KEY TAKEAWAYS

- Current core eurozone government bond yields are inconsistent with improving macro fundamentals and supply dynamics.

- Country-specific factors that impacted the eurozone last year are fading.

- Global recession fears are overdone.

- Eurozone domestic demand remains strong. Falling eurozone unemployment, rising wages and fiscal impulse will boost income growth in 2019.

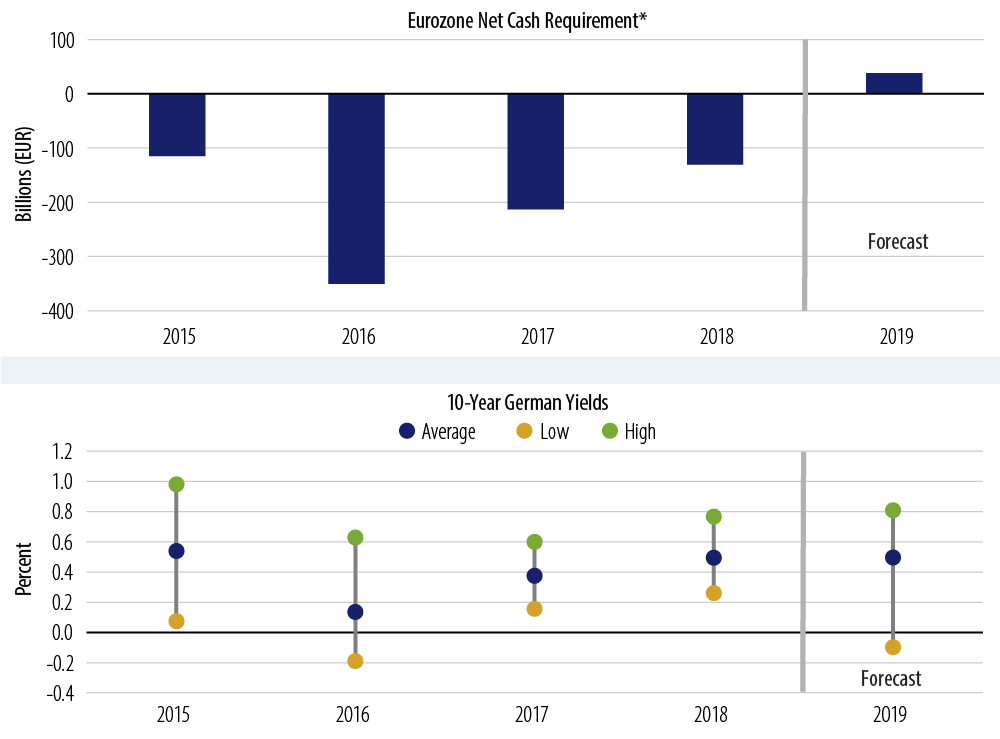

- As the ECB scales back its asset purchases, the private sector will be left to digest more government bonds. As a result, the scarcity factor suppressing yields should decline.

- Global recession fears are overdone,

- Country-specific factors that impacted the eurozone last year are fading,

- Eurozone domestic demand remains strong, and

- Slowing ECB reinvestments will be less supportive over the medium term.

Global Recession Fears Are Overdone

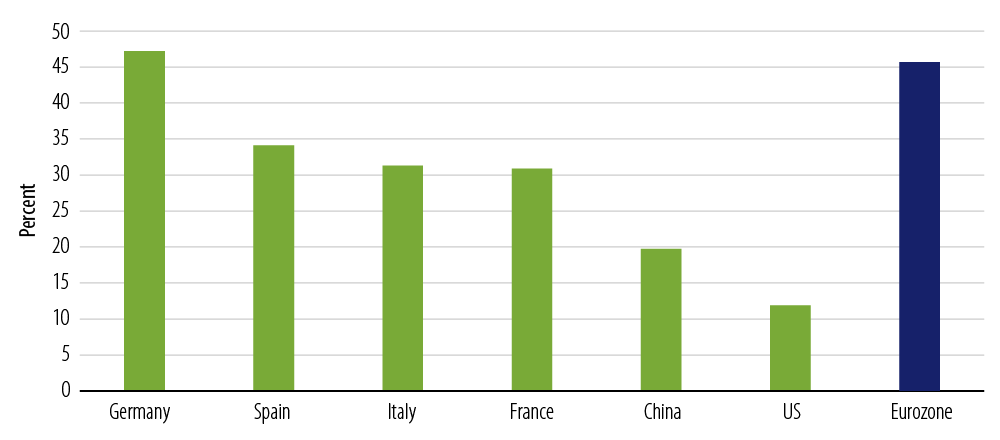

Among the major economies, the eurozone is significantly linked to the global manufacturing cycle due to its high export exposure. Trade as a percentage of GDP is 47% in Germany compared with around 30% for the other three largest economies—Spain, Italy and France—and much higher than that of both China and the US.

