KEY TAKEAWAYS

- Australian credit spreads are wider than those in the US, UK and Europe, offering better compensation for defaults despite higher average credit ratings.

- The shorter average time to maturity in Australian corporate credit reduces duration risk compared to other DM countries.

- Australian issuers often engage in debtholder-friendly activities, such as equity issuance, to maintain investment-grade ratings during economic downturns.

- Diversification and return potential can be enhanced by exploring structured credit, such as RMBS, and different parts of the bank capital structure.

- Offshore credit markets offer additional opportunities for diversification, including high-yield bonds, fallen angels and bank loans, which are not as accessible in Australia.

- Working with an experienced active investment manager is crucial for effectively navigating the various segments and opportunities within both the Australian and global credit markets.

Introduction

Investors seeking exposure to assets with defensive income profiles while also limiting interest-rate risk can confidently look to credit. Currently, starting yields are high, the macro outlook is strong and resilient fundamentals support the asset class. Defining the appropriate asset mix, however, requires an appreciation of relative value across regions and sectors, and a thoughtful approach to protecting against a deterioration in economic fundamentals while maintaining liquidity.

We believe there’s currently merit in Australian investment-grade credit forming a central role in your portfolios. An initial attraction for investors include income yields surpassing those of equity and property securities, which have increasingly stretched valuations. Comparison against similar offshore assets serves to further emphasise the advantage of Australian credit.

However, Australian credit is not a one-size-fits-all solution. The inclusion of “plus” sectors into the asset mix can improve diversification, liquidity and total-return potential. There’s an array of options to choose from and examining each, especially in the context of the attributes of a core Australian investment-grade allocation, is worth further exploration.

Australian Credit at the Core

The basis for using Australian corporate credit as a major pillar of a credit allocation is strong, especially when considering hedging costs.

Australian credit attractions include:

- Wider credit spreads and compensation for risk of default versus offshore markets including the US, UK and Europe. Credit spreads are wider despite:

- A higher average credit rating

- Shorter average time to maturity (shorter duration)

- Higher outright yields versus unhedged exposure beyond two years and versus offshore hedged exposure across the yield curve

- A unique issuer base and index composition

Wider Credit Spread

The credit spread represents additional yield on a security (beyond a risk-free government bond of the same maturity) and is a function of an issuer’s economic health and prevailing investor sentiment. At the index level, the weighted average spread of Australian credit is currently wider than for other regions such as the US, UK and Europe.

