KEY TAKEAWAYS

- China’s local currency bond market is the second largest bond market in the world, behind only that of the US.

- Although foreign ownership of China local currency bonds has historically been low by design, China has been making foreign ownership more accessible over the past 15 years.

- We believe the Chinese local currency bond market presents a good diversification and yield enhancement opportunity relative to the very low yields found in other developed bond markets.

- Western Asset has been, and remains, on the cutting edge of Chinese bond market developments required to ensure our clients have access to the full scope of potential alpha-generating opportunities.

Would you provide a high-level overview of the China local currency bond market?

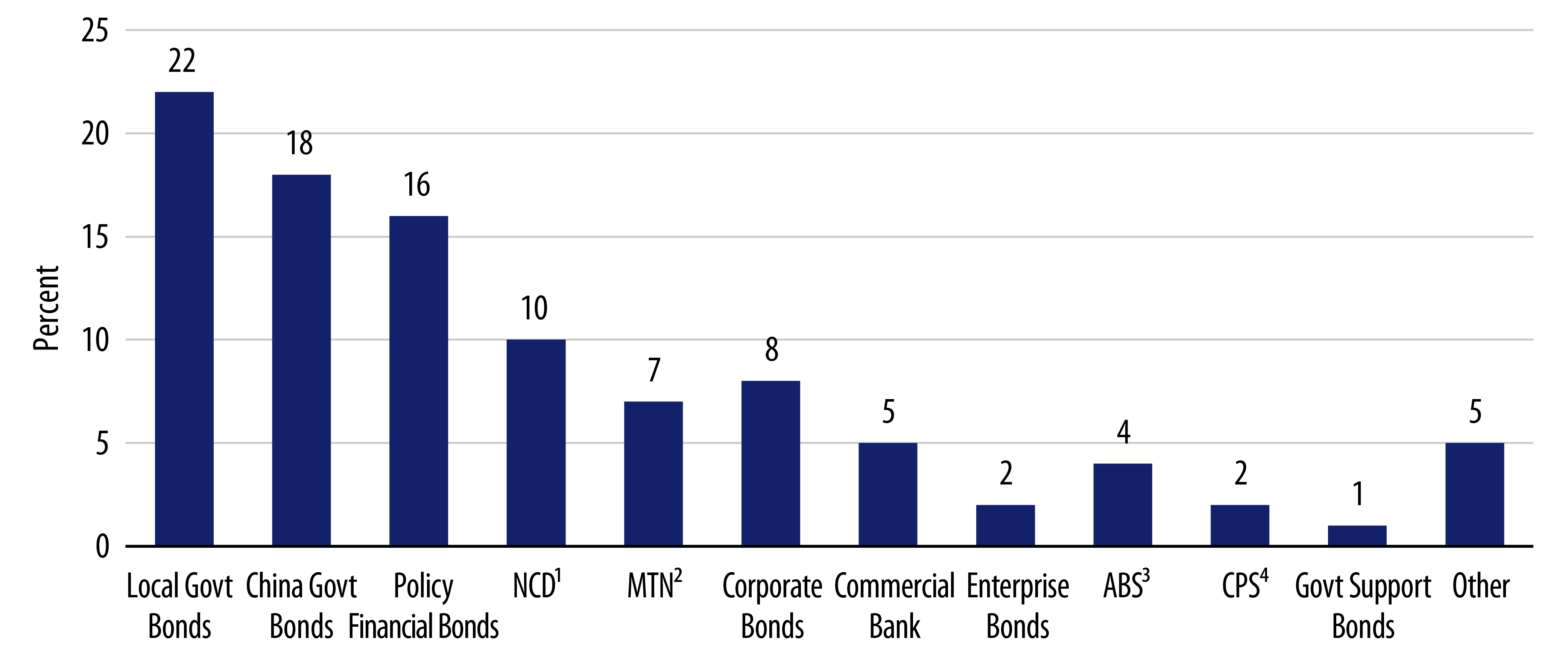

DS: The US$15 trillion China local currency bond market can be segmented into three broad categories:

- Government and municipal bonds (40% of the market size): includes Chinese government bonds (CGBs) issued by the Ministry of Finance and local government bonds issued by various Chinese local governments.

- Financial sector bonds (33% of the market size): includes policy financial bonds (PFBs) issued by the three Chinese policy banks—the China Development Bank, the Export-Import Bank of China and the Agricultural Development Bank of China. This category also includes bonds issued by commercial banks, insurance companies and security houses.