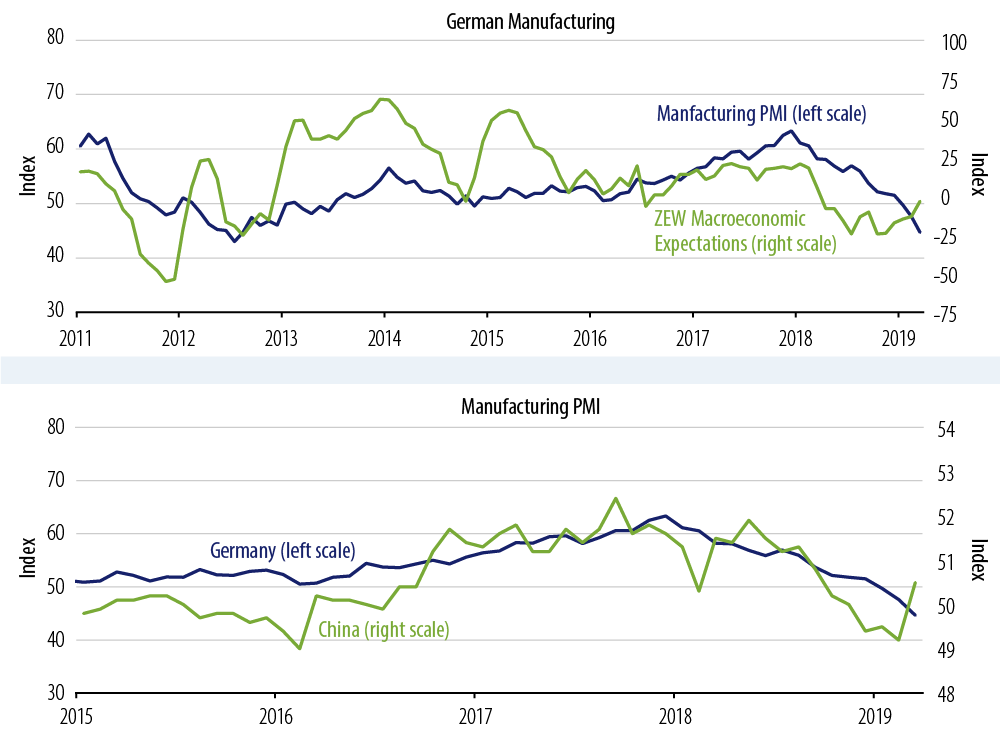

Global manufacturing slowdown fears rose sharply in late-2018 coincident with an extreme level of global economic uncertainty. At the time, global trade war escalation, the US government shutdown, falls in energy prices and Brexit uncertainty were at the forefront. The weaker data the market feared became apparent in the first quarter of 2019 with a collapse in manufacturing data globally.

Policymakers responded quickly to this downdraft. China provided additional stimulus and the US Federal Reserve (Fed) signaled that interest rates were likely to remain on hold while both the ECB and Bank of Japan telegraphed policy would stay accommodative for longer. This supportive policy backdrop—combined with increased optimism surrounding China-US trade discussions, the likely avoidance of a “no-deal” Brexit and signs that growth in Asia is picking up—should turn the global manufacturing cycle that has been softening since early 2018.

Signals from business surveys in Asia, higher industrial commodity prices and leading indicators for global growth also point to a bounce in the global manufacturing cycle. This is corroborated by the recent strong recovery of growth-sensitive assets such as equities and corporate bonds. The eurozone manufacturing cycle, which typically exhibits a high correlation to the global manufacturing cycle but with a lag, should stabilize and start to improve in the second quarter.

Country-Specific Idiosyncratic Factors Are Fading

Two major disruptions to German manufacturing in the second half of 2018 were the sharp drop in auto production as a result of new emissions standards on the region’s car industry and transportation bottlenecks, which particularly impacted the petrochemical industry.

Car registrations and production declined sharply in 4Q18, equivalent to approximately 0.2% of German GDP. This year, however, car registrations have rebounded which will help clear car dealer inventory and should support production later in the year. The low water level on the river Rhine last year disrupted fuel and goods shipments to manufacturing companies with an estimated negative impact of 0.4% of German GDP growth in 4Q18 and nearly tipped the German economy into recession. Water levels have now reverted to normal levels, which will ease the transportation bottlenecks and provide a fillip to the German economy.