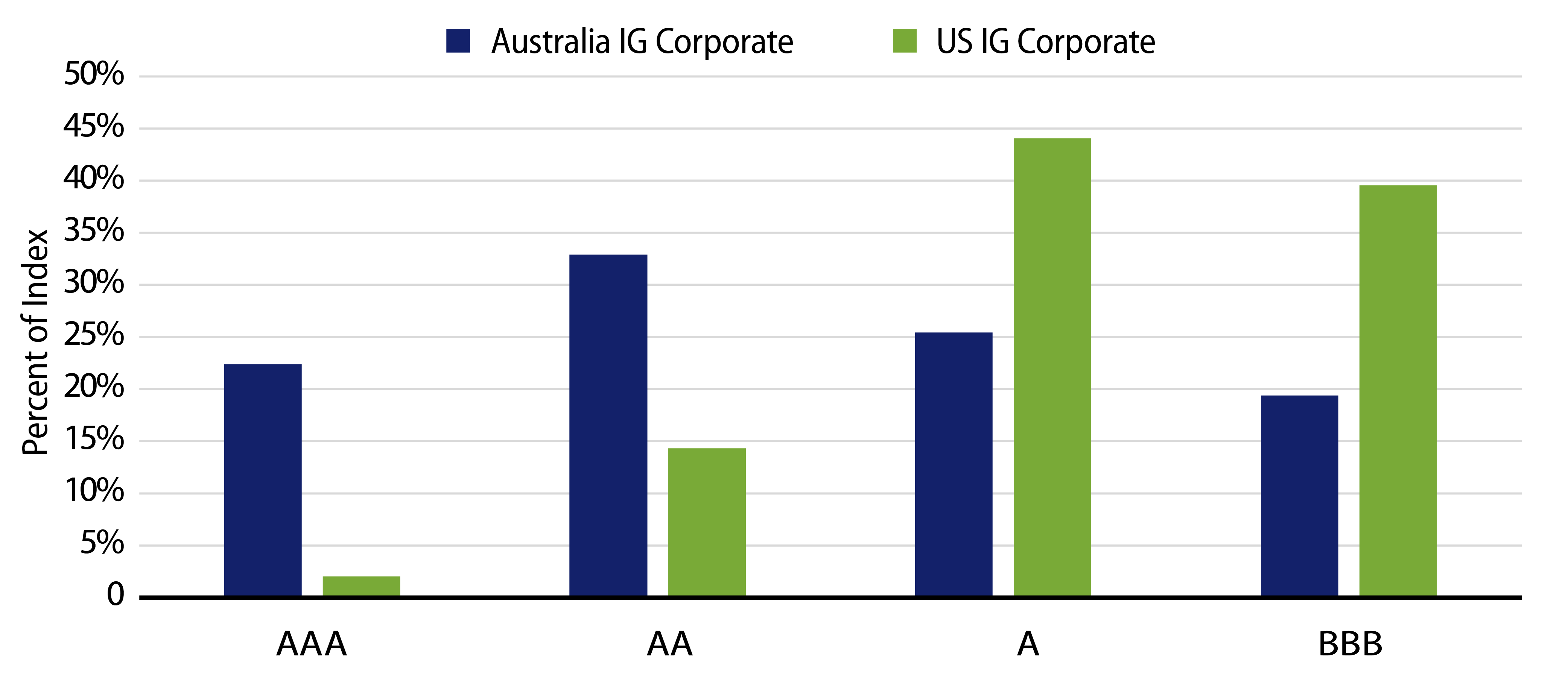

The wider benchmark spread for Australia comes despite higher average credit quality. Australia’s index is comprised of a greater proportion of higher-rated issuers in the AAA and AA bands versus the lower A and BBB band ratings in the US. By definition, investors should demand greater compensation for lending to lower-rated issuers, as their fundamentals are weaker. In the UK and Europe, with average ratings of A-, one notch below Australia’s average A rating, investors could also expect a wider spread. However, this, like in the US, is not the case.

