KEY TAKEAWAYS

- Global growth has improved from the worst-case fears of late-2018 and monetary policymakers have declared explicitly that their goal is to extend the expansion.

- With the annual US growth rate slipping below 2% and inflation falling further, we believe the Fed will begin to discuss whether a policy cut is needed.

- While risks of a “hard Brexit” have increased with the departure of UK Prime Minister Theresa May, we continue to believe a deal will be reached.

- We expect global growth to remain sturdy, and for interest rates in the US to remain attractive compared with the rates of other developed market countries.

- The global backdrop of low inflation, low interest rates and accommodative monetary policy underscores our resolve to stay the course with overweight spread products and a long duration complement.

At the turn of the year, we felt our call for spread sector outperformance depended on sturdy global growth and accommodative monetary policy. We were looking primarily for three scenarios: trend growth in the US helped by a more dovish Federal Reserve (Fed) policy stance, stabilization then improvement in the Chinese economy aided by a lessening of trade tensions, and stabilization in European growth while avoiding a tail-risk political event, particularly Brexit. Sound familiar? Up until a few weeks ago, everything played out largely according to script. The downward trajectory of growth abated and prospects slowly brightened across all three economic regions (the US, China and the eurozone). Until recently, spread sector outperformance has been exceptional (Exhibit 1).

But as unlikely as it may seem, we now need help with those same scenarios. The Fed needs to move to a more dovish stance, trade tensions need to lessen and worst-case fears over Brexit need to recede. The good news is that global growth has improved from the worst-case fears of year-end 2018 and monetary policymakers have straightforwardly spoken to the need to extend the expansion. The bad news is the risks enumerated above threaten a further downshift in global growth.

The Fed has been extremely clear that its intent is to keep policy on hold unless a meaningful change in conditions occurs. Its thesis is that the economy at trend growth—with financial conditions seemingly easy and inflation only temporarily below target—warrants patience. Indeed, in its dot plot, the Fed continues to signal that the next move will be an eventual tightening. But while the change in policy stance will be belated, expect the Fed to find an opportunity to message that it is open to the prospects of easing rates. Our view is that annualized US economic growth is slipping below 2%. Inflation not only remains below the Fed’s target, but has fallen further as the year has progressed. Indeed, the Fed’s confidence in its errant inflation projections is remarkable, given that core Personal Consumption Expenditures (PCE) has only exceeded 2% once in the last six years. Inflation expectations, as measured by TIPS (Treasury Inflation Protected Securities) breakevens, have fallen well below 2%. Lower growth, lower actual as well as expected inflation, and increasing risks to global growth in our view all make the point rather clearly that Fed Chair Jerome Powell’s “overarching goal” of extending the expansion needs lower, not higher policy rates. Our view is that the Fed will acknowledge the need to monitor developments closely with a view as to whether to ease policy.

We have been cautiously optimistic on Chinese growth, understanding the sustained monetary and fiscal stimuli that have been at work would slowly but surely gain traction. Indeed, the economic indicators have been signaling not just economic stabilization but improvement as well. Our view that the second half of 2019 would prove better than the first appeared to be coming home. Now the reignition of trade tensions has put that improvement at risk. Our expectation had been that there would be a trade deal, bringing down the temperature of US-China tensions. But we understand completely that the economic competition between these powers will be ongoing. We still hold out hope that a deal may yet be completed. But even if it is not, we expect Chinese growth, while weaker than otherwise, to remain sturdy. The need to successfully compete economically with the US in the face of escalating trade disputes will demand yet more stimulus, and we believe it will be forthcoming.

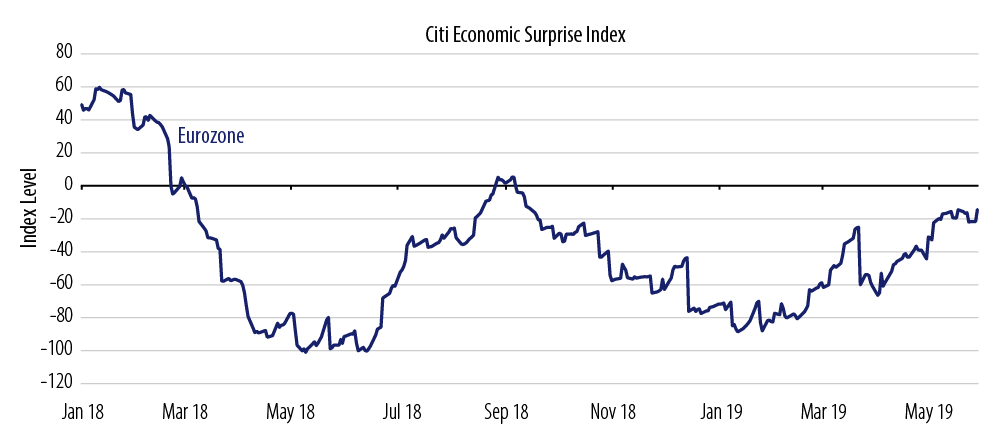

Trend growth in Europe is reckoned to be only in the neighborhood of 1.0% to 1.25% annually, so the bar for growth is low. Despite gathering political clouds, the economic backdrop for European growth had been quietly but steadily improving (Exhibit 2). Our view has been that such modest levels would be achieved absent a political shock, particularly Brexit. As Americans, the good news about Brexit is that however dysfunctional our politics seem, the British have managed to outdo us. With Prime Minister Theresa May’s departure, the risks of a “hard Brexit” have increased. Our base case, though, remains that a mutually palatable deal will be reached. This will take time, and weigh on business and investment sentiment.

An investor looking at the reasonable prospect of moderate US and global growth, subdued inflation and determined monetary accommodation might well consider that spread products, with their higher yields, would be the prohibitive favorite in producing superior returns. With growth risks rising, this thesis is put into question. Concurrently, with growth risks rising, the advisability of holding long duration positions as a crucial strategic portfolio position is reinforced. Our view remains that US and global inflation will be extraordinarily slow in resuming any upward trend. A downshift in global growth brings an actual resumption of a downward trend back into play. Policymakers must be—and in our view will be—very attentive to this development. This reinforces the prospects for global sovereign and US Treasury yields to remain low or move lower.

Our thesis is that global growth will remain sturdy. This seemingly low bar for global growth is now being challenged, but we think optimism on this point remains warranted. The fledgling improvement we had been seeing in global economic data two weeks ago may become less pronounced, but we believe it is unlikely to be reversed. Furthermore, policy accommodation may be forthcoming to undergird the expansion, particularly from China and the US. Last, there is the very real prospect of positive surprises. Two weeks ago, market optimism of an impending trade deal was rampant. This has been replaced by extreme pessimism that a deal can be reached. Optimism that a “hard Brexit” was completely off the table abounded; now fear has taken its place. If these uncertainties are lifted, investors who exited spread positions will be hard pressed to reclaim positions.

Furthermore, the world of yield starvation is coming very much back into play. Over 20% of the Global Aggregate index (some $10+ trillion of securities) have negative yields. Interest rates in the US of 2%+ are high by comparison. In the US investment-grade corporate bond market, yields and yield spreads are also the most generous. Low inflation, accommodative monetary policy, low worldwide interest rates and what had heretofore been a slowly improving global growth backdrop lead us to stay the course: overweight spread products with a long duration complement. It may take time, but good news may once again emerge.