Infrastructure Investment Under Solvency II: Application to US Municipal Bonds

Executive Summary

- Solvency II is a regulatory framework concerning the amount of capital that insurers in Europe must hold to reduce the risk of insolvency.

- To further promote European infrastructure investment while prudently calibrating risks, the European Commission made additional proposals to relax solvency capital requirements.

- This paper provides a summary of a subset of taxable municipal bonds that we believe would mostly be considered Solvency II infrastructure investments and how they each fare against the eligibility criteria.

- The favorable capital-relief treatment available to eligible munis that meet the infrastructure criteria under Solvency II increases their investor base by improving their attractiveness to European insurers.

- US municipal bonds that qualify as infrastructure investments under Solvency II provide benefits to both European insurers and the residents in those communities that can now more easily and cheaply finance crucial infrastructure projects.

Introduction

Global financial regulation continues to evolve and shape the behavior of investors. For the insurance industry in Europe, the impact of Solvency II—which sets forth guidelines concerning the amount of capital that insurers must hold to reduce the risk of insolvency—continues to permeate. Recently, in an effort to further promote European infrastructure investment while prudently calibrating risks, the European Commission made additional proposals to relax solvency capital requirements.1

In this short note, we consider the criteria that municipal bonds would need to satisfy to qualify as infrastructure investments under Solvency II, and to be eligible for favorable capital treatment under the regulation. We provide specific examples of obligors that would and would not satisfy these criteria.

Overview

In the US, a significant portion of infrastructure investment is financed through the municipal bond market. Moody’s reports that there is $800 billion of rated municipal infrastructure debt currently outstanding. Much of this issuance will likely qualify for capital-charge relief under Solvency II, which covers infrastructure located in Europe and also Organization for Economic Cooperation and Development (OECD) countries such as the US.2,3

Investors should generally consider the three primary components of US municipal bonds:

- The bond issue: What is the purpose of the bond? Is it for a specific project, for general system-wide or governmental needs, or to refinance existing debt?

- The obligor: This is the entity responsible for paying back the debt, which may be issued by a general governmental entity and/or a department of the entity (such as a city or state), a separate authority or agency charged with operating a system such as a transit agency, or perhaps a limited liability entity (LLC) engaged in a specific project.

- The security features that govern debt repayment: This may be a general obligation or the appropriation of a government unrelated to use of the asset(s), a pledge of revenue derived either from a system or a specific asset, or an availability payment related to a specific project.

What Is Eligible for Favorable Relief?

Favorable treatment may be realized if the investment conforms to the following criteria:

- The Project Entity’s Revenues Derive from Infrastructure Assets

- Cashflows Are Strong and Predictable

- In general, municipal infrastructure cashflows are robust. The essential nature of the assets allows for flexible tariff raising that supports cashflow. Most municipal cashflows are not subject to rate regulation; instead, control is vested in the obligor (infrastructure entity), providing significant debt protection. Typically, there are a large number of end users.

- Investments Have Regulatory and/or Contractual Protections

- The legal framework governing debt issuance—typically in the form of a trust agreement/indenture— specifies covenants, events of default and remedies. A trust indenture is viewed as a contractual obligation within the US. Specific project-related debt generally allows for a security interest in the physical asset being financed, but debt that is issued by an agency or authority and is backed by system-wide cashflows usually does not. Other security features can include a lien over accounts, the right to force a rate increase to meet contractual obligations including debt repayment and step-in rights, which meet the regulatory and contractual protections requirements for a “Qualifying Infrastructure Investment” under Solvency II.

- The Holding Period Is Long-Dated

- Infrastructure debt is long-dated, typically matching the useful life of the assets or system being financed, which should be attractive to buy-and-hold investors looking for solid long-dated fixed-income investments.

- Credit Ratings Are Investment-Grade

- Examples:

