KEY TAKEAWAYS

- The automotive industry is changing as the result of innovation in the areas of electrification, autonomous driving and shared mobility.

- With transportation estimated to account for between 15% and 25% of global carbon emissions, and road vehicles responsible for almost three-quarters of that share, the environmental motivation is clear.

- The shift to more electric-based and autonomous vehicles will disrupt the traditional automotive workforce, as well as the automakers.

- Capable automotive leadership with diverse backgrounds, industry expertise and strategic partnerships to address knowledge gaps will be essential to traverse the obstacles ahead.

- While the automotive industry adapts to these trends, Western Asset remains committed to its ESG investment approach and will continue to engage with issuers to promote best practices.

Once the Disruptor, Now the Disrupted

Commercialization of the automobile in the early 1900s transformed livelihoods and living standards across the industrialized world. As the automobile industry developed, millions of manufacturing and assembly jobs were created, petroleum and steel companies grew significantly, and train usage fell sharply. When passenger cars became commonplace, larger homes were built in the suburbs, tourism activity increased, and the movie drive-in and fast food drive-thru industries were born.

Though cars remain well entrenched in modern lifestyles, in more recent years the automotive industry has been the subject, rather than catalyst, of change. In early 2007, Original Equipment Manufacturers (OEMs) and Tier I/ II suppliers were challenged by leveraged balance sheets, expensive cost structures and large pension liabilities. Given the highly cyclical nature of demand for automotive products, the Great Financial Crisis dealt a particularly damaging blow to the industry, so much that executives from the Detroit Three and United Auto Workers (UAW) leadership were forced to seek emergency funding from the US government to avoid bankruptcy.

Between 2009 and 2017, the industry benefited from very low unemployment levels, favorable financing terms and solid residual values. Global sales and production volumes rebounded, resulting in improved margins, record profitability and healthier balance sheets. Since then, however, a new set of challenges has emerged, including several major environmentally and socially driven shifts in demand. These secular trends, which will play out over multiple years, include electrification, autonomous driving and shared mobility.

In this piece, we will take an in-depth look at these disruptive changes. We will explore their implications on the automotive workforce and on society, and the governance and strategy required to navigate them. To conclude, we will review how these environmental, social and governance (ESG) factors have shaped our investment outlook and positioning in the automotive sector.

Electrification: Between a Rock and a Hard Place

Transportation is estimated to account for 15% to 25% of global carbon emissions, with road vehicles responsible for almost three-quarters of that share.1 Given that almost 200 countries have committed to reducing their emissions under the Paris Agreement, there is no doubt that the usage of electric vehicles (EVs) must increase around the world.

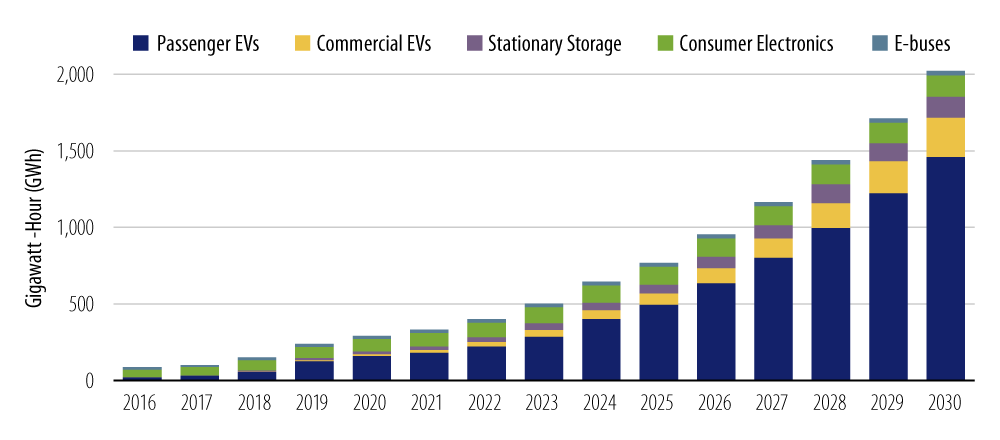

The path to achieving this, however, is clouded by supply and demand-related concerns. Electric batteries, which are currently priced between $150 and $200 per kilowatt hour, are still too expensive to incentivize a complete shift to EVs. To even the playing field between EVs and internal combustion engine vehicles (ICEVs), battery costs must fall to $75 per kilowatt hour. This is projected to occur sometime between 2025 and 2030, driven by technological advances and economies of scale.2