Shorter Tenor

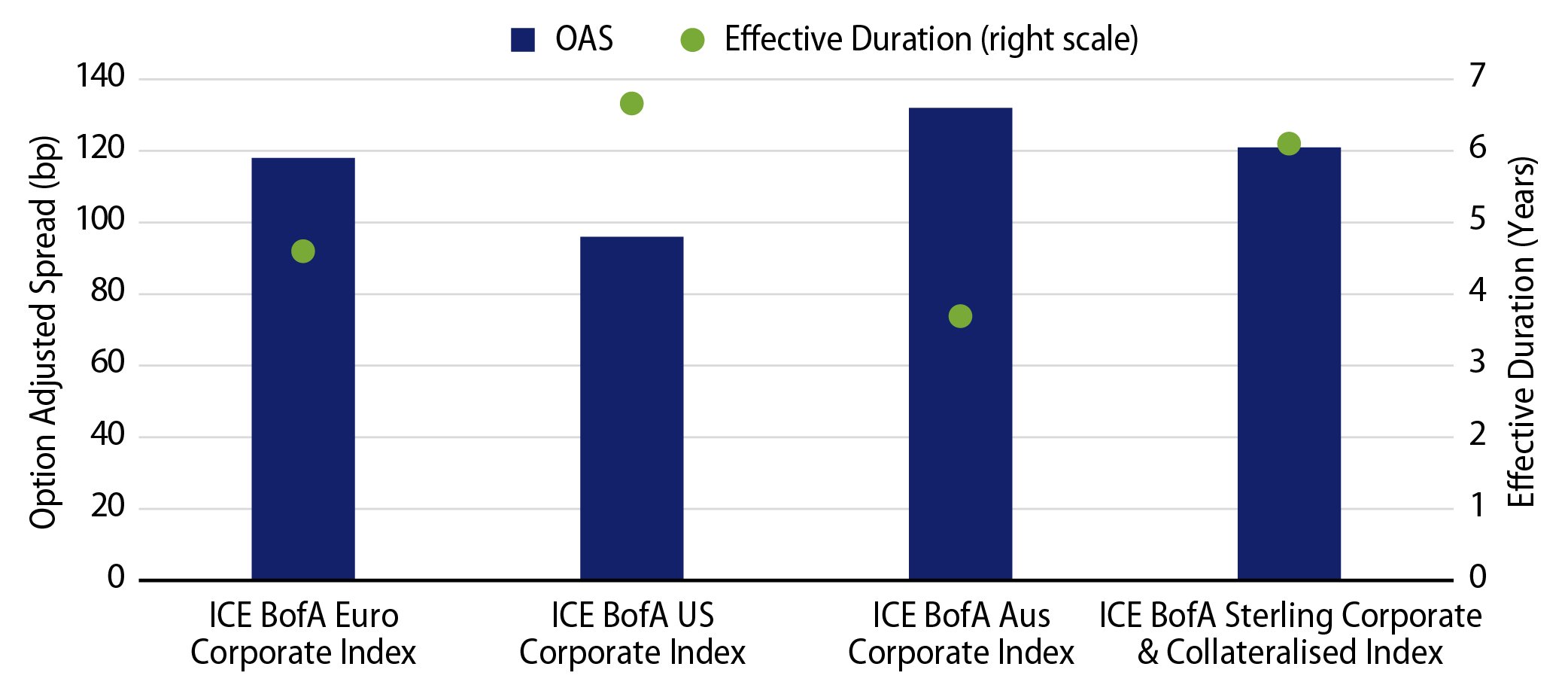

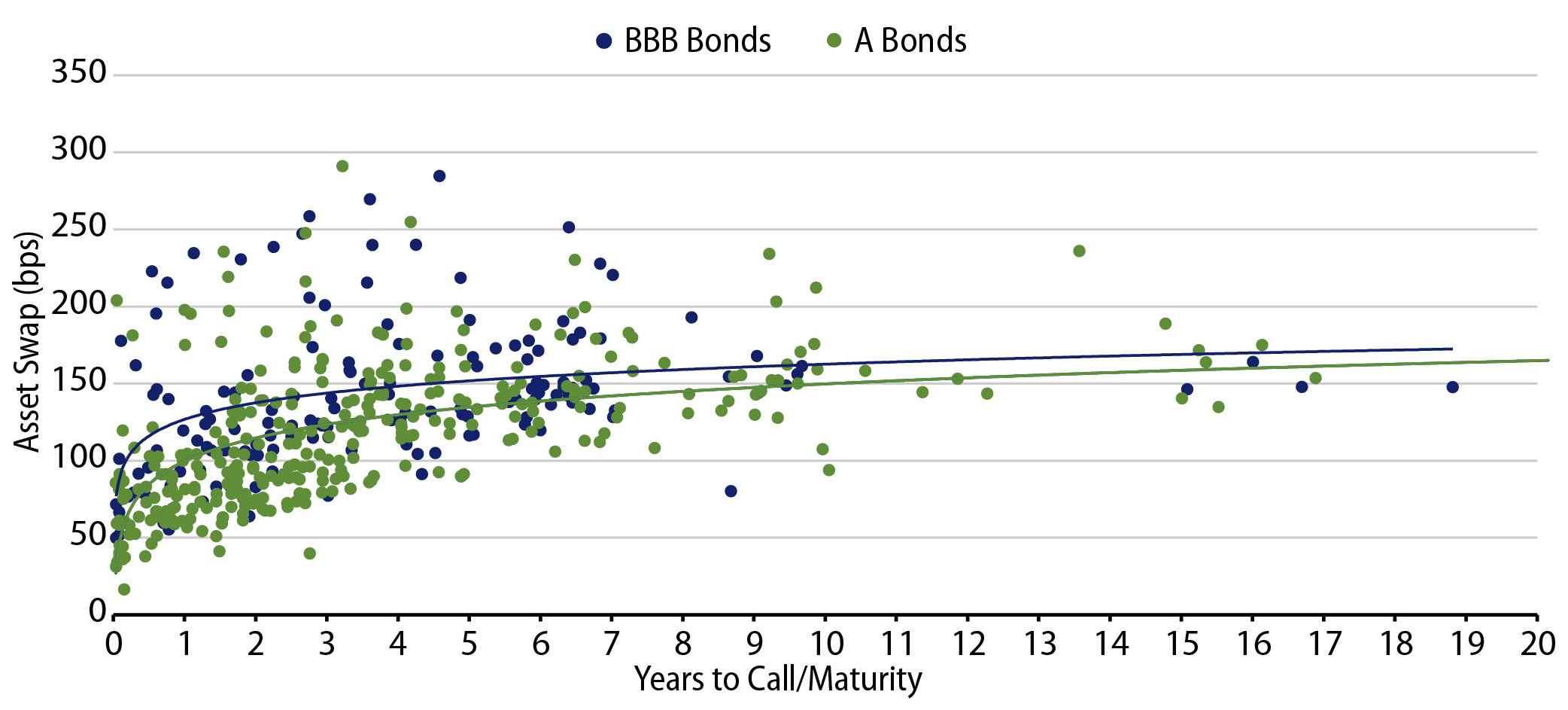

Wider spreads prevail despite Australian investors lending capital for shorter average time frames compared to investors within other developed market (DM) countries. Time to maturity and duration of the Australian corporate benchmark are both inside those of Europe, the UK and the US. The attraction of this attribute relative to the option-adjusted spread (OAS) is depicted in Exhibit 4.

