KEY TAKEAWAYS

- The enormity of the downward economic shock due to COVID-19 is without modern precedent, but the same is true of the scope of the monetary and fiscal policy response.

- While global GDP growth is expected to take a bigger hit than at any time since the Great Depression, optimism can now be seen that a global economic recovery is beginning to gain traction.

- Economic activity has responded sharply to the stimulus provided by policymakers. In the US fixed-income markets, both investment-grade and high-yield corporate bonds have been the biggest beneficiaries of stimulus.

- We believe that opportunistically positioning yield-curve flatteners, along with an overweight in corporate bonds, can provide an asymmetrically positive risk/reward proposition.

- We remain of the view that this is going to be a long, hard slog.

The COVID pandemic has taken an astonishingly exorbitant toll on humanity from both a medical and economic perspective. The financial markets have also come under extreme pressure, but have rebounded substantially.

The path of the virus holds the key to the outlook. So much is still unknown. Listening to a broad range of medical experts is not always reassuring. Their learned conclusions and predictions vary widely. Reasonable people can disagree about the medical state of affairs. The global case counts keep rising. Economic reopenings are invariably followed by renewed COVID cases. On the other hand, the death rate has started to drop sharply. The lower mortality rate for younger persons and better therapeutics are key reasons. The medical community has finally begun to get the measure of the disease, maybe simply by the trial and error of six months of battle. There seems to be substantially less fear of hospital and medical infrastructure being overwhelmed, which was the initial motivation for government-induced shutdowns. Of course, the game-changer would be a vaccine, and there is an increasing number of reasons for optimism in this regard.

On the economic front, the devastation has been immense. In the US, Federal Reserve (Fed) Chair Jerome Powell summarized the shock succinctly: “We went from the lowest level of unemployment in 50 years to the highest level in close to 90 years, and we did it in two months.” Globally, the decline in annual GDP is estimated to be more than -5%, the worst outcome since the Great Depression.

Indeed, the enormity of the downward economic shock is without modern precedent. And policymakers globally have responded with a Herculean amount of monetary and fiscal stimulus. Economic activity has reacted sharply, albeit from an extremely depressed base. So despite the tremendous circumstances, optimism is growing that a global economic recovery is gaining traction.

Markets are forward-looking discount mechanisms. The optimism on both the medical and economic fronts, combined with ongoing policy commitment, has caused global risk assets to rally meaningfully. In the US fixed-income markets, investment-grade corporate bonds as well as high-yield corporates have been the biggest beneficiaries.

The overarching goal of US economic policy is to keep the corporate infrastructure intact to facilitate a recovery. This crucial objective led to allowing the Fed to buy corporate bonds directly for the first time ever. As we pointed out in our last note, the 2Q20 market commentary, our portfolio strategy has centered on making corporate bonds, predominantly investment-grade, our cornerstone investment.

As we also said in our last note, investment-grade yields have declined by the end of every US recession. Lowering high-grade borrowing costs is a crucial objective in sustaining the recovery. Additionally, providing plentiful liquidity to facilitate the borrowing needs of more challenged corporations has also been a bulwark of the Fed’s program. The Fed’s avowed commitment to maintaining an extraordinarily accommodative stance until a “vigorous” recovery is underway continues to bode well for this sector.

Overseas investment is yet another source of demand for US corporate credit. With global policy rates more closely aligned, hedging costs for foreign investors have collapsed. Global fixed-income investors desperately need yield. Yet developed country policy rates are zero or negative, and there is little prospect of any increases for years to come. US corporate yields may be very low by historical standards, but they are much higher than in most of the developed world. These factors underpin global buying support for US corporate bonds.

