KEY TAKEAWAYS

- A wide spectrum of potential Brexit scenarios remains.

- On balance, our base case is for Parliament ultimately to support a “Plan B” deal with further political and possibly legal assurances from the EU around the backstop agreement.

- Under this outcome or an “extend” scenario, the probabilities are tilted towards a softer or later Brexit. Consequently the probability of a hard “no deal” Brexit has fallen.

- Under our base case, we expect gilt yields to rise, UK credit assets to react positively and sterling to appreciate from current levels.

- With growth likely to rebound somewhat and against an existing backdrop of a tightening labour market and rising wage pressures we think it is likely that the financial markets will start to price in policy tightening by the BoE.

For anyone living in the United Kingdom since the Brexit vote in 2016 the unfolding tragicomedy has rivaled anything that even this country’s great bard William Shakespeare scripted at his creative peak. Reality has indeed been stranger than fiction. This brief note attempts to look beyond the current political agitation and assess the impact of three alternative Brexit scenarios on UK financial markets.

Ever since the UK government invoked Article 50 on March 29, 2017, the seemingly constant flow of news headlines around Prime Minister Theresa May’s domestic political challenges and the frequently changing narrative around UK and EU negotiations has opened up a wide range of potential Brexit scenarios. Even for Brexit aficionados, the various scenarios have often been difficult to keep up with and remain a head scratcher for game theorists. In short, having a high degree of confidence around which Brexit outcome may be the most likely is fraught with difficultly and is therefore something of a fool’s errand. Currently there is no majority for any outcome but ultimately we know that one of them has to happen.

On January 15 the government’s proposed Brexit “deal” was defeated by a significant margin of 432-202. We anticipate the government will seek further assurances from the EU in order to seek parliamentary approval for a revised “deal”. However, there remains a wide spectrum of potential outcomes which can be broadly grouped into three main scenarios:

- The “deal” scenario: Having lost the vote on January 15 the government’s “Plan B” proposal is subsequently voted through Parliament and the UK exits the EU on March 29 on the same or similar terms to the existing deal.

- The “extend” scenario: The government’s proposal is rejected by Parliament and Brexit is delayed through extending Article 50.

- The “no deal” scenario: The government’s proposal is rejected by Parliament and Article 50 is not extended. Under this mechanism the UK would leave the EU on March 29 under WTO rules.

The “Deal” Scenario

Views on both sides of the Brexit debate within the Conservative Party and Parliament more generally have remained firmly entrenched. For the last several weeks parliamentary arithmetic pointed strongly to Prime Minister May losing the vote on January 15 by a wide margin even with further political assurances from the EU around the backstop agreement, which is the key but deeply unpopular sticking point that unites many pro- and anti-Brexit supporters.

The government, recognizing that it was likely to lose the vote at the first attempt, has recently been openly discussing a “Plan B”. In hoping it will pass at the second or subsequent attempt, the government would seek further political and possibly legal assurances from the EU around the backstop agreement for “Plan B” with the intention that as we get closer to the March 29 deadline this will persuade enough MPs to support it.

Even with further assurances from the EU, the “Plan B” deal is unlikely to be substantively different from the existing one so implicit in the “deal” scenario are presumably government hopes that the fear of alternative scenarios would persuade enough MPs to back the deal. In the case of pro-European MPs, the fear is around a “no deal” Brexit while for Eurosceptic MPs the fear is of a second referendum or an early general election, both of which could lead to the UK remaining in the EU.

The “Extend” Scenario

With Parliament unable to reach agreement on a deal the (revised) amendment to the 2018 Withdrawal Act now applies whereby the government has three days (previously 21 days) to make a statement to the House of Commons; this is the “Plan B” described above.

Under the Grieve amendment, MPs would then be able to propose amendments to this “Plan B”, thereby effectively exerting greater control over the Brexit process. While these amendments are not legally binding, the government might feel compelled to follow these proposals if there are no viable alternatives.

One likely amendment proposal would be to extend Article 50, although this would require unanimous agreement by the EU. The EU has previously indicated its willingness to consider such a proposal, itself suggesting that it wishes to avoid “no deal” but this is complicated by European elections in May (among other factors), and still doesn’t resolve the fundamental issue of how the UK will exit the EU.

While the “extend” scenario buys more time, it raises the probability of two further scenarios: a second referendum or an early general election. Both of these scenarios increase the probability either of the UK remaining within the EU or leaving on terms that keep the UK more closely aligned to the EU.

The “No Deal” Scenario

While there would appear to be no consensus across political parties in Parliament for a “no deal” Brexit, this doesn’t mean it could not happen. Mechanistically, if Parliament fails to agree on a deal or doesn’t agree with the EU to extend Article 50, then the UK will leave the EU on March 29 on WTO terms.