Attractive All-In Yields

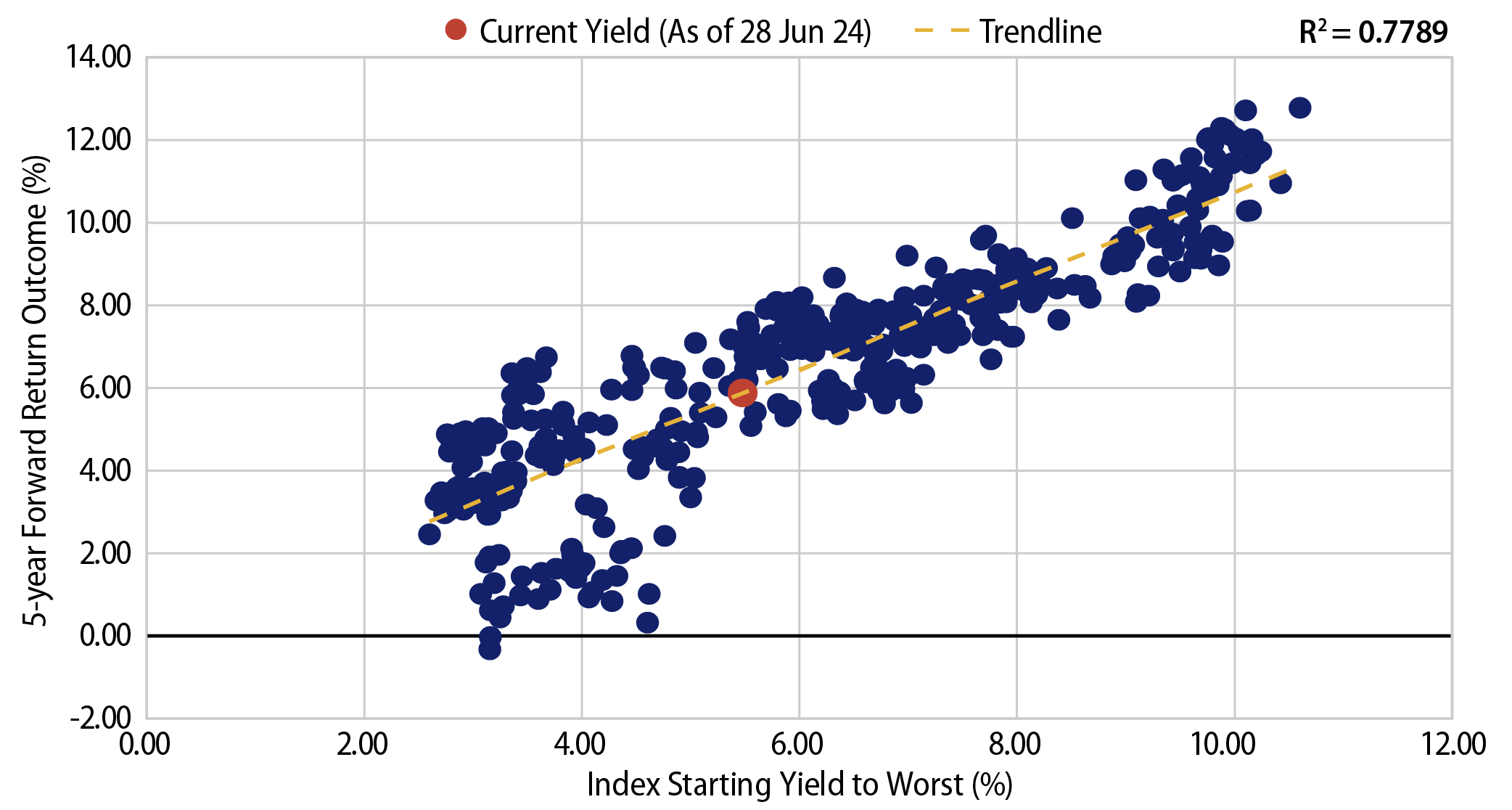

The higher correlation between starting yields and subsequent average annual returns over longer time frames is reassuring for credit investors including the asset class as a component of their long-term portfolio mix. The predictive power (as represented by the coefficient of determination or the R2) over five years is shown in Exhibit 5.