- Corporate sector bonds (27% of the market size): includes bonds issued by state-owned enterprises (SOEs) as well as privately owned enterprises (POEs).

Why is it important for investors to consider investing in China’s local currency bond market?

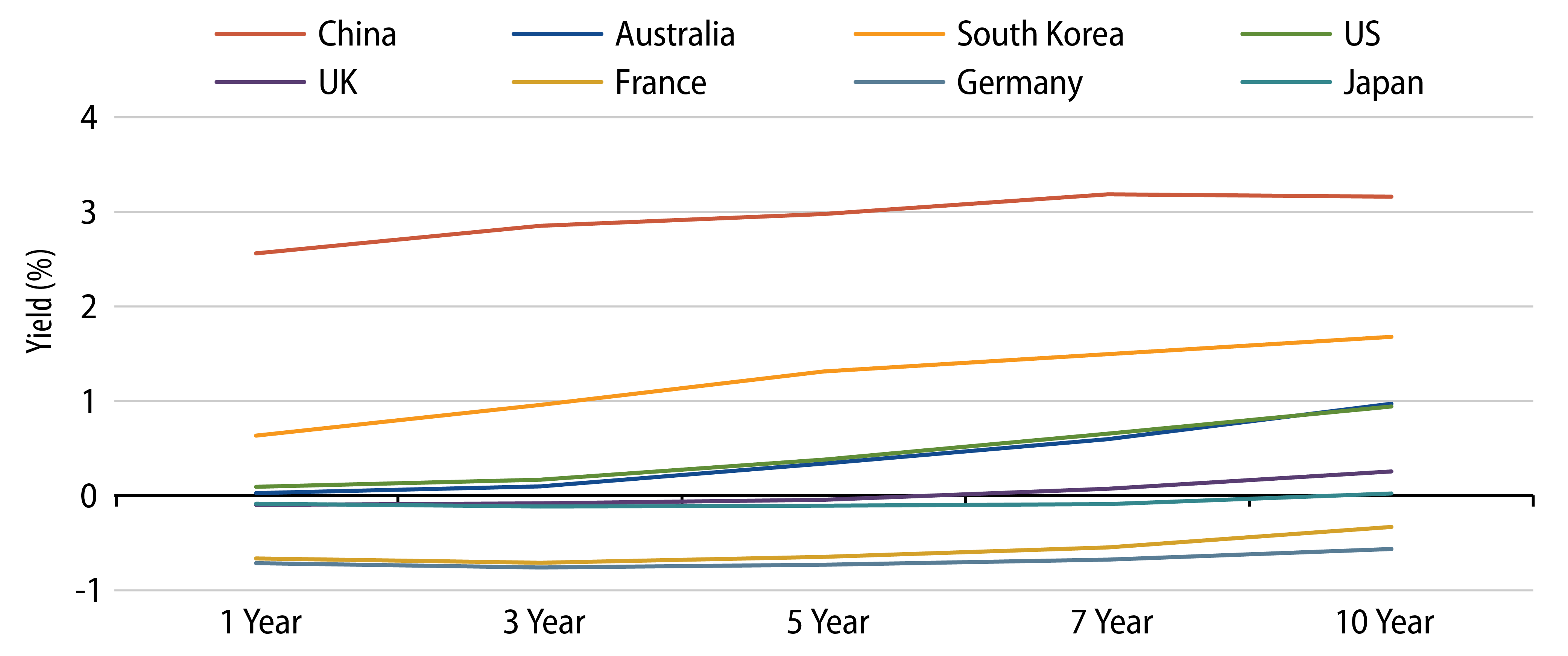

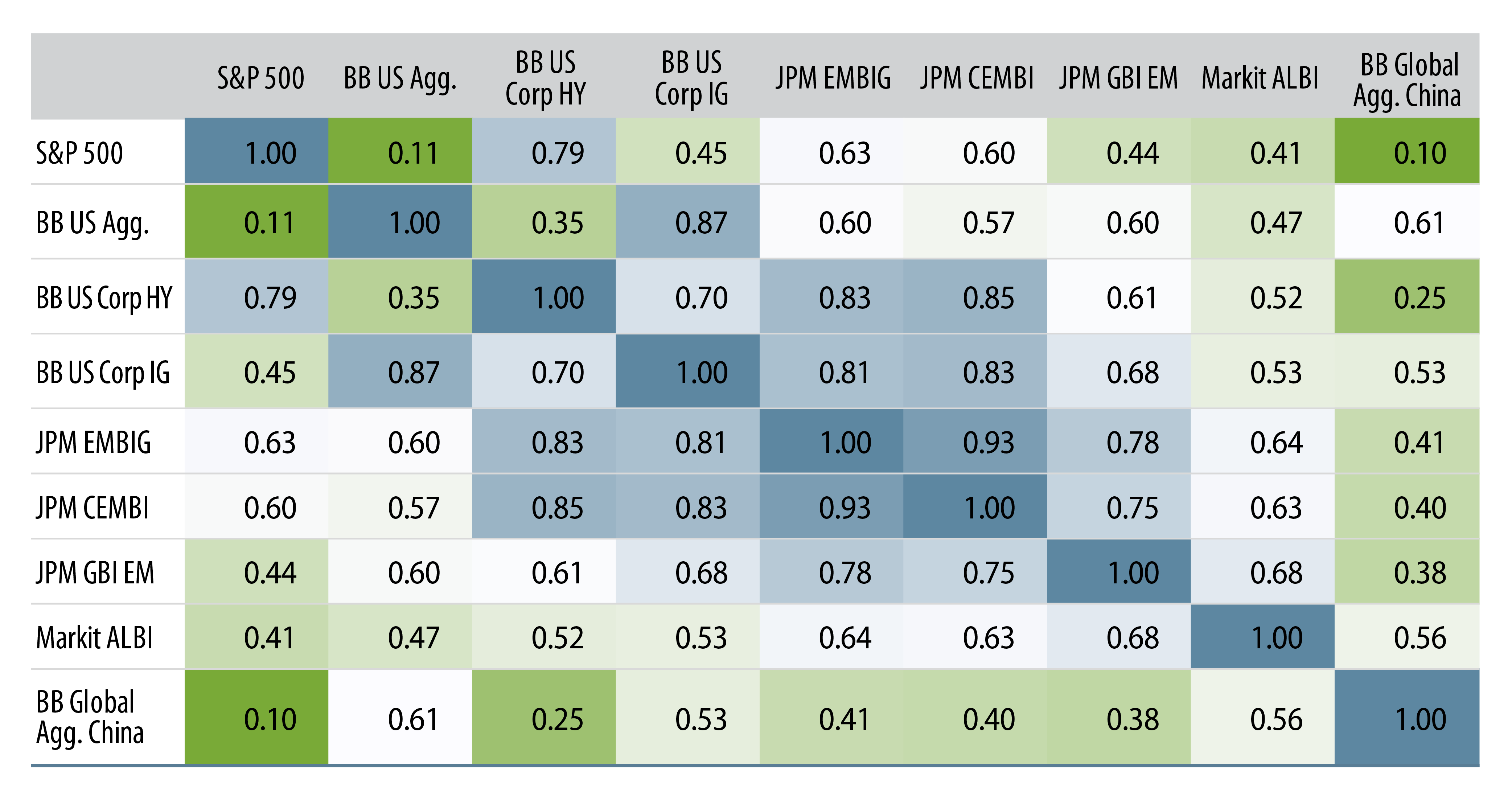

STS: China is now the world’s second largest economy after the US. We believe the current political environment is supportive of greater political/macroeconomic stability, policy continuity and a coordinated policy execution by the Chinese government. With approximately US$15 trillion in market value, China’s local currency bond market is also now the second largest bond market in the world behind the US. This large and increasingly liquid bond market can provide global fixed-income investors with a wide and deep investment universe from which to diversify and generate alpha. Given that China local currency bonds offer attractive valuations versus similarly rated peers, and a nice alternative to developed market (DM) government bonds with low or negative yields, we believe this sector will eventually play a more significant role in global bond portfolios.

Foreign ownership of China local currency bonds has historically been low by design—less than 5%. China has gradually relaxed regulations of its capital markets and has been making foreign ownership incrementally more accessible over the past 15 years. This more relaxed access evolution has allowed the Chinese yuan to be included in the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) basket as a recognition of China’s economic clout.

