KEY TAKEAWAYS

- The unexpected COVID-19 pandemic, along with an oil price war between Russia and Saudi Arabia, created a market environment unlike any we’ve seen in history.

- March 2020 was the worst-ever month on record for investment-grade credit, and the second-worst month ever for high-yield credit.

- Our base case outlook is that near-term global growth will be severely impacted, but that this shortfall will prove to be largely transitory as policymakers push to resuscitate economic activity.

- A continued focus on issuers with strong balance sheets, financial flexibility, and conservative and proven management teams should allow our portfolios to weather a period of temporary dislocation.

- In an environment where everything looks to be “on sale,” we are balancing our investments in those areas that we believe can endure a prolonged economic downturn.

At the outset of 2020 the Western Asset MAC strategy was positioned for another year similar to 2019—one with slow, but still positive growth. However, a global shock in the form of the COVID-19 pandemic and surprise oil price war between Russia and Saudi Arabia have resulted in the current and unprecedented market backdrop. Recent weeks have recorded the most quickly we’ve ever gone from bull to bear market in history.

The response from global governments to shut down social and economic activity has been equally unprecedented—an experiment never before tested in human history. Given the high levels of uncertainty across the market, we have sought to be extremely thoughtful about implementing trades in MAC portfolios over recent weeks. While we are on the attack to capture what we believe are very compelling, deep value opportunities, we are also equally mindful of current risk levels, as it is still too early to tell how long the economic impact related to COVID-19 will last.

What Happened?

