KEY TAKEAWAYS

- Our view is that markets are recalibrating to a future that may appear much different than the present.

- Given the pro-cyclical policy and pent-up demand, we believe investors should stay the course in overweighting spread sectors relative to global or sovereign bonds.

- While they are currently facing challenges, EM local currency bonds offer the potential for abundant yields.

- We are optimistic that EM will ultimately benefit, provided that Covid threats recede, global growth persists and interest rates remain low.

The dog days of August are almost over, and good riddance. The stunning forcefulness of the delta variant, the Chinese lockdown (Covid)/crackdown (regulatory)/and slowdown (economy) have unfolded against the backdrop of the nearly incomprehensible debacle in Afghanistan. Yet markets have been largely calm. Equities and fixed-income markets continue to behave well. Our supposition is that markets are recalibrating to a future that may appear much different than the present. The resurgence of the medical challenges will be beaten back, as the world knows that broad-scale vaccinations are the answer. Amid today’s rising Covid hospitalization toll is a concurrent meaningful reacceleration of vaccination rates around the world. It will take time, but it is coming. The current period of elevated prices, supply constraints and labor shortages will fade. The enormity of the tailwinds of monetary and fiscal policy combined with the once-in-a-century unleashing of consumer demand coming out of a pandemic will not be repeated. The secular headwinds that defined the pre-pandemic growth and inflation landscape—debt, demographics and technological displacement—will become a prominent part of the narrative. Moderate growth, moderate inflation and low-for-long rates seem to be coming back as the underpinnings of current market pricing.

Our contention has been that the pre-pandemic levels of output could be achieved and that the Covid threat would ultimately be put in the rearview mirror. We believe our message is a very optimistic one. But the path, in our view, will continue to be uneven, and the achievement will not be reached quickly. Further, there has to be asymmetry in the reaction function of central banks—quick to ease, slow to tighten. This is why we think monetary policy will have to continue to be very accommodative.

For fixed-income investors, trying to maintain yield advantages by overweighting spread sectors should be a dominant focus. As the recovery has developed, and as the circumstances of the Covid battle have changed, we have rotated among the various sectors. Meaningful overweights to investment-grade and “plain vanilla” high-yield have moderated in favor of reopening sectors. Bank loans, residential mortgage-backed securities, selective commercial structured products and emerging market (EM) positions have become more prominent.

On the interest-rate front, our guess was that rates might trade broadly in a range of perhaps 1.25%-1.75% for 10-year notes. If all were to go smoothly, by the end of the year, the upper end of that range might be seen—though should developments prove more challenging, the bottom end of the range could come to fruition. We were surprised to see the top end hit just weeks into the year, as the vision of a global boom/reflation trade became popular. But the Covid path has unfortunately been more challenged, and now we find ourselves at the bottom end of our range. Our disposition is to reduce duration, especially in the intermediate portion of the curve, but remain overweight to mitigate exposure to the potential of softer growth. Part of this calibration simply reflects that lower quality spread products do not trade to their arithmetic durations, especially in a risk-off period. Hence, in a market context, a portfolio’s empirical duration likely will be less than its reported duration.

