ESG Essentials: What You Need to Know About Environmental, Social and Governance Investing

Executive Summary

- ESG investing aims to increase “responsible investments” by factoring ESG considerations into investment decisions to better manage risk and generate attractive, long-term returns.

- Several leading institutional investors have demonstrated their commitment to ESG investing by integrating it throughout their portfolios.

- ESG appeals to investors as it can align investing with their personal values, make an impact on society and/or improve the risk/return profile of one’s investments.

- Investors need not sacrifice performance to adopt ESG principles; empirical studies have comprehensively shown a positive linkage between ESG and corporate financial performance.

- Western Asset believes the ongoing development of ESG investing within fixed-income provides asset owners with opportunities for superior risk-adjusted returns.

The level of discourse around the value of Environmental, Social and Governance (ESG) investing has increased in recent years, leading many to consider whether and how to incorporate ESG across their own portfolios. Generally, ESG investing aims to increase “responsible investments” by factoring ESG considerations (Exhibit 1) into investment decisions to better manage risk and generate attractive, long-term returns.

Consideration of ESG issues is not new to Western Asset. We have long believed that ESG factors can affect the creditworthiness of fixed-income issuers’ securities and therefore impact the performance of fixed-income investment portfolios. Our ESG investment policy seeks to reflect the changing environment in which the Firm and its clients operate, and incorporates ESG considerations into our credit analysis of corporate bond and other debt issuers.

UNPRI Examples of ESG Factors

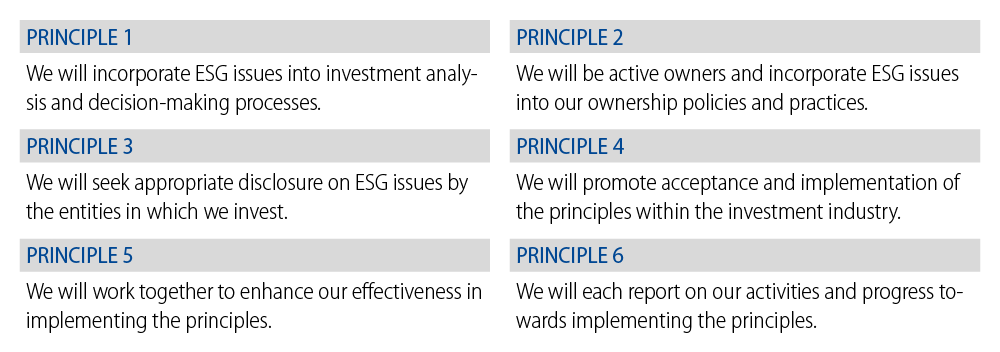

Our commitment to ESG investing is underscored by our relationship with the United Nations-supported Principles for Responsible Investing (PRI). Western Asset is a signatory to the PRI initiative—an international network of investors collaborating to put the six Principles for Responsible Investing into practice (Exhibit 2).

Six Principles for Responsible Investment

The ESG Movement

Western Asset is aligned with institutional investors in embracing the growing importance of ESG factors in the investment decision-making process. Several leading institutional investors have demonstrated their commitment to ESG investing by integrating it throughout their portfolios and increasing their portfolio allocations to ESG-related investments. Some well-known examples include Swiss Re,1 which is implementing ESG benchmarks for all its investments, California State Teachers’ Retirement System (CALSTRS),2 which adopted an ESG investment policy in 2008 and has chosen to invest $2.5 billion in low-carbon global equity strategies, and the Japan Government Pension Investment Fund (GPIF), which plans to invest 10% of its equity portfolio (approximately $29 billion) in ESG-related investments.3

In addition to asset owners’ increased awareness of ESG investing, business leaders and policymakers are growing more attuned to the investment risks posed by environmental and societal factors such as climate change, natural disasters, income inequality and water shortages. According to the 2018 World Economic Forum (WEF) Global Risks Report,4 which has been published on an annual basis since 2005, environmental hazards are increasing both in terms of frequency and potential impact over the next decade, with WEF survey respondents only expecting this pattern to continue. Similarly, the risks of social instability and involuntary migration (e.g., increasing numbers of environmental refugees in the aftermath of natural disasters) have been flagged as highly important to policymakers because they are so deeply interconnected with other global risks.

We expect investor adoption of ESG to continue to increase over the coming years, and believe that the application of ESG in particular to the fixed-income asset class will accelerate. We recognize, however, that a large set of investors is still evaluating what role ESG should play in their portfolios, or they are in the very early stages of integrating ESG into their portfolios. This paper is intended to provide these investors with an overview of ESG strategies and a better understanding of how ESG can enhance their investments.

