In this Q&A, Western Asset’s Head of the Tokyo Investment Team, Kazuto Doi, addresses questions about our Currency Alpha strategy. He explains how this currency-focused strategy aims to generate a competitive positive return, irrespective of the market environment for global currencies.

First, our Currency Alpha strategy seeks to take advantage of the inefficiencies of the global currency markets. These inefficiencies are a function of the complex and dynamic relationships among macro fundamentals, country-specific policy objectives and global macro considerations, as well as the fact that market participants such as central banks/governments, importers/exporters, travelers, individual and institutional investors have different objectives. Second, our Currency Alpha strategy has historically shown very low or even negative correlations to traditional asset classes because it’s designed to have almost zero exposure to interest-rate and credit-spread risks. Third, Currency Alpha is a highly liquid strategy because G10 currency markets are the largest and deepest currency markets in the world. Finally, Currency Alpha is a simple and transparent strategy—it’s composed of currency long/short positions primarily using currency forward contracts.

Currency markets are different from bond markets in that they don’t offer a “risk premium.” However, the presence of various types of market participants with competing interests in the currency markets make these markets highly inefficient. For example, central banks tend to intervene in currency markets in order to smooth exchange-rate fluctuations, not to maximize profits, which is generally the case with macro-oriented investment funds. A variety of market participants tend to trade currencies based on non-macro incentives that create a short-term divergence in currency trajectories, but we believe that currency valuations should ultimately be a function of underlying macro fundamentals. Therefore, the alpha opportunity in currency markets reflects the gap between what markets are pricing in and underlying fundamentals. Currency Alpha focuses on business cycle developments that can play out over several months.

Our Currency Alpha strategy is designed to be a market (beta) neutral strategy; it is not exposed to interest-rate or credit-spread risks. As seen in Exhibit 1, this strategy has shown very low or even negative correlation to traditional asset classes.

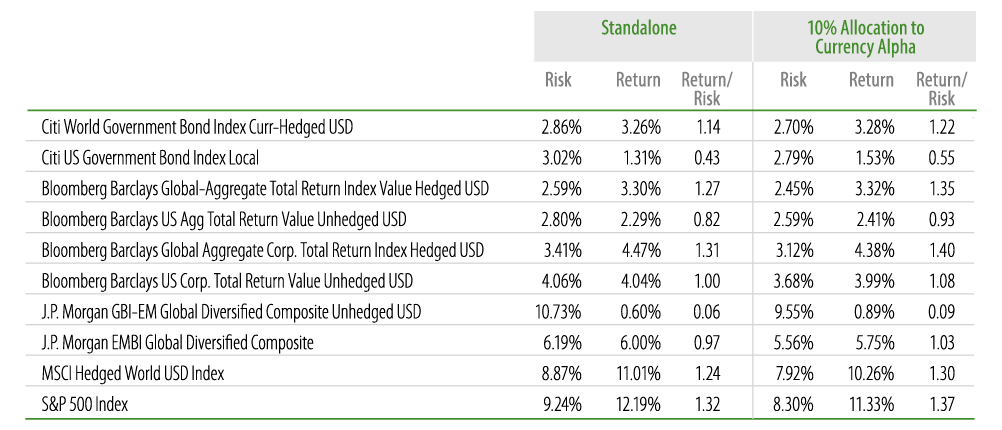

Due to its low correlation to traditional asset classes, adding Currency Alpha to a broader investment portfolio that includes global bonds, credit or equities would have improved the risk-return profile of the overall portfolio. Exhibit 2 shows the potential impact of adding a 10% allocation to Currency Alpha.

Correlation to Currency Alpha from July 2012 to September 2017

Risk-Return Profile from July 2012 to September 2017

This information is based on a hypothetical allocation and is provided for illustrative purposes only.

The Tokyo Investment Team developed a proprietary quantitative model that enables us to make relative value assessments of (primarily) G10 currencies. Our model processes a few hundred macro and financial variables on a monthly basis to produce relative currency assessments based on mid-term developments over relative business cycles. These assessments work as solid starting points for our broader currency strategy discussions because there are many non-quantifiable factors, such as unanticipated political risk developments or governance-related scandals that our model cannot capture let alone process. To address this, we draw on the invaluable insights of colleagues across our fully integrated global investment management teams to help refine our assessments and make the necessary adjustments in portfolio positioning.

Currency Alpha is managed within a volatility band of 5% to 8% with the objective of producing an annual return of 5% over a market cycle (a 3- to 5- year period). In general, the level of risk employed must be proportional to the portfolio managers’ conviction and the opportunities across global markets. In other words, the portfolio runs less risk if there is low conviction on underlying fundamentals, and runs more risk when conviction and associated alpha opportunities are greater. Diversification benefits of offsetting strategies are also considered and combined to ensure that no single position dominates returns. Our risk managers work closely with the Investment Team to realize the appropriate calibration and position sizing to maintain overall portfolio volatility within our pre-determined range. Stress testing and scenario analysis are also run regularly to increase awareness of potential drawdown risk.

With nine offices on five continents and seven fully integrated global investment management teams, Western Asset’s depth of resources enables our Currency Alpha strategy to integrate relative assessments from our proprietary quantitative model with on-the-ground insight and knowledge provided by our colleagues around the world. Along with the Tokyo Investment Team, the Firm has specialized sector teams that focus on all fixed-income areas as well as dedicated risk managers for each strategy. We believe our experience managing global portfolios since the 1990s positions us well to identify attractive investment opportunities for the benefit of our clients.