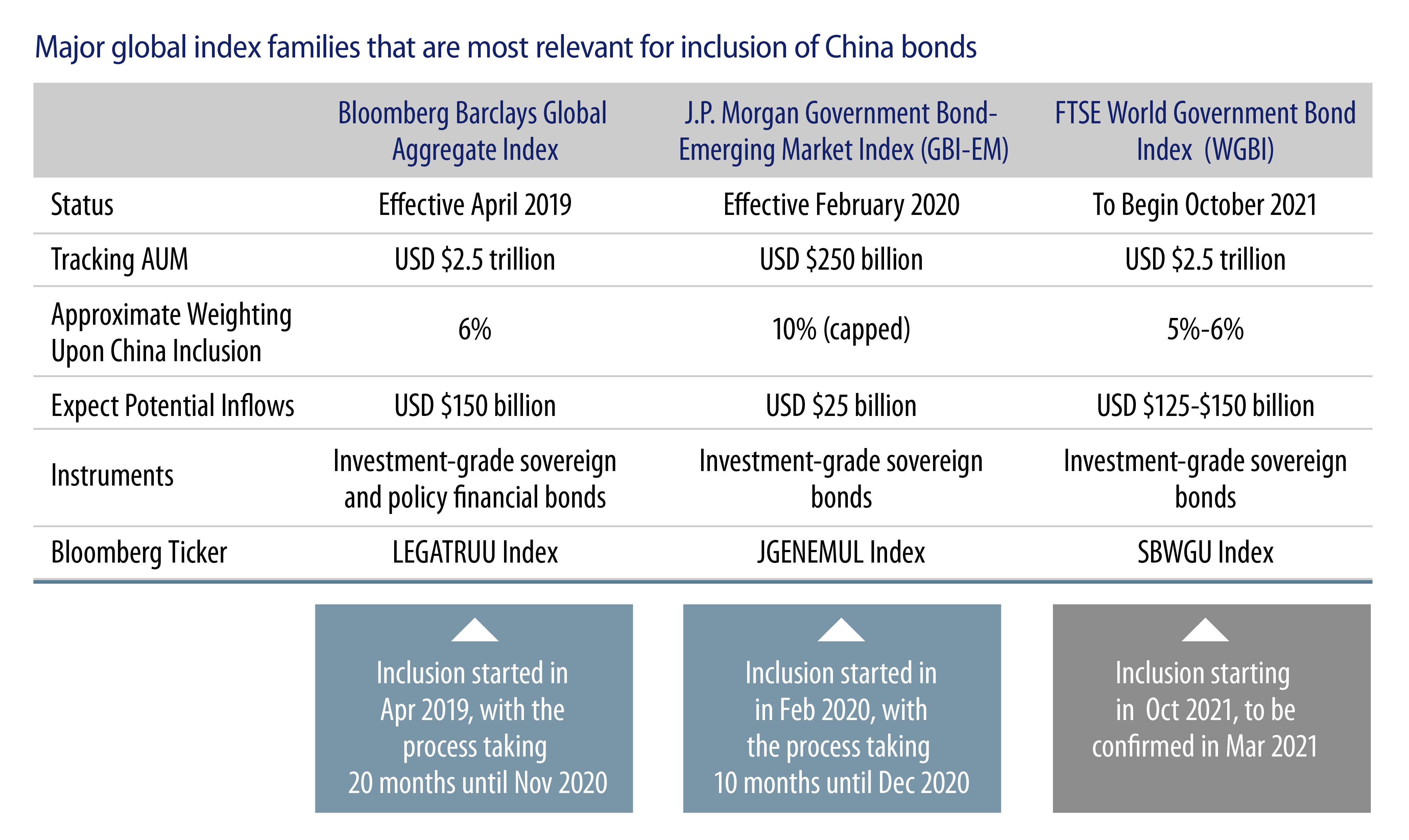

China local currency bonds began entering major global fixed-income indices starting in April 2019, when Bloomberg began including local currency CGBs and PFBs into its flagship Bloomberg Barclays Global Aggregate Index. Next came phased inclusion, beginning in February 2020, into the J.P. Morgan Government Bond Index–Emerging Markets, the Emerging Markets (EM) family of indices and the representative benchmarks for local-currency-denominated EM sovereign bonds. Finally, FTSE Russell announced in September 2020 that China local currency bonds would be included in its flagship global bond index, the FTSE World Government Bond Index (WGBI), starting in October 2021. With over US$5 trillion of AUM tracking these three major indices, the technical tailwinds provided by passive investors alone are substantial.

