How to Differentiate ESG Approaches Among Asset Managers, and the Western Asset Approach to ESG Investing

Executive Summary

- The ways in which various asset managers approach ESG investing can differ significantly across a number of parameters, including organizational structure, depth and breadth of coverage, and screening methods.

- In this piece, we offer 10 specific questions that investors can ask to help assess an asset manager’s approach to ESG investing.

- Western Asset’s approach to ESG investing is defined herein by answering those same 10 questions.

- Investors can best achieve their goals by fully understanding the differences among managers’ ESG approaches, then partnering with the appropriate manager.

In our recent paper, ESG Essentials: What You Need to Know About Environmental, Social and Governance Investing, we discussed the surge in interest in ESG, the range of ESG investment styles and investor motivations for adopting ESG. As we explained in that paper, investors define1 ESG in a variety of ways and have different reasons for adopting ESG. Likewise, asset managers vary in their definitions of ESG, as well as in the way that they incorporate ESG into their investment processes.

ESG Investment Universe

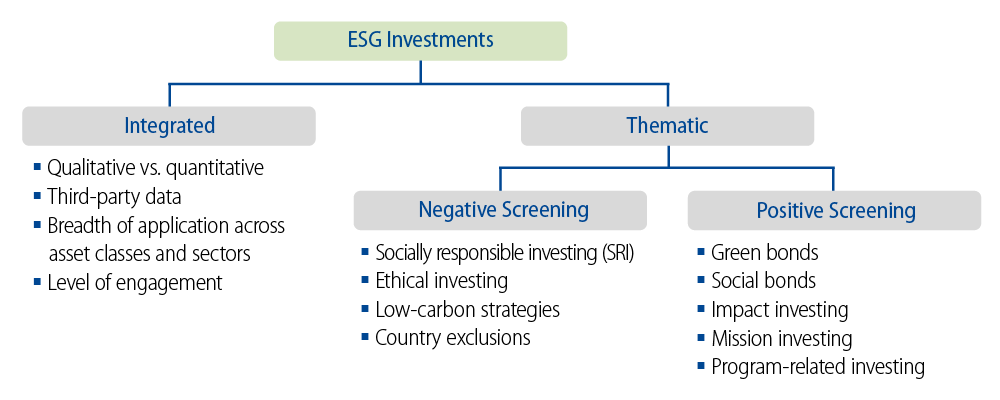

In this piece, we outline the general ways in which asset managers’ approaches to ESG can differ, and we provide a guide for asset owners to evaluate asset managers from an ESG perspective. This guide is primarily designed to apply to integrated ESG investments, but has applicability to thematic ESG investments as well (see Exhibit 1). We then explain Western Asset’s view of ESG and our own integration approach, including how these views and approaches fit into the described taxonomy.

The Many Dimensions of ESG Investing

All investment approaches involve some degree of subjectivity, and ESG analysis is no exception. One asset manager’s approach to ESG can differ markedly from another manager’s approach across a number of parameters. Here we delineate and explain some of these dimensions:

- Bottom-up versus top-down: Some asset managers may apply ESG factors at the issuer level, whereas others may have specific sector views or macroeconomic views relating to ESG.

- Centralized versus decentralized organizational structure: In a centralized model, ESG specialists are responsible for driving and conducting ESG research and portfolio management, whereas in a decentralized model, investment professionals perform both traditional and ESG research and portfolio management.

- Third-party versus proprietary assessment: Some asset managers use third-party ratings and data as part of their process, while others do not. Those that utilize third-party data may also vary in terms of which data they consider important, and how they use that data in their models.

- Quantitative versus qualitative: Some asset managers may take a purely quantitative approach, often driven by third-party data, whereas others may utilize qualitative factors.

- Depth and breadth of ESG coverage: Asset managers may be more or less limited in their application of ESG across asset classes, sectors and issuers.

- ESG versus non-ESG benchmarks: Asset managers typically have a preference between ESG-specific and traditional benchmarks.

- Level of engagement: Some ESG asset managers may take an activist role in their engagement with issuers, whereas others may take a less active role.

- Negative versus positive screening: Asset managers with strong views on environmental or social issues or certain macroeconomic views may categorically exclude certain sectors or types of investments. For example, an asset manager with a strong view on environmental factors may remove fossil fuel producers and heavy industry from its eligible universe. This is referred to as negative screening, while in contrast, a positive screening approach seeks investments with better ESG profiles across all investment types.

