Managing Risk in Changing Volatility Environments

Executive Summary

- Markets display distinct regimes of low volatility and of high volatility. They spend comparatively little time at the average.

- Managing risk across changes in volatility regimes is challenging: current risk levels have persistence and can’t be ignored, but the possibility of a switch to a very different regime can’t be ignored either.

- Western Asset uses both standard risk assessments (that project forward the current environment) and approaches that help understand possible behaviors in a changed risk environment.

- The current risk environment is relatively calm. We do not expect it to stay this way, so we maintain vigilance by using such methods to evaluate risks to our portfolios.

- Among other techniques, we find that we can gain insights about changed risk environments from:

- Scenario analysis, whereby a current portfolio is assessed in extreme environments, both historical and hypothetical

- Fundamental analysis of the credit cycle, whereby we use forward-looking indicators of the credit cycle to help form a view as to when defaults will start to pick up

- Examining market and instrument structure to determine where there can be price action that has a disproportionate disconnect from fundamentals in stressed environments

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

The Danger of Calm Seas

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

Volatility Regimes

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

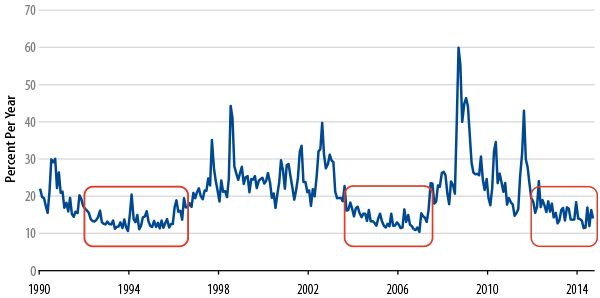

US Stock Market Volatility - CBOE VIX® Index

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

US Treasury Yield Volatility - Merrill Lynch Move© Index

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

Time-Independent Risk Assessments

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

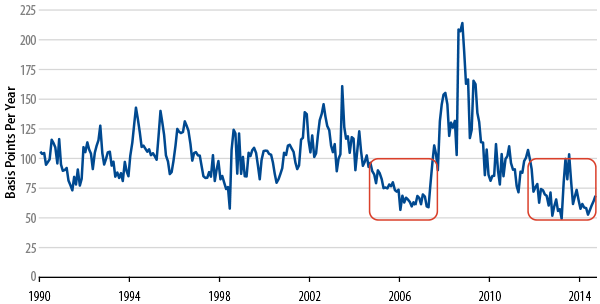

Scenarios for a Western Asset Global Credit Portfolio

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

The Inevitable End of the Credit Cycle

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

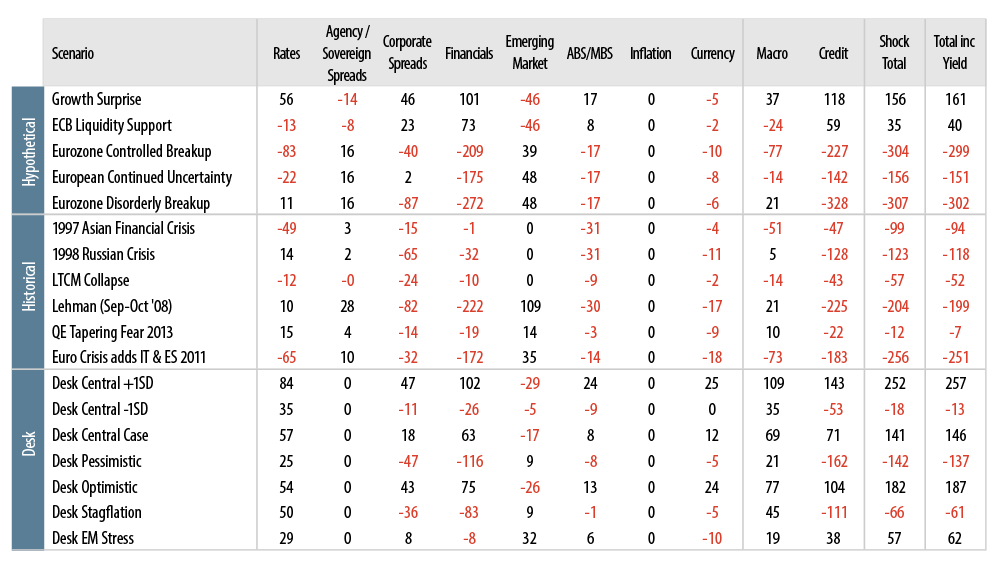

Average Leverage in US High-Yield Market

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

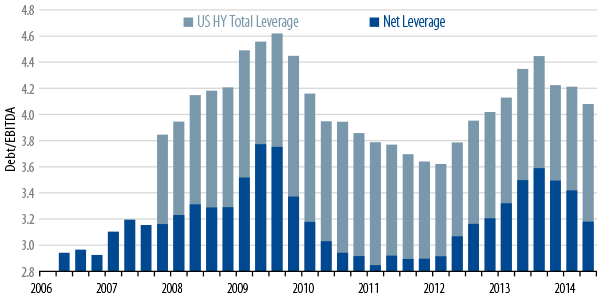

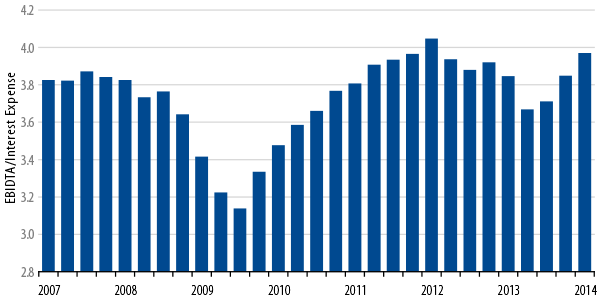

Interest Coverage in US High-Yield

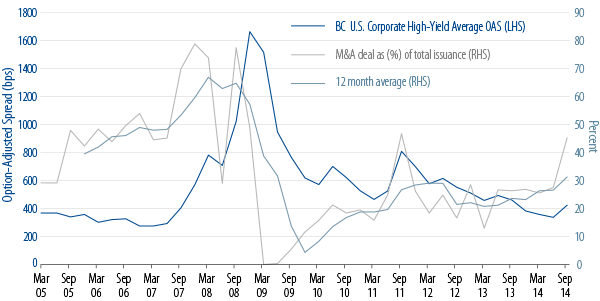

High-Yield Index OAS vs M& Issuance

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

In the 2009 Cycle, Spreads Bottomed 2.5 Years Before Defaults Topped

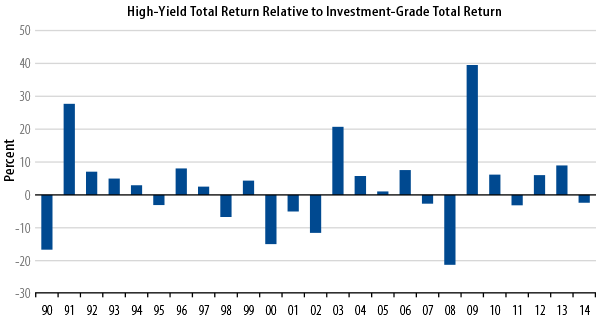

High-Yield Typically Outperforms Investments-Grade Early in a Cycle, But Not Necessarily in Back Half