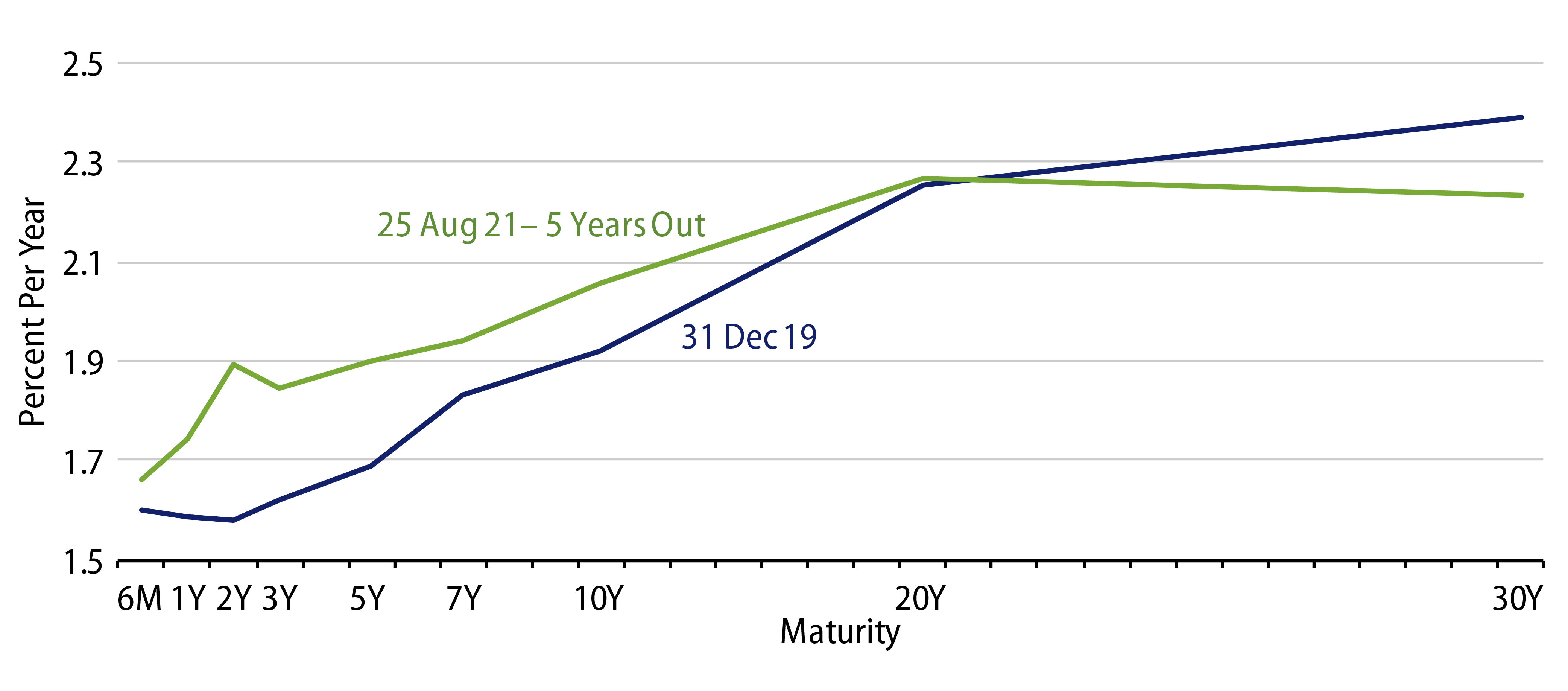

One of the concepts widely employed by policymakers as well as market participants is the five-year forward yield curve. The idea is that this provides the market estimate of what “normalized” interest rates are expected to look like. Remarkably, today’s five-year forward yield curve looks very much like the yield curve for the pre-pandemic year-end 2019 yield curve (Exhibit 1).

Much like the questions back then, the question most often asked by fixed-income investors today is “where can I get extra yield?” Global developed market (DM) policy rates are pinned at zero or negative levels, credit spreads are reasonably narrow, and the liquidity premium between public and private credit are at historical tights. Getting additional yield presents an acute challenge. This becomes particularly apparent if the conditions for an imminent change are not readily obvious. Credit spreads tend to follow the business cycle, with the tightest level coming very late in the cycle. With pro-cyclical policy and pent-up demand likely to carry this business cycle forward for perhaps several years, our best judgement is that investors should stay the course in overweighting spread sectors relative to global or sovereign bonds.

