KEY TAKEAWAYS

- Populations in developed economies are aging. Population growth rates are slowing, and life expectancy is generally rising.

- A shrinking workforce and slower population growth will likely constrain economic activity.

- Elevated public and private debt levels suggest financing to support the elderly will prove challenging.

- Policymakers will need to remain vigilant in response to slowing economic growth; nonetheless, we are optimistic on the outlook for interest rates and fixed-income.

Introduction

There is a Japanese word ''ikigai'' (pronounced ee-kee-ga-ee), which translated to English means ''a reason to live.'' It is often associated with the Okinawa prefecture in Japan, which is consistently among the places with the longest-living people on earth. The region has often been dubbed ''the land of the immortals.'' Despite average life expectancy now lagging other prefectures in Japan in recent years, at birth the average resident can expect to live for close-to 83 years, according to the Ministry of Health, Labour and Welfare of Japan—12 years longer than the global average life expectancy. Japan is still seen as one of the world’s economic superpowers. It is also often seen as the poster-child for what is expected to be the most significant demographic trend to impact the global economy in the coming decades: population aging. Roughly 30% of the Japanese population is of retirement age, according to the latest United Nations Population Division (UNPD) data.

The UNPD predicts that many high- and middle-income countries are following in Japan’s wake. Population growth is slowing, populations are aging and old-age dependency ratios are rising. As long-term fundamental value investors, we examine the impact of aging and slowing population growth and the consequences for the global economy. Our analysis provides a short background on the key demographic trends before considering the relationship between rising debt levels and the public provision of old-age-related spending. We conclude by providing our thoughts on the macroeconomic impact of these challenges, and why as a result we are optimistic on the outlook for fixed-income investors.

Populations Are Aging

Links between demographics and economic growth date back several centuries. Early models of demographic theory included the Demographic Transition Model (DTM)1, popularised by Frank Notestein, as illustrated in Exhibit 1. The model shows how demographics shift as an economy develops and industrialises. This model can be used to plot the population growth rate and demographic trajectory of many of the world’s economies. With a growing number of countries experiencing declining population numbers and more immediately aging demographics, there is a growing debate that the world is entering a fifth stage of the model that reflects these dynamics.

Over the last few decades, significant forward strides in health care provision have facilitated a broad upward trend in life expectancy. At the same time, fertility rates have been on a downward trend over the last half-century, as illustrated in Exhibit 2. The concern is that since the boom in the middle of the 20th century, fertility rates have fallen consistently across both developed and less developed economies, in a growing number of cases below what is known as the replacement rate. Better education, women’s increased participation in the workforce and family planning are among the wide-ranging forces behind declining fertility rates. This is leading to slower population growth in the short term and the likelihood of shrinking populations in the coming decades. At present, the population is still growing but at an ever-slowing rate. The UNPD predicts that the global population will start to dwindle in absolute terms towards the end of the century. The global population growth rate peaked in the early 1960s and has been declining since.

Importantly for the global economy, stalling population growth is reducing the rate of growth of economically active or ''working-age'' populations. This important cohort had grown rapidly as first Baby Boomers born between 1946 and 1964 entered the workforce before Eastern Europe and China became integrated into the global economy after 1990. This generation is now reaching national retirement ages at the same time that working-age populations are stalling or shrinking in many middle- and high-income countries; those toward the latter stages of the DTM. Using Japan as an example, the old-age dependency ratio has risen, from close to 14 in 1980 to 51 in 2022. This most recent data reflects a ratio of one elderly dependent for every two people of working age. Old-age dependency ratios in Italy and Germany are not far behind, with a plethora of other countries expected to experience sharply rising old-age dependency ratios in the coming decades. This is illustrated in Exhibit 3. The general lack of reform for retirement and other entitlement policies has meant that this ticking bomb is now affecting a growing group of economies, including those that had previously benefited from favourable demographics, such as the United States.

