KEY TAKEAWAYS

- The low or negative correlation benefits of high-quality bonds with risk assets all but disappeared in 2022.

- Real yields are now back to pre-GFC levels, and nominal yields of Treasuries, investment-grade and high-yield bonds are at heights unseen in many years.

- As yields have risen and spreads have widened, we cannot rule out the risk that Fed overtightening could lead to a recession.

- Our view is the Fed will likely slow then pause its rate hikes no later than the first quarter of next year.

- The reversal of inflation would be a potential game-changer.

By some accounts, this has been the worst year for bonds since the Great Depression. In addition, the low or negative correlation benefits of high-quality bonds with risk assets, particularly equities, all but disappeared. This made for the narrative of the “death of the 60/40 portfolio,” which also had its worst year on record. As central banks across most of the developed (DM) and emerging market (EM) world squeeze liquidity, asset markets have come under relentless pressure, perhaps culminating with the recent collapse of crypto assets of all types. Bear markets are brutal, and the difficulty is in trying to survive. But ultimately they do provide a benefit: they restore value.

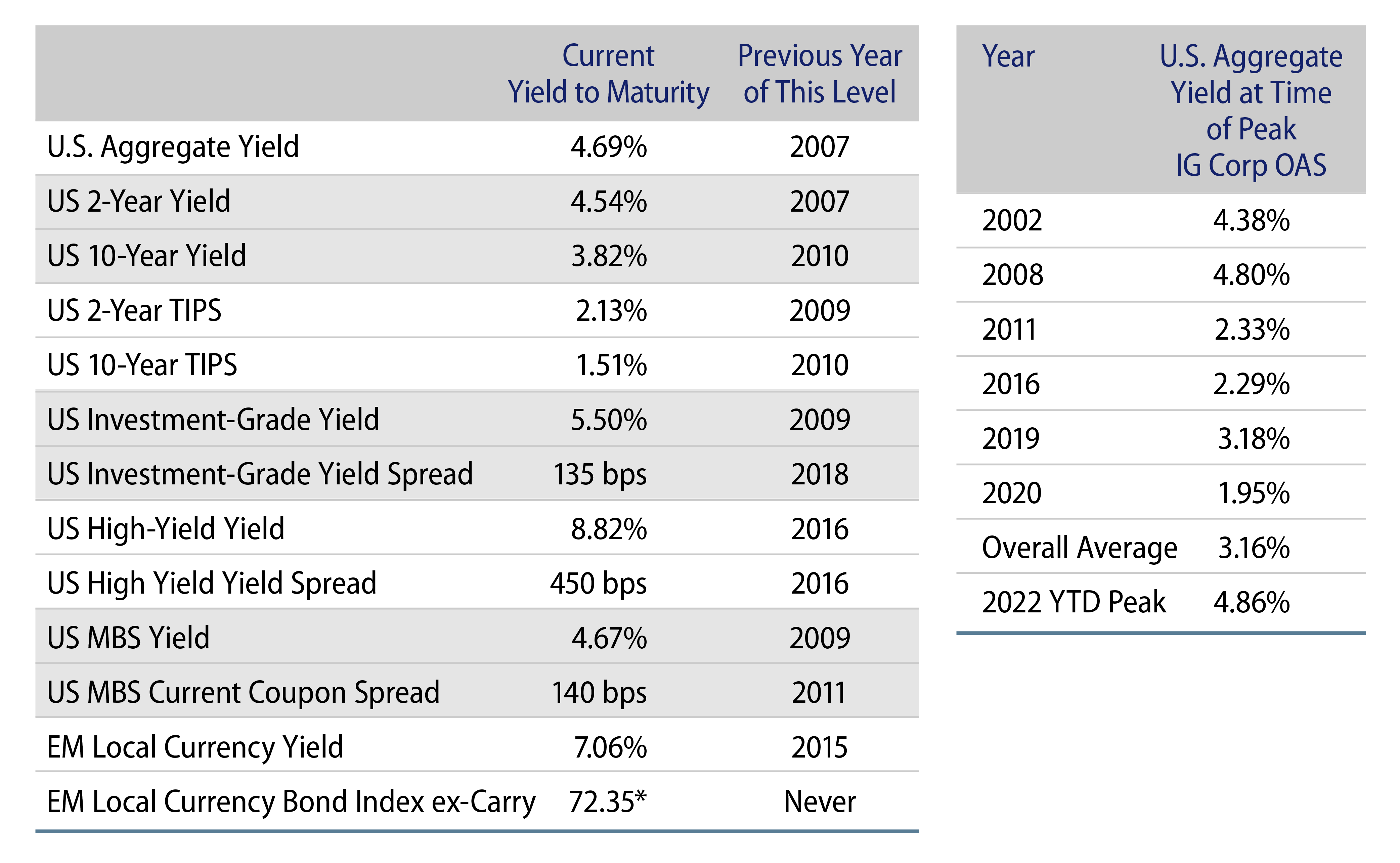

Exhibit 1 displays current yield to maturity and spread levels, and the last time they were this elevated. Real yields are back to pre-GFC (global financial crisis) levels, and nominal yields of Treasuries, investment-grade and high-yield bonds are at heights unseen in many years. The yield on the Bloomberg aggregate index has not been this high since 2007. The key point to understanding why today’s yields on spread sectors are so high is the combination of both rising yields and yield spreads at the same time. While previous peaks in yields spreads were wider than they are now, lower Treasury yields provided an offset to the total index yield. The index yield level today is very attractive relative to those of previous distressed peaks.

The root cause of the central bank draconian tightening is the elevated inflation rates, which are persisting across the globe. The early monetary and fiscal accommodation employed to protect economies from the difficulties posed by Covid were then exacerbated by massive reopening demand as populations came out from under Covid only to be met with limited supply. Price shocks were then amplified by the Ukraine-Russia conflict driving commodity prices northward, and amplified further still by the reinstatement of Covid lockdowns in China, which further stressed supply chains. All this occurred while meaningfully significant segments of the populations chose not to immediately reenter the workforce amid the ongoing Covid recovery.

