KEY TAKEAWAYS

- China’s large bond market can provide global fixed-income investors with a wide and deep investment universe to help diversify their investments and generate alpha.

- Western Asset believes that as the Chinese capital and currency markets continue to mature and open up, we can successfully exploit attractive value opportunities in both Chinese onshore and offshore markets.

- Fundamentally, we think the Chinese yuan should remain relatively firm on a trade-weighted basis, buoyed by China’s trade surplus and relatively high economic growth.

- Foreign ownership of onshore China bonds is currently very low. This makes the Chinese bond market primarily driven by domestic interest rate trends and one of the least sensitive to US interest rates.

- Western Asset continues to be on the cutting edge of Chinese bond market developments required to ensure investors have access to the full scope of potential alpha-generating opportunities within China.

Why is it important for investors to consider investing in China’s local bond market?

DS: China is now the world’s second largest economy. We believe the current stable political environment is supportive of greater political/macroeconomic stability, policy continuity and a coordinated policy execution by the Chinese government.

With approximately US$13 trillion in market value, China’s local onshore bond market is now the second largest bond market in the world, behind the US. This large bond market can provide global fixed-income investors with a wide and deep investment universe to diversify and generate alpha. Given that China local bonds offer attractive valuations versus similarly rated peers, we believe this sector will eventually play a more significant role in global bond portfolios.

Foreign ownership of China local bonds has historically been low—less than 5%—primarily due to long-standing capital controls imposed by the government. China has been gradually relaxing the rules of its capital markets and has been making foreign ownership incrementally more accessible over the past 15 years. This more relaxed access evolution has allowed the Chinese yuan to be included in the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) basket as a recognition of China’s economic clout.

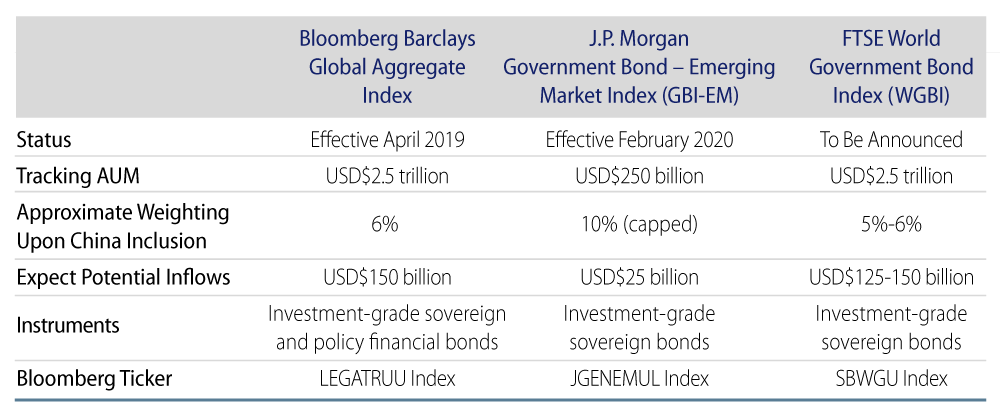

China local bonds will be entering major global fixed-income indices moving forward. In April 2019, Bloomberg began including onshore China government bonds (CGBs) and policy financial bonds (PFBs) into its flagship Bloomberg Barclays Global Aggregate Index. Inclusion is expected to occur gradually over a 20-month period and end with a weighting of approximately 6%. Bloomberg’s planned inclusion recognizes China’s continued efforts to enhance access to what is now the world’s third largest bond market. Bloomberg Chair Peter T. Grauer said that the “announcement represents an important milestone on China’s path towards more open and transparent capital markets, and underscores Bloomberg’s long-term commitment to connecting investors to China.”

In addition to the Bloomberg Barclays Global Aggregate, J.P. Morgan announced that, starting February 2020, CGBs will be included in the J.P. Morgan Government Bond Index–Emerging Markets, the emerging markets (EM) family of indices and the representative benchmarks for local-currency-denominated EM sovereign bonds. Inclusion in the GBI-EM will occur over a 10-month period and end with a weighting of 10%.