Given the slow-moving nature of demographic transitions, absent catastrophic events, the prospect of an aging population is not in doubt; a significant swathe of incoming retirees is certain. Similarly, fertility rates are only expected to trend lower and the next generation of the working age population has already been born. To change the expected results of current population trends either requires: 1) a sudden change in life expectancy or death rates that disproportionately impact either the elderly or those of working age, or 2) a sizeable reform in retirement policies.

Public Debt Levels are Extremely Elevated

Public and private debt levels across developed economies have spiked since the turn of the 21st century, with public sector budget deficits commonplace. ''The Great Accumulation,'' from the 1970s through to the 2000s, saw government debt-to-GDP ratios rise gradually across developed economies2. This period was followed by the global financial crisis (GFC) and subsequently COVID-19, putting unprecedented pressure on governments to support economies. According to data from the IMF, as shown in Exhibit 4, in 2020 public debt as a percentage of GDP in advanced economies surpassed 100%. This marks the highest debt-to-GDP ratio since WWII when governments maintained extensive deficits to finance the war.

Aging populations are expected to aggravate already elevated public debt loads. As individuals reach retirement age, their reliance on state-provided pensions, health care benefits and social security multiplies. According to the Organisation for Economic Co-operation and Development (OECD)3 in 2019, over the next 30 years ''absent policy changes, aging pressures could increase the public debt burden by an average of 180% of GDP in G20 advanced economies''. The rising population of elderly people will put an increasing strain on both public and private finances.

Demands on public finances are already bloated. The recent rise in global government bond yields will raise the cost of servicing public debt. A swathe of government bonds will need to be refinanced before the end of 2024 at significantly higher rates. In the US as of the 15th April, 2024, close to 33%, or $8.1 trillion, of marketable US Treasuries (USTs) will mature before the end of 2024. Deglobalisation and near-shoring require increased subsidies for local businesses, geopolitical fragmentation has renewed the importance of defense spending while there is an increasing expectation that governments support ESG-related initiatives. The International Energy Agency (IEA) suggests annual global clean energy expenditure will need to rise from USD 1.8 trillion in 2023 to 4.5 trillion by the early 2030s to meet a new net zero pathway4. To guard against unsustainable public spending, budget deficits will need to be actively managed. We anticipate that the need to budget more for an aging population will come at the expense of other spending priorities.

Individuals typically pay significantly more taxes while of a ''working age,'' notably through income taxes. The tax revenue base for governments will likely shrink as populations age and working-age populations decline, providing governments with an additional budgeting challenge in the face of rising old-age related entitlements. There are several alternatives to mediate these issues, for example, policies that encourage more immigration of working-age individuals, raising retirement ages, reducing public sector benefits and increasing income taxes. There is evidence that some of these measures are being put into place; Japanese officials have been taking steps to increase national retirement ages, and in France, despite national protests the pension age has been increased. However current levels of immigration are insufficient to offset the impact of a shrinking working-age population and all of the aforementioned options are politically divisive. We argue that these solutions are not prominent enough to overcome the current issues.

Despite no widely accepted empirical evidence that public debt limits exist, there is increasing concern over the longevity and sustainability of debt levels and the persistence of public budget deficits. The US debt trajectory specifically has faced increased attention lately, due to persistent budget deficits over the last several years, and the long-term debt rating downgrade by Fitch in 2023. As government debt burdens have become increasingly precarious, there are only now a small handful of governments rated AAA by ratings agencies. Looking back to the post-war period, the spike in public debt levels in the 1940s was followed by a combination of favourable growth-rate/interest-rate differentials, financial repression and inflation2. These encouraged fiscal surpluses and allowed governments to reduce debt-to-GDP ratios. Since then, key developed market (DM) central banks have become independent and financial globalisation has expanded rapidly. Post-war debt reduction strategies are arguably no longer viable. Governments now face limited options to manage public debt ratios other than via fiscal consolidation. We do not foresee governments running fiscal surpluses, but under the premise that governments are required to spend more mindfully, this should act as a tailwind for fixed-income. More conservative fiscal stimulus, absent any significant tax changes, will allow governments to issue debt less aggressively.