A Guide for Conducting ESG Manager Due Diligence

How, then, can an investor determine the robustness of an asset manager’s ESG approach, and ensure that the manager’s approach is aligned with their own? The following is a list of 10 questions we suggest investors ask asset managers in order to make these determinations:

- At what level(s) do you incorporate ESG factors, e.g., macroeconomic, sector, issuer?

- How does ESG fit into your organizational structure?

- How do you weight environmental versus social versus governance factors?

- What weight do ESG factors carry in your investment decisions?

- Do you use third-party ESG vendor research, and if so how?

- Is your research quantitative or qualitative?

- Do you recommend ESG benchmarks?

- To which asset classes do you apply ESG?

- What is your level of engagement with issuers?

- Do you apply any exclusions to your investment universe?

The Western Asset Approach to ESG Investing

Here are Western Asset’s own answers to the aforementioned due diligence questions:

1. At what level(s) do you incorporate ESG factors, e.g., macroeconomic, sector, issuer?

As a fundamental, value-oriented asset manager, Western Asset invests in a diversified set of opportunities that seek to deliver superior risk-adjusted returns for its clients over the long term. When analyzing these opportunities, Western Asset’s investment professionals consider many factors that may impact future cashflow, including environmental, social and governance concerns. Western Asset believes that ESG factors can affect the risk and return profile of its investments and views ESG analysis as an essential component of its investment process.

In forming our top-down macroeconomic perspective, which forms the basis of our portfolio construction, we consider and analyze a wide range of macroeconomic and geopolitical factors, including how raw material consumption, climate change, demographics and socioeconomic development will affect income, wealth and global growth in the future. From this macroeconomic outlook we determine our duration and yield-curve positioning as well as country and currency allocations. Sector allocation decisions are then made based on this outlook, in conjunction with sector specialist views on fundamentals and relative value.

ESG analysis performed at the subsector and issuer levels then feeds into our security selection process in the credit and sovereign sectors. This ESG analysis involves the identification and examination of specific environmental, social and governance factors that can potentially affect creditworthiness. Western Asset’s research analysts tailor these factors to take into account geography, regulatory environment, natural resource utilization, supply and value chain, and other unique considerations at both the subsector and issuer levels.

2. How does ESG fit into your organizational structure?

Western Asset’s ESG organizational structure is largely decentralized, as our research analysts conduct ESG analysis as part of a comprehensive research process. We believe that our research analysts are best equipped to analyze ESG factors in conjunction with traditional metrics given their deep expertise in the sectors and industries they cover. We expect this integrated approach to result in more thoughtful and thorough relative value assessments than one in which ESG research is compartmentalized.

At the same time, we have centralized key oversight functions to advance our knowledge of ESG across the firm. Our Global ESG Advisory Committee, comprised of research analysts and portfolio managers representing the investment-grade, high-yield and emerging market (EM) sectors from our offices around the world, works with our Global Head of ESG Investments to develop best practices and ensure that ESG analysis is applied consistently across the Firm.

Western Asset is also a signatory of the PRI (Principles for Responsible Investing), an international network of investors collaborating to improve and promote the integration of ESG factors into investment analysis and decision-making processes, and a member of the PRI’s Sustainable Development Goals (SDG) Advisory Committee.

3. How do you weight environmental versus social versus governance factors?

While Western Asset has historically had a focus on governance, we believe environmental, social and governance factors are equally critical to analyze. The specific types and relative importance of environmental, social and governance risk factors will vary among countries, sectors and issuers, as determined by our research analysts. As disclosure practices around environmental and social considerations have improved, so too has the investor’s ability to incorporate them into the investment process. We continue to view governance as key not only on a standalone basis but also as it relates to environmental and social factors, given its influence on the ability of an issuer to perform within the environmental and social arenas.

4. What weight do ESG factors carry in your investment decisions?

ESG analysis is part of Western Asset’s overall investment process from both a top-down and bottom-up perspective, as we believe it better enables us to evaluate investment opportunities at all levels. More specifically, we consider ESG performance in the context of market price, just as we do with traditional financial metrics. That is, we favor issuers whose ESG profiles we expect to improve and issuers whose ESG performance is inadequately valued by the market. We may also view an issuer with poor ESG performance as attractive if we believe that its management has the appropriate strategy and controls to improve its ESG profile, or if we view the valuation as adequately compensating for the ESG risk. Conversely, a high performer from an ESG perspective may not be attractive if those attributes are already reflected in the bond’s current valuation.