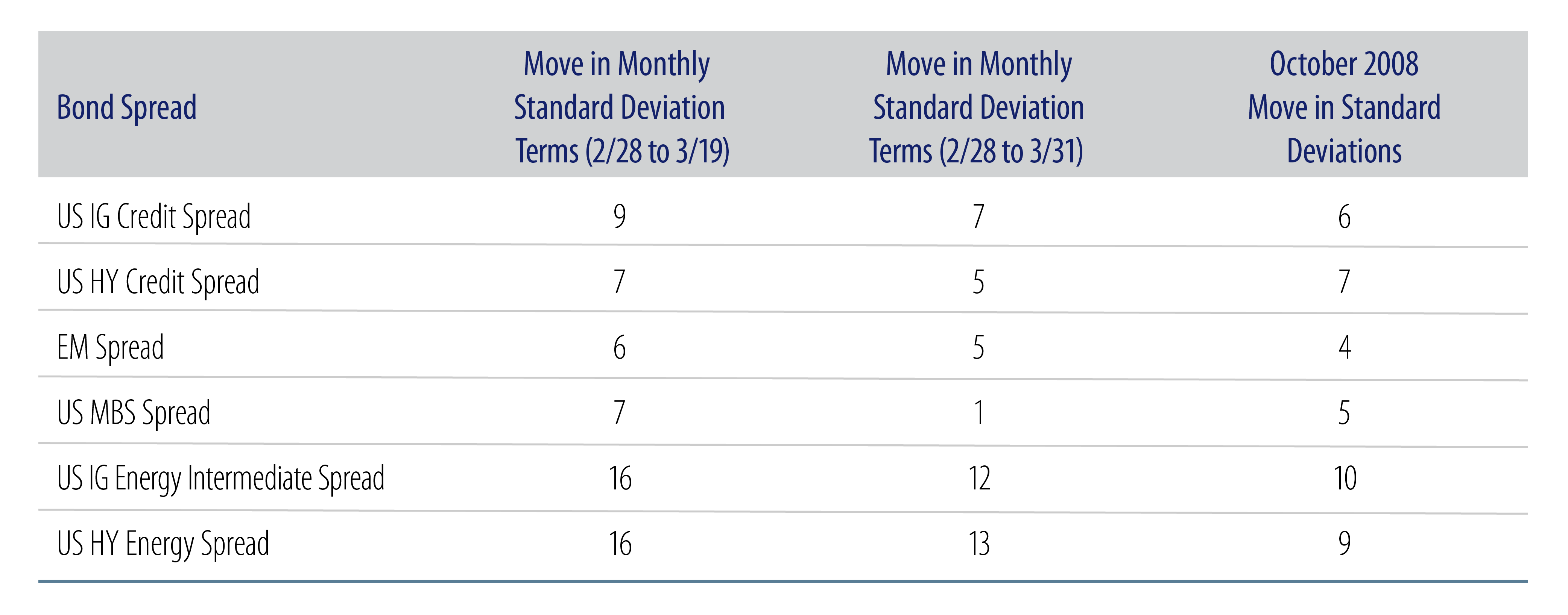

As we looked at the world in early January of this year, the market was anticipating a continued slow recovery with annual US GDP hovering around 2% through 2022. Fast forward just a few months and the picture has been dramatically turned on its head. What transpired in late-February through early-March 2020 was an unprecedented shock, in terms of both of its magnitude and its swiftness (Exhibit 1). While the magnitude is self-explanatory, it is the ferocity of the bond spread moves that commands our attention. The drawdowns observed in 2008 occurred over a prolonged 16-18 month period; in 2020, however, they occurred within the span of only two to four weeks.

It is worth highlighting that the month of March alone was the worst ever on record in the history of the investment-grade credit market, with spread curves quickly inverting in a short period of time reflecting not only a sign of deep distress, but also fear of elevated defaults. March 2020 was also the second worst month on record in the history of the high-yield market. In other sectors, agency MBS, a normally highly liquid sector, collapsed with spreads spiking to levels not seen since 2008. Equity market volatility also surpassed 2008 levels—above 80 as measured by the volatility index, VIX—in an extremely short period of time (Exhibit 2). This level translates into the equivalent of the S&P fluctuating 5% every day for the next 20 business days. The fact that the market was expecting this to occur on a daily basis underscores the severity of the crisis.

Where Do We Go From Here?

Recognizing that the current market environment is not one we ever expected, we remain optimistic as our MAC strategy has been and continues to be built upon bottom-up, fundamental research. A significant amount of due diligence goes into all of the credits and positions that ultimately are allocated to our portfolios; a focus on “bendable” versus “breakable” credits has always been our goal. We believe that our continued focus on issuers with strong balance sheets, financial flexibility, and conservative and proven management teams will allow our portfolios to weather a period of temporary dislocation.