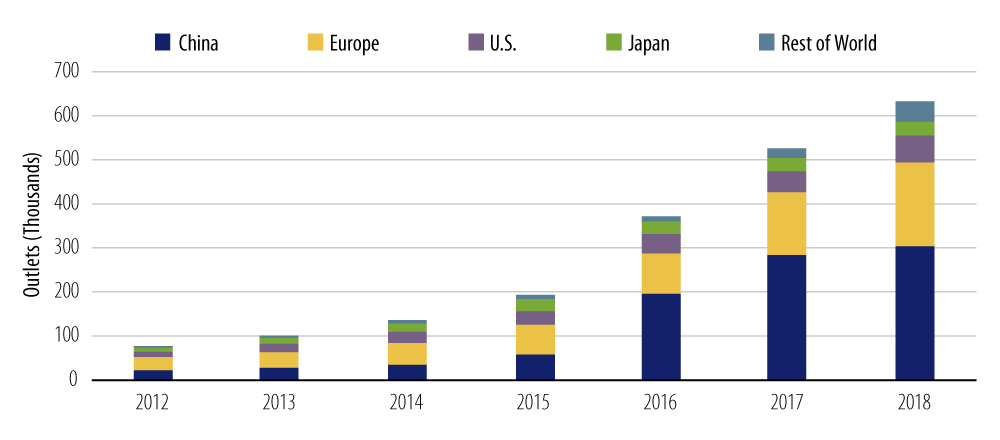

At present, EV-inclined consumers have limited purchase options, with offerings that are either expensive relative to mass market ($35,000 or below) ICEVs or limited to luxury (above $75,000) buyers. In addition, consumers remain hesitant due to “range anxiety” around the sparseness of public charging infrastructure (Exhibit 1). Increasing the density of charging networks within the US, China and Europe to a more operable level by 2030 could cost upwards of $3 billion per year,3 with some portion of that burden likely to fall on the automakers.

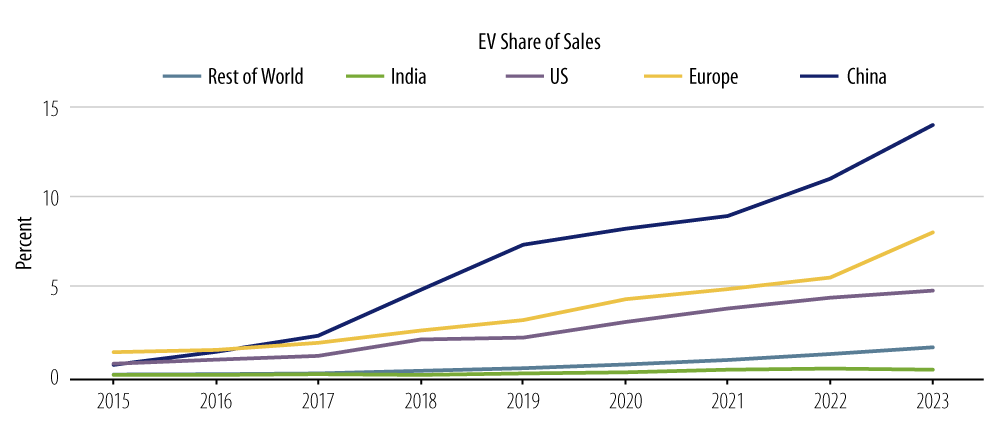

The EV growth that has occurred to date has been driven largely by regulatory support. China, where EVs have the highest adoption rate in the world at 7%, has been most proactive. It began a national direct subsidy program for EVs in 2015 and places limits on the registration and usage of ICEVs. It also requires charging infrastructure to accompany new residential construction, public parking lots and large public buildings. These policies are selectively enforced at the provincial level.

