KEY TAKEAWAYS

- LIBOR is one of the world’s most widely used financial benchmarks for short-term interest rates and determines the rate for unsecured short-term borrowing between banks.

- LIBOR will be phased out at the end of 2021 and the transition to a new reference rate will be a major undertaking for many financial institutions.

- Due to the vast number of financial vehicles tied to LIBOR, it will be replaced by several different indices that will serve the same function going forward.

- Several working groups around the world have been researching their respective recommendations to replace LIBOR for their local markets.

- Western Asset is monitoring the situation closely, and providing this summary of the status of the LIBOR retirement to help investors and financial professionals best prepare for the transition ahead.

It’s well known that LIBOR, the London Interbank Offered Rate, is being largely phased out by the end of 2021. Ahead of this landmark shift, Western Asset has been actively involved with industry working groups across the investment, operational and legal spectrums to determine the best course of action for our clients and their portfolios. Western Asset has formed an internal working group comprised of subject matter experts to proactively prepare for the eventual transition at the end of 2021. The group has been focused on maintaining an inventory of LIBOR-related exposures, with a particular emphasis on holdings that have maturities past 2021. The inventory also includes portfolio instruments with LIBOR-related terms, accounts and funds with benchmarks tied to LIBOR, and other agreements using LIBOR to determine receivables or payment obligations.

Western Asset, like all asset managers, is dependent on the development of new market conventions and associated liquidity. We are closely monitoring the proposed alternatives, as well as efforts by issuers to replace LIBOR-related language and update fallback provisions. We fully expect the pace of market developments to increase significantly over of the course of 2020 and into 2021.

Western Asset’s working group is also committed to ensuring that any operational processes dependent on LIBOR will work as intended with replacements reference rates. Preliminary analysis of Western Asset systems have not identified any large gaps in handling LIBOR replacements.

This paper provides background on LIBOR, its history, why it’s being replaced (and with what instrument, if known) as well as practical investment implications.

Background and Scandal

The London Interbank Offered Rate is a reference interest rate used globally for unsecured short-term borrowing between banks. LIBOR is managed by the Intercontinental Exchange (ICE) and derived from a waterfall methodology that starts with a daily poll of large banks for their submissions as to the rate which they would lend to other large banks on an unsecured basis. LIBOR is calculated across five currencies and for seven tenors ranging from overnight/spot to 12 months. LIBOR is one of the most widely used benchmarks for short-term interest rates in the world.

Interbank borrowing declined significantly during the financial crisis and its aftermath. Central banks have since flooded the market with liquidity and interbank borrowing has become more of a theoretical exercise. Given that the rates submitted by some banks were based on a theoretical exercise rather than on actual transactions, the risk of manipulation of the rate increased. Banks were suspected of reporting fraudulent rates that were advantageous to their current trading positions. An international investigation into LIBOR that began in 2012 revealed that many banks had in fact manipulated interest rates going back a number of years. In July 2017, UK regulators announced that banks would no longer be required to participate in LIBOR calculations by the end of 2021.

Coordinating the Transition Away From LIBOR

Even before the LIBOR scandal broke, global regulators had been researching alternatives for a new reference interest rate based on transactions from a robust underlying market. The scandal revelation pushed regulators to action. For example, in the US the Federal Reserve (Fed) convened the Alternative Reference Rates Committee (ARRC) in 2014 to identify and analyze substitutes. ARRC membership is comprised of a diverse set of private-sector entities that have an important presence in markets affected by US dollar LIBOR as well as a number of banking and financial sector regulators as ex officio members.

