Going Global: The Western Asset Approach to Global Bond Investing

Executive Summary

- Western Asset’s investment philosophy is particularly well suited to managing global portfolios as it focuses on long-term fundamental value investing using multiple diversified strategies.

- The Firm’s dedicated Global Portfolios Team works closely with all of our sector teams to ensure that the best ideas from the sector analysts are reflected in portfolios.

- Our goal is to build global portfolios that perform well under various market conditions and deliver strong risk-adjusted outperformance over a full market cycle.

- The Firm’s approach has been tried and tested across multiple cycles and has delivered strong positive returns across three flagship global strategies that draw on different opportunity sets spanning the risk and return spectrum.

- Western Asset’s proprietary risk system, the Western Information System for Estimating Risk (WISER), is an invaluable tool for managing global portfolios.

- Our strong long-term track record across three global flagship strategies is a testament to our global bond investing approach, and our historical success in generating returns from macro strategies is a key differentiator.

In recent years we have seen a marked increase in client interest for global bonds, reflecting the potential investment return and diversification benefits available outside of domestic markets. This brief overview reviews how Western Asset approaches global bond investing—supported by our enduring investment philosophy, active investment management style and truly global investment resources—and it also highlights our successful long-term investment record across three flagship strategies.

Western Asset’s Investment Philosophy

At Western Asset our investment philosophy focuses on long-term fundamental value investing, using multiple diversified strategies. We believe this philosophy is particularly well suited to managing global portfolios, where fundamentals and valuations frequently diverge among countries and sectors. We generate returns by using active macro strategies and tactical asset allocation across the global fixed-income opportunity set. To do this, we seek to identify relative value among countries and sectors in global fixed-income and currency markets.

The Firm’s top-down views drive duration and yield-curve positioning, country allocation, currency strategy and relative-value trading. The decisions we make regarding each of these aspects are informed and supplemented by disciplined bottom-up research from our regional and sector analysts located across the globe in order to determine sector allocation and individual issuer selection opportunities. To maximise the ability to generate returns, investment decisions are focused on portfolio managers’ convictions with respect to attractive fundamental valuations and portfolio diversification opportunities.

Our Investment Approach

Constructing Western Asset’s global portfolios begins with the Firm’s global investment outlook, which is determined by the Global Investment Strategy Committee (GISC). The GISC meets weekly and is comprised of all of Western Asset’s regional and sector heads, and is chaired by Western Asset’s Chief Investment Officer (CIO). Regional strategic views and portfolio positions are communicated globally to ensure that the information synthesized in the global investment outlook originates with the Firm’s local experts on the ground in any given geographical area. Our goal is to develop a collegial and consensus-driven approach to developing our major strategic investment themes. This not only encourages full and open contributions but also introduces challenges to simplistic or consensus views by involving dissenting opinions, diverse experience and incisive critical thinking.

Taking the key themes from the GISC, the Global Portfolios Team (GPT) builds global portfolios that seek to perform well under various market conditions and deliver strong risk-adjusted outperformance over a full market cycle. The GPT’s primary responsibilities are portfolio construction and calibration of global portfolios, and all of its members also sit on the GISC. The GPT determines the overall level of risk in global portfolios, consistent with client guidance, and within the proportion of risk allocated to each strategy. This risk allocation is informed by regular input—formal, informal, quantitative and qualitative—from our dedicated Risk Management Team.

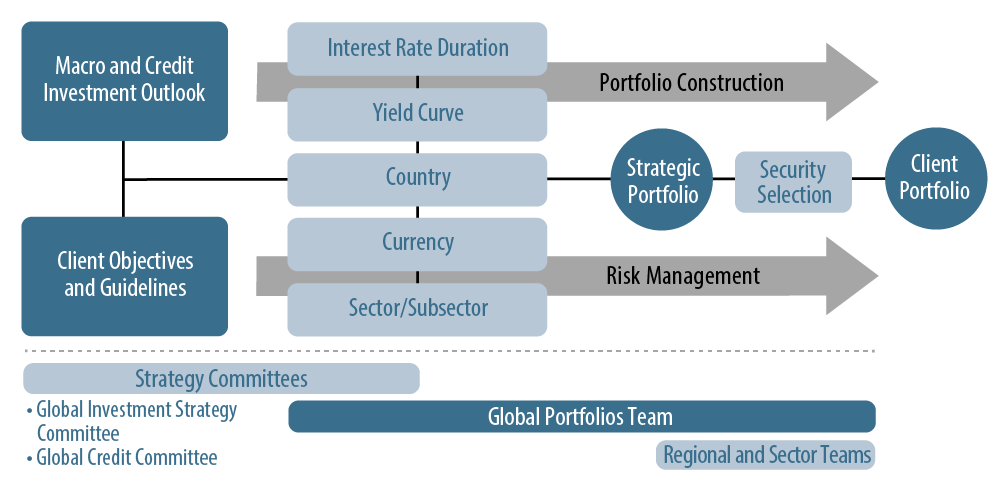

Global Portfolios: Investment Process and Team Interaction

Exhibit 1 summarizes our investment process and highlights the GPT’s role in identifying the best relative value opportunities across the broad global investment universe. These top-down relative value decisions made across the key drivers of returns determine the strategic or “model” portfolio, which forms the basis from which individual client portfolios are tailored to meet specific client goals and objectives.

