yields are headed—is regarding where we think the US dollar is headed. This is an important question as the returns of any fixed-income portfolio with developed or emerging markets (EMs) currency exposure will be inextricably linked to the gyrations of the world’s major reserve currency. The Trump Administration’s recent rhetoric advocates for a strong US dollar policy, but this has only served to further muddle the currency’s outlook because it contrasts with the same Trump Administration’s protectionist tilt, which—at least historically—does not support the US dollar. In this note, we highlight the various forces that support our view of a weaker US dollar.

Grasping at Thin Air?

Forecasting, especially as it relates to currency markets, is a slippery art. Indeed, market participants have time and again used a variety of seemingly robust approaches to gauge the fair value and direction of currencies, only to be frustrated and perplexed by the eventual outcome. While every approach has its merits, each one has the tendency to gain or lose relevancy during periods of acute market stress and at different stages in the economic cycle. For example, what influences currencies most over a specified time horizon: growth or interest rate differentials, global trade and investment activity, or relative movements in debt and equity markets? Do periods when central banks are pursuing non-standard monetary policy goals or periods of particular market fear or exuberance influence these variables?

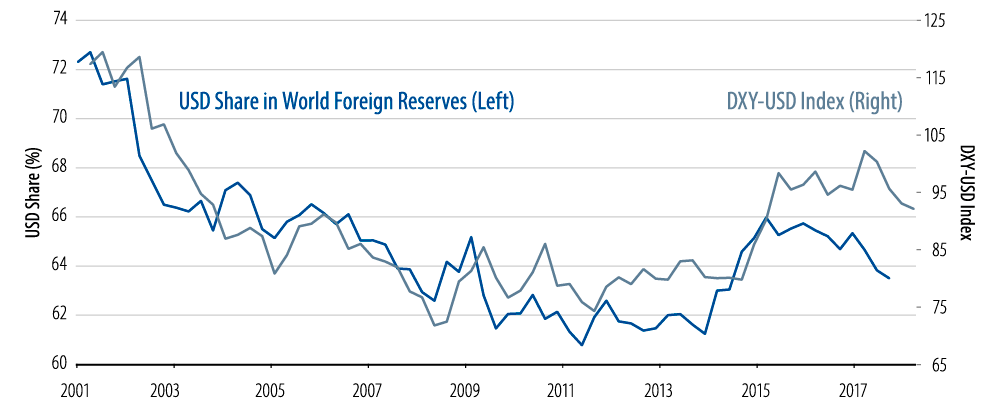

To try and tackle these questions, some historical context is in order. Starting in 2001, the US dollar began a decade-long decline versus a broad basket of currencies (briefly interrupted by the 2008 global financial crisis which generated a massive US dollar squeeze). Explanations for US dollar weakness during this 10-year period include, but are not limited to: the steady decline in US long-term interest rates, the soaring US trade deficit (the after-effects of a strong US dollar during the 1990s), a ballooning US fiscal deficit (as a result of tax cuts and increased military spending), the loss of investor confidence in the US dollar following various Wall Street scandals (e.g., Enron, Worldcom), the bursting of the technology bubble in 2001, and the decreasing share of the US dollar in the world’s stock of foreign reserves.