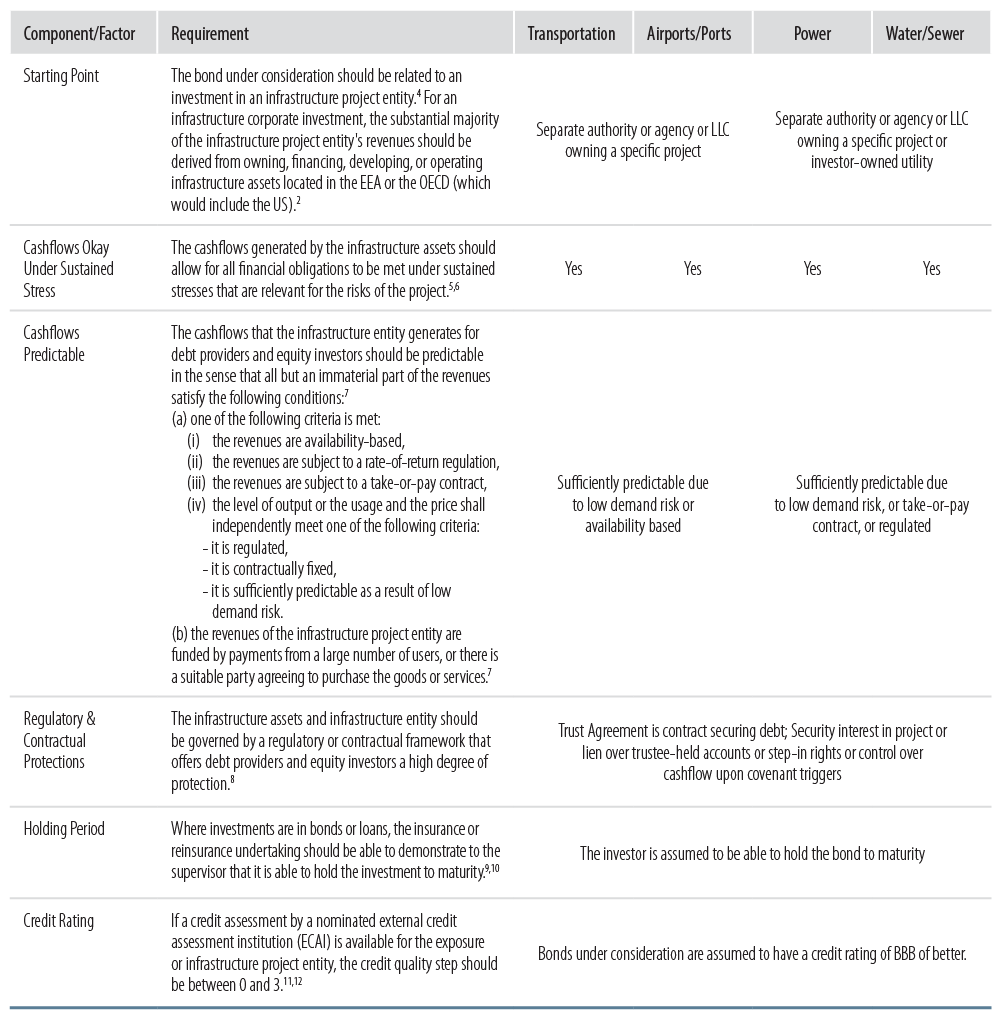

- In Exhibit 1, we summarize a small subset of taxable municipal bonds that we believe would mostly be considered Solvency II infrastructure investments and how they each fare against the eligibility criteria. In Exhibit 2, we examine Solvency II requirements as applied to municipal infrastructure sectors.

The Solvency II definition of “Infrastructure Project Entity” excludes debt issued by general governments or their departments since the substantial majority of revenues does not necessarily derive from owning and operating infrastructure assets. Debt issued by agencies, authorities or LLCs, however, whether for an infrastructure system or for a stand-alone project, may qualify. Recently, the scope of infrastructure investments under Solvency II has been extended from projects to corporate groups.1

Public ratings are available on most securities, and they carry a strong rating. At the end of 2016, Moody’s reported that 99% of its universe of US municipal infrastructure debt was rated at least investment-grade.

Sample of US Taxable Municipal Infrastructure Debt: Do They Qualify Under the Solvency II Infrastructure Requirements?

Basic Requirements for Solvency II for Municipal Infrastructure Sectors

Investment Conclusions

In this brief note we have highlighted the eligibility of portions of the US muni universe under the requirements of Solvency II. The favorable capital-relief treatment available to those munis that meet the infrastructure criteria increases their investor base by improving their attractiveness to European insurers. This should also promote issuance in the sector and enhance the overall liquidity of the asset class.

In summary, US municipal bonds that qualify as infrastructure investments under Solvency II provide benefits to both European insurers and the residents in those communities that can now more easily and cheaply finance crucial infrastructure projects.

Endnotes

- Nick Reeve: Commission Calls for Solvency II Rule Change to Boost Infra Spending. Investments & Pensions Europe, June 8, 2017

- Commission Delegated Regulation (EU) 8.6.2017 C(2017) 3673 final, Article 164b(1)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(1)(f )

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(1)

- Commission Delegated Regulation (EU) 8.6.2017 C(2017) 3673 final, Article 164a(1)(a)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(1)(a)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(2)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(1)(c)

- Commission Delegated Regulation (EU) 8.6.2017 C(2017) 3673 final, Article 164a(1)(d)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 164a(1)(d)

- Commission Delegated Regulation (EU) 2016/467 of September 30, 2015, Article 180(12)(d)

- Commission Delegated Regulation (EU) 8.6.2017 C(2017) 3673 final, Article 164b(7)