As noted earlier, while China’s bond market is the second largest in the world, the level of foreign participation remains low due to long-standing quota restrictions imposed by China. This is gradually changing given that the China Interbank Market (CIBM) is almost fully accessible to foreign institutional investors, and is thus paving the way for sizable foreign inflows into the market over the long term. In a DM environment that still has low government bond yields, CGB yields can provide an attractive pickup. Passive inflows from Bloomberg Barclays and J.P. Morgan benchmark inclusions are estimated to have already exceeded US$150 billion and analysts estimate that total inflows from being added to new indices—which will also include the FTSE WGBI phase-in starting in 2021, as well as positioning from active managers—will exceed US$770 billion over the next five years. This provides a supportive environment for index sponsors to include these bonds in various other indices such that we may eventually see indices with a primary focus on China going forward. We believe it is not too late for investors to benefit from a first-mover advantage as index inclusion activity provides a strong technical tailwind for China local currency bonds in the future.

How is the Chinese economy faring?

DS: China successfully contained the COVID-19 outbreak soon after it was detected in Wuhan around December 2019. The strong implementation of non-pharmaceutical interventions such as quarantines, mass patient testing and contact tracing has been effective in curbing initial and subsequent viral outbreaks. This has allowed China’s business activity in both the manufacturing and service sectors to resume to pre-Covid levels faster than in most countries. On the external front, despite tariffs and US-China tensions, Chinese export growth has been strong due to overseas demand for medical and pharmaceutical products, as well as for electronic goods, due to work-from-home restrictions. E-commerce giants such as Alibaba have seen a huge growth in demand for Chinese manufactured goods.

Prior to the outbreak, it was anticipated that China would enjoy a healthy 5.5% to 6.0% annual growth rate. While the viral outbreak at the start of 2020 resulted in a significant disruption to China’s economy, it was a temporary shock due to successful containment. China’s sharp economic rebound in 2H20 is likely to resume and we anticipate China’s GDP will continue its 5% to 6% growth rate over the next several years as the economy resumes its structural transition away from low-end manufacturing and investments toward consumption, services and the information technology sectors. The journey will undoubtedly be bumpy; headline growth indicators may at times be weak, but in our opinion, the probability of a sustained China slowdown remains low as China’s per-capita GDP is still at EM levels and the government continues to have considerable fiscal and monetary policy levers to boost economic growth. China’s contribution to the world’s economy, in our view, will grow and remain highly significant.

Can you explain the “dual circulation” economic plan recently introduced by President Xi?

DS: China’s “dual circulation” first mentioned at a Politburo meeting chaired by President Xi aims to address China’s structural slowdown, and seeks to avoid an EM “middle-income” trap and a fragile external environment. This initiative is dubbed “dual circulation” (双循环) as it consists of an “inner circulation” (内循环), which aims to boost China’s domestic demand as well as productivity growth, and an “outer circulation” (外循环) that reinforces China’s position as the world’s factory. Adopting twin engines of growth is also necessitated by the increasing deglobalization trend amid geopolitical tensions between the US and China. Shifting focus to domestic demand has great potential, especially since China’s provinces and municipalities such as the Zhejiang and Guangdong regions have both passed the threshold for high-income economies. Together, these regions are equivalent to the world’s third largest economy. In addition, the Chinese middle class is estimated to have reached 300-400 million people and their potential for bolstering domestic consumption is huge. Areas of potential increased domestic demand and productivity growth include the following:

- E-Commerce: Domestic e-commerce has increased significantly in recent years. Online sales reported by Alibaba during the 2020 “Singles’ Day” shopping festival, also known as “Double 11” as it is held on November 11, were up 86% from the previous year and far exceeded the sales of Thanksgiving, Black Friday and Cyber Monday, combined, in the US.

- Urbanization: Reforms to promote effective urbanization continue as China’s progress in urbanization notably lags its peers, according to the World Bank. By reducing spatial frictions in China’s labor market such as the “hukou” household registration system designed to restrict labor mobility and population growth in larger cities, labor productivity would improve despite the shrinking working population. Urbanization reforms would also help narrow the income gap between urban and rural households, reduce precautionary saving by rural workers and boost domestic demand.

- SOE Reforms: Reforms by SOEs would contribute to improved resource allocation. While SOEs account for 39% of total industrial assets in China, versus 21% for POEs, SOEs’ return on assets has been persistently below that of POEs. According to researchers, SOE reforms could add another 0.7%-1.2% to China’s long- term growth per year by allowing proactive exits of zombie firms, a reduction in government subsidies and the hardening of SOE budget constraints to improve the efficiency of credit allocation.