Recommended Replacements

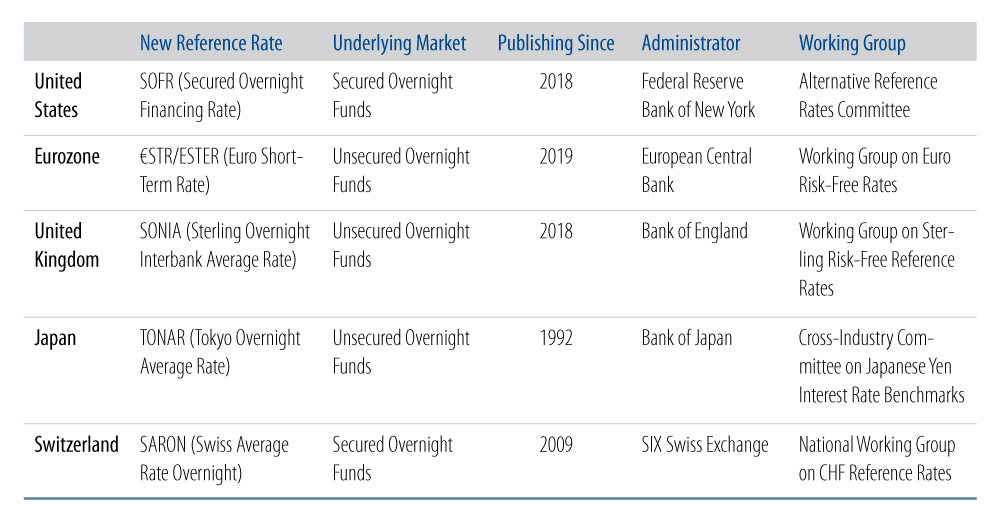

LIBOR won’t simply be replaced with one new reference rate. The current recommendations from government-sponsored or government-commissioned organizations around the globe propose to replace LIBOR with a number of different reference rates (see Exhibit 1).

United States: Secured Overnight Funding Rate (SOFR)

In the US, ARRC considered a number of options including but not limited to the Federal Reserve’s fed funds rate, T-bills, the Secured Overnight Reference Rate (SOFR) and Treasury bonds. In June 2017, ARRC concluded and the Fed concurred that the preferred option was SOFR. The Federal Reserve Bank of New York (FRBNY) began collecting data to calculate SOFR in 2014 and first published the rate in April 2018. The Fed had been conducting daily surveys of primary dealers’ borrowing activities since 1998, which can provide an indicative SOFR going back over 20 years. Though there are some technical differences between the survey rate and SOFR, the data can provide important insight into how a broad measure of repo market activity would have performed over a long time horizon. The Fed has declared that it hopes SOFR will replace LIBOR as the reference rate for financial instruments that had previously utilized LIBOR. The FRBNY announced that it plans to begin publishing SOFR indexes in the first half of 2020.

SOFR determines the cost of borrowing cash overnight while posting risk-free assets such as Treasury securities as collateral in a reverse repurchase agreement (repo). The scale of these types of repo borrowing transactions is massive, averaging nearly $1 trillion per day according to the FRBNY. There are three repo sectors included in the SOFR calculation (1) the Tri-Party General Collateral Rate collected by the Bank of New York Mellon, (2) the General Collateral Financing (GCF) repo rate from the Depository Trust & Clearing Corporation (DTCC) and (3) the bilateral Treasury repo transactions cleared at the Fixed Income Clearing Corporation (FICC). The FRBNY pools the data from these three sources and solves for the median transaction-weighted repo level, which in turn becomes the SOFR rate.

SOFR was selected by the ARRC to be the alternative reference rate because (1) it is compliant with the principles of the International Organization of Securities Commissions (IOSCO), (2) is a transaction-based rate, (3) it relies on a robust daily volume and (4) is an overnight rate which closely tracks other overnight rates.

The IOSCO is an international body that includes the world’s securities regulators and is recognized as the global standard setter for securities regulation, oversight and enforcement. IOSCO covers more than 90% of the world’s markets and is considered to be the defining source in establishing standards for benchmarks for security markets worldwide. In June 2018 the New York Fed issued a statement that SOFR was in compliance with regard to the IOSCO’s principles for financial benchmarks.

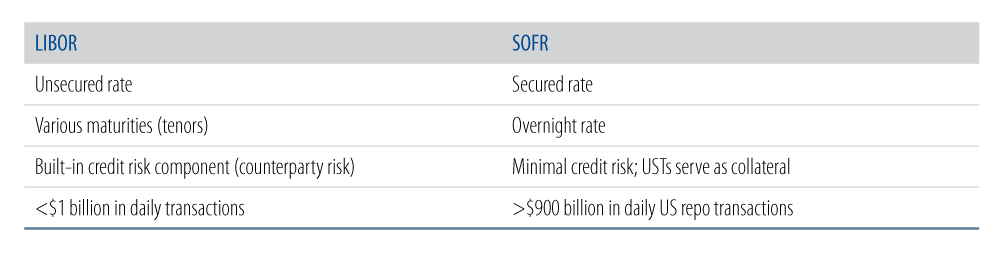

LIBOR and SOFR: Key Differences

As mentioned earlier, LIBOR is an interbank unsecured lending rate whereas SOFR is a rate secured by US Treasuries. LIBOR is available in different tenors including overnight, 1 month, 3 month, 6 month and 12 month. SOFR is only available overnight. LIBOR has a credit component as it is the rate at which banks will lend to other banks whereas SOFR has negligible credit risk as counterparty risk is negated by the secured nature of the transaction while the underlying collateral is deemed to be risk free. How to adjust for these differences is one of the key issues in the transition as discussed in more detail next.