To offset the diminishing capacity of governments and willingness of corporations to bear the fiscal burden, there is an increasing expectation that households will need to shoulder more retirement, health care and social security spending. This will add extra pressure on those of a working age to save for their own retirement and for their dependents' retirement. One way or another, financing the needs of the growing elderly population will come at the expense of other spending priorities.

Impact on the Global Macroeconomy

Demographic trends will undoubtedly have extensive global macroeconomic impacts. The outlook for those economies reaching stage five of the DTM face the biggest challenges. Slower population growth will subdue global demand for goods and services. Rising old-age dependency ratios create financing challenges for governments. On the supply-side, we see a shrinking and an aging workforce constraining production capacity, and even slowing productivity growth—both to the detriment of economic activity.

As we present in Exhibit 5, using UNPD forecasts for DM working-age populations, we calculate real GDP growth over the next 30 years will be 50% lower than what we have seen over the last 30 years. This assumes productivity rates remain constant. Europe is among the regions facing the most pressing challenges, with the working-age population expected to shrink by roughly 17.5% over the next 30 years. The US, where growth in the working-age population has remained more robust over the last several decades, is not immune to these challenges. UNPD forecasts see the US’s working-age population growing at an annualised rate of just 0.13% through to 2050, while over the same period the working-age population as a share of the total population in the US will fall by 5 percentage points (pp).

Towards the end of the 18th century, the economist Thomas Malthus5 forewarned that an expanding population would put increasing demands on the world’s production. Put simply, the more people, the greater the need for food, energy, housing and all kinds of goods and services. In the present day, rather than the expanding population that Malthus spoke to, population growth is declining. Slowing (and even negative) population growth should see demand wane for goods and services globally and economic output moderate in tandem. In the most recent Agriculture Outlook for 2023-2032,6 produced jointly by the Food and Agriculture Organisation at the UN and the OECD, they declare that ''agriculture demand is projected to grow more slowly over the coming decade due to the foreseen slowdown in population and per capital income growth.''

As we highlighted above, rising old-age dependency ratios create an increasing need for old-age related public entitlements. Budget deficits are being increasingly scrutinised amid a sharp rise in the cost of servicing debt over the last few years. As a result of the limited capacity for governments to support the growing population of elderly, households are increasingly being expected to compensate for where fiscal spending falls short. However households are not flush with cash. Data shows that US consumers, who had built up a pot of savings during the Covid era, have now burned through these. The current cost of living crisis provides an additional challenge for households to finance the needs of a rising old-age dependency ratio. Households will need therefore to defer their spending to save for their own retirement and that of their dependents. Household savings ratios will need to rise, taking away from near-term consumption and economic growth.