Outside of China, 13 countries and 30 cities and states have set deadlines to eliminate ICEVs, with the most ambitious targets set by Bristol in the UK (2021) and Norway (2025).4 More broadly, the European Commission has mandated average new car emissions to decrease from the current level of 120.4 g CO2/km to 95 g CO2/km by 2021, with a 15% reduction from that level by 2025 and a 37.5% reduction by 2030. Auto manufacturers that fail to meet these levels will pay a penalty of €95 for each excess g/km.5 Conversely, manufacturers will receive extra credit in their emissions calculations for new vehicles emitting less than 50 g CO2/km, i.e., EVs and fuel cell vehicles. At the present time, most OEMs claim that they will not be subject to any EU emission-related fines regarding the 2021 deadline. This outcome is predicated on a material increase in plug-in hybrid electric vehicle (PHEV) production and sales in 2020, some new EV launches, as well as more “mild-hybrids” (ICEV with EV functionality to switch off engine when braking/stopping and then restart quickly), which benefit from a more lenient treatment by the EU.

In the US, federal tax credits for EVs are being phased out, and the Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA) are working to weaken fuel economy standards across the country. In addition, American car buyers remain loyal to sport utilities vehicles (SUVs), which consume about 25% more energy than medium-sized cars. SUVs accounted for nearly half of all US car sales last year and have been the second largest contributor to global carbon emissions since 2010.6 The popularity of SUVs is a feature of other markets as well, including Europe.

Overall, while growth has slowed, transportation-related emissions are still rising across the globe, suggesting that regulators must become more stringent in order to meet climate goals. We expect that outside the US, regulations will continue to tighten, further accelerating consumer EV demand (Exhibit 2). Managing products across regions, already a highly complex task, will become more costly, further compressing automotive profits. For example, Daimler recently estimated that electrification will reduce its margins by 1% per year through 2022.7

Despite the magnitude of climate-related risks facing the automotive sector, there are few opportunities to support carbon transition through green bond investments. Even in the euro-denominated market, where green bond issuance is currently active, the majority of automotive issuers are absent. Although we have engaged with companies to explore green financing options, most remain insufficiently proactive in this area of the credit markets. Issuer reluctance may partially be due to the pricing of green versus non-green bonds, which is perceived to be modest, as well as the currently limited amount of projects and/or low-emission fleets that could be used to secure new offerings. Whether or not green automotive issuance ultimately expands, Western Asset remains committed to its ESG investment approach and will continue to engage with issuers to promote best practices within their respective operations and supply chains.

Autonomous Driving and Automotive IoT: The New World

Like EVs, autonomous vehicles (AVs) face a cost disadvantage relative to ICEV, but by a far more daunting margin. This is due to the costs associated with the features and automotive connectivity related to the IoT or “internet of things.” The cost of a research AV car is around $400,000, including LiDAR (light detection and ranging), advanced GPS, data storage and graphics processing components.8 Yet OEMs must prepare for the advent of AV, or risk extinction if consumers fully migrate to hands-off driving. As with EVs, AVs will require automakers to make significant investments today in order to position properly for the future.

Companies that invest prudently now will eventually be in a position to monetize these investments by offering upgrades, applications and ancillary services such as infotainment and predictive maintenance. Estimates of the market opportunities created by autonomous driving vary widely, ranging from hundreds of billions to trillions.9 But the market will be competitive and crowded as many technology companies, both large and small, are already pursuing these new revenue streams.