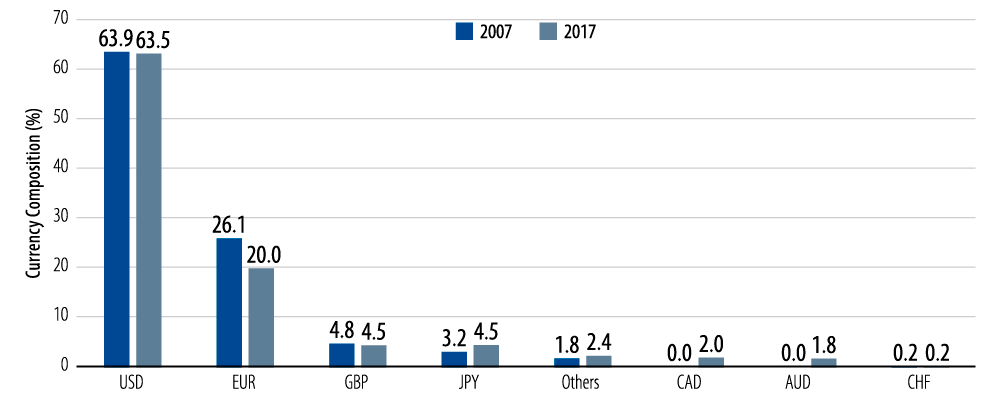

USD Share in World Foreign Reserves

The decline of the US dollar came to a sudden halt in 2011, ironically around the time S&P downgraded US sovereign debt. Market panic concerning the integrity of the euro and the peripheral European debt crisis fueled the beginning of what would become a multi-year US dollar bull-run. The US dollar subsequently moved higher after the taper tantrum of 2013, which ushered in higher bond yields on expectation of the Federal Reserve’s (Fed’s) first post-crisis rate hike. US dollar momentum started to peak in 2014–2015 as the sudden and sharp end of the commodity price super-cycle dented the China invincibility narrative, generating a flight to quality toward the US dollar. The tipping point for the US dollar was the surprise outcome of the 2016 US presidential election. In 2017, the US dollar reversed course and began to fall as the euphoria associated with more US growth stimulus (reflected in higher equity markets and higher bond yields on prospects of tax reform and infrastructure spending) gave way to “America First” protectionist rhetoric and to political gridlock in Washington.

Building a Mosaic

We see the US dollar buffeted by a number of macro and technical-related crosswinds. Below, we provide our thoughts on the forces we believe have the most influence on the US dollar’s path over the course of this year.

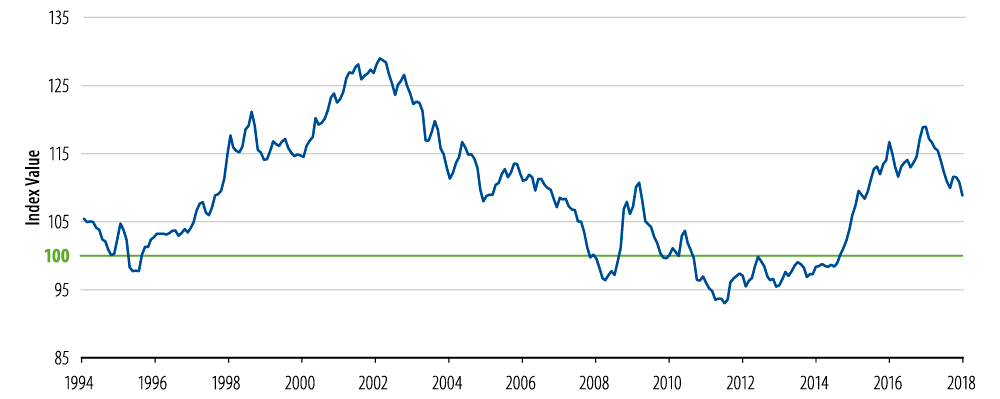

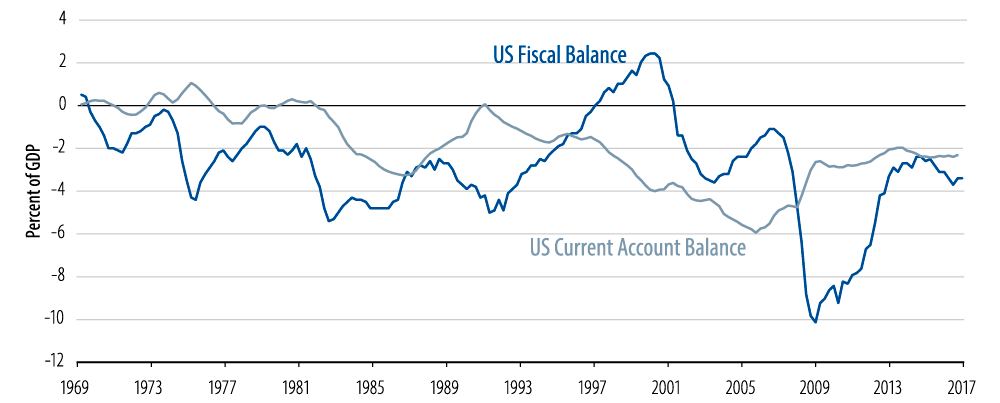

Through the lens of traditional valuation methods, the US dollar appears to be overvaluedMarket participants use several valuation methods to determine whether a currency is over- or under-valued. We believe the real effective exchange rate (REER)—a measure of the trade-weighted exchange rate of a currency against a basket of currencies after adjusting for inflation differences—serves as a useful long-term “anchor” for where a currency should revert in the long run. On a REER basis, the US dollar appears to be still somewhat overvalued, especially when analyzed against the backdrop of persistent US fiscal and current account deficits (Exhibits 2 and 3).