In France last year, political protests negatively affected both consumer confidence and the service sector. Consumer confidence has rebounded during the first quarter and the negative downturn in French service purchasing managers’ indices (PMIs) has begun to reverse.

The Italian government’s reticence to accommodate EU budgetary rules has eased in recent months. This has allowed funding costs to fall and reduced market angst surrounding Italy’s membership in the EU. As political worries fade so should the Italian risk premium embedded in 0% 10-year German bund yields.

Eurozone Domestic Demand Remains Strong

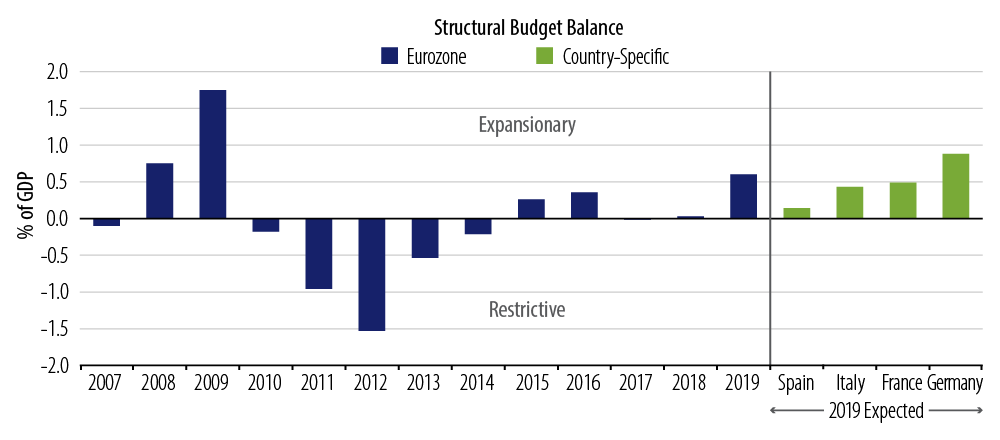

Falling eurozone unemployment and rising wages should boost real income growth in 2019 and support the domestically orientated service sectors. The recent rebound in eurozone service PMI data enhances our confidence that the domestic economy will act as a buffer during this period of manufacturing weakness. Additionally, a positive fiscal impulse in 2019, the largest in a decade, should lend further support to eurozone growth. That fiscal easing is being led by Germany, which has seen the most volatile swing in the downturn, is a positive factor.

ECB Rate Cuts Are Unlikely

The last time that German 10-year yields were negative was 2016, just after the UK Brexit referendum. At that juncture the market was pricing 25 basis points of cuts over the next year. In March 2019, the ECB substantially revised down its growth and inflation forecasts for the next three years. It extended its forward guidance for unchanged rates by three months from September 2019 to December 2019 and announced plans for a TLTRO III (targeted longer-term refinancing operations) to aid bank lending to the real economy. ECB President Mario Draghi highlighted the high level of uncertainty buffeting markets but reiterated that the probability of recession and inflation expectations becoming de-anchored remained low. The market is currently pricing unchanged interest rates through December 2021. With German bund yields already trading at levels consistent with even lower interest rate expectations we believe that any further extension of ECB forward rate guidance is unlikely to have a material impact on the level of bund yields.

Supply Dynamics Will Be Less Supportive

Slowing ECB reinvestments will be less supportive over the medium term. As the largest price-insensitive buyer scales back its asset purchases, the private sector will have to digest more supply of government bonds. Over time the scarcity factor suppressing yields will decline.

Risks to Our View

Key downside risks to an underweight eurozone duration position would be a “no deal” Brexit, a renewed flare-up in Italian political risks and further weakness in the global manufacturing cycle. Over the past three years the lows in German bund yields have been coincident with Brexit and Italian-related risks. On the upside, stronger German manufacturing and French service sector data, and a general improvement in Italy would be strong positives. More visible improvement in eurozone bank equities and a realignment between European inflation expectations and oil prices would also benefit an underweight duration stance.

Summary

In our view there is currently a large disconnect between current market pricing and German and eurozone macro fundamentals.

We believe that eurozone assets are currently priced for a pessimistic outcome, global slowdown concerns are overdone and recession fears will recede. We think the country-specific idiosyncratic factors that dampened growth materially in 2H18 are beginning to fade. Eurozone domestic demand remains well-supported via rising employment and wages and fiscal easing. We expect that the scarcity value of the German government yields will decline as net supply rises.