Shared Mobility: Not a Game Changer … Yet

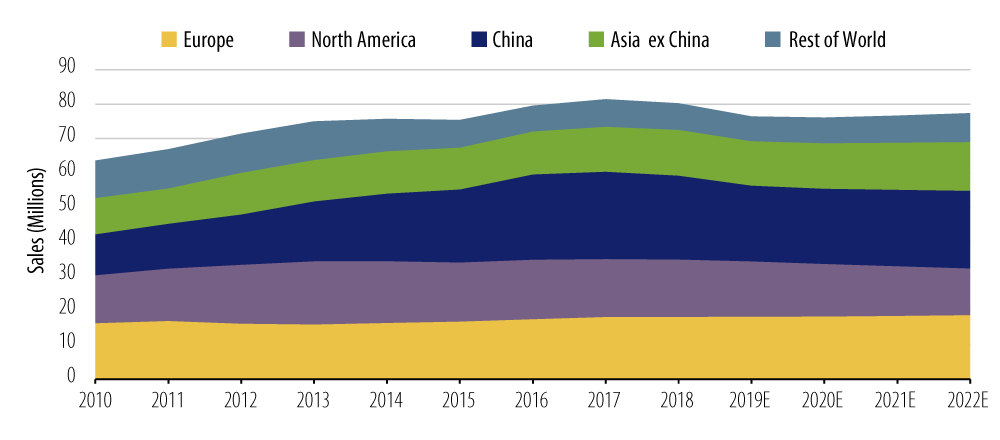

Despite the seeming ubiquity of Uber and Lyft, ridesharing has not yet significantly impacted the auto industry. Assuming annual road travel of 10 to 15 thousand miles, car ownership at 60 to 75 cents per mile is more attractive than ridesharing at $1.50 to 2.50 per mile,10 helping to maintain global car sales at 75 to 80 million units per year (Exhibit 3). Traditional consumer preference also remains entrenched—63% of US survey respondents would rather own their own vehicles than rideshare, even if the latter were free.11

However, as large cities—which occupy just 2% of the world’s land mass but produce 70% of the world’s carbon emissions12—come under pressure to address climate issues, urban policymakers and planners will need to critically examine shared mobility practices. Ridesharing has actually increased mileage and exacerbated traffic in large US metropolitan areas; 60% of rideshare users would otherwise have used more carbon-efficient public transportation, and rideshare drivers drive a staggering 43% of their miles without a passenger.13

In addition, consolidating passengers through autonomous ridesharing services would not only reduce carbon emissions, but also accelerate the commercial viability of AVs by decreasing the operating cost per mile. This would increase the attractiveness of ridesharing relative to car ownership—and could negatively impact demand from the traditional car-buyer base.

Societal and Secondary Impacts

Because EVs take about a third less time to make than ICEVs, and EVs require fewer parts,14 fewer workers will be required to support the automotive manufacturing process. Furthermore, auto jobs will revolve less around assembly and servicing, and more around engineering and technology functions that support and advance energy efficiency, autonomous driving and ridesharing capabilities. Further down the value chain, the distribution model will also change because of lower maintenance needs, growth in digital channels, and new customer segments. Workers will need to build new skill sets to meet the industry’s evolving needs, and automotive companies will need to develop channels to capture and retain new talent.

