Market Commentary

A smooth sea never made a skilled sailor. ~Franklin D. Roosevelt

Executive Summary

- Optimism for a synchronized global recovery earlier this year has given way to anxiety over potential EM or European crises.

- The divergence between economic data expectations for the US compared with other developed markets has been breathtaking.

- With EM real yields relative to DM real yields at close to a 10-year high, the most important variable for EM returns remains improving global growth.

- EM difficulties have suddenly become acute due to downwardly revised growth expectations, higher US rate expectations, a strongly rising US dollar, protectionism and sharply higher oil prices.

- We expect solid growth in the US, China, Japan, Australia and non-emerging markets and do not share the extreme market pessimism about Europe.

- While our viewpoint remains optimistic, maintaining portfolio assets to protect against the vagaries of downside risks is crucial.

The uneven nature of the global recovery has reared its ugly head again. The optimism for a global synchronized recovery at the beginning of the year has given way to anxiety over potential emerging markets (EM) or European crises. The divergence in performance between the US bond market and markets in the rest of the developed world has been breathtaking. The driver of this divergence is the expectation that US growth will pick up sharply in the second half of 2018, while growth expectations for Europe, China and EM have all been lowered.

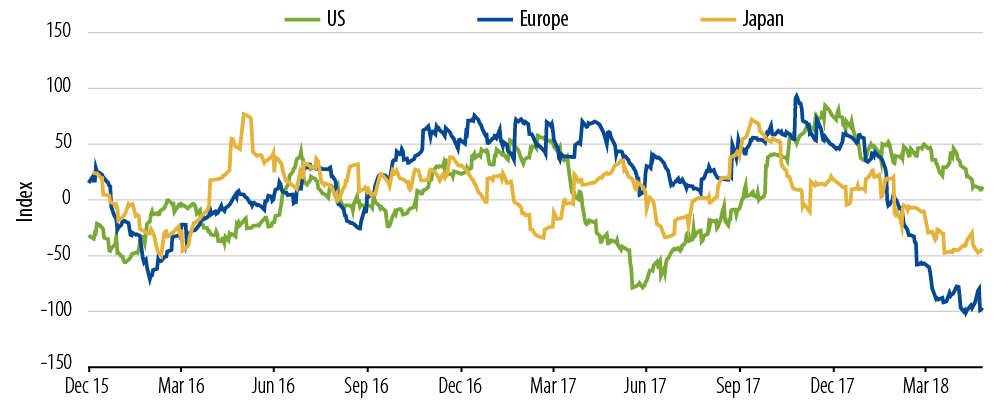

Citi Economic Surprise Index

Exhibit 1 shows the Citi Economic Surprise Index, which measures how economic data are coming in relative to expectations. While the US economy has declined slightly, it has held up the best. The drop in the eurozone has been the most striking. This divergence has led to a substantial increase in the US dollar versus other world currencies. It has been particularly difficult for EM, where the combination of higher US rates, a dollar squeeze and lowered non-US growth expectations has proved particularly difficult.

Our investment thesis has been that as global growth improves, even with a two-steps-forward/one-step-back pattern, spread products would continue to outperform US Treasuries and sovereign bonds. This thesis also relies on the premise that developed market (DM) central banks will be cautious in outlining and proceeding on their respective paths to normalization. It has been almost fully 10 years since the global financial crisis. After flirting with deflation in 2016 on the back of global recession fears, with oil prices plunging to $25 a barrel, then dealing with Brexit, global DM inflation has bounced. Knock on wood, the fears of global deflation are receding into the rearview mirror. But the global inflation lift-off is still in its early days, and improving from very low levels. Indeed, as growth expectations for much of the world outside the US have been scaled back, the DM central bank focus on underpinning growth remains the key priority, rather than short-circuiting remote inflation fears.

In the US, though, expectations have moved decisively toward greater optimism. Ten years into the recovery, with unemployment near 4%, the economy has been hit with meaningful fiscal thrust in the form of tax cuts and greater government spending. Indeed, in line with most consensus estimates, we feel core Personal Consumption Expenditure (PCE) inflation this year will finally hit the Federal Reserve’s (Fed) long-term target of 2%. But our main conviction remains that a sharp rise in US interest rates is unlikely. We see little chance of either a sustained or substantial rise in US core inflation. Unlike forecasters expecting a dramatic surge in US growth in the second half of the year, we believe GDP for 2018 will once again come in at the 2.0% to 2.5% range. Also unlike most forecasts, we do not believe that the Fed is going to be ultra-hawkish in trying to offset fiscal stimulus with aggressive rate hikes. Our view continues to be that the Fed understands the long-term challenges facing underlying US growth, and it has no interest in pursuing a policy that might short-circuit the expansion. Indeed, in the Federal Open Market Committee (FOMC) minutes just released from its May 1–2, 2018 meeting, we highlight two comments:

“It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee’s symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.”

and

“… some participants noted it might soon be appropriate to revise the forward-guidance language in the statement indicating that the ‘federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run’ or to modify the language stating that ‘the stance of monetary policy remains accommodative.’”