ESG Means Different Things to Different Investors

Most readers are probably already aware that the acronym ESG stands for Environmental, Social and Governance. Yet within the ESG space, terminology and definitions have not yet been standardized; there are myriad ways to express ESG views. Terms such as sustainable investing, responsible investing, socially responsible investing (SRI) and impact investing are sometimes misunderstood and mistakenly used as synonyms. To add to the confusion, “SRI” has more recently been used as an acronym not only for “socially responsible investing” but also for “sustainable, responsible and impact” investing by the US SIF: The Forum for Sustainable and Responsible Investment.

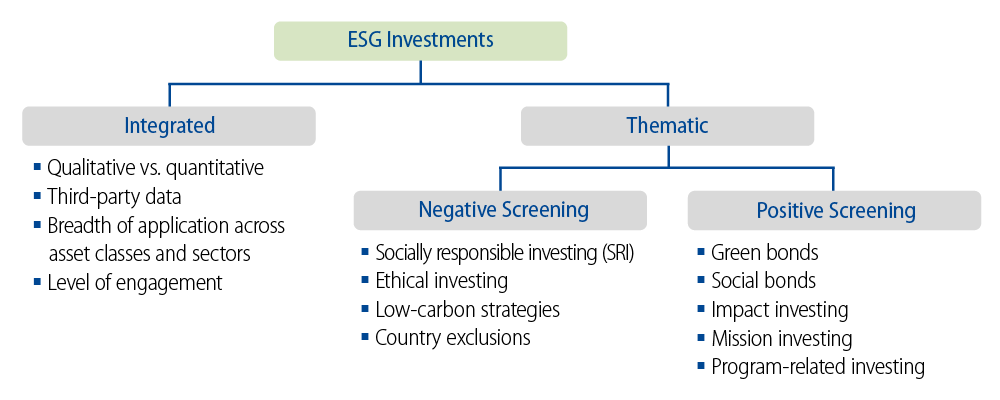

Sustainable investing and responsible investing (and SRI as defined by the US SIF) are umbrella terms that broadly encompass all investments with ESG characteristics. For simplicity and clarity, we will begin with the term “ESG investments” as a starting point. We suggest first dividing the ESG universe into two main categories: integrated and thematic (see Exhibit 3).

Integrated vs. Thematic ESG

Integrated ESG investments incorporate ESG analysis throughout the overall investment process without emphasis on any particular factor. The specifics of the implementation can vary widely among investment managers. For example, some approaches may be exclusively qualitative while others may be quantitative, some may use third-party ratings data, some may apply ESG to certain asset classes or sectors, and some may take a more active level of engagement on ESG issues than others. Given the wide degree of variance across approaches, it is extremely important for investors to understand how their potential managers define and incorporate ESG in order to select the appropriate partner to achieve their goals.

In contrast to integrated ESG investments, thematic ESG investments seek to implement specific views, typically within the environmental and social categories, such as climate change, diversity, or economic equality. Thematic ESG investments can be further subdivided into two categories: negative screening or positive screening.

Negative vs. Positive Screening

Negative screening seeks to effect change by excluding a particular asset class or classes. One common and long-used form is socially responsible investing (SRI), which typically excludes or limits exposure to industries such as alcohol, tobacco, firearms, gaming or fossil fuels. Negative screens can also be designed around factors like carbon exposure or human rights violations.

Positive screening seeks to effect change by focusing on a particular asset class. Sometimes referred to as “impact investing,” these strategies adhere to specific sustainability goals, such as clean energy, low-income housing, minority-owned small businesses or micro-businesses in frontier economies. In the fixed-income sector, investment options include green bonds and social bonds. Subcategories include investment activities by 501(c)(3) nonprofits that incorporate their missions (known as “mission investing”), and investment activities by foundations that accomplish their tax-exempt purpose but may deliver below-market returns (known as “program-related investing”).

While SRI strategies have existed for decades, increases in the level and quality of ESG-related disclosures have enabled growth in integrated and positive screening investment options, and facilitated more widespread adoption of ESG into the investment process.

ESG Investment Universe

The Rationale for ESG

Investor interest in ESG is generally driven by one or more of the following objectives: aligning investments with personal values, making an impact on society and/or improving the risk/return profile of one’s investments. Thematic investments are typically motivated by the first and/or second objectives. There are many investors who adopt an integrated ESG approach solely with the third objective in mind: generating a better risk/return. Some of these investors utilize ESG seeking to enhance returns over the long-term, others to reduce risk and still others to accomplish both.