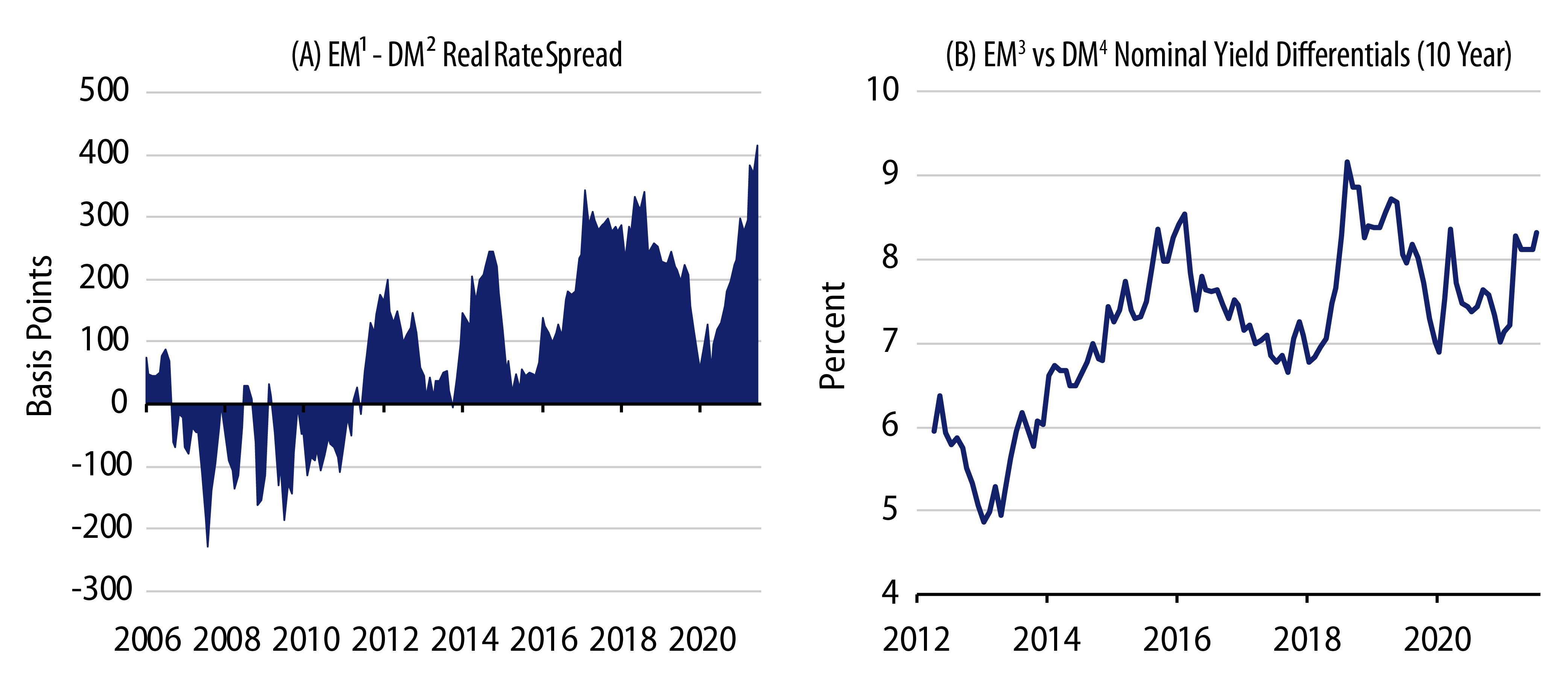

With global and US growth decelerating from very strong levels, Covid resurging, and the Federal Reserve on the verge of tapering, the macro outlook for EM local currency is not immediately promising. But as value investors, this is the area of global fixed-income where yield is not scarce, but rather abundant. Exhibit 2 displays the yield advantage of a broad array of EM bonds relative to DM bonds in both real and nominal terms. The real yield advantage of EM is a stunning 4.06%, standing at a 15-year wide. In nominal terms, this particular EM basket yield advantage of over 800 basis points (bps) versus DM bonds stands out in a fixed-income world starved for yield.

The challenge is that to maximize the yield advantage, one would buy these bonds unhedged (accepting the currency risk). Currency risk introduces some volatility and therefore demands thoughtful position management. In an EM basket with an 800-bp yield advantage, these currencies would have to depreciate by 50% over the next nine years in order to underperform DM bonds.

In our last note, we outlined the case for a meaningful positive reversal of fortune for this sector. Briefly, for this to happen investors need three things: Covid to diminish, global growth to be firm and interest rates not to rise precipitously. We like the prospects of all three.