As difficult as the inflation situation has become, the continuation of monetary tightening runs the risk of fighting last year’s war, as it were. The global economy is beset by strong headwinds. Geopolitical considerations tilt risks to the downside. Further, the lagged effects of the most substantial and rapid global synchronized tightening in decades have yet to come through. This comes as the inflationary tailwinds of yore have abated or reversed. To be sure, inflation needs and has a long way to fall. But forward-looking as opposed to lagging indicators are turning sharply. Monetary policy, as measured by money-supply growth or broad liquidity provisions, has become restrictive. Fiscal drag is in evidence globally. Housing prices in the US and much of the DM world have started falling. Goods prices are falling and inventories are building. Supply chains have eased. Commodity prices have fallen sharply from elevated levels earlier in the year. Our view is that the continuation of such downward price pressures will lead the Federal Reserve (Fed) to slow then pause its rate-hiking program by no later than the first quarter of next year. Fed officials’ stated intent has been to pause when they become sufficiently confident that inflation is on a sustained downward trajectory. They also continue to promote forward guidance that rates will not be reversed from those levels for a significant period of time.

Our contention is that markets are forward-looking and will grasp the change in the inflation trajectory even as the Fed continues to remain restrictive. Indeed, this month’s violent bounce and extraordinary reversal in the US dollar’s direction may be harbingers of just that dynamic. We expect this to be a protracted process. Central banks are determined to show fortitude and patience as inflation subsides. This will occur against below-trend growth in the US and globally. But the key is that lower inflation is the necessary bedrock for better markets long term. As confidence grows that the fight is being won, and perhaps decisively, valuations can improve even against a backdrop of subpar growth.