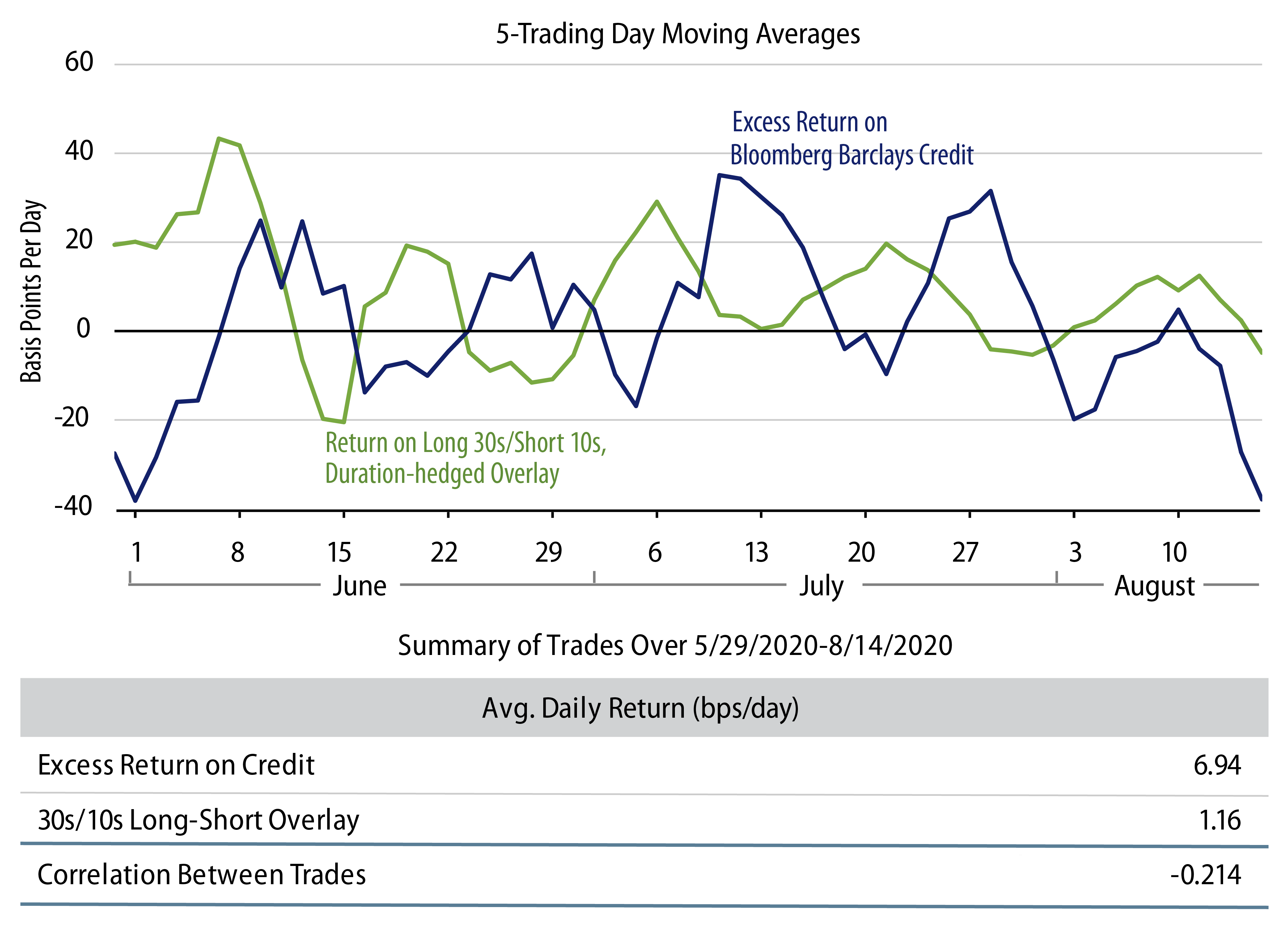

The chances of more “lockdowns” in response to ongoing COVID-19 outbreaks cannot be ruled out. The enormity of the global debt load continues to be a serious risk. How do investors help balance a portfolio designed for a global recovery? In our webcast last month, we amplified our theme of opportunistically positioning in yield-curve flatteners. We believed this would be a powerful diversifying and hedging device for our overweight in corporate bonds. Theoretically, the key to using strategies with negative correlations is that they must be viewed as having asymmetrically positive risk/reward attributes. Otherwise, the question would be, “Why hedge when you could just simply reduce your exposure?” Our strongly held view is that this trade possesses these asymmetrical characteristics. We feel it is straightforwardly negatively correlated with spread sector performance. The asymmetry is judgmental, but rests on the proposition that while yield-curve flattening can be expected in a “risk-off’ environment, the overarching concern of policymakers to keep financial conditions from quickly or sharply deteriorating implies a reasonable probability of increased central bank long-maturity asset purchase defense. The more persuasive fundamental arguments follow from our view that we remain in a highly disinflationary environment. This strategy implicitly seeks to take advantage of rising rate expectations evidenced when the yield curve steepens. It is best utilized by investors, like ourselves, who believe any significant inflation threat lies far into the future. Exhibit 1 shows the experience of this strategy combined with an investment-grade corporate bond overweight since our last note.

The aversion most investors have toward longer-term Treasury bonds is rooted in the fear that while possibly temporarily dormant, much higher inflation lies ahead. This is evidenced by the shape of the yield curve. Taking 10 years of Treasury duration risk affords only a 66 basis point (bp) yield. Yet the spread between 10- and 30-year Treasuries, a fully hedged duration trade, stands at fully 75 bps. In this world of very low yields, and the high probability that policy rates will stay “low for long,” we think this spread pricing helps provide an opportunity for defensive positioning.

The stronger inflation suspicion championed by many is that policy stimulus will persist long after recovery has been achieved and eventually lead to an inflation problem. But while this scenario is plausible, it appears to us to be at best far into the future. We think there are too many ifs. If the economic recovery can be sustained; if the recovery strengthens and broadens; if the deflationary impulse is truncated; if the policy stimulus remains every bit in force; then…maybe we see inflation pick up sharply. We believe this economic recovery is not even remotely out of the woods. In our view, policymakers are right to be completely focused on precluding a relapse. Interest rates and inflation may well be anemic for years. It will be a long climb out of this hole if all goes well.

We are extremely gratified that our optimism at the depth of the despair in the markets has proved warranted. But winning the battle being fought against the downward economic and price pressures is no foregone conclusion. Looking forward, the massive addition of global debt—already a huge problem before the crisis—will retard growth for years. We remain of the view that this is going to be a long, hard slog.