Western Asset View

On balance our base case scenario is a “deal” whereby Parliament ultimately supports the government’s “Plan B” but either under this outcome or an “extend” scenario the probabilities are titled towards a softer or later Brexit. Consequently, the probability of “no deal” has fallen.

Market Implications

Sterling

The depreciation in sterling pre-dates the Brexit referendum with weakness starting in early 2016 and extending further post the June vote, falling in total approximately 20% from the recent peak in 2015. Since then sterling has recovered modestly but has since traded in a relatively tight range, suggesting that a significant amount of “bad news” has already been discounted. It would certainly be hard to argue that the Brexit related news flow has improved since the referendum and consequently any scenario that avoids a “no deal” outcome is likely to be supportive for sentiment. While it is difficult to be too precise about how far sterling could appreciate we think that a gain of at least 5% from current levels is possible.

UK Gilts

A similar logic applies to the level of UK gilt yields. Gilt yields initially fell sharply in response to the referendum result, a slowdown in growth in 1H16 and the subsequent “insurance” rate cut by the Bank of England (BoE) in August 2016 (subsequently reversed in November 2017). Since then gilts have generally traded in a relatively narrow range of 1.0%-1.75% (10-year yield), with the current level of around 1.25% towards the lower half of this range.

Under our base case scenario we expect the UK economy to respond positively to the removal of more than two years of political and economic uncertainty and this should provide support for business investment and consumer confidence. Indeed, even under the “extend” scenario, which would still prolong uncertainty, the immediate avoidance of a “no deal” result would still likely provide a boost to sentiment.

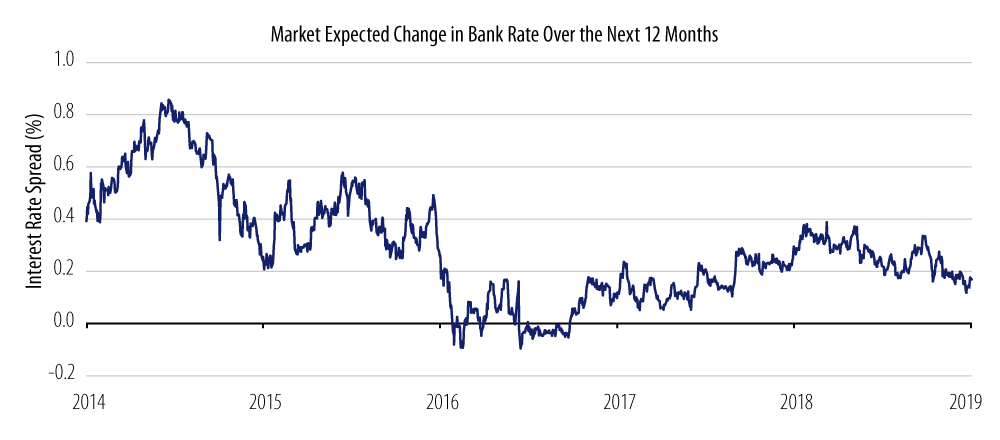

With growth likely to rebound somewhat and against an existing backdrop of a tightening labour market and rising wage pressures we think it is likely that financial markets will start to price in policy tightening by the BoE. Exhibit 4 highlights that less than 20 basis points (bps) of rate hikes are priced over the next 12 months. We believe this combination of improved sentiment and the potential repricing of BoE rate hikes would be negative for gilt yields.

UK Credit

UK credit spreads are back to levels above where they traded prior to the Brexit referendum in 2016. Similar to sterling and UK gilts we believe there is scope for UK credit to react positively to the avoidance of a “no deal” Brexit and for spreads to tighten from current levels. Of the various scenarios the one that is potentially most negative for UK credit would be a Jeremy Corbyn-led Labour government given the Labour Party’s proposed manifesto plans.

Portfolio Implications

Since the Brexit referendum our investment team, in close cooperation with Western Asset’s risk team, has modeled alternative Brexit scenarios and their potential impact on portfolios. Our active risk in UK markets remains modest given the high degree of uncertainty around potential Brexit outcomes but we believe that portfolios will benefit under our base case “deal” or alternatively the “extend” scenario.

We have also modelled more market negative alternative scenarios such as “no deal” or a potential Labour Party election victory and while they would have negative impacts on portfolios we believe the impact would be relatively modest and partially offset by other positions such as long US duration exposure.

Summary

On balance our base case scenario is a “deal” whereby Parliament will ultimately support the government’s “Plan B” but either under this outcome or an “extend” scenario the probabilities are tilted towards a softer or later Brexit. Consequently the probability of a hard “no deal” has fallen.

Under our base case we would expect UK assets to react positively as we believe a considerable amount of Brexit-related “bad news” is already reflected in valuations.

Western Asset portfolios should benefit modestly from our base case.