As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

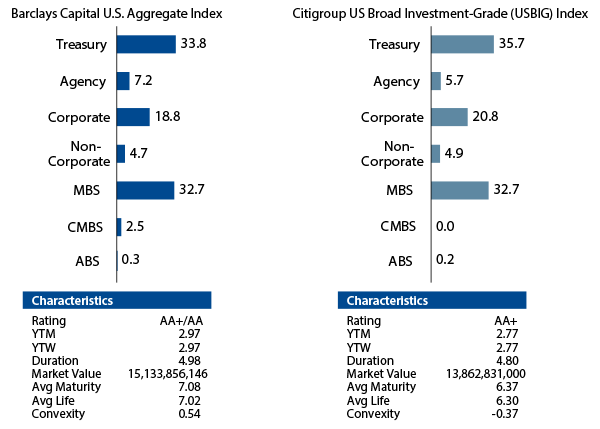

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

Historical Composition & Projected Changes for the Barclays Capital U.S. Aggregate Index

Source: Barclays Capital, Western Asset

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

Know Your Index

Source: Citigroup, Barclays Capital, Western Asset

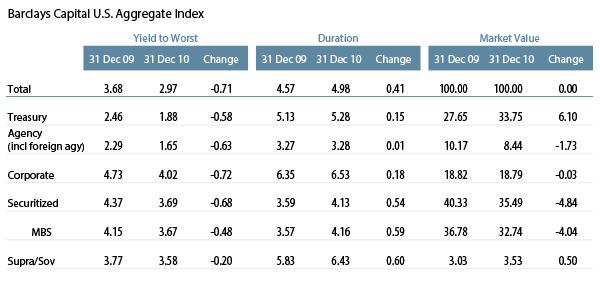

Changing Characteristics

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

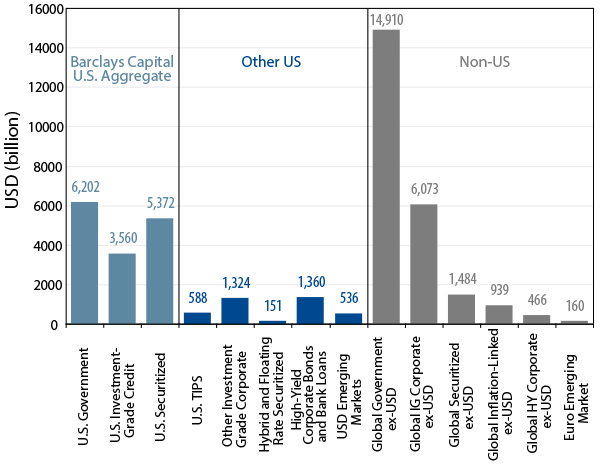

Fixed-Income Opportunities

Source: Barclays Capital

Is the Aggregate Really an Aggregate?