Finally, China local bonds are also being considered for inclusion in another major bond index, the FTSE World Government Bond Index (formerly the Citi World Government Bond Index). We anticipate an announcement sometime in 2020 from FTSE on this development.

As noted earlier, while China’s bond market is the second largest in the world, the level of foreign participation remains extremely low (below 5%) due to long-standing quota restrictions imposed by China. This is expected to change given that the China Interbank Market (CIBM) is almost fully accessible to foreign institutional investors, and is thus paving the way for sizable foreign inflows into the market over the long term. In an environment that still has low government bond yields in developed markets (DM), CGB yields provide an attractive pickup.

Indeed, analysts have estimated that the potential passive inflows into the China onshore bond market from mainstream bond index inclusion will exceed $300 billion over the next few years. This will provide an environment for index sponsors to include such bonds in various other indices so that we may eventually see indices with a primary focus on China going forward. We believe initial investors will benefit from a first-mover advantage and index inclusion activity will provide a strong technical tailwind for China local bonds in the future.

Would you provide a high-level overview of the China local currency bond market?

DS: The US$13 trillion China local bond market can be segmented into three broad categories, each representing roughly one-third of the overall market, as follows:

- Government and municipals bonds are issued by the central government and local governments throughout China.

- Financial sector bonds include PFBs issued by the three so-called Chinese policy banks—the China Development Bank, the Export-Import Bank of China and the Agricultural Development Bank of China. This category also includes bonds issued by commercial banks, insurance companies and security houses.

- Corporate sector bonds are those issued by state-owned enterprises (SOEs) as well as privately owned corporations.

Would you explain the evolution of foreign investor access to China’s local currency bond markets?

DS: In the early stages, back in 2002, foreign investors had the ability to access the China local equity market via the use of a quota-based system that required obtaining a Qualified Foreign Institutional Investor (QFII) license from the Chinese government. In 2010, when the People’s Bank of China (PBoC) provided access to the domestic interbank bond market, Western Asset, along with its parent company Legg Mason, applied for and obtained a QFII quota from the Chinese government that allowed the Firm to obtain onshore Chinese government bond exposure for its clients. In 2011, QFII was enhanced to facilitate foreign investment in mainland China via offshore renminbi (RMB) accounts. RMB QFII, also known as RQFII, was limited to only Hong Kong subsidiaries of Chinese financial institutions but was later expanded to include other institutions in subsequent years.

In 2015, the PBoC further relaxed its rules for investing in the CIBM without quota limits by allowing foreign central banks and sovereign wealth funds to trade directly by registering with the government. More recently, similar CIBM access was granted to a much wider range of institutional investors and asset managers like Western Asset have sought to adapt to the evolution of capital account liberalization by accessing the local markets via the CIBM. Finally, in mid-2017, access further evolved via another channel called Bond Connect, allowing all types of foreign institutional investors the ability to invest in China via Hong Kong. While accessing Chinese local markets may appear daunting for investors seeking a “DIY” or do-it-yourself solution, Western Asset believes its clients can leverage the experience and knowledge gained by Legg Mason and Western Asset over the past several years to stay on the cutting edge of these ongoing developments.

We believe that as the Chinese capital and currency markets continue to mature and open up, we can successfully exploit attractive value opportunities in both Chinese onshore and offshore markets.

How is the Chinese economy faring? Are there concerns of a hard landing?

DS: Western Asset continues to lie in the soft-landing camp, meaning that the Firm is expecting China’s headline GDP growth to decelerate to 5%-6% annually over the next few years as the economy makes a structural transition away from low-end manufacturing and investments toward services and the information technology sector. The journey will undoubtedly be bumpy; headline growth indicators may at times be weak, but in our opinion, the probability of a hard landing remains low as China’s per capita GDP is still at EM levels and the government has considerable policy levers to boost economic growth. China’s contribution to the world’s economy remains significant given its growing base. For example, 6% growth in China now contributes the same amount to world GDP as 10% China growth did just five years ago.