Western Asset constructs portfolios using diversified strategies, with no single allocation or strategy designed to dominate risk or returns. For global strategies, the majority of excess returns are expected to come from active management of interest-rate and yield-curve strategy, country allocation, currency and sector allocation. These top-down strategies are driven by long-term assessments of economic behaviour and relative valuations, and are integral to the Firm’s investment process. However, there are certain times in the market cycle when Western Asset would expect to achieve more excess returns from bottom-up issue selection strategies. Here, we draw on the expertise of our specialist sector teams from their respective regional offices.

The GPT works closely with all of Western Asset’s sector teams to ensure that the best ideas from the sector analysts are reflected in portfolios. This happens both formally via senior credit and other sector team representation on the GISC and through meetings with each sector’s portfolio managers, but also informally through frequent and direct interaction with the analysts.

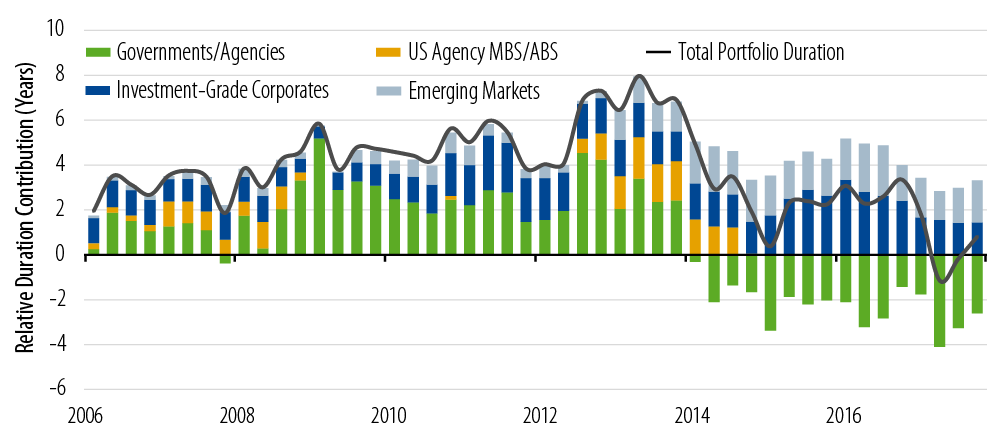

Global Total Return Duration Strategy

We seek to generate alpha in global strategies by dynamically rotating risk across market sectors on a relative value basis, and efficiently incorporating key sector themes in conjunction with macro strategies. Western Asset has a strong, long-term track record utilising macro strategies, which is a key differentiator of our global program. This is why we believe that we can continue to produce strong risk-adjusted returns going forward irrespective of the level of global yields or the current phase of the credit cycle.

To demonstrate how we have fully utilised our duration flexibility, Exhibit 2 highlights the dynamic nature of our Global Total Return (GTR) strategy from both an overall duration and a sector allocation basis. For example, at the end of 2013 the GTR portfolio’s duration was close to the eight-year maximum limit and by the end of 2014 portfolio duration was close to zero. More recently, the GTR strategy has been short overall duration and currently has a significant short duration position in government bonds.

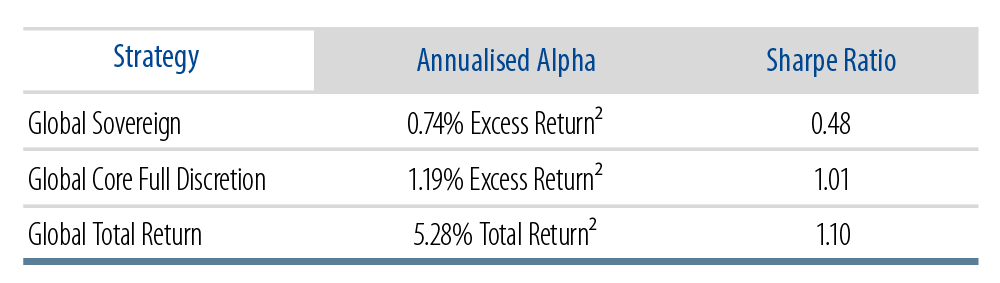

Western Asset’s Competitive Strengths in Global Strategies

Long-term track record and deep experience managing global strategiesWestern Asset was a pioneer in global bond investing and has been managing global strategies for over two decades. Our approach has been tried and tested across multiple cycles and has delivered strong positive returns across three flagship strategies1 that draw on different opportunity sets spanning the risk and return spectrum. We demonstrate this “tried and tested” approach with our long-term track record across three distinct strategies shown in Exhibit 3.