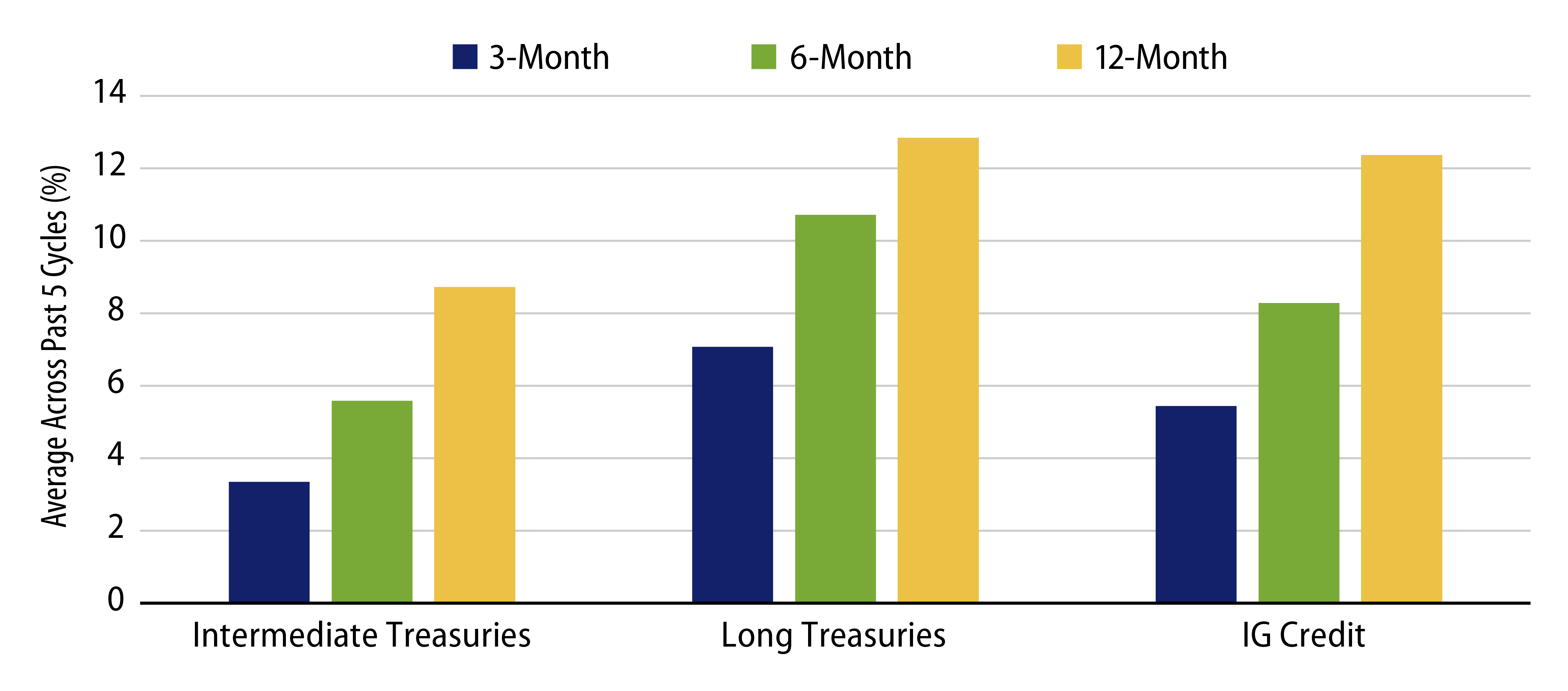

Investors have turned extremely defensive in the face of the unprecedented monetary squeeze. As yields have risen, so have spreads widened as the potential for Fed overtightening leading to a recession cannot be ruled out. Despite yields on almost all fixed-income sectors being at one- or two-decade highs, investors continue to fear the worst. What could change this dynamic would be the prospect of the Fed pausing. Staying on the sidelines when rates are potentially peaking is a different but significant money-management risk. Exhibit 2 shows the historical total return of fixed-income sectors after the fed funds rate has peaked.

Another risk asset fear comes from the possibility of a global recession, as tightening has been synchronized for much of the world. Important to this issue is the restoration of China’s growth. The bar here is low, as Covid restrictions and property-market deleveraging caused China’s growth to be the lowest in over 20 years. Again, while probably a protracted process, our view is that China’s growth will improve over the course of 2023.

The key for investors hinges on valuations. As we pointed out earlier, these are currently attractive. The storyline of persistently elevated inflation and hawkish central banks willing to risk overkill have elevated government rates and driven spread sector yield spreads to anticipate a substantial surge in defaults. The continued strength for the dollar, led by more resilient US growth in the face of weak global growth has further stressed risk assets. The challenge is that the narrative has played well so far, and its continuation cannot be ruled out. Markets are braced for what we might characterize as a dismal outcome. But this is not the only scenario. Could growth in China and Asia improve as the West wanes, reversing the dollar’s ascendency? Could central bank pauses change the dynamic for future pessimistic outcomes? And most importantly in our view, could the change in direction of inflation be a potential game-changer?