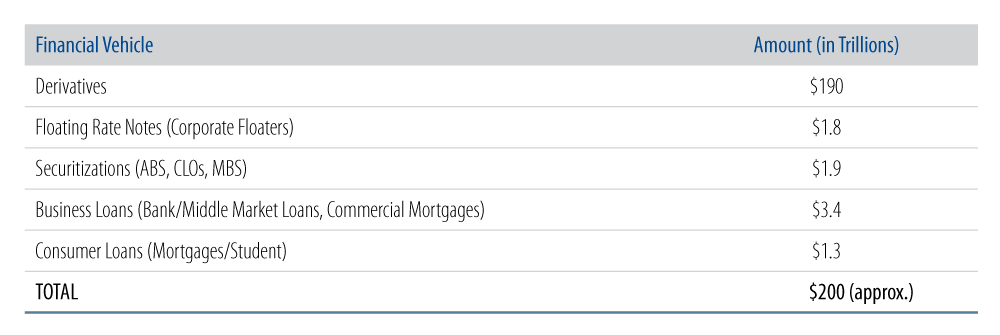

There is approximately $200 trillion in identifiable notional value of financial instruments that currently utilize US LIBOR as a reference rate. It’s important to note that 82% of these instruments mature before the end of 2021.

United Kingdom: SONIA

The UK Working Group on Risk-Free Reference Rates recommended SONIA, or the Sterling Overnight Interbank Average Rate, as the reference rate to succeed LIBOR in April 2017. The Bank of England began publishing a reformed version of SONIA in April 2018. As of June 2019, over 40 sterling bonds have been issued with reference to SONIA compounding. Similarly, April 2019 saw the first publicly placed securitization deal with SONIA reference and the traded monthly notional value in SONIA swaps is roughly equal to that of Sterling LIBOR. The next major step on the roadmap for Sterling implementation is the availability of term rates in early 2020. In addition, the working group supports developing a term benchmark, although it expects the use of forward risk-free term rates to be more limited compared to the current LIBOR environment.

Europe: Euro-Short Term Rate (€STR/ESTER)

The EU working group on risk-free reference rates has recommended ESTER as the LIBOR successor in September 2018 after a public consultation. The rate will start being published by the European Central Bank (ECB) by October 2019, leaving only a small window for successful transition. To mitigate the associated risks, the working group recently produced a report together with specific implementation recommendations on the issue. In the report the working group outlined characteristics of various transition paths without taking an explicit view. It is currently requesting feedback on key recommendations, including modification of the current methodology for calculating the overnight reference rate for the euro known as Eonia (Euro Overnight Index Average), and continued publication of this modified Eonia until at least the end of 2021, the transition for LIBOR-related benchmarks in other jurisdictions. The working group also proposed a specific spread methodology.

Switzerland: Swiss Average Rate Overnight (SARON)

The Swiss National Working Group on Swiss Franc Reference Rates recommended SARON in October 2017 as the replacement rate for LIBOR. SARON is the only reference rate not administered by a central bank going forward. It is also structurally different from most other countries in that it is a secured rate (only SOFR in the US is also of that type). It is a volume-weighted average of transactions and binding quotes on the order book of the Swiss Infrastructure and Exchange’s electronic trading platform. As such, it was established in 2009 and is calculated back to 2000. The national working group does not believe that a forward-looking term rate based on SARON derivatives will be feasible and, in October 2018, recommended using, wherever possible, compounded SARON. This is due to its being less volatile, an overall lower rate and more stable than 3-month LIBOR in times of market turbulence.