- Technology Innovation: Despite setbacks seen by the “Made in China 2025” initiative, China’s research and development (R&D) spending has been growing rapidly for years. China’s global innovation ranking has surpassed Japan’s and moved up to 14th place, according to the World Intellectual Property Organization (WIPO).

- Relaxation of Entry Barriers: According to the Organisation for Economic Co-operation and Development (OECD), China’s entry barriers in services remain notably higher than those of OECD members, despite government liberalization in the sector each year. By cutting its “negative list” for foreign investment access, China scrapped restrictions in legal services and insurance in 2018, transportation and value-added telecommunications in 2019, as well as ownership caps on securities, fund management, futures and life insurance firms in 2020. As new jobs rotate from manufacturing to services, boosting productivity growth in the service sector now becomes more necessary. By liberalizing the sector, related foreign capital, experience and competition can be drawn in to accelerate China’s productivity convergence to the sector frontier.

What investment opportunities in China local currency bonds do you currently find attractive?

DS: We believe the Chinese local currency bond market presents a good diversification and yield enhancement opportunity relative to the very low yields in developed market bonds. At the initial stage, we believe CGBs and PFBs are a good entry point to express a medium-term constructive view of the Chinese economy and the Chinese yuan without taking on significant credit risk. As the local Chinese credit market develops, we will devote greater credit analytic resources to participate in the alpha-generating opportunities.

Would you explain the evolution of foreign investor access to China’s local currency bond markets?