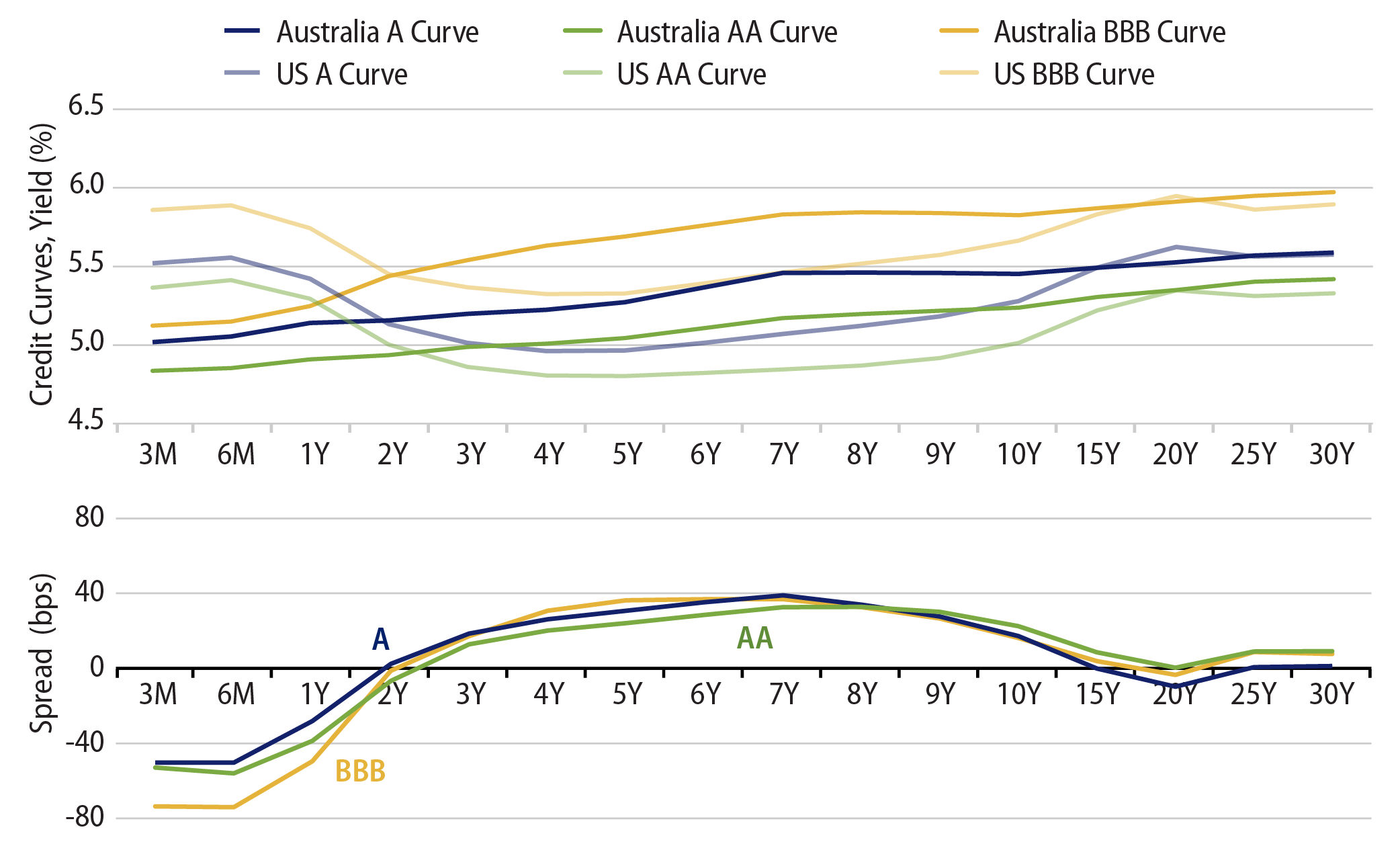

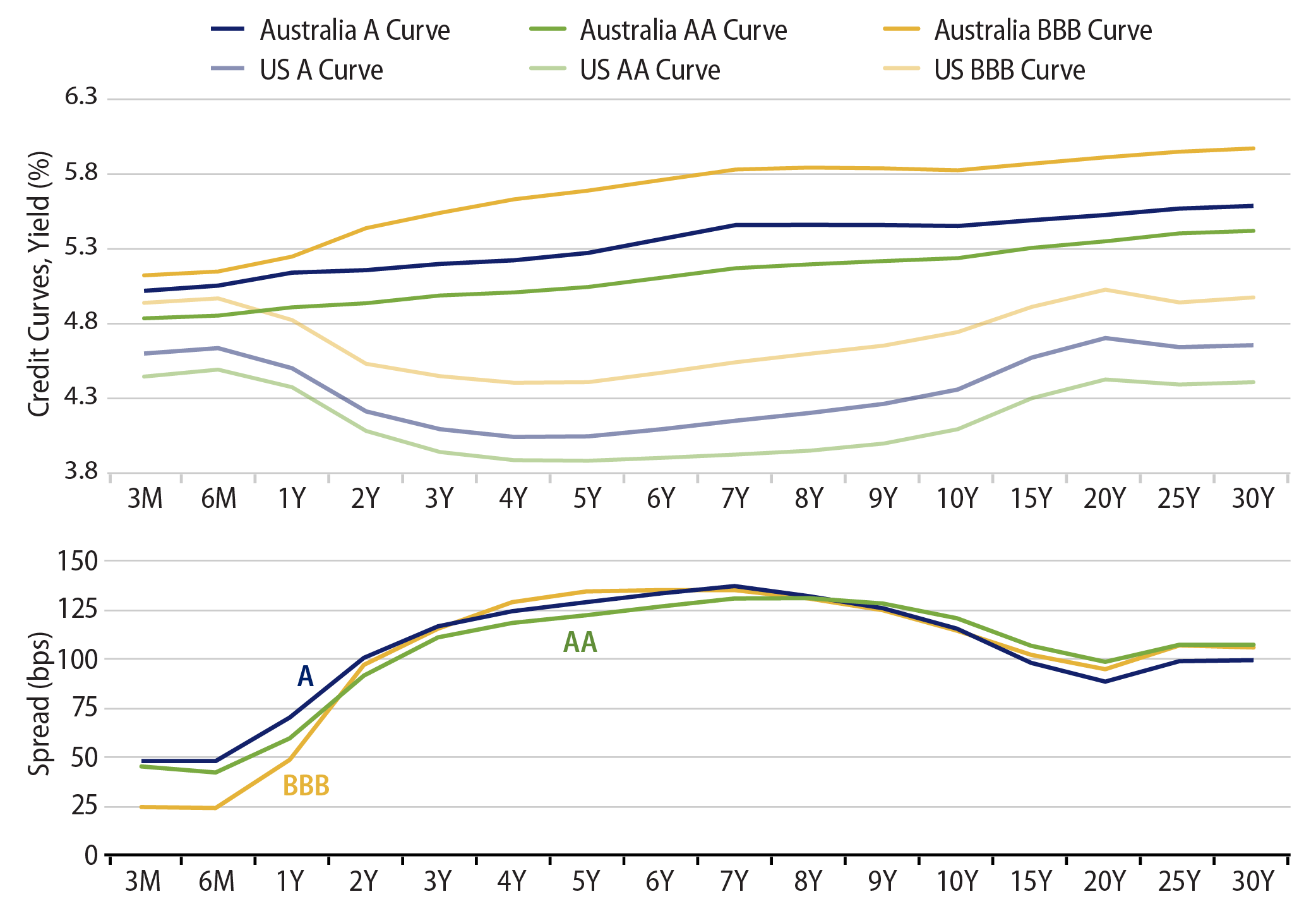

Starting yields can be evaluated from credit curves to determine relative value at different points and across rating bands. Australia’s credit curves appear relatively attractive versus those of the US after about two years when evaluated without reference to currency risk, as shown in Exhibit 6.

Of course, offshore credit exposes investors to currency risk. For investors wishing to hedge that risk, a hedged US credit yield is a more appropriate comparison. The interest-rate differential between the US and Australia means there is currently a cost to hedge US credit exposure. Once accounted for, the all-in yield of hedged US credit is inferior to Australian credit regardless of tenor or rating band.

Australian credit’s attraction is clear in that context.