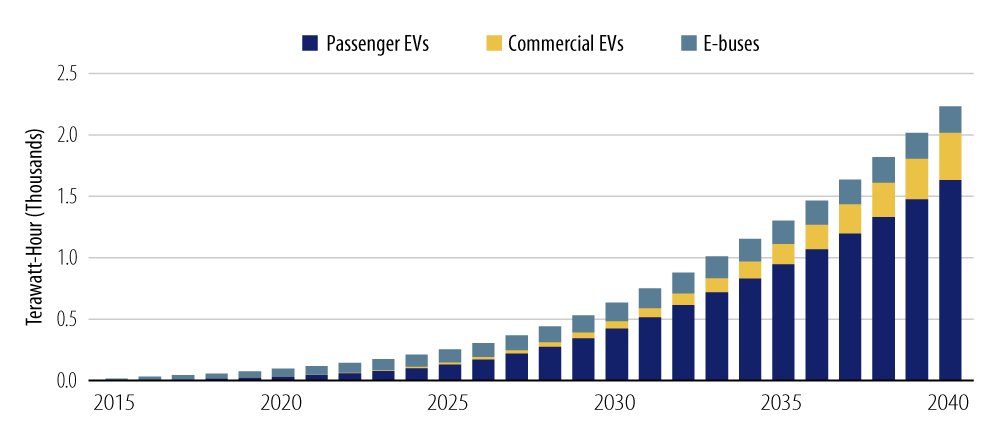

The energy and power sectors will also be affected, as demand for electricity (and subsequent infrastructure) will rise along with EV penetration (Exhibit 4), eventually displacing oil demand by 13 million barrels a day, according to International Energy Agency projections.15 Demand for copper, lithium, cobalt and nickel is expected to increase correspondingly (Exhibit 5). This should provide a boost to parts of the metals & mining sector, one that we have favored within our portfolios in part due to this structural demand. Companies within this sector may need to adjust their production efforts to meet the demand for these elements; sources are subject to geology, and new mines are increasingly located in geographies outside of developed countries. ESG considerations are critical for mining companies that have to address not only the inherent safety risks of their activities, but also environmental impacts and social responsibilities. For example, mining companies must manage heavy water and power needs in the production process, safely dispose tailings, manage relationships with host country regulators and officials, and safeguard local communities against exploitation. Effective governance is essential to manage these risks, not just for mining companies within their own businesses, but also for automotive companies within their supply chains.

Autonomous mobility will also have a wide-ranging impact. In its fully developed form, autonomous driving will enhance the quality of life of suburban commuters who would otherwise spend hours behind the wheel, as well as the elderly and physically disabled who would otherwise have limited geographic mobility. New services will be needed to accommodate the changing needs of these customer segments.

At the same time, AVs may enable roads to accommodate additional vehicles due to their ability to adjust speed more quickly and precisely. Combined with population growth, this potential for increased vehicle density could actually result in higher numbers of cars on the road, adding to the list of challenges for city planners. In addition, legal and regulatory frameworks must be well designed to address and contain the risk of injuries and casualties due to technical malfunction, user error and cyber-terrorism.

The Role of Corporate Strategy and Governance

Though the exact timing of all these trends is far from certain, key inflection milestones are expected to occur in the latter half of the 2020s, leaving automakers a short runway to prepare. Meanwhile, high uncertainty remains around which emergent technologies will become industry standards, how uptake will vary across regions, how externalities to society will be distributed and how regulations will shape the market.

Corporate vision and leadership are key in navigating this uncharted territory. As the traditional business model is being upended, the auto industry needs to consider innovative approaches and make hard choices. Senior management cannot conduct business as usual, but rather must be open-minded to different viewpoints, and fluidly incorporate regional and technical perspectives. Diversity in management and board composition will help companies to address these challenges. One leader in this area is General Motors, where 25% of the board has technology experience, senior leadership includes a female CEO and CFO, and half of the workforce are women.

Some automakers will need to build the agility to pivot aggressively as trends take shape. We note that Volkswagen (VW), which was convicted for misstating its auto emissions in 2015, recently announced a $66 billion commitment to investments over the next five years in EV and AV. These plans include an addition of 75 new EV models by 2029 and a target to sell 26 million EVs over the next 10 years.16