USD Real Effective Exchange Rate History (Index, 2010=100)

USD Twin Deficits

The USD is now competing against other, more attractive currency markets Emerging markets are benefiting from the global recovery that is now underway. The rebound in global trade volumes and commodity prices since the 2014–2015 oil price collapse bodes especially well for the terms of trade—the relative price of exports and imports—and growth prospects for a number of EM countries. We believe EM economies have stabilized for the most part and are now better positioned to absorb shocks than at any other time over the past three to four years. EMs’ “higher beta” to stronger global growth continues to drive flows into the asset class and we expect this trend to continue. In our view, EM local debt markets is the area of greatest opportunity for investors. Yield spreads are historically attractive at a time when global growth fundamentals have reversed from the headwinds of prior years into a powerful tailwind.

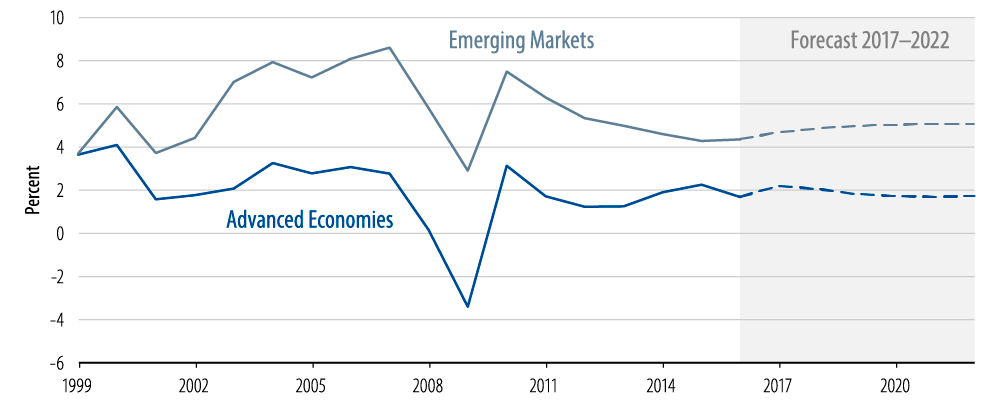

GDP Growth

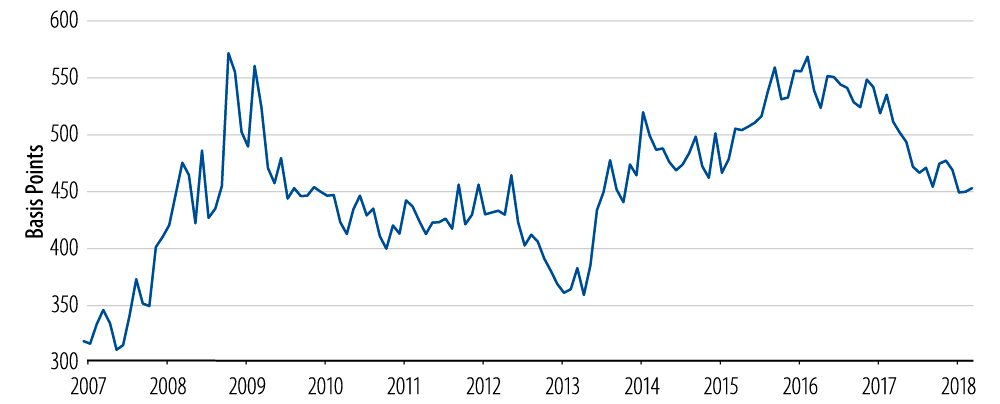

Spread Between Local Currency EM and DM Sovereign Yields

As the global recovery progresses, eurozone GDP is growing at its fastest pace in seven years, with momentum, it seems, for further improvement. The growth dynamic is broad-based, with the reliance on net exports being dissipated as domestic demand has strengthened. Furthermore, it is not only the “core” economies that are benefiting; the peripheral economies are also on an upward trajectory. Despite the European Central Bank (ECB) extending asset purchases to September 2018 and ECB President Mario Draghi’s dovish announcement that policy will remain accommodative until at least 2019, we believe the continued cyclical recovery aided by accommodative policy should help the output gap narrow further. In our view, this fundamental picture combined with receding EU political risk is very supportive for continued euro strength.