The moderation in China’s growth rate is a continuation of the ongoing trend evident since 2012, as workers’ wages have risen and demographic headwinds have emerged. A calibrated economic slowdown in China is both necessary and welcome, underscoring the transition of the economy from an investment-driven growth model to one based more on services and consumption. The IMF has commented that China’s structural transformation will prove to be more healthy and sustainable in the long run.

While credit growth has been aggressive by many measures, it’s crucial to understand that China’s debt is predominantly financed domestically, primarily by Chinese households underpinned by very high levels of personal savings. The high financial leverage is built up by state-owned banks lending to state-owned companies and local governments. Due to this construct, lending can be directed and debt reconfigured in difficult circumstances. Hence, in our assessment, the risk of a “Lehman-type” freezing of the financial system in China is remote despite the high debt-to-GDP ratio.

What do you believe are the top risks facing China in the near-term?

DS: n our view, the two greatest risks to China continue to be accelerated capital outflows and a full-scale trade war with the US.

Accelerated Capital Outflows: At US $3.2 trillion, China’s foreign reserves are the world’s largest, but the size of capital outflows following the Chinese yuan fixing reform/devaluation on August 11, 2015—estimated by Bloomberg to be US$740 billion—is ingrained in the minds of Chinese policymakers and deeply concerning if repeated. However, since the 2015 episode, the State Administration for Foreign Exchange (SAFE) has instituted more stringent enforcement of capital controls and a crackdown in large overseas M&A activity. To anchor market confidence, the PBoC has been keeping the Chinese currency’s fixing at a relatively stable level and has enhanced communications and transparency to the market. The effectiveness of these measures has successfully reduced capital outflows and anchored the Chinese yuan. In our view, a repeat of large capital outflows is unlikely.

A Full-Scale Trade War: A large trade war between the US and China would affect the global economy significantly and unsettle financial markets. This could lead to a sharp slowdown in global economic growth. Today, global manufacturing supply chains are highly integrated. As the famous iPhone manufacturing study showed, focusing on bi-lateral trade statistics can be misleading. The study found that for every $229 iPhone sold in the US, the US trade deficit with China increased by the same amount. Yet the value captured from these products through assembly in China is around $10. Hence, to reduce the bilateral trade surplus with the US iPhone the assembly plants would have to be moved to other countries, which would re-configure and disrupt Apple’s supply chain. This could adversely impact Apple as much as Chinese assembly plants. Further, there is a risk that the trade war could morph into a currency war, whereby countries weaken their currencies to gain an export advantage to mitigate higher US import tariffs. Last, a full-scale trade war could severely weaken financial markets, which could cause a credit crunch. In our base case, once Phase 1 of a trade deal is signed, we believe that the US and China will continue to announce concessions sufficient enough to halt further escalation of frictions while working toward longer-term solutions on some of the more challenging structural issues being debated (e.g., forced technology transfer).

Are you concerned about the possible depreciation of the Chinese currency and investing in China local bonds in today’s environment of rising interest rates?

DS: Fundamentally, we think the Chinese yuan should remain relatively firm on a trade-weighted basis, buoyed by China’s trade surplus and relatively high economic growth. Given the diverging monetary policies of the US and the rest of the world, a modest weakness of the Chinese yuan vis-à-vis a strong US dollar backdrop is possible, but we expect the Chinese yuan to remain an outperformer compared with other EM currencies.

As part of its foreign exchange reforms, the Chinese government clearly wants market forces to play a larger role in determining the exchange rate and for the currency to exhibit two-way flexibility instead of a one-way bet on either depreciation or appreciation. Hence, we have seen the PBoC’s daily fixing mechanism move toward a trade-basket-based foreign exchange regime instead of bilaterally referencing the US dollar only.

