Macros, Markets and Munis