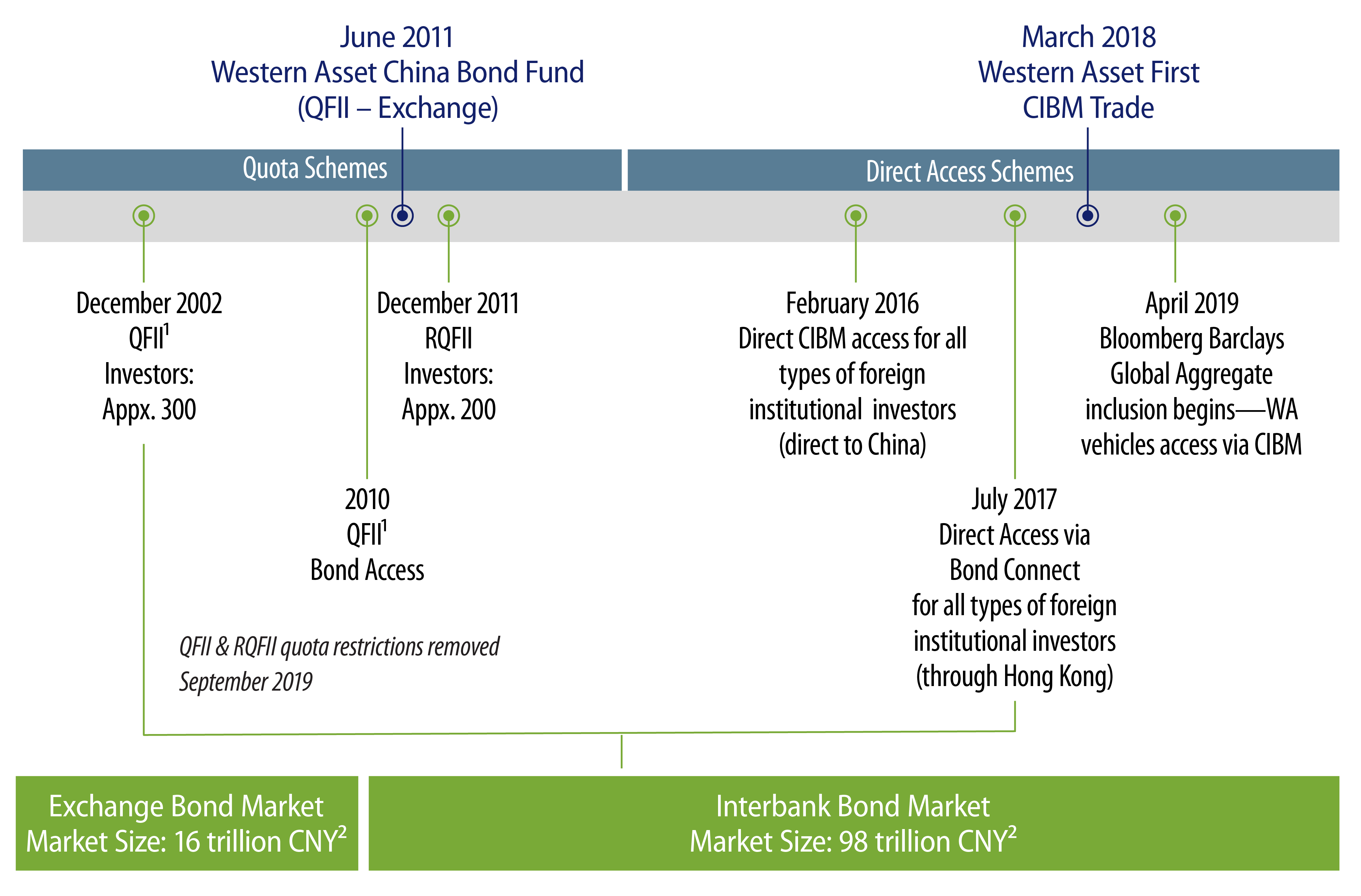

STS: In the early 2000s, foreign investors had the ability to access the China local equity market via the use of a quota-based system that required obtaining a Qualified Foreign Institutional Investor (QFII) license from the Chinese government. In 2010, when the People’s Bank of China (PBoC) provided access to the domestic interbank bond market, Western Asset applied for and obtained a QFII quota from the Chinese government. This allowed the Firm to obtain local currency Chinese government bond exposure for its clients. In 2011, QFII was enhanced to facilitate foreign investment in mainland China via offshore renminbi (RMB) accounts. RMB QFII, also known as RQFII, was limited to only Hong Kong subsidiaries of Chinese financial institutions but was later expanded to include other institutions in subsequent years. In 2015, the PBoC further relaxed its rules for investing in the CIBM without quota limits by allowing foreign central banks and sovereign wealth funds to trade directly by registering with the government. Subsequently, similar CIBM access was granted to a much wider range of institutional investors, and asset managers like Western Asset adapted to the evolution of capital account liberalization by accessing the local markets via the CIBM. By mid-2017, access was made more convenient through another channel called Bond Connect, allowing all types of foreign institutional investors the ability to invest in China via Hong Kong. Finally, in 2019, China further liberalized its access by removing quota restrictions previously in place for years under the aforementioned QFII/RQFII programs, then most recently announced consolidation of the QFII/RQFII regimes into one scheme, allowing investors to make a one-time application that has been further streamlined. Evolution of foreign investor access has been fast and furious, but all of these enhancements demonstrate China’s strong desire to make local market access easier for foreign investors, and ease the regulatory and administrative burden that existed previously. The evolution to access China’s local currency markets has been the most dramatic over the past decade as we have observed with the numerous changes implemented by the government. While accessing Chinese local markets may still appear daunting for investors seeking a “DIY” or do-it-yourself solution, we believe our clients can leverage the experience and knowledge gained by Western Asset over the past several years to stay on the cutting edge of these ongoing developments.

We believe that as the Chinese capital and currency markets continue to mature and open up, we can continue to exploit attractive value opportunities in Chinese local currency markets.

Are you concerned about the recent increase in defaults on SOE debt?

DS: We hold the view that sporadic defaults by non-systemic SOEs are healthy for China’s credit market development, as it encourages more credit differentiation and investment discipline. It also shows that the government has become more confident and tolerant with SOE defaults, as part of its multi-year reform/deleveraging campaign to improve the sector’s efficiency and to wean investors off the belief that government will bail out every SOE regardless of the company’s fundamentals. We do not believe that the recent defaults will give rise to systemic risks, as the default rate remains low overall and most Chinese SOE debt is held domestically. Although it may periodically cause some short-term market volatility, the spillover to the rest of the market, including the most recent episodes, has largely been contained to specific regions and to structurally challenging sectors (e.g., metals & mining).

In terms of investment preference, we remain wary of exposure to peripheral SOE credits in non-strategic challenging sectors such as commodities trading, metals & mining, and from lower-tier local governments funding entities. We also steer clear of companies with minimal publicly available information that we believe may expose investors to “black hole” risk. On the other hand, we like core central SOEs with strong financials that hold leading market positions in highly strategic sectors such as utilities, and oil & gas. Our expectation is that large SOEs under the Chinese central government should stay resilient through the full business cycle, and are less susceptible to market volatilities and any further escalation in US-China tensions, given their large domestic-oriented operations. Given their high strategic importance, they are also expected to receive strong support from the central government, if needed.