10-Year Returns

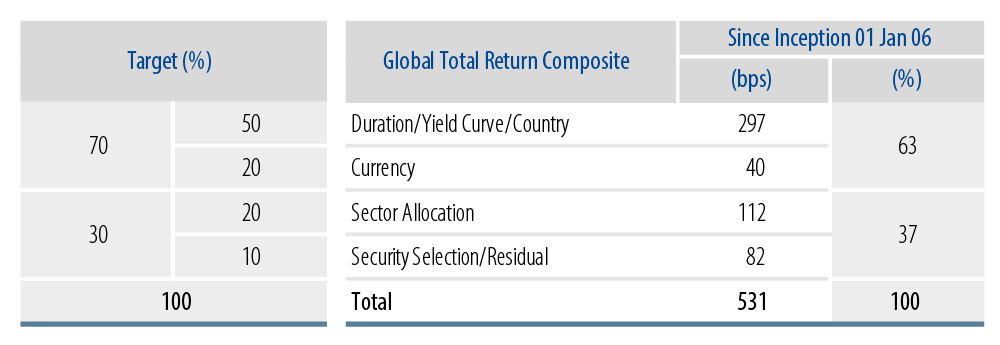

Returns are well diversified, with macro factors as the largest contributorsOur global portfolios are not reliant on high-income sectors or wide credit spreads to generate return, which is particularly important in the current environment as we approach the latter stages of the credit cycle. We quantify this by highlighting our long-term attribution, which demonstrates that on average, two-thirds of returns within our GTR strategy have come from duration, yield curve, country and currency strategies.

A dedicated global portfolios teamAnother feature of our global program is Western Asset’s ability to calibrate the highest-conviction investment ideas from the Firm’s specialist teams, globally, into a portfolio that seeks to maximize returns within its targeted risk budget. We do this by combining actively managed macro strategies with long-term fundamental value investments in sectors, such as investment-grade credit and emerging market sovereigns and currencies. Macro strategies provide ballast to riskier sectors during periods of stress and allow us to hold onto high-conviction positions while generating alpha from active trading.

We believe what differentiates us is having a dedicated team responsible for assimilating Western Asset’s highest-conviction ideas, undertaking relative value analysis and combining these into a diversified portfolio. Ours is an approach that contrasts with the more common “sum of the parts” method to constructing global portfolios. We also stand behind our strong, long-term track record and high Sharpe ratios as evidence of Western Asset’s ability to assimilate our best ideas into robust, risk-aware global portfolios.

Fully integrated and robust risk management frameworkWestern Asset’s proprietary risk system, the Western Information System for Estimating Risk (WISER), provides yet another tool for managing global portfolios. The ability to stress test portfolios through different historical and hypothetical market scenarios gives our GPT an advantage when evaluating how the portfolios will perform under tail-risk events. Western Asset owns the WISER correlation matrix, which means we have a greater understanding of how various correlations change throughout the cycle. We can also “time travel” and use correlation matrices from different time periods to assess how associated volatility levels may impact total portfolio volatility. For example, is portfolio volatility low because portfolios are not taking enough risk or is portfolio volatility low because the implied market volatilities are low?

Ultimately, we believe the best way to quantify Western Asset’s success in managing global portfolios is to evaluate the contribution to returns over a full market cycle. For instance, if we assert that one of our strengths is the ability to add value across all sectors and to rotate risk as fundamentals and valuations change over time, then we should be able to demonstrate this.

Exhibit 4 illustrates the since-inception performance contribution for Western Asset’s Global Total Return strategy and demonstrates our balanced and diversified approach with no one particular source of alpha dominating.

Long-Term Performance Contribution

Conclusion

Western Asset’s global bond program incorporates the best ideas from across the Firm to construct portfolios in a well diversified and risk-aware manner. Our dedicated GPT ensures that our highest-conviction views are reflected in global portfolios and that they have demonstrated a dynamic approach to allocating portfolio risk over multiple cycles. Our strong long-term track record across three global flagship strategies is a testament to this approach, and we believe our successful history of generating returns from macro strategies is a key differentiator.

Endnotes

- The Global Portfolios Team manages three flagship strategies: Global Sovereign, Global Core Full Discretion and Global Total Return, an unconstrained investment-grade-only strategy.

- Performance for Global Sovereign and Global Core Full Discretion strategies is measured against traditional global bond benchmarks such as the FTSE World Government Bond Index or the Bloomberg Barclays Global Aggregate Bond Index. Annualised Alpha is therefore excess return over the benchmark. Global Total Return portfolios are measured in absolute return terms and Annualised Alpha is therefore the annualised total return.