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

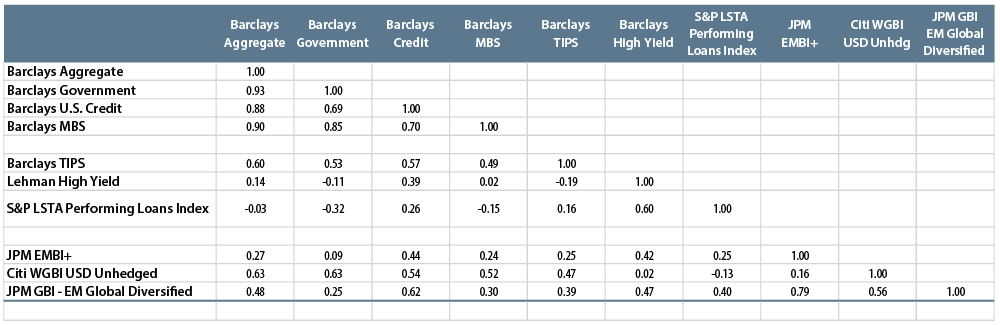

Correlations

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

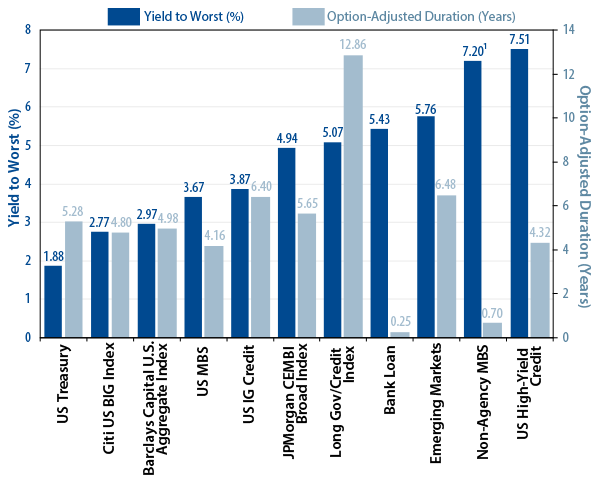

Index Yields and Durations

Source: Barclays Capital, Citigroup, JPMorgan, S&P/LSTA, Western Asset

Loss- Adjusted

Summary of Rules for Inclusion in the Barclays Capital U.S. Aggregate Index

- USD-denominated and non-convertible.

- Fixed-rate, although can carry a coupon that steps up or changes according to predetermined schedule.

- Rated investment-grade (Baa3/BBB-) by at least two of the rating agencies.

- − If only two agencies rate the bond, the lowest rating is used to determine eligibility.

- − If only one agency rates the bond, it must be investment-grade rated.

- Must have at least one year until final maturity.

- Must have at least $250 million par amount outstanding.

- ABS must have at least $500 million deal size and $25 million tranche size.

- CMBS must have original deal size of at least $500 million and $25 million tranche size.

- In order to remain in the index, CMBS must have current outstanding transaction size of at least $300 million.

Source: Barclays Capital

The Shortcomings of Fixed-Income Indices

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

Investor Concerns

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

The Importance of Income

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

The Quality of Ratings

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.

Conclusion

As we embark on a new investing year, we are hearing concerns from investors regarding their fixed-income allocations. Conventional wisdom is: a) reduce duration, as interest rates are likely to rise, and b) increase liquidity to protect against systemic risk. While we are not convinced that rates will move significantly higher in 2011, we do acknowledge that it is a risk. The chances of another systemic event are also real and are worthy of consideration. So what should an investor do? One thing we can recommend with confidence is that investors continue with active management.

A natural response from the events that unfolded in 2007 and 2008 is to reduce risk and, in many cases, go passive—the thinking being that passive exposure will provide greater liquidity and less risk and that fixed-income will need to be an anchor to windward within a portfolio allocation. Regarding the move to a passive approach, our view is caveat emptor—let the buyer beware. We are not attempting to discredit passive investing. Rather, we want to highlight changes that are likely to occur to the popular benchmarks and explain how those changes will likely impact performance.

Indices are dynamic portfolios. The many changes that are unfolding in the aggregate indices may or may not be in investors’ best interests. Presented below are a number of changes that we expect to see in the aggregate indices over the next several years:- The allocation to US Treasuries (UST) is likely to continue to increase as the US government continues to run trillion-dollar-plus deficits (Exhibit 1).

- The maturity profile of the Treasury sector is extending and will likely continue to do so.

- The agency MBS allocation has declined as a percentage of the indices, and is likely to keep declining as the housing market continues to struggle. Additionally, there could be volatility in this sector, since it is susceptible to the actions of the US Congress, as Freddie Mac and Fannie Mae remain in conservatorship with no resolution in sight.

- The coupon concentration in agency MBS now is in 4.5% and 5.0% coupons, whereas previously it had been in 5.0% and 5.5%. This has led to a longer duration despite a decline in yields. The duration of these issues will extend further if and when interest rates increase, resulting in a longer overall duration for the indices.