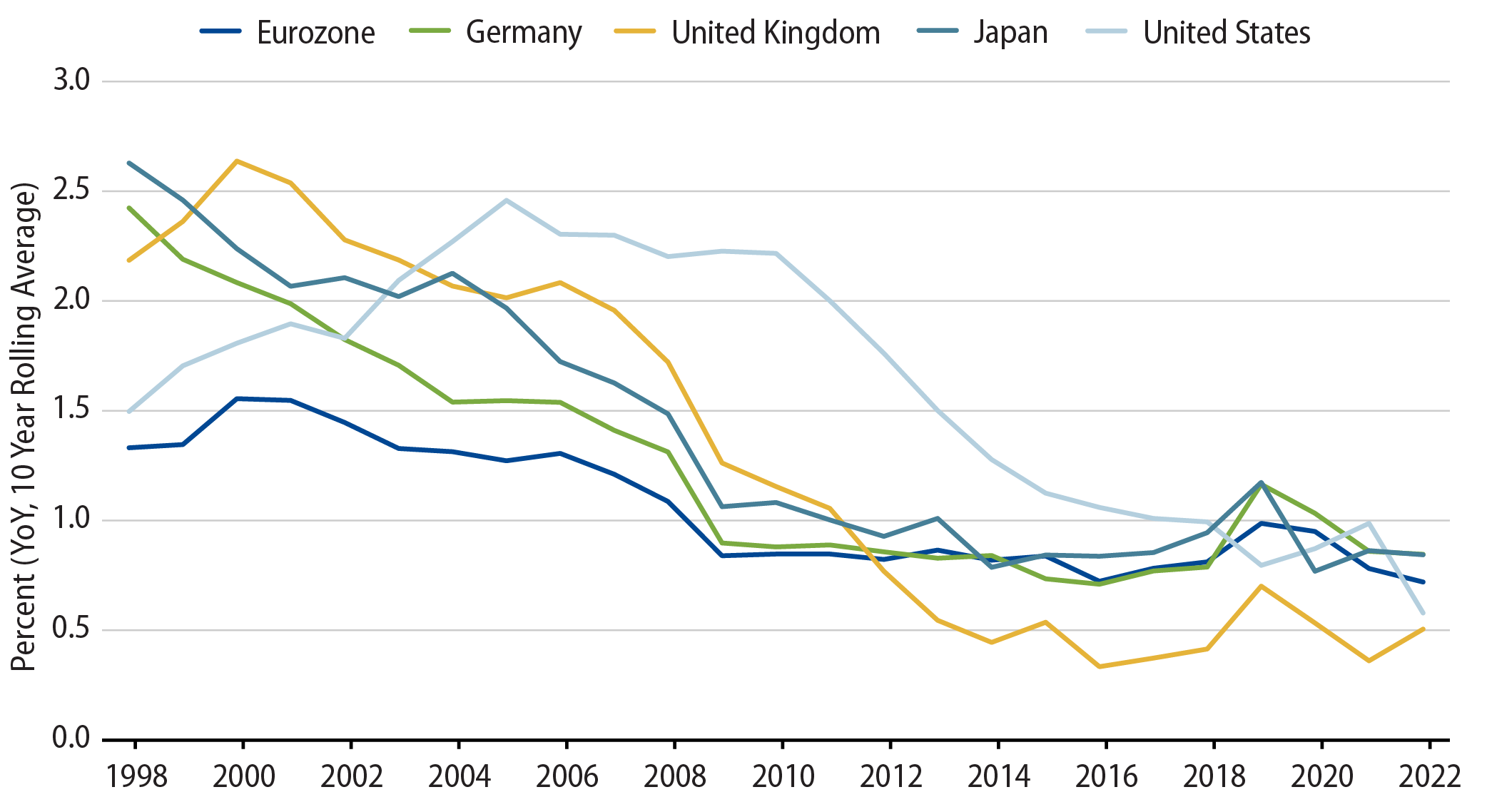

It is important to take a look at the role played by public and private investment, and the rate of growth of productivity. Productivity growth has slowed markedly over the last several decades, as illustrated in Exhibit 6. This is during a period of ultra-easy monetary policy, as central banks have kept policy rates at or close-to zero. Low interest rates should encourage borrowing for investment in new technologies and capital, which in turn should accelerate productivity. However productivity rates have fallen. There is no clear sign of an upswing either. Going back to analysis we presented in Exhibit 5, using the latest data on productivity growth rates, annual GDP growth over the next 30 years would be another 0.5 pp lower.

Entrepreneurship and innovation play a significant role in driving investment and productivity growth. Economist and demographer James Liang, among others, notes that older economies are less entrepreneurial.7 Slower innovation will hinder the impact of technology change on productivity rates and potential economic growth. Liang further hypothesises that Japan’s lacklustre economic growth over the last few decades since the Asian financial crisis in the late 1990s is a result of its aging population. This can be taken one step further. Classical textbook economic theory stipulates that benign productivity rates discourage investment; companies are only inclined to invest if they believe that it will be worthwhile. As we have seen, recent productivity growth has provided little encouragement for the private and public sectors to invest. Lower desired investment depresses real interest rates. In their research paper from 2019, Bergeaud et al find a circular relationship whereby low interest rates (caused by ultra-easy monetary policy) caps productivity growth.8 Indebted, unproductive companies are kept in business by access to an abundance of cheap credit. Truly productive firms are stifled. The process of ''creative destruction'', a term coined by economist Joseph Schumpeter9 and loosely akin to the idea of ''survival of the fittest'', is overridden. As Bergeaud et al8 find, this creates a downward spiral which, absent a technology shock, ends with low productivity rates and low real interest rates.

