MiFID II: An Overview for Clients

Executive Summary

- The primary aim of MiFID II is to provide more protection to investors and help ensure market integrity.

- Although not without its costs and challenges for the industry, Western Asset believes that the implementation of MiFID II should be an overall positive event for our clients.

- Liquidity should continue to be available and we believe markets will quickly adjust to the new requirements.

- Western Asset has elected to pay for research directly from its own account to comply with new MiFID II research cost unbundling requirements and will not pass the cost along to its clients.

- Western Asset expects to be in full compliance with MiFID II by the effective date of 3 January 2018.

Introduction

The financial industry in Europe is about to change. Stricter oversight regulation intended to enhance investor protection, preserve market integrity and improve overall transparency will become effective on 3 January 2018. The new regulation is known as MiFID II—the sequel to the existing Markets in Financial Instruments Directive or MiFID. With an unprecedented global reach and impact on capital markets and structures, MiFID II will cost the financial industry an estimated €2.5 billion to implement . This new directive is certain to usher in a new era for the financial services industry and its clients.

Western Asset has been at the forefront of the changes driven by MiFID II. This paper aims to help share our experience and views with our clients. Overall, we believe that the implementation of MiFID II should be a positive event for our clients.

Background

MiFID was first introduced in 2004 and came into force on 1 November 2007. It serves as the cornerstone of capital markets regulation in Europe. As a result of the credit crisis and market integrity issues, the political forces in Europe pushed for a revision of MiFID that will now become effective on 3 January 2018.

MiFID II: Enhancing Market Integrity and Investor Protection

While many of the existing rules under MiFID are being enhanced by MiFID II, the new regulation also introduces a suite of new rules and requirements aimed at enhancing market integrity and investor protection. In our view, the rules can be broadly summarised into two categories: those related to market integrity and those relating to investor protection. The key elements of these changes are summarised in Exhibit 1:

Summary of MiFID II New Regulations

Given the breadth of the changes, in this paper we focus on the most noteworthy among them.

Primary Client Considerations

Market Integrity

MiFID II provides for a more rigorous regulatory oversight of trading venues and brokers. It sets out more onerous transparency requirements for the fixed-income markets that are more closely aligned with the current equity obligations. The expectation is that more fixed-income trading will move to electronic trading platforms (e.g., Bloomberg, MarketAxess, TradeWeb) and away from voice trading, bringing about greater transparency in fixed-income markets and ultimately narrowing bid and offer spreads.

Transparency

As mentioned above, a key component of MiFID II sets out to achieve greater transparency in the way fixed-income instruments are traded. With respect to trading, the specific new areas of focus are as follows:

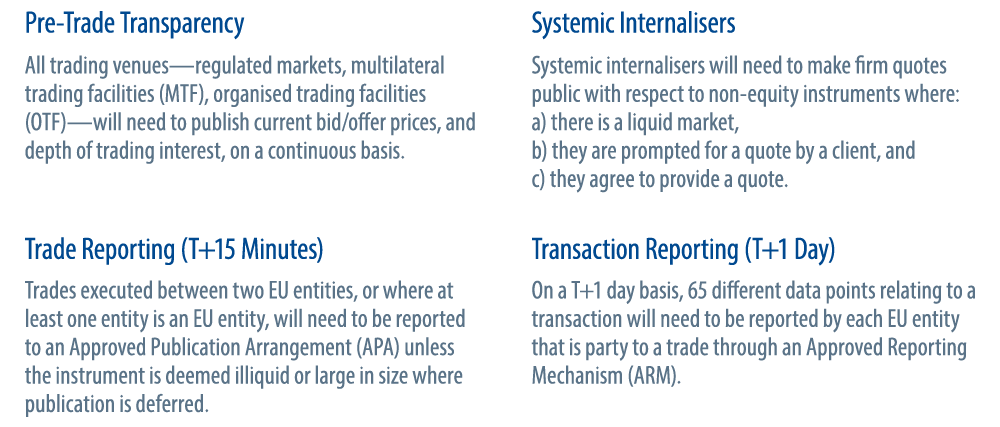

How MiFID II Will Enhance Transparency in Fixed-Income Markets

Payment for Research

MiFID II introduces a requirement for investment research costs to be paid separately from transaction costs. This includes research provided to asset managers by banks and other trading counterparties that do not currently charge explicitly for research. Investment research includes materials providing a conclusive investment recommendation, thus excludes pieces on general market conditions or sector trends. The new regulation will require investment research to be paid for in one of two ways: from the investment firm’s own account or through a research payment account (RPA) funded by a separate charge to an underlying client.

Western Asset has elected to pay for research directly from its own account and will not pass the cost of research to its clients, which is in contrast to our current practices where we do not pay for research in any manner. Western Asset has a long-standing global credit research department and we expect that the transition to the new research framework will be a smooth one for the Firm and our clients.

