KEY TAKEAWAYS

- The confusion with Fed communications in 2018 reflected its struggle to define a workable strategy for the next phase of the interest rate cycle.

- We expect that the Fed will eventually adopt a “wait-and-see” strategy in 2019. Such a strategy would build on many of the points Fed Chair Powell made in his Jackson Hole speech.

- We expect at most one more rate hike in 2019. If it turns out, as we suspect, that realized inflation continues to undershoot the Fed’s 2% target, then a “wait-and-see” strategy would translate into no more rate hikes this year.

- The Fed’s evolution toward the new strategy has been uneven, and it’s possible that the Fed will once more slip back into its old strategy of removing accommodation before finally and emphatically embracing the “wait-and-see” approach.

This note describes our outlook for the Federal Reserve (Fed) in 2019.

A Look Back at 2018: Confusing Communications

Communications from Fed officials were rather confusing in 2018. The confusion was not about their near-term intentions. The Fed raised interest rates at every quarterly meeting, and each time the move was almost fully priced into markets well before the event. The confusion was instead about where policy would be headed over the medium term. Fed officials equivocated on how far rates were from the neutral level; they vacillated on whether or not restrictive policy would eventually be warranted; and they obfuscated the substance of their data-dependent approach. Forward interest rate markets magnified these verbal gyrations: two years forward overnight interest rates moved from 2.2% last January to a high of 3.2% in October before moving all the way back to 2.2% at the beginning of January 2019.

A possible explanation for the 2018 confusion is that the Fed has struggled to come up with a workable strategy for the next phase of the interest rate cycle. The strategies used by Fed Chair Jerome Powell’s predecessors have been made obsolete by changing circumstances. By way of a brief review, Chair Ben Bernanke’s strategy was straightforward: with unemployment too high and inflation too low, monetary policy should be easy and aimed at supporting the recovery. Chair Janet Yellen’s strategy was a little more nuanced, but nonetheless fairly easy to summarize: with unemployment and inflation closer to target, emergency accommodation was no longer needed and should be (gradually) scaled back. Neither strategy will be of much use to Chair Powell in the coming year, as the economic variables are close to target levels and accommodation has been removed. Powell will need to formulate his own approach, one better suited to the current circumstances.

Stuck Between the Old and the New

In his last Jackson Hole speech, Powell laid out one approach that could become the core of the Fed’s strategy. In that speech Powell downplayed the importance of empirical estimates of the neutral policy rate, and in their place he played up the importance of data dependence. The approach could be summarized as a “wait-and-see” strategy, by which officials would take their cues from realized data, and from realized inflation data, in particular. Such a strategy would be reminiscent of Chair Alan Greenspan’s monetary policy in the mid-1990s. As Powell himself noted, Greenspan’s strategy allowed the economic recovery to continue for a record 10 years and is considered one of the real bright spots in the history of US monetary policy.

While the Jackson Hole speech outlined one potential way forward, the problem has been that movement toward this new strategy has not been consistent. There have been more than a few instances when Powell and others have muddied the waters by seemingly reverting to an old strategy, or simply by being unclear about their commitment to the new one.

The December 2018 Fed meeting was one specific instance of being stuck in between the old and the new strategies. In a nod to the new strategy, the post-meeting statement softened the forward guidance by replacing “expects” with “judges,” a change that was meant to convey more uncertainty, Fed officials later explained. They also lowered their estimates of rate hikes in 2019 from three to two, and Chair Powell referred to “data dependence” on a number of occasions in his press conference. All of these changes pointed in the same direction, and suggested that the Fed was coming around to the “wait-and-see” approach that Powell described in Jackson Hole.

The confusing part, however, was that the Fed seemed unwilling to fully embrace the new strategy. Instead, the statement and press conference included a number of items that suggested the Fed was still stuck on the old strategy. Why, for instance, include any forward guidance at all? Why not just drop the guidance entirely, given that rates are now within the Fed’s estimates of neutral? If the strategy is to be truly data-dependent, why not show more concern about realized inflation falling in the most recent prints? Why not show more concern about the lagged impacts of the previous rate hikes? Investors who were looking for a more decisive statement were disappointed that the movement to the new strategy was not more definitive or emphatic.

Looking Ahead to 2019

So, what will the Fed’s strategy be in 2019? We expect the themes from Jackson Hole will continue to work their way to the fore, eventually displacing the older strategies, and for the Fed to arrive at a “wait-and-see” strategy for 2019. Clearly progress toward this new strategy has been uneven, which has added to both the uncertainty and the market volatility. However, the direction of the evolution of policy has been clear, and we expect a “wait-and-see” strategy will emerge as preferred over the alternatives, likely sooner rather than later. Our view in this regard is based on four observations.

First, a moderation in US growth will go a long way toward convincing Fed officials that monetary policy is in fact no longer accommodative. Overreliance on imprecise empirical estimates of neutral policy can lead to mistakes, Powell noted in Jackson Hole. Rather than empirical estimates, we suspect growth data will play an outsized role in shaping the Fed’s view on neutral policy. US growth surprised on the upside in 2018, leading Fed officials to suspect policy was easier than they previously estimated, and therefore that more tightening was needed. That process is likely to work in reverse as growth moderates. We expect growth to slow to a 2.0%-2.5% pace in 2019. As that moderation takes place Fed officials will be less confident in their estimates of neutral and will in turn be more cautious with interest rate hikes.