Japan: Tokyo Overnight Average Rate (TONAR)

In 2015, 12 financial institutions active in the Tokyo market and the Bank of Japan (BoJ) established a working group to study the options for a Japanese yen (JPY) risk-free reference rate. In December 2016 the BoJ announced that TONAR, an unsecured interbank interest rate and reference rate for JPY would be the risk-free rate in Japan. TONAR is based on data supplied by information providers with respect to transactions brokered in the uncollateralized overnight call money markets between banking institutions. Reform is still at an early stage with regard to developing an alternative benchmark reference rate, which will most likely be tied to TONAR. The BoJ established the Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks to develop the methodology to construct a benchmark rate.

Supplemental Q&A

1. How can an overnight rate replace a term rate as a reference rate for financial instruments?

To address the issue that rates such as SOFR are simply “overnight” and don’t have the tenors of LIBOR, ARRC and the other government-sponsored or government-commissioned organizations making recommendations regarding the transition endorse some kind of average of the new reference rate over a period of time, rather than a single day’s reading, to determine the appropriate setting. The various impacted asset classes need to determine whether the readings used to calculate the average will look back or look forward. An in-advance protocol would reference an average of the new reference rate observed before the current interest period begins, while an in-arrears protocol would reference an average over the current interest period. An alternative to the use of the average of the new reference rate as the replacement rate for a term LIBOR contract may be found in the futures market. For example, in May 2018 the Chicago Mercantile Exchange (CME) started trading SOFR futures, with activity concentrated in 1- and 3-month tenors. Establishing an “indicative” forward-looking term rate through the futures market is promising though the challenge will be realizing the trading volumes required to meet IOSCO standards.

2. What is the rate history between the new reference rates and LIBOR?

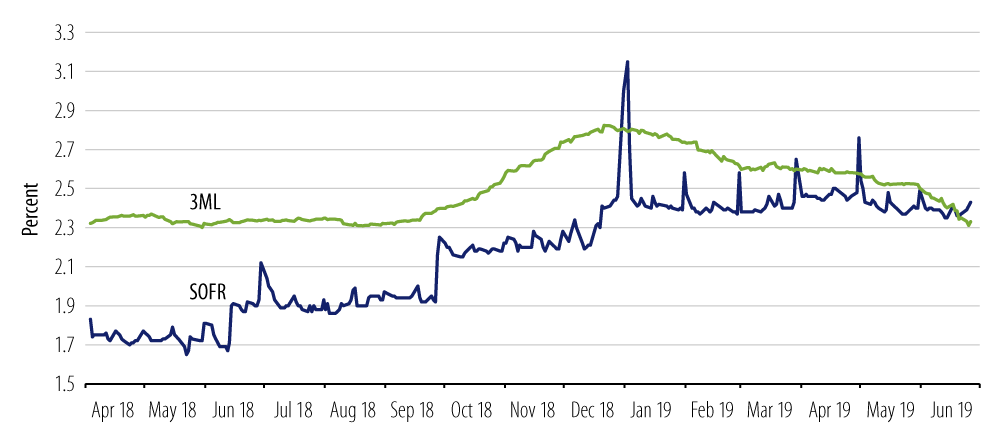

None of the new reference rates have had a perfect correlation to LIBOR. For example, since the Fed began publishing SOFR in April 2018, a comparison of the rate to 3-month LIBOR shows that, as one would expect, the risk-free rate is generally lower than that of the unsecured term rate. This relationship held until year-end 2018 and into the first week of 2019. The spread between SOFR and 3-month LIBOR inverted due to banks’ reluctance to lend and their desire to hold cash to improve the optics of their balance sheets. The relationship has been further influenced by a change in market sentiment regarding the expectation of Fed actions. In January 2019, the Fed signaled a pause in its campaign of hiking rates and by June suggested a rate cut was coming. (It then cut rates by 25 basis points (bps) in July and again in September.) For these two reasons—year-end (and quarter-end) funding pressures and a change in market expectations regarding future Fed actions—there are times when there is significant noise around comparing the spread between SOFR and a term LIBOR rate. Across all jurisdictions there will be a need to provide spread adjustments in an effort to attain economic neutrality.

3. Given that SOFR typically is a lower rate than LIBOR, how will investors be made whole in the event their reference rate is switched from LIBOR to SOFR?