Further, there are investors who, motivated by risk/return-related reasons, employ thematic approaches. For example, an insurance company inherently has heavy exposure to climate risk, so it may invest in a low-carbon strategy to minimize its enterprise-level risk. Likewise, while alignment and impact are often expressed through thematic ESG investments, they can also be considerations for investors employing an integrated approach.

To summarize, investors may be driven by multiple, overlapping objectives, further outlining the need for transparency, communication, and clear understanding about ESG investing between asset managers and asset owners.

The Impact of ESG on Investment Performance

A common misperception of investors is that they need to sacrifice performance to adopt ESG. Indeed, a recent survey of US institutional investors revealed that performance concerns were cited by 47% of those who have not yet made ESG investments as the leading reason for inaction in this regard.5

On the contrary, empirical studies have comprehensively shown a positive linkage between ESG and corporate financial performance.6 Similarly, there is substantial evidence supporting the value of ESG in equity performance.7 The amount of data and number of analyses specific to the fixed-income sector are more limited, but the body of work there is growing as well. For example, fixed-income ESG studies to date have concluded that bonds issued by companies with better governance practices have significantly outperformed the market,8 that sovereign ESG profiles can be indicative of future spreads9 and that issuers with worse environmental practices typically bear a higher cost of debt.10

Another common argument made by those who are undecided on the relationship between ESG and performance is that if issuers that are top ESG performers have access to a cheaper cost of capital, their bonds will trade at tighter spreads and thus offer less total return potential. This reasoning fails to address two possibilities. An issuer that trades at a premium to the market can continue to outperform either because its spreads tighten further or because its spreads are less vulnerable to widening due to its lower exposure to ESG-related risks.

Opportunities for Fixed-Income Investors

As noted earlier, the application of ESG to equities is more established than for other asset classes such as fixed-income, real estate and private equity. However, historical studies of fixed-income investment results actually show a higher share of positive ESG findings (i.e., better investment performance) than with equities.11 Additionally, the positive relationship between ESG and financial performance at both the corporate and portfolio levels is particularly strong in emerging markets and North America, perhaps because ESG is in its earlier stages of application and sophistication in these regions.

As an asset manager and fiduciary, Western Asset has long considered ESG factors in its investment process. We view ESG as an essential part of our credit analysis and believe that ESG provides a valuable way to assess the risk of an issuer. We believe that the ongoing development of ESG investing within fixed-income asset management provides asset owners with opportunities for superior risk-adjusted returns, and we continue to work to advance these developments on behalf of our clients.

Endnotes

- “Swiss Re among first in the re/insurance industry to integrate ESG benchmarks into its investment decisions,” 2017 July 06, http://www.swissre.com/media/news_releases/nr20170706_MSCI_ESG_investing.html.

- CALSTRS Investment Policy for Mitigating Environmental, Social and Governance Risks, https://www.calstrs.com/general-information/investment-policy-mitigating-environmental-social-and-governance-risks.

- “Japan’s GPIF expects to raise ESG allocations to 10 percent,” July 14, 2017, https://www.reuters.com/article/us-japan-gpif-esg/japans-gpif-expects-to-raise-esg-allocations-to-10-percent-ftse-russell-ceo-idUSKBN19Z11Y.

- World Economic Forum Global Risks Report 2018, http://reports.weforum.org/global-risks-2018/.

- “Catching the Wave: Maximizing ESG Business Potential in the North American Institutional Marketplace,” Greenwich Associates, September 2017.

- “ESG and financial performance: aggregated evidence from more than 2,000 empirical studies,” Gunnar Friede, Timo Busch, and Alexander Bassen, 2015. Measures of corporate financial performance include accounting-based performance, market-based performance, operational performance, perceptual performance, growth metrics, and risk measures.

- See, e.g., “How ESG Affects Equity Valuation, Risk and Performance,” MSCI, November 2017; “Environmental, Social & Governance Investing: A Quantitative Perspective of how ESG can Enhance your Portfolio,” J.P. Morgan, 14 December 2016.

- “ESG Investing in Credit Markets,” Barclays, 17 November 2016, Figures 26 and 31.

- “Did ESG Ratings Help to Explain Changes in Sovereign CDS Spreads?”, MSCI, October 2017.

- See, e.g., “Corporate Environmental Management and Credit Risk,” Rob Bauer and Daniel Hann, 2011; “Environmental Performance and the Cost of Capital: Evidence from REIT Bonds and Commercial Mortgages,” Piet Eichholtz, Nils Kok, and Erkan Yönder, 2014.

- See Friede, Busch, and Bassen.