KEY TAKEAWAYS

- The economy’s growth last year was supported by fiscal stimulus and strong consumer activity, but fiscal policy is not expected to contribute to growth this year.

- International trade and global growth rates have weakened, with no immediate signs of a turnaround, indicating potential headwinds for the economy.

- Despite geopolitical risks, the recalibration of central bank policies and sturdy global growth provide a positive fundamental backdrop for fixed-income investments.

- MBS faces headwinds from the Fed’s quantitative tightening and policy tightening, yet reduced rate volatility and low prepayment risk should support positive MBS performance.

- EM currencies are at low levels due to a strong US dollar, but they stand to benefit from a shift in US interest-rate policy, especially as EM countries have already raised rates and improved financial policies.

The new market mantra is “higher for longer.” Prevailing market and Federal Reserve (Fed) sentiment is that with the economy’s resilient growth persisting this year and inflation still above the Fed’s target, the Fed may cut policy rates just once or twice and those cuts are now not expected until well into the second half of the year. Our view has been that with the uneven but steady diminution in inflation, the more important takeaway is that rates will ultimately move downward even if the timing remains uncertain. Moreover, as the inflation picture clears, the outlook for spread sector outperformance versus Treasuries remains favorable. Our strong suspicion is that growth is likely to slow over the balance of the year. In conjunction with falling inflation, this may allow the Fed to cut rates sooner.

The inflation picture remains one of a bumpy path toward lower levels. Interestingly, the economy’s trajectory also suggests a bumpy path toward lower levels. The US economy grew 3.10% last year. This was helped by additional fiscal stimulus and a vibrant consumer. This year, that picture is changing. Fiscal policy will no longer be additive to growth. The current narrative suggests that with unemployment low, and with housing and stock prices high, consumer spending should remain robust. Additionally, the high-tech sector continues to boom and corporate profits remain healthy.

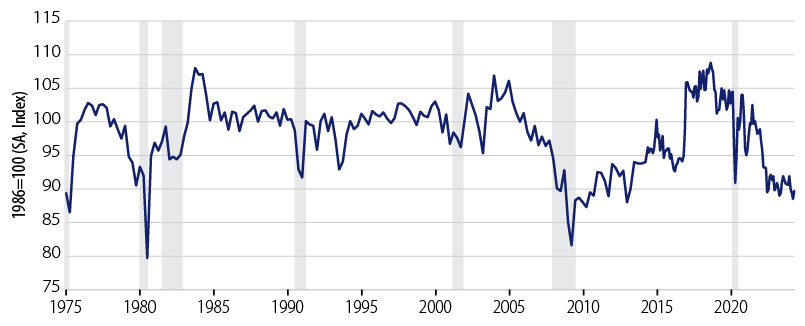

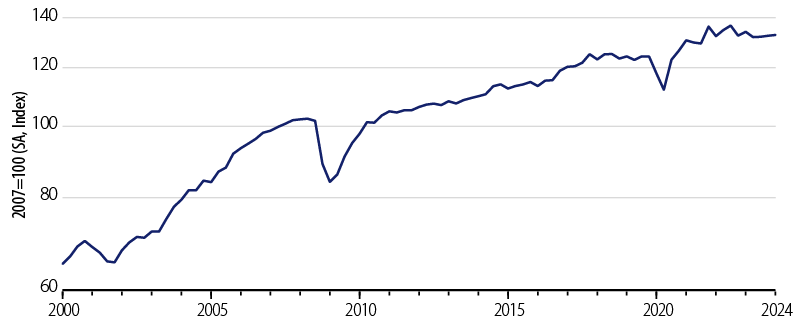

But there are cautionary signs developing on the other side of the ledger. Exhibits 1-4 display some sectors of the economy that are sluggish—small business, housing, the service sector and international trade.

Small business sentiment continues to decline. The “locked-in” housing market suggests housing starts will remain modest and will not be a source of growth. After the post-Covid boom in service spending, activity in this sector is slowly waning. International trade has weakened from healthy pre-Covid growth rates. Global growth has already downshifted, suggesting that a turnaround should not be expected.

Furthermore, we continue to look for consumer retrenchment, and recent data as well as anecdotal evidence suggests this may already be starting. Our base case remains one of below-trend growth, falling inflation and accommodative Fed policy to forestall a recession. Today’s favorable backdrop should provide a cushion to a benign downshift in growth. But lower interest rates are part of that transition as well.

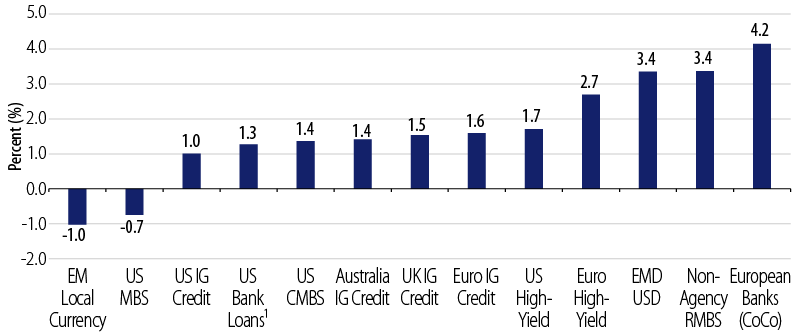

On the sector front, the broad-based outperformance is shown in Exhibit 5. Resilient growth, lower inflation and potential rate cuts have provided a powerful tailwind for sector performance this year. Notably, the only two sectors to have underperformed have been mortgage-backed securities (MBS) and local currency emerging markets (EM). Both these sectors enjoyed vibrant returns in the fourth quarter of last year as Treasury rates fell. But the softening of interest-rate cut expectations this year has caused both to suffer as their performance tends to be highly correlated with US interest rates. However, our view is that these two sectors should be meaningful contributors to performance over the balance of the year.

MBS has been plagued by a variety of fundamental headwinds. These include Fed selling as part of its quantitative tightening (QT) program, Fed policy tightening and an inverted yield curve. But the most difficult obstacle by far has been the enormity of fixed-income volatility. Even as the VIX, FX volatility and corporate credit volatility all declined, Treasury rate volatility remained very high. The anomaly of the “risk-free” asset class being the most volatile of all the asset classes has been stunning. All these negative forces should either abate or reverse this year. We feel particularly strong about a meaningful drop in interest-rate volatility. Importantly, prepayment risk, the usual danger to this sector, figures to be minimal. With close to 90% of US homeowners locked in to a 5% or lower mortgage rate and roughly half at 3% or less, the decline in mortgage rates necessary to trigger a substantial prepayment wave would have to be in the hundreds of basis points.

Local currency EM usually is one of the prime beneficiaries of a halt in developed market (DM) central bank hiking. This time, with EM countries having hiked rates well before the DM central banks, and currencies at depressed levels due to the elevated dollar, the potential benefits should be meaningful. These EM countries also have strengthened their institutions and their financial policies, and for the most part have been cautious. A turn in the US interest-rate outlook, just as we saw in 4Q23 would probably precipitate a notable rally.

Overall, our theme has been constructive across the breadth of fixed-income sectors. The disastrous inflation and other challenges of the Covid crisis are slowly unwinding. Central banks have the opportunity to recalibrate policy rates downward. Meanwhile, global growth is sturdy. Geopolitical risks are unfortunately a persistent part of today’s risk assessment. But if the world can find a way forward relatively peacefully, the fundamental backdrop for fixed-income should remain very favorable.