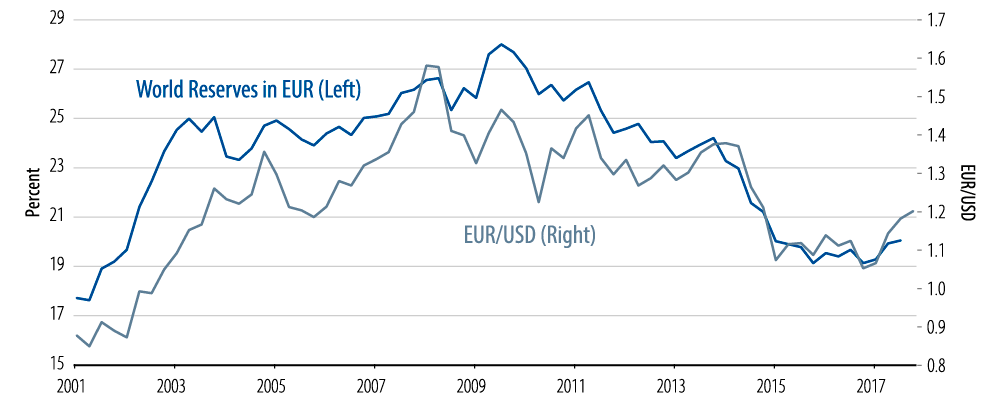

We also highlight two important technical factors that can further buoy the euro: 1) asset managers reversing their underweight positioning in European equities and fixed-income, and perhaps more importantly, 2) reserve managers adding to their euro holdings out of the US dollar, reversing a decline from its highs in 2009 (Exhibits 6 and 7). While the foreign exchange markets comprise more participants than reserve managers, we believe this activity is a good barometer of what long-term investors are doing as they will ultimately drive currency valuation over the longer term. Should reserve managers continue to increase holdings in euro out of US dollar, this would be euro/US dollar supportive.

EUR Share of World Reserves Versus EUR/USD

World’s Foreign Exchange Reserves: 2007 Versus 2017

The USD has decoupled from key Interest rate differentials (for now)A high interest rate currency should appreciate relative to a low interest rate currency, or so the story goes. Year-to-date (as of March 2018), the yen has appreciated approximately 6% versus the US dollar despite wide interest rate differentials that would be US dollar supportive. While the yen’s rise has mainly been attributed to rising risk aversion, and this force might take some time to run its course, we do not expect the Bank of Japan to deviate from its steadfast “overshooting commitment” to weaken the yen until “actual” versus “expected” inflation rises and stabilizes around its 2% target.

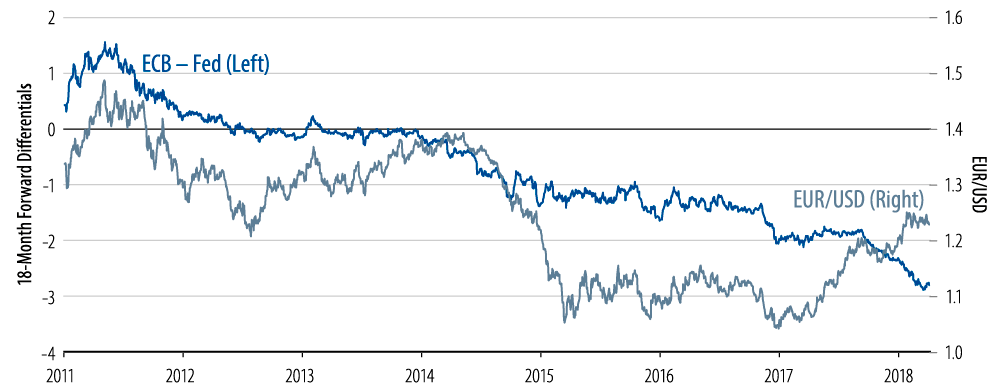

Until 1Q17, the level of the euro versus the US dollar, in our opinion, was determined primarily by forward interest rate differentials (Exhibit 8). It was a relationship that worked well for several years and underpinned our valuation case for being underweight the euro versus the US dollar in global and broad market portfolios. However, we concluded at the time that the euro could be in a position to strengthen versus the US dollar as the market was underestimating the improvement in eurozone data and sentiment and, with this, the corresponding large increase in expected portfolio flows back into eurozone assets. The euro appreciation we have observed thus far, in the face of a US dollar supportive interest rate differential, is a reminder that growth and related flows should not be quickly dismissed when assessing a currency’s fair value.