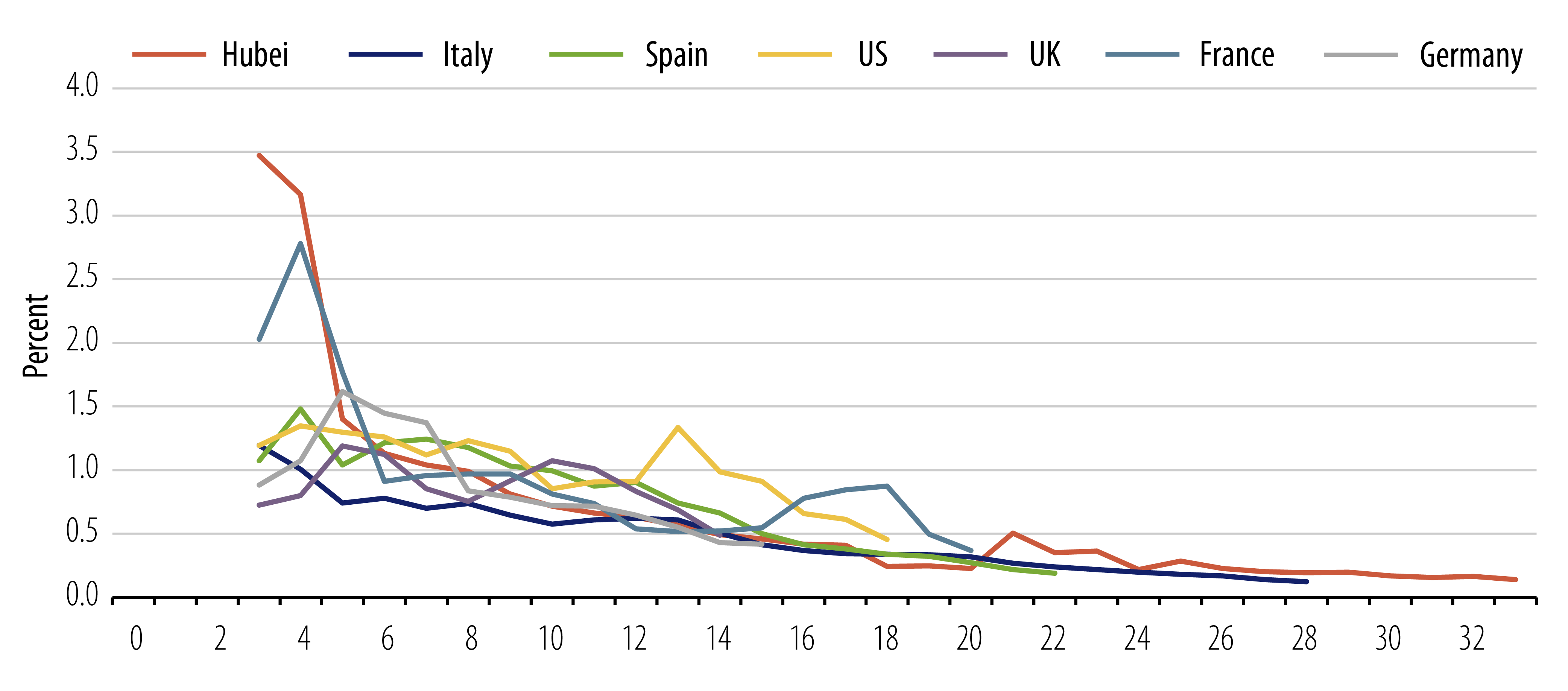

We recognize that the length and severity of the COVID-19 pandemic is uncertain. However, in the face of this uncertainty we remain optimistic that containment and “social distancing” measures will work as intended to flatten the case number curve and curb the overall spread of the virus to a point at which economic activity can resume. We are also aware of the downside risk in current projections related to the COVID-19 spread and recognize that things could get worse from here.

With that said, our base case scenario is that the global economy will remain in shutdown for most of 2Q20. Toward the end of 2Q20 we believe we will see some business activity resume and select restrictions lifted. We think 3Q20 will likely be a transitionary period as a greater number of individuals return to work across the globe and business conditions begin to improve. By 4Q20 we believe there is a strong likelihood that the international economy will show more signs of recovery. By the time we exit 2020, we believe we will have a global economy that is reasonably robust and headed back toward trend-line growth.

During this current period of economic shutdown, we believe that aggressive fiscal and monetary policy will go a long way toward “bridging the gap” where there is economic dislocation (Exhibit 4). To date, we have seen aggressive stimulus provided by central banks and policymakers globally, all of which has provided a tremendous amount of relief.

MAC Portfolio Positioning Moves

In recent weeks, we have been taking advantage of value opportunities across a number of sectors while recognizing the need to protect MAC portfolios against further downside risk. In higher quality segments of the market, we have been active in the new-issue calendar. Year-to-date new issuance in investment-grade corporate credit has been recorded as the fastest start to a year. The majority of issuance has come from well-known issuers of the highest quality, offering deals with significant new-issue concessions. Benefiting from our deep network of relationships across the Street, we have had a number of opportunities to participate in primary issuance at healthy concessions relative to where we could purchase similar paper in the secondary market.

Within the secondary market, we have sought opportunities in select subsectors and in names and/or situations that we believe can withstand the current challenging conditions. In an environment where everything looks to be “on sale,” we are balancing those investments with names in other subsectors that we believe can endure a prolonged economic downturn. The trades we have implemented in the secondary market can be classified into three types:

- Relative value: Intended to position the portfolio more defensively while either maintaining or incrementally increasing yield, e.g., selling an unsecured bond and purchasing a secured bond.

- Deep value: Intended to take advantage of credits “on sale” in select sectors that are essential to the economic recovery, e.g., airlines.

- Opportunistic: Intended to take advantage of attractive credits with select issuers that may stand to benefit from the current environment of self-quarantine, e.g. cable/wireless, food & beverage, healthcare and waste removal.

We believe the combination of these new investments and our diversified sector positioning across key fixed-income asset classes should enhance the expected total return profile of MAC portfolios, especially in a scenario where COVID-19 and oil market-related pressures abate and a sustained market recovery takes hold (Exhibit 5).