Unique Characteristics of the Australian Investment-Grade Bond Market

Further support for Australia’s allure as a core pillar of credit allocation is tied to the unique nature of the issuer base. Australia lacks a liquid sub-investment-grade high-yield market. Australian corporates are thus compelled to maintain investment-grade credit ratings to ensure access to reasonable costs of funding.

In the case of deteriorating fundamentals, Australian issuers have historically undertaken debtholder-friendly activities such as equity issuance to protect against downgrades. A raft of equity issuance during the pandemic is an example where downgrades of any significant magnitude were avoided.

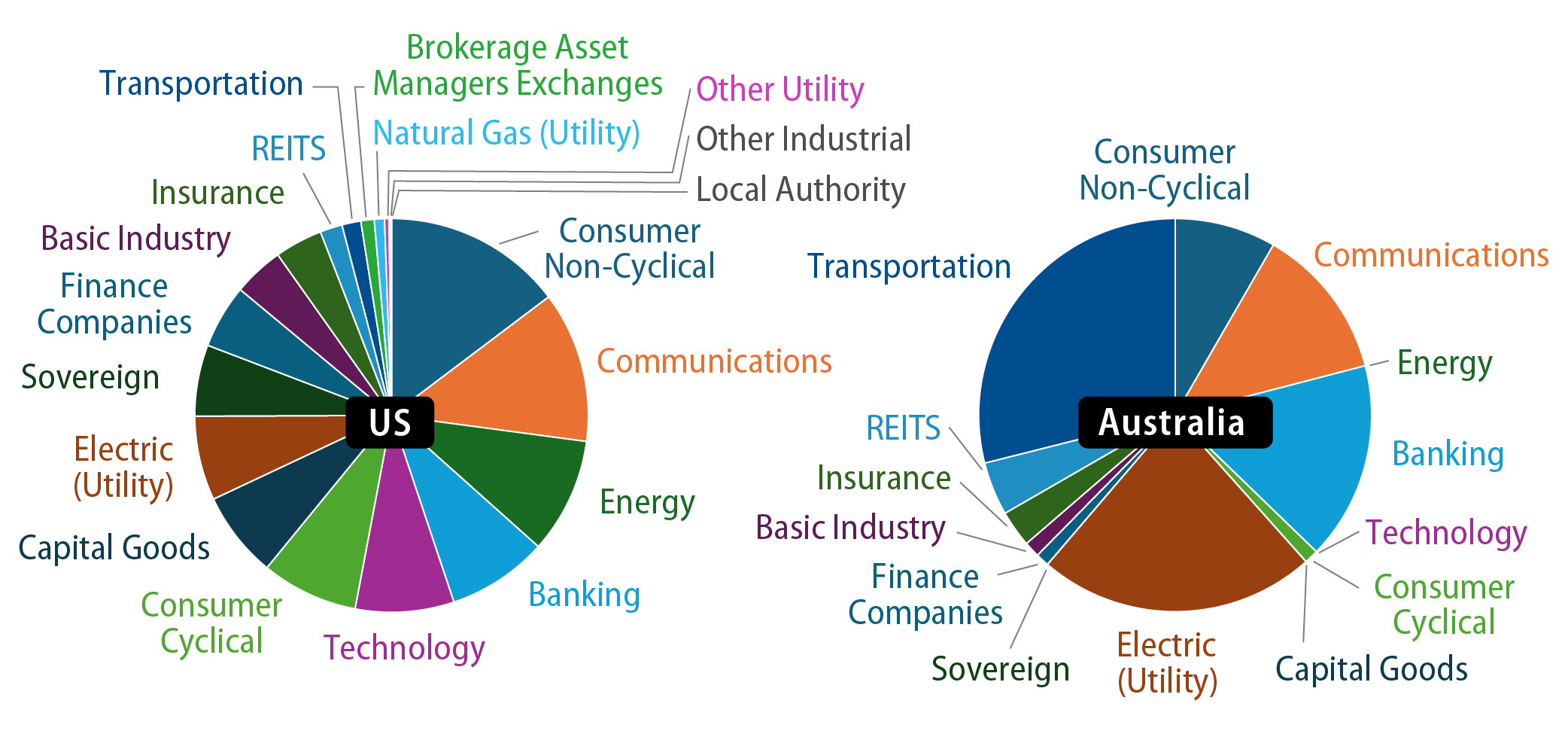

Interestingly, the largest subsectors in Australia’s BBB index are transport, electric utilities, banking and communications. Whereas subsector representation in the US is dominated by consumer noncyclicals, communications, energy, banking and technology. Monopolistic and duopolistic positions for issuers within Australia are often coupled with long-life assets that have predictable income streams such as infrastructure, toll roads, ports and airports. These traits provide comfort that higher leverage and lower interest coverage are manageable. Superannuation fund equity ownership appetite and dominance ensure well-supported equity raisings.