In addition, the Chinese yuan’s inclusion into the IMF’s SDR basket was a recognition of China’s economic influence and a boost to the currency’s international status. This, along with inclusion in major global indices, should generate increased demand for Chinese yuan-denominated assets over the medium- to long-term, as global reserve and asset managers gradually diversify their currency allocations. In addition, we believe the Chinese government is aware that SDR inclusion requires capital account liberalization and this should encourage them to continue carrying out the necessary financial reforms and a gradual opening up of China’s capital markets.

Petro yuan, the denomination and settlement of oil and gas trade in Chinese yuan is an increasing phenomenon. The “shale revolution” has reduced US net imports of oil and gas to zero, with China emerging as the largest buyer of Middle Eastern and Russian hydrocarbons. Given concerns over the Trump administration’s “weaponizing of the US dollar,” OPEC members are increasingly willing to settle their hydrocarbon trades in Chinese yuan. As of June 30, 2019, IMF data showed that 1.9% of global FX reserves are in Chinese yuan compared with 4.2% in the British pound. Sovereign wealth funds and central banks are likely to increase their FX reserve holdings of Chinese yuan, given its low base and its increasing importance in the oil and gas market.

As noted earlier, foreign ownership of onshore China bonds is extremely low. This makes the Chinese bond market both primarily driven by domestic interest rate trends and also one of the least sensitive to US interest rates (US Treasury beta of 0.14 over the last three years). Further, for EM debt in general, there exists a misperception within the investor community that US monetary tightening will be negative for EM under all scenarios. Although EM fared poorly during the 1994 and 2013 changes to US monetary policy expectations, there are also examples in which EM has performed well under tightening regimes of the past several decades. Notably, during the 2004-2006 rate hiking cycle, the JP Morgan GBI-EM Global Diversified index (EM local currency sovereign bond index) returned 36.8% (14.9% annualized). Hence, China local bonds could offer attractive diversification in the context of a global portfolio.

What investment opportunities in China local currency bonds do you currently find attractive?

DS: We think the Chinese onshore bond market presents a good diversification and yield enhancement opportunity relative to very low yields in DM fixed-income. Given SDR entry, we believe CGBs and PFBs are a good entry point to express a medium-term constructive view of the Chinese economy and the Chinese yuan without taking significant credit risk.

What is Western Asset’s experience investing in Chinese bond markets?

DS: Western Asset has delivered value to investors over the long-term using the Firm’s time-tested investment philosophy: long-term fundamental value-driven investing that deploys multiple diversified strategies for prudent risk management. We believe there are several key strengths that will enable the Firm to retain its leadership position in the Chinese fixed-income space as it continues to grow and evolve.

First, Western Asset maintains a highly effective globally integrated platform that possesses strong Asia research capabilities led by our Asian Bond Team based in our Singapore office. Investment management and research capabilities in Asia leverage the views of the broader global investment management team, primarily the Emerging Markets Team based in our Pasadena, California headquarters.

Second, Western Asset has been managing dedicated Asian bond strategies since 1994 and has maintained a presence in the region since the late 1990s. We have been investing in both the onshore and offshore Chinese fixed-income markets since June 2011.

Finally, Western Asset has been on the cutting edge of Chinese bond market developments required to ensure our clients have access to the full scope of potential alpha-generating opportunities within China. As mentioned earlier, the Firm, along with our parent company Legg Mason, applied for and obtained a QFII quota from the Chinese government back in 2010. This allowed Western Asset to obtain onshore Chinese government bond experience and exposure for our clients. More recently, in 2018, when Bloomberg Barclays announced the planned phase-in of local onshore Chinese bonds into the Bloomberg Barclays Global Aggregate (BBGA) Index, the Firm embarked on a multi-faceted project to ensure the Firm would be fully prepared to access the markets when the BBGA Index began phasing in both CGBs and PFBs, effective April 2019. The Firm currently maintains commingled vehicles that can access the China Interbank Bond Market (CIBM) directly in order for the Firm’s global clients to gain exposure to local onshore Chinese bonds. In addition, leveraging our recent experience, Western Asset has been collaborating with clients who have elected to obtain their own access registrations (via CIBM or Bond Connect) to invest in China’s domestic bond market.