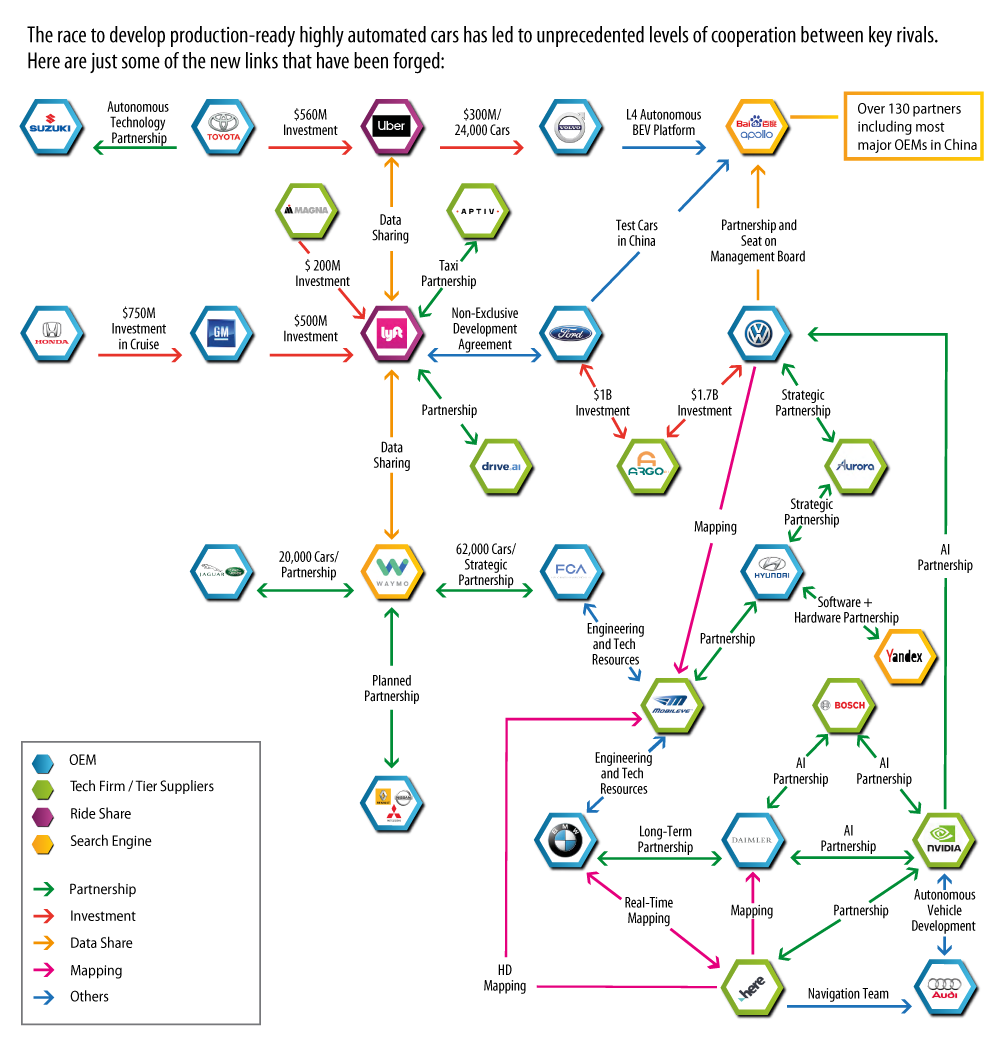

Given the requirements for expertise outside of automakers’ core competencies, partnerships and joint ventures to fill in the gaps are crucial. In addition, cross-industry cooperation has several benefits, including mutualization of research and development costs that would otherwise have to be fully absorbed by the automaker, and standardization of operating technologies that on their own are not commercially differentiating factors for the end-use customer.

OEMs, shared mobility companies and technology players have already formed numerous relationships (Exhibit 6). These arrangements vary widely in scope and complexity. Within the automotive industry, partnerships range from targeted joint ventures such as BMW and Jaguar Land Rover’s collaboration to develop electric drive units, to more ambitious alliances such as VW and Ford’s partnership on both EVs and AVs, to full-blown mergers such as the recently announced Fiat Chrysler-PSA transaction. More broadly, we would highlight connections with two of the leading AV development companies: Waymo, which tests its technology on vehicles supplied by Jaguar Land Rover and Fiat Chrysler Automobiles, and Cruise Automation, which was acquired by GM in 2016 but sold a 20% equity stake to Softbank in 2018.

Investment Outlook and Positioning

In addition to the ESG risks explored in this piece, the automotive industry must contend with ongoing uncertainty around trade negotiations between the US, Mexico, China, and Europe (Brexit), managing costly and complex global re-structuring programs in the midst of a more challenging production environment, and maintaining healthy balance sheets and liquidity buffers ahead of an inevitable turn in the cycle.