As a general matter, neither ESG nor non-ESG considerations categorically outweigh each other as they are not isolated from one another in our investment process. However, we do manage customized solutions for clients who wish to express a specific ESG theme or tilt in their portfolios.

5. Is your research quantitative or qualitative?

Western Asset uses a combination of quantitative analysis and qualitative judgments to assess the ESG profiles of issuers and sovereigns. We believe that quantitative measures on a standalone basis are inadequate to measure the true ESG performance of an issuer, as they are backward-looking and fail to inform how the issuer will perform going forward. Furthermore, they are sometimes outdated, subject to selection bias, or not directly comparable to metrics provided by other issuers in the peer group. For example, two consumer goods issuers may have made similar progress toward their goals to use recycled plastic, but the milestone set by one may be much more ambitious and meaningful than the other. Thus, our viewpoint is not informed by data alone.

6. Do you use third-party ESG vendor research, and if so how?

Western Asset utilizes multiple quantitative and qualitative inputs, including MSCI reports and data, to assess investments from an ESG perspective. Ultimately, our investment decisions are made using a proprietary framework, as this allows us to focus on the ESG factors that we view as material to investment performance and that incorporate metrics and information that are not addressed by third-party vendors.

Additionally, third-party ESG vendor issuer coverage is still relatively limited.2 Western Asset searches for investment opportunities across a broad range of fixed-income sectors, including investment-grade, high-yield, EM sovereigns, EM corporates and bank loans. We do not rely on third-party ESG vendor research alone as our investment universe is far more expansive.

7. Do you recommend ESG benchmarks?

We generally recommend that clients use traditional non-ESG benchmarks coupled with an ESG ratings overlay. Third-party ESG vendors provide limited coverage of asset classes and issuers, which results in a narrower set of eligible investments for ESG-specific benchmarks. We do, however, subscribe to MSCI ESG ratings and data, and can utilize ESG benchmarks for any given mandate if that is the client’s preference.

8. To which asset classes do you apply ESG?

Western Asset has long considered environmental, social and governance factors essential to its credit and sovereign investment process. As such, we integrate ESG considerations into our analysis of corporate issuers across all sectors, including investment-grade, high-yield and bank loans, as well as sovereign and corporate issuers in both EM and frontier markets.

9. How do you approach engagement with issuers?

We believe that one of Western Asset ’s advantages as a large global fixed-income manager is our ability to conduct face-to-face meetings with management. We view these meetings as a crucial tool not only for assessing the quality of management but also for informing our views about how issuers assess and manage environmental and social risks. This engagement allows us to elevate our analysis beyond routine “box-checking” and incorporate more timely data and information than annual or quarterly disclosures alone would provide. As a bondholder, we do not take an activist approach but rather work with issuers to improve their transparency around the key ESG factors we consider relevant.

10. Do you apply any exclusions to your investment universe?

Western Asset has decades of experience managing portfolios with social and ethical restrictions for clients, having managed customized SRI (Socially Responsible Investment) portfolios since 1986. As of December 2017, Western Asset managed $115.1 billion in assets with SRI restrictions.

If a client does not specifically prohibit or limit exposure to certain sectors or issuers, Western Asset seeks to maximize risk-adjusted returns by evaluating relative value across a wide universe of investment opportunities. An essential component of this investment process is the consideration of the key ESG factors which may not be adequately addressed by traditional financial reporting and metrics. This assessment of ESG risks plays an essential role in determining our outlook for valuations and resultant asset allocation.

A Final Word

There is a wide variation among asset managers’ investment processes, including their approaches to ESG. Investors can best achieve their goals by fully understanding the differences among managers’ ESG approaches, then partnering with the appropriate manager to create the appropriate solution. We encourage investors to use this paper as a guide to differentiate among ESG asset managers and select the partner that best suits their needs.

Endnotes

- See “ESG Means Different Things to Different Investors” in ESG Essentials: What You Need to Know About Environmental, Social and Governance Investing.

- For example, only 60%-65% of the high-yield universe and 80%-85% of the investment-grade corporate universe are covered by MSCI ESG research.