There are a number of commentators that suggest an aging population is inflationary; the elderly consume more than they produce, creating a scarcity of supply and driving up prices. The working-age population is a net producer of goods and services. As working-age populations contract, companies also fight for a shrinking supply of labour. Supply-demand dynamics suggest that firms are forced to pay more for labour and so wages rise. We argue against the view that aging populations are inflationary; we do not believe that these dynamics will prove sufficient to create sustained upward pressure on inflation. Despite an aging population, Japan has seen decades of low consumer demand which has helped inflation remain low. We see an important role for inflation-targeting central banks in adjusting monetary policy to react to economic imbalances between supply and demand as populations age and population growth slows. On the demand-side, waning population growth should see demand-driven inflation moderate. In essence, fewer people means less demand and therefore lower prices.

Conclusion

For the last 40 years, much of the developed world has benefited from the demographic dividend resulting in part from the growth of the world’s working-age population. This trend, which has been helped by favourable demographic dynamics, supported economic activity. It also saw governments rack up unsustainable levels of debt. But these demographic tailwinds are rapidly becoming headwinds to productivity and economic growth as fertility rates have fallen and life expectancy has risen. Rapidly aging populations and slowing population growth will challenge both governments and the private sector to budget their spending more sustainably. Monetary policy will play a key role in ensuring inflation remains at target, amid tepid economic growth. Under this scenario we expect central banks to promote an accommodative policy stance, which should be supportive for fixed-income assets. More conservative fiscal policy could also provide a tailwind for bonds. As these demographic adjustments unfold, they will prove to be one of the most significant secular headwinds to the global economy in the years to come.

- Early models of demographic theory were first introduced by demographer Warren Thompson in an academic paper he authored in 1929, entitled ''Population''. He theorised a three-stage process to demographic transition. Using Thompson’s work as a foundation, Frank Notestein in 1945 pioneered and popularised what is now known as the Demographic Transition Model (DTM).

- Please see the following reference for a comprehensive overview of historical public debt levels: Barry Eichengreen, Asmaa ElGanainy, Rui Esteves & Kris Mitchener, ''Public Debt Through the Ages,'' International Monetary Authority, January 15, 2019, Public Debt Through the Ages (imf.org)

- Dorothée Rouzet, Aida Caldera Sánchez, Théodore Renault, Oliver Roehn, ''Fiscal Challenges and Inclusive Growth in Ageing Societies'', OECD Economic Policy Paper No. 27, September 2019, Fiscal Challenges and Inclusive Growth in Ageing Societies | OECD

- International Energy Agency (IEA), ''Net Zero Roadmap: A Global Pathway to Keep the 1.50C Goal in Reach'', IEA, September 2023, Net Zero Roadmap: A Global Pathway to Keep the 1.50C Goal in Reach | IEA

- Thomas Robert Malthus, ''An Essay on the Principle of Population as it Affects the Future Improvement of Society, with Remarks on the Speculations of Mr. Goodwin, M. Condorcet and Other Writers'' (1st edn), 1798, London: J. Johnson in St Paul's Church-yard

- OECD/FAO, ''OECD-FAO Agricultural Outlook 2023-2032'', OECD Publishing, July 2023, OECD-FAO Agricultural Outlook 2023-2032 | OECD/FAO

- James Liang, ''The Demographics of Innovation: Why Demographics is a Key to the Innovation Race'', 2018, United Kingdom: John Wiley & Sons, LTD.

- Antonin Bergeaud, Gilbert Cette, Rémy Lecat, ''The Circular Relationship Between Productivity Growth and Real Interest Rates'', Banque de France Working Paper No. 734, October 2019, The Circular Relationship Between Productivity Growth and Real Interest Rates | Banque de France

- Joseph Alois Schumpeter, ''Capitalism, Socialism and Democracy'', 1962, New York: HarperCollins.