What is your outlook on Chinese local rates and the Chinese yuan (CNY)?

DS: The PBoC has largely normalized interest rates in 2Q20 as business and consumer activity reverted to pre- Covid levels. PBoC Chief Yi Gang has publicly eschewed the unorthodox ultra-accommodative monetary policy adopted by many developed economies. The central bank wants to keep interest rates at normalized levels after successful virus control to safeguard future economic growth and promote financial stability. As a consequence, local Chinese interest rates—at more than 3%—are the highest among developed countries. While Chinese interest rates may creep higher in the first half of 2021 on stronger growth and tighter credit conditions, we see the 10-year CGB yield peaking at 3.5% before declining to 3.2% by the end of 2021. The PBoC should keep open market operations and medium-term lending facility rates unchanged throughout 2021 with the 7-day repo rate to average 2.2%-2.4% due to subdued inflation and vulnerabilities in the SOE sector. Primary supply of CGBs will likely decline as the government may rein in the official budget deficit at 2.8% of GDP. The impact of negative technical factors, including structured deposit compression and credit defaults should ease in 2021 and help the CGB yield curve to soften and bull-flatten next year.

Fundamentally, we continue to believe the CNY should remain relatively firm on a trade-weighted basis. The attractive interest rate differential, inflows into China bonds and equities, an improvement in the current account surplus due to strong exports, and a collapse in international M&A and tourism outflows are a recipe for a robust CNY going forward. We also expect the CNY to remain an outperformer compared with other EM currencies. As part of its foreign exchange reforms, the Chinese government clearly wants market forces to play a larger role in determining the exchange rate and for the currency to exhibit two-way flexibility instead of a one-way bet on either depreciation or appreciation. In addition, the CNY’s inclusion into the IMF’s SDR basket was a recognition of China’s economic influence and a boost to the currency’s international status. This, along with inclusion in major global bond indices, should generate increased demand for CNY-denominated assets over the medium to long term, as global reserve and asset managers gradually diversify their currency allocations. In addition, we believe the Chinese government is aware that SDR inclusion requires capital account liberalization and this should encourage it to continue carrying out the necessary financial reforms and opening up of China’s capital markets. We expect foreign inflows into China’s bond market to reach $200-$230 billion in 2021, with foreign ownership of CGBs likely to reach 12% (versus 9.9% in October 2020).

Finally, for EM debt in general, the recent shift in the US Federal Reserve’s inflation objective to average inflation targeting supports our long-held view that policy rates will remain low for the foreseeable future—hence, ongoing low/negative levels of real rates. The resulting real rate differential between the US and EM countries is a dynamic that should benefit capital and portfolio flows into EM countries. In this context, China local currency bonds could offer attractive diversification in the context of a global portfolio.

What is Western Asset’s experience investing in Chinese bond markets?

STS: Western Asset has delivered value to investors over the long term using the Firm’s time-tested investment philosophy: long-term fundamental value-driven investing that deploys multiple diversified strategies for prudent risk management. We believe there are several key strengths that will enable the Firm to retain its established position in the Chinese fixed-income space as it continues to grow and evolve. First, Western Asset maintains a highly effective globally integrated platform with strong Asia research capabilities led by our Asian Bond Team based in our Singapore office. Investment management and research capabilities in Asia leverage the views of the broader global investment management team, primarily the Emerging Markets Team based in our Pasadena, California headquarters. Second, Western Asset has been managing dedicated Asian bond strategies since 1994 and has maintained a presence in the region since the late 1990s. We have been investing in both the onshore and offshore Chinese fixed-income markets since June 2011. Finally, Western Asset has been on the cutting edge of Chinese bond market developments required to ensure our clients have access to the full scope of potential alpha-generating opportunities within China. As mentioned earlier, the Firm obtained a QFII quota from the Chinese government back in 2010. This allowed Western Asset to obtain local currency Chinese government bond expe- rience and exposure for our clients. Most recently, by the time the Bloomberg Barclays Global Aggregate (BBGA) Index first began phasing in both CGBs and PFBs in April 2019, the Firm was fully prepared with its China-registered commingled vehicles that access the China Interbank Bond Market (CIBM) directly in a very efficient and cost effec- tive manner in order for the Firm’s global clients to gain exposure to local currency Chinese bonds. Leveraging our recent success, Western Asset continues to collaborate with clients who have elected to obtain their own access registrations (via CIBM or Bond Connect) to invest in China’s local currency bond market.