EUR/USD Versus 18-Month Forward Interest Differentials

Periods of Fed tightening do not necessarily augur US dollar strength While conventional wisdom suggests that Fed tightening cycles should strongly correlate with a strengthening US dollar, the actual record is mixed. For example, since December 2015, the US dollar has depreciated 4% while the Fed has hiked rates 150 basis points (bps). The same dynamic occurred during the 2004–2006 period when the US dollar depreciated 7% while the Fed hiked rates 425 bps. We believe investors need to be mindful that current Fed tightening is not happening in a vacuum, but rather against a backdrop of expected future short-term rate increases across the UK, Canada and the eurozone.

US fiscal policy is supportive of growth prospects, but its longer-term impact is uncertain We expect the Tax Cuts and Jobs Act—which improves US corporate competitiveness relative to the rest of the world—combined with a recently approved increase in spending caps, to put positive upward pressure on GDP growth, which should be US dollar supportive. However, because the tax bill includes front-loaded timing gimmicks, we expect most of the growth benefits will occur in the first few years, possibly adding only 0.25% to 0.50% each year to GDP, then fade out.

Sharp, protectionist rhetoric muddles the near-term picture for the US dollar Ernest Hemingway once wrote: “The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” The Trump Administration’s recent announcement of indiscriminate steel and aluminum tariffs, along with its aggressive posturing toward countries such as China, raises the odds of a global trade war and only serves to further cloud the US outlook in the eyes of the world. While textbook economics says that tariffs by themselves should work to strengthen the home currency, it is important to consider what the retaliation by the US’ major trading partners might be. For instance, during the last episode of steel tariffs that occurred under the George W. Bush Administration in 2002, the US dollar declined versus other major currencies as the European Union imposed retaliatory tariffs and the World Trade Organization ruled the US steel tariffs were a violation of international trade rules. In instances such as these, policies that are perceived by the market to be US dollar negative could generate a self-reinforcing dynamic whereby reduced foreign investor demand for USD-denominated assets results in downward pressure on the currency.

Taking a Stand

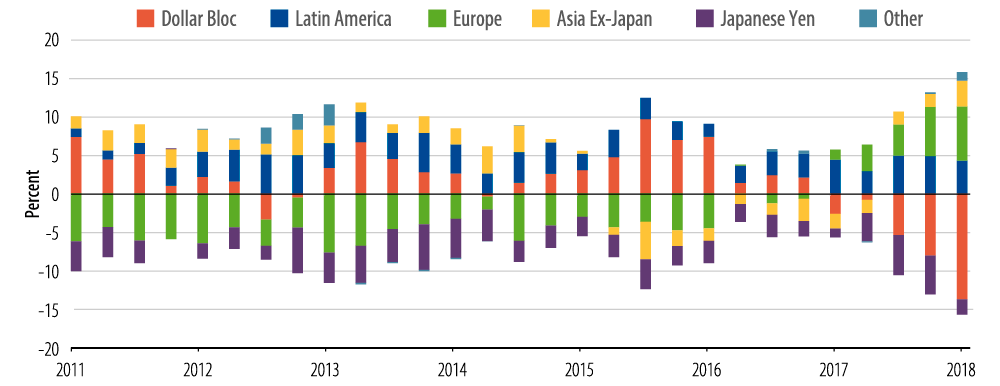

We recognize the futility of forecasting. However, as a long-term fundamental value manager looking to exploit relative value opportunities across global fixed-income markets, we also recognize how critical it is to have a view on global foreign exchange markets, particularly as they relate to the US dollar. This value approach is reflected in the evolution of our currency positioning in global portfolios. For example, we started to move to an underweight position in the US dollar in early 2017 given our view that the currency was overvalued (Exhibit 9).

Looking ahead, we do not believe recent periods of US dollar strength represent the start of something more permanent. Instead, we see the US dollar succumbing to the gravitational pull of cyclical and technical forces that should bolster the appeal of non-US currencies, such as the euro and select EM currencies. The risks to this view include a stronger US growth and inflation outcome, which would push the US dollar higher, or a material downshift in the eurozone economy that would push the euro lower. A global growth shock could also present serious challenges, but for now, all the cyclical data suggest this to be a low probability event.

Global Portfolios: Historical Currency Positioning