Seeking Enhanced Income Without Detracting From Liquidity

While Australia may be a great starting point for a credit allocation, it’s not a panacea. There are numerous ways to broaden the investment universe, increase diversification and boost return potential without overly detracting from liquidity.

Targeting 100 basis points (bps) above the cash bank bill swap rate (BBSW) is readily achievable by focusing solely on shorter-dated, high-quality domestic investment-grade names with strong liquidity metrics.

For those looking to achieve potentially higher total returns, investors can:

- Lend longer

- Reduce quality or liquidity

- Explore relative value within the bank capital structure

- Consider structured credit

- Go offshore

These options all offer different levels of appeal.

1. Lend Longer

Earning a term premium to compensate for longer lending timeframes is customary. At present, Australia’s credit yield curve is relatively flat beyond six years, so longer lending doesn’t offer significant return uplift potential.

2. Reduce Quality or Liquidity

Swapping investment-grade securities for sub-investment-grade securities may introduce greater risk, but may also improve returns. Australia doesn’t possess a properly functioning liquid high-yield market per se. In recent times, riskier issuers have typically looked to private credit capital providers as a source of funding. Investors with lower liquidity needs should be mindful that private credit is subject to lock-up and should demand a substantial illiquidity premium. The absence of mark-to-market valuation in private credit also masks true volatility.

3. Explore Relative Value Within the Bank Capital Structure

Exploring relative value opportunities across the entire capital stack of major Australian banks is another way to enhance returns. Return prospects and risk across different parts of the bank capital stack vary considerably over time and offer tactical trading opportunities for skilled managers. For example, Tier 2 subordinated bonds currently trade at approximately 2x the spread of senior bonds. Given fair value based on historical averages, recent upgrades to Tier 2 ratings by Fitch indicate capital uplift potential. Farther down the capital structure, Tier 1 (Hybrid) Capital is trading expensively versus Tier 2 and long-term averages. Investors should be cautious.

4. Consider Structured Credit

Gaining more direct exposure to Australian bank loan pools via structured credit in the form of residential mortgage-backed securities (RMBS) may offer premium yields compared to senior, Tier 2 and hybrid securities. The highest tranches of the securitised exposure may offer premium yields. Diversified, well-seasoned loan pools are favoured.

5. Go Offshore

A global sleeve may help alleviate some of the shortcomings of the Australian credit market. Enhancing diversification through exposure to different monetary and fiscal policy cycles, broader sector and subsector opportunities and security types is possible.

The lack of high-yield issuance in Australia is prohibitive, as is the non-existent bank loan market and the unappealing spread levels for hybrid securities at the bottom of the bank capital stack. Offshore credit markets do not present the same hurdles.

High-Yield Credit

Global high-yield markets are much larger and more liquid, meaning bid/ask spreads are much tighter and frictional trading costs are lower. Within those markets, fallen angels offer a particularly attractive opportunity to optimise returns. As depicted in Exhibit 11, fallen angels, which have been downgraded from investment-grade, offer outsized spreads versus the full BB cohort. Skilled managers that can identify issuers with the potential to be reinstated to investment-grade status (rising stars) may be handsomely rewarded.

Global AT1s

Restricted to the wholesale market, global Additional Tier 1 securities (AT1s) offer spreads that are much more reflective of their position in the capital structure versus the retail-dominated hybrid market of Australia. Global AT1s are also much more liquid. Investors are wise to consider offshore exposure here.

Bank Loans

No reliably tradeable market for bank loans exists in Australia, and while private markets can trade, they are not liquid at all. A large, liquid and higher-yielding opportunity set may be available in the US. Tapping offshore markets offers an opportunity to increase diversification and maintain liquidity versus other alternatives such as private credit which are not liquid.

Conclusion

Australian investment-grade credit is an excellent option for investors to consider to strengthen the core of credit allocations. Enhancing return potential can be achieved in a variety of ways, with each offering value at different points in the cycle. Partnering with a skilled investment manager that has the resources across each segment is crucial.