Market Commentary

We use Halloween to scare the kids and bankers to scare the adults.

~Anthony T. Hincks

Executive Summary

- Jerome Powell will be the new Fed Chair, succeeding Janet Yellen in February 2018.

- Powell is considered dovish and expected to continue with Yellen’s trajectory of very gradual rate increases.

- In the aftermath of the financial crisis, this current period represents the most aggressive monetary experimentation we have seen in much of the developed world.

- We have been taken with just how sluggish US inflation has been in light of a pickup in global growth and continue to believe this is inflation delayed, not aborted.

- Even as short rates have risen steadfastly, the long end of the Treasury curve has remained anchored.

- The very good news is that the improvement in global growth has reduced the impediment to US growth. If sustained, inflation should find an uptrend.

- At this point we believe policymakers are wise to go slow, and we think Jerome Powell is a fine pick with just that path in mind.

On November 2, President Donald Trump named Jerome Powell the next Chair of the Federal Reserve (Fed) Board, succeeding Janet Yellen. This confirmed our thesis that the Trump Administration would be looking for Fed candidates who were 1) pro-growth, 2) comfortable with low short-term interest rates, 3) open to a lighter touch toward financial regulation, and 4) members of the Republican Party. Still, when John Bellows specifically singled out Jerome Powell as the man to watch in our early August Fed note, (Exhibit 1) it seemed a very bold call, considering such a packed field, an unpredictable administration and a candidate with little name recognition. Indeed, during much of August and September, many articles speculating at length on a broad variety of potential candidates failed to mention Powell at all.

President Trump’s Pick for Fed Chair

This appointment represents continuity with the Fed regimes of Ben Bernanke and Yellen. We expect the process of “inching” up the fed funds rate will continue as we go into early next year. Much will depend on the naming of Fed governor appointees in line with our more dovish hypothesis, but with growth remaining above trend, unemployment clearly at or below the Fed’s goal, and the prospects of a meaningful tax cut, a continuation of very gradual rises in short-term rates seems straightforward.

We think this is the correct course. We have never seen such aggressive monetary experimentation as we have seen in much of the developed world in the aftermath of the financial crisis. Experimental policies may have unforeseen consequences. There are always long and variable lags. With inflation in the US and developed world both well below policy goals (a ubiquitous standard of 2%), central banks are wise to move toward the path of policy normalization in a very cautious way. Exhibit 2 displays the path of developed-market (G10) growth and inflation in the aftermath of the crisis. The very good news is that growth has firmed, albeit from a very low level. The inflation picture, however, remains exceptionally subdued. This has been a major surprise in this year’s economic development. In fact, Janet Yellen has called it “mysterious.”

Developed-Markets Growth & Inflation

We have been believers that the process of inflation bottoming and the resulting path to interest-rate normalization would be very, very slow. Yet even we have been taken with just how sluggish US inflation has been in light of a pickup in global growth. We continue to believe this is inflation delayed, not aborted. Still, one should respect the evidence. In the US, the core personal consumption expenditures index has not been above the Fed’s target of 2% since 2012. At its current annual rate of 1.3%, the need to more preemptively raise short rates does not appear to be compelling.

The US growth outlook for 2018 looks to be another 2+% growth year—with a major tax cut, perhaps better. Does such cyclical strength presage a meaningful pickup in longer-term interest rates? We think not. Our view has always been that the story of long-term interest rates is little more than the story of long-term inflation. In many past recoveries, inflation has risen in line with cyclical strength, and basing longer-term rate forecasts on cyclical forecasts worked out reasonably well. But in a highly disinflationary world, which we have been in since the turn of the century, inflation dynamics have not readily followed cyclical forces. Add the burden of global debt into this picture, and a sharp rise in developed-market interest rates does not seem likely.

A further note of caution is exemplified by the flattening of the yield curve. Historically, the yield curve has the best predictive success of all the “leading economic indicators.” Indeed, the yield curve has often been called the “Cassandra” of leading indicators. As per the Greek myth, Cassandra’s predictions were always right, yet never believed. And so it is with the flattening of the yield curve. So often this occurs as the Federal Reserve is tightening. The Fed does this based on the economic evidence it has on hand. The prevailing financial wisdom of the times is invariably supportive of this policy. When the yield curve flattens meaningfully in this process, it seems either the Fed or the market has it wrong. So in order to keep hiking away, the Fed and the financial community must come up with a highly plausible explanation of why “this time it is different.”

In the internet cycle, the “New Economy” meant the inverted 2000 yield curve was misguided in predicting a potential slowdown as the Fed accelerated the pace of hiking. In the 2005–2006 period, it was the “conundrum” or “savings glut” that explained why the yield curve would have no predictive value. The Fed drove short rates to 5.25%, convinced the economy had little downside risk. The simple truth is that when the central bank is hiking into a seriously flattening yield curve, it must have a narrative to explain why the yield curve is wrong. Otherwise it rationally follows that the Fed should stop hiking. With every cycle, such a narrative is produced. It seems eminently plausible. After all, the concurrent evidence is that the economy is growing, so it is easy to dismiss Cassandra’s warnings.

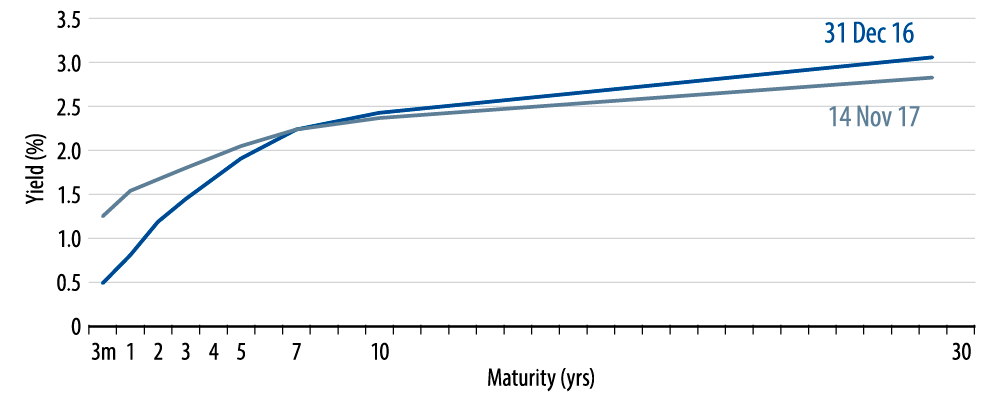

Exhibit 3 is the current US Treasury curve and that of the beginning of the year. Even as short rates have risen steadfastly, the long end of the Treasury curve has remained anchored. The yield spread between 2- and 30-year bonds has narrowed by 71 basis points. Clearly, the yield curve is starting to signal caution. Yes, there are thoughtful arguments about why the long end is giving off an errant signal. “These rates have been artificially suppressed by central bank buying.” Or, “the yield spread versus other developed markets keep these rates artificially low.” Maybe. But to our minds the rates the central bank controls are more reliably short rates whereas long-maturity bond investors have a free choice. We take the warning sign of the yield curve at face value.

US Treasury Yield Curves

The very good news from our perspective is the improvement in global growth. This has reduced the impediment to US growth. If sustained, inflation should find an uptrend. But this continues to be a very slow global process, even amidst a US cyclical improvement. Policymakers are wise to go slow. We think Jerome Powell is a fine pick with just that path in mind.