The minutes note the Fed’s discussion surrounding whether inflation higher than 2% might be “helpful” and whether the neutral funds rate might be reached before “too long.” This is not an avenue of thought that leads to rapid or persistent rate hikes.

What makes the focus on the path of US rates particularly concerning for market participants at this stage is the change in expectations for global growth, specifically as it affects emerging markets. With EM real yields relative to DM real yields at close to a 10-year high, the most important variable for EM returns remains improving global growth.

The difficulties for EM have become acute. Our bullish thesis since early 2017 has been that the valuations of both EM bonds and currencies were at distressed levels at a time when the risks of shortfalls in global growth and inflation were finally reversing. Opposing this thesis were the risks of protectionism and rising central bank policy rates. As the global economy improved and central banks took a cautious approach to outlining their plans for normalization, EM flourished. This year, the prospect of a synchronized global recovery galvanized early-year EM strength. Since then, however, downwardly revised growth expectations (particularly in Europe), higher US rate expectations, a strongly rising US dollar, protectionism and sharply higher oil prices have served up a nightmarish cocktail. Add the idiosyncratic difficulties of Turkey and Argentina, and you have an asset class turning from darling to demon in just three months.

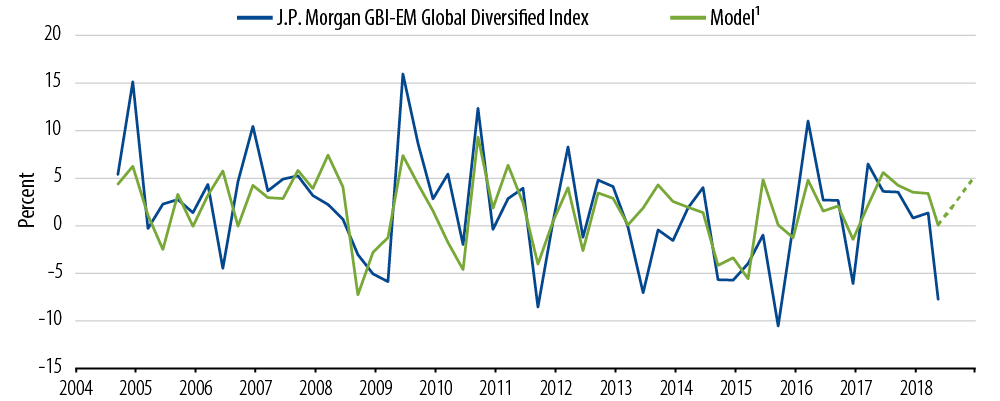

In the short run, market psychology and pessimism can accentuate price moves in this volatile asset class. Ultimately, the long-term fundamental drivers of EM asset prices, particularly the underpinning of global growth, will tell the tale. Exhibit 2 displays an outcome of a regression model that explains local EM performance. Two of the three major components of this model are the movement in commodity prices (a surrogate for global growth) and the EUR/USD performance, which highlights the importance of both US dollar moves and the strength of Europe. Note that EM has underperformed even this model, which incorporates many of the difficulties previously discussed.

EM Local Market Returns Modeled Using EM-DM Growth Differentials, EUR/USD and Commodities

1Model uses the GDP differential, S&P GSCI Commodity Index and EUR/USD. Dotted line shows forecasts using Western Asset estimates.

Here is the crucial question in our view: Is the global recovery in jeopardy? A key component of the outlook is Europe. The recent political challenges in Italy have reintroduced the political risk premium in the eurozone. As Italian government bonds have spiraled downward, fears of a potential banking crisis have arisen. We are holding to our view that this will not prove systemic. We do believe, though, that it will be a drag on European growth and will keep the European Central Bank (ECB) on a very accommodative path. Despite the tumultuous price movements in global bond markets, we continue to believe strongly that global growth will remain solid. Across our franchise, we expect solid growth in the US, China, Japan, Australia and non-emerging markets. Nor do we share the extreme market pessimism about Europe, though conditions there need to be closely monitored. Seldom have our combined forecasts been so far away from the market’s pessimistic expectations.

As global growth remains vibrant, we also expect the US dollar rally to abate. The Fed has signaled its willingness to go slowly in raising rates. The outperformance of the US economy is also widening its current account deficit, which in the past has been very beneficial for non-US growth.

Steady EM growth, improved external accounts, prudent fiscal policy and advantageous positive real rates are the fundamental ingredients needed for EM to stave off the currently turbulent external environment. Our conviction in these drivers remains strong.

Globally, policymakers need to remain very cautious. The fragility of the global recovery continues to necessitate policy help. US Treasury bonds continue to be a key component of diversified portfolio construction. While our viewpoint remains optimistic, maintaining portfolio assets to protect against the vagaries of downside risks is crucial.