Best Execution

While the concept of best execution is not generally changing in light of MiFID II, there is a higher monitoring threshold that investment firms will need to meet. In particular, firms will need to take “all sufficient steps” rather than “all reasonable steps,” to achieve best execution as is currently required.

In response to the new requirements, Western Asset will generate a report for its clients that will list the top-five venues for each asset class traded by the Firm on an annual basis. This additional client report will provide information on how Western Asset seeks best execution in its transactions and how it adheres to its order execution policy.

Investor Protection

One of the main goals of MiFID II is to provide more protection to investors. Therefore, Western Asset believes that the implementation of MiFID II should be a net positive event for its clients.

The investor protection element of MiFID II will enable our clients to receive more information about their investments on a periodic basis. In addition to trade and holdings data, clients will be receiving costs and charges information relating to their portfolios. This is a new concept for fixed-income asset managers and the industry is working on developing an appropriate standard. The costs and charges reports will be provided to clients on an annual basis.

Investors will be further protected through planned enhancements to our product development process, including greater oversight by the board of directors as required by MiFID II. Under the new regulation, investment firms will be required to take a more formal and coordinated approach to how products and strategies are developed, sold and monitored to a target market.

Finally, as a result of MiFID II, investors will receive a greater amount of performance and risk disclosures in the marketing and investment materials, with the aim of enabling them to make better informed investment decisions.

Western Asset’s Initial Efforts to Comply with MiFID II

Western Asset has comprehensively reviewed its IT systems, policies and procedures as well as controls in preparation for the implementation of MiFID II. As a result, we are employing a number of new systems, including working with new trade and transaction reporting providers. We are also partnering with large data providers to enable us to obtain and analyze the vast amount of trade data that will be required going forward. We are also adopting new compliance monitoring tools, including tools for monitoring the receipt and usage of broker research.

The most significant system change comes as a result of trade and transaction reporting as well as the earlier referenced costs and charges analysis and reporting. Western Asset has selected reputable third party vendors to assist the Firm in complying with trade and transaction reporting requirements, respectively. We are working with these firms to build the necessary links with Western Asset’s trading systems and to ensure that all necessary data are provided.

Western Asset’s Ongoing Compliance

Western Asset’s long-standing Compliance Monitoring Program (CMP) ensures compliance with its policies and procedures and with the laws and regulations applicable to its business. The CMP utilizes a risk-based approach to identify, rank and address the risks that Western Asset has identified in its business. Western Asset UK’s CMP is being updated to ensure that Western Asset monitors compliance with the new MiFID II requirements.

A Client’s Role

To assist Western Asset in meeting its obligations under MiFID II, each of our clients will need to provide a valid LEI to the Firm. LEIs will enable investment firms to trade on EU venues and with EU brokers, as well as to meet their trade and transaction reporting obligations.

As required under MiFID II, we will look to our clients to accept the terms of our new order execution policy prior to 3 January 2018.

Key Issues for the Industry Prior to Implementation

The broker research payment requirements are proving controversial outside the EU and in particular in the US, due to the Securities and Exchange Commission “soft dollar” rules. Western Asset feels that the most recent communication by the UK Financial Conduct Authority to the Alternative Investment Management Association and other industry organisations provides much needed clarity on how to achieve “middle ground” in applying the rules outside the EU. As a result of the FCA letter, Western Asset is taking steps to put in place controls in line with the FCA recommendations.

In addition to research, extraterritoriality of trade reporting has also posed some concern for global firms. In particular, where a non-EU entity trades with an EU venue, certain personal information for order record-keeping purposes will need to be provided by non-EU firms. Such firms will need to make arrangements to ensure such data are available to the venues when required.

Finally, there is a number of technical issues that the industry is still trying to resolve including setting a standard for voice trade time stamps, obtaining ISINs for over-the-counter trades in real time, developing a standard for costs and charges reporting and determining which counterparties will be deemed as systemic internalisers.

Impact of MiFID II and Increased Transparency Rules

Western Asset has been in constant contact with its peers, as well as with the counterparties and trading venues through which it trades, to understand the impact of MiFID II on trading post 3 January 2018. We believe that, overall, markets will quickly adjust to the new requirements. In addition, with the more practical methodology ultimately adopted by the European Securities and Markets Authority related to the transparency of fixed-income investments, we believe that liquidity will continue to be available in the markets and the new rules will create limited disruption to normal business activities.

In the product development arena, we envisage better engagement between product manufacturers and distributors as MiFID II will open better lines of communication between the two, allowing for better outcomes for investors.

While the transition may be challenging initially, investors will ultimately have more information available to make better educated investment decisions. Western Asset will work with its clients to provide the necessary support and to ensure that any additional information provided will meet our clients’ needs.

Endnotes

- Attracta Mooney: €2.5bn cost of MiFID II rattles asset managers. Financial Times, 27 January 2017.