Because SOFR is a risk-free overnight rate it is reasonable to assume that under normal market conditions it would be set at a lower level than an unsecured term rate with embedded credit risk. A straight-up replacement of SOFR for LIBOR would likely result in a reduction of the value of the underlying instrument. To address this issue, the ARRC has recommended the adoption of a benchmark spread adjustment to ensure that the pre- and post-replacement rate levels are compatible. In the US, the ARRC is expected to recommend a methodology to determine the spread adjustment that is intended to reflect the historical relationship between the two rates. ARRC is consulting with representative stakeholders in an effort to make the determination. One important issue will be the length of the sample period. While the Fed has only been publishing SOFR since April 2018, it has been collecting the data used in calculating SOFR since 2014. If it is decided to calculate the median differential from April 2018—December 2021 (expected transition date) the rate could be different than if it is decided to look back to 2014. According to Barclay’s the average spread for the longer period is approximately 25 bps while for the shorter period its closer to mid-30s. With the Fed having pivoted to easing policy, it’s possible the averages could converge. ARRC has opined that the methodology and eventual spread adjustment for derivative contracts may differ from the recommendation for the cash markets.

4. How can an overnight rate replace LIBOR as a benchmark for performance?

LIBOR and similar short-term interbank rates are currently used as performance benchmarks for many portfolios, such as money market funds, which invest in short-term fixed-income instruments. These types of benchmarks are used to signify the short-term and investment-grade nature of the investments and, at times, a desire for a floating interest rate which resets on a regular basis. As LIBOR represents a rate that compensates for the credit risk of counterparties such as banks, portfolios benchmarked against LIBOR will often invest heavily in bank-related debt such as commercial paper, certificates of deposit and bonds. For this reason, the popularity of LIBOR based benchmarks has been steadily in decline since the global financial crisis as the desire for portfolios with significant exposures to banks has been replaced with a focus on greater industry diversification.

As mentioned earlier, a move from LIBOR to alternatives such as SOFR will likely result in a systematic decrease in the interest rate to reflect the decrease in inherent risk. This is why any portfolio that seeks to outperform LIBOR by a set margin (or alpha), will need to restate this objective after the transition in order to maintain the investment strategy and expected level of total return. For many investment managers of short-term funds, such as money market fund providers, the intention will be to keep the investment objectives and strategy of funds unchanged after the decommissioning of LIBOR. This will ensure that investors in such funds will not experience a significant change in their investments. Similarly, any fund that charges investment management fees based on performance referenced to LIBOR will need to restate this objective in order to minimize the level of disruption to investors.

5. What will happen to LIBOR-referenced instruments that remain outstanding when LIBOR is discontinued?

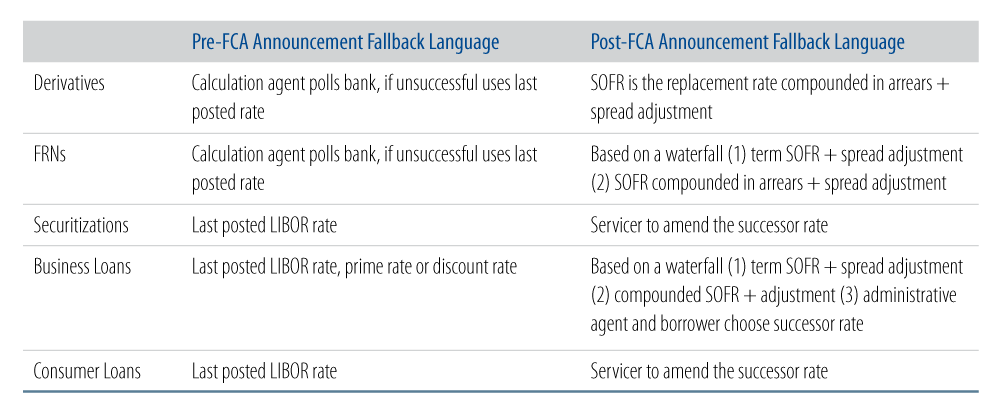

This issue remains one of the most difficult ones facing the transition. Where the asset class is regulated by a central authority or important trade group that determines terms, the transition may be easier. This group (see Exhibit 5) includes derivatives, which are overseen by the International Swap and Derivatives Association and residential mortgages, a super majority of which is backed by a government sponsored entity. For more heterogeneous asset classes, the transition will be more complex. This group includes bank loans, corporate floating rate notes, CLO tranches, ABS and student loans.