Given the plethora of headwinds against automakers, Western Asset maintained a negative outlook and underweight positioning versus our respective benchmarks throughout 2017 to mid-2019. With industry sales at or near peak levels and comparatively tight trading levels, Western Asset’s global automotive research team found few positive catalysts to drive relative outperformance and a lengthy list of potential cyclical, secular and technical concerns. These include deteriorating industry fundamentals, particularly outside the US, heightened trade/tariff uncertainties, fears of a rating downgrade for a large US-based OEM to below-investment-grade, volatile raw material input costs and persistent new issuance from OEMs to help fund their captive finance businesses. All of these events resulted in wider spreads, higher yields and decreased investor sentiment in the space. Even in the midst of this challenging fundamental backdrop, Western Asset was able to identify credits with a positive outlook, including several that met the “rising star” theme which has been a key focus of our credit research team over the last several years.

Today, we are cognizant that the current risk/reward opportunity set is more balanced, specifically in the investment-grade automotive subsector, as several headwinds have abated and spreads more fully reflect the fundamental difficulties and structural risks the industry faces. With this in mind, Western Asset has adopted a slightly more favorable view of the sector, primarily based on our assessment of relative value, and as such we remain comfortable investing in the short/intermediate part of the yield curve for select OEMs and suppliers.

Looking ahead, Western Asset believes the industry will remain under pressure from the aforementioned cyclical and secular forces, resulting in additional negative rating agency actions in the US and Europe this year and in 2021. Separately, we believe there is an increasing likelihood of further industry consolidation at both the OEM and supplier levels over the course of the next three to five years, as the benefits of increased, size, scale and diversification may provide some insulation against margin pressure and rising research and development costs. As we move forward, our preference is to invest in companies with strong balance sheets, large liquidity buffers, disciplined capital allocation policies, flexible cost structures and solid free cash flow generation capabilities to help manage through a more challenging operating environment.

- “The Climate Opportunity of Auto 2.0: How Big Tech Drives Faster EV Adoption,” Morgan Stanley, 9/5/2019.

- BloombergNEF, Morgan Stanley, Credit Suisse.

- “The Challenge of the Two Clocks,” “The Challenge of the ‘Far’: EVs,” Credit Suisse, 6/27/2019.

- National ICE Phase-Out Announcements, BloombergNEF, 9/5/19.

- "Reducing CO2 emissions from passenger cars," European Commission website.

- "Growing preferences for SUVs challenges emissions reductions in passenger car market, " International Energy Agency, 10/15/2018.

- Daimler Capital Market Day, 11/14/19.

- “The Challenge of the Two Clocks,” Credit Suisse, 6/27/2019.

- “The Challenge of the Two Clocks,” Credit Suisse, 6/27/2019.

- “The Climate Opportunity of Auto 2.0: How Big Tech Drives Faster EV Adoption,” Morgan Stanley, 9/5/2019; “The Challenge of the Two Clocks,” Credit Suisse, 6/27/2019.

- “How shared mobility will change the automotive industry,” McKinsey & Company website, April 2017.

- “Cars & Climate: Tech’s Opportunity to Tackle CO2,” Morgan Stanley, September 2019; c40.org.

- “The New Automobility Report: Lyft, Uber and the Future of American Cities,” Schaller Consulting, 7/25/2018; “Estimated TNC Share of VMT in Six US Metropolitan Regions,” Fehr & Peers, 8/6/2019.

- An ICE drivetrain contains over 2,000 parts, whereas an EV drivetrain contains around 20. "Seven Reasons Why The Internal Combustion Engine is a Dead Man Walking, " International Energy Agency, 10/15/2018. Forbes Magazine/Website, 9/6/2018.

- "Global Oil Demand to Hit a Plateau Around 2030, IEA Predicts, " Bloomberg.com, 11/12/2019.

- “VW Challenges Rivals With $66 Billion for Electric Car,” Bloomberg, 11/15/2019.

- "Infographic: Self-Driving Car Connections,"Automotive iQ, 6/4/2019.