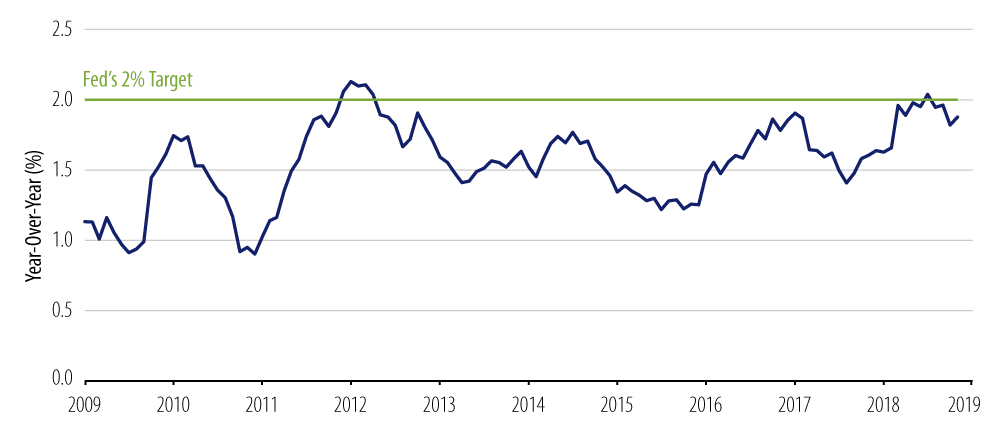

Second, inflation continues to undershoot the Fed’s 2% target, even as growth has outperformed and the unemployment rate has remained below 4%. The inflation undershoot calls into question the validity of the Fed models. Questioning the models is familiar territory for Powell, who has highlighted their inherent uncertainty, but in this instance it is the direction of the miss that really matters. Inflation has been consistently under the Fed’s target since the recovery started 10 years ago. In fact, since mid-2009 the Fed’s preferred inflation measure, Core Personal Consumption Expenditures (PCE) inflation, has only been above target for four individual months, and only one of those months was in the last five years. The persistence of disappointing inflation, especially in the presence of what should otherwise be supportive conditions, raises questions about the Fed’s inflation credibility. Should inflation continue to disappoint, the Fed will need to do more than just pay lip service to supporting inflation expectations. A more explicit focus on realized inflation data would be a reasonable first step in that direction.

Third, in the current environment we see the Fed’s overarching goal as protecting and extending the economic recovery. A recession in the next year or two would be particularly challenging for the Fed, as it would have to grapple with the trifecta of limited room to lower interest rates, an already extended balance sheet and uncertainty about fiscal policy support. This is not to say that the Fed wouldn’t respond appropriately, but just that it would be challenging. It would be much better, clearly, to simply avoid the recession and not have to count on its own ingenuity to find a way out.

Fourth and finally, the reaction to the December hike may serve as a small push toward adopting a new strategy sooner rather than later. Commentators from all sides of the economic debate have pointed out the weaknesses in the case for further hikes, especially given the muted inflation threat. The scale of the market reaction to recent Fed comments may also cause officials to take notice. That’s not because tightening in financial conditions has changed the outlook (any impacts are likely modest, at this point), but instead because the market volatility has underscored the uncertainty about the outlook. As Powell has said himself, when the outlook is uncertain, it’s best to proceed cautiously.

Chair Powell’s New Year

Chair Powell started the new year with a new set of talking points. The following excerpts provide an idea of his themes (emphasis is ours):

“Now when we get conflicting signals as is not frequently the case, policy is very much about risk management…First, as always, there is no preset path for policy.”

“And particularly with the muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves. But we’re always prepared to shift the stance of policy and to shift it significantly if necessary in order to promote our statutory goals of maximum employment and stable prices.”

“…and under Janet’s leadership, the committee nimbly, and I would say flexibly, adjusted our expected rate path.”

“…but what I do know is that we will be prepared to adjust policy quickly and flexibly, and to use all of our tools to support the economy, should that be appropriate, to keep the expansion on track, to keep the labor markets strong and to keep inflation near 2 percent.”

~Fed Chair Jerome Powell, Atlanta, January 4, 2019

These talking points are yet another step in Powell’s evolution toward a new “wait-and-see” strategy. Powell’s reference to “muted inflation readings” is an especially important point. By casting the realized inflation data in a starring role, Powell is consciously moving away from the forward guidance that had tripped up the market in December and moving instead toward a more truly data-dependent approach.

We Expect at Most One More Hike in 2019

Below-target inflation continues to surprise the Fed and many investors. We have been skeptical that inflation will suddenly turn higher, and that skepticism is heightened at the beginning of 2019 by the many headwinds facing inflation, including lower energy prices and slower home price appreciation, among others.

A “wait-and-see” approach would elevate the significance of these headwinds to higher inflation. If it turns out, as we suspect, that realized inflation continues to undershoot the 2% target, then a “wait-and-see” strategy would translate into no more rate hikes this year. Showing more true data dependence, at least as it pertains to inflation data, may also help support inflation expectations, which have been under pressure as of late. A shift in focus to the inflation data cannot come too soon, in our view, and one hopes that it isn’t coming too late.

Our own preference would be for the outlook to be entirely dependent on the inflation data, and therefore no more hikes would be forthcoming. If the Fed were truly committed to a “wait-and-see” strategy right now, then the outlook would indeed be straightforward. But, as the experience of 2018 has shown, the Fed’s evolution to its new “wait-and-see” strategy has been neither as quick nor as direct as it could be. Chair Powell’s new talking points have recently moved the Fed in the direction we anticipate. These taking points will need to be sustained throughout the year, however, and it’s entirely possible that the Fed will once more slip back into its old strategy of removing accommodation, before finally and emphatically embracing the “wait and see.” In any case, we do think the Fed will get to “wait and see” eventually, and the strategy that Chair Powell outlined in Jackson Hole will define the next phase of the interest rate cycle.