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

The Disconnect Between Fundamentals and Pricing

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

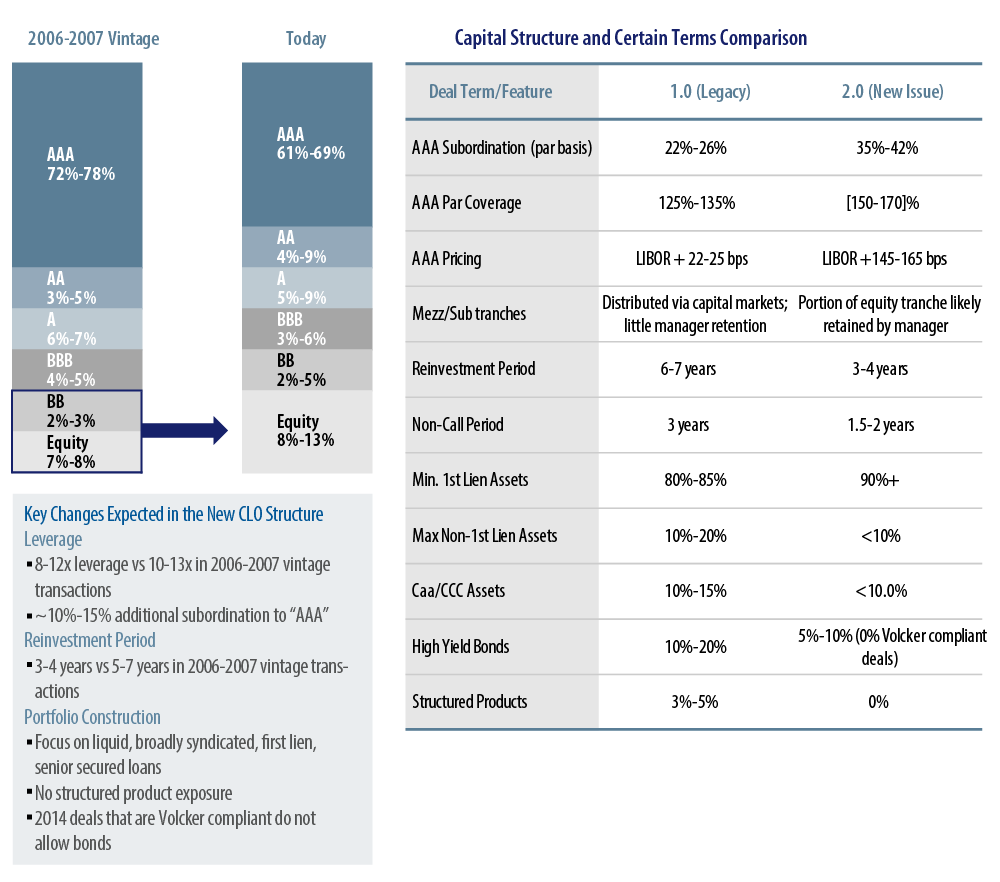

CLO Structure 2.0 vs Legacy

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

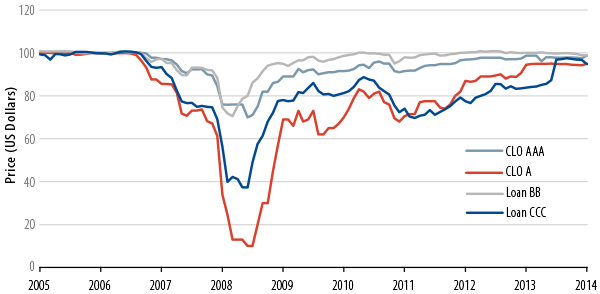

CLO and Loan Index Levels

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

Conclusion

Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. —John Maynard Keynes

Endnotes

- US Federal Reserve Chair Yellen: “This normalization [of monetary policy] could lead to some heightened financial volatility.” http://www.federalreserve.gov/newsevents/speech/yellen20141107a.htm

- See Managing Extraordinary Risk, Western Asset white paper, February 2013

- Bloomberg/BofA Merrill, spread series ER00.

- Annual Default Study: Corporate Default and Recovery Rates, 1920-2013. Moody’s Investor Service. Exhibit 30. The year 1933’s speculative-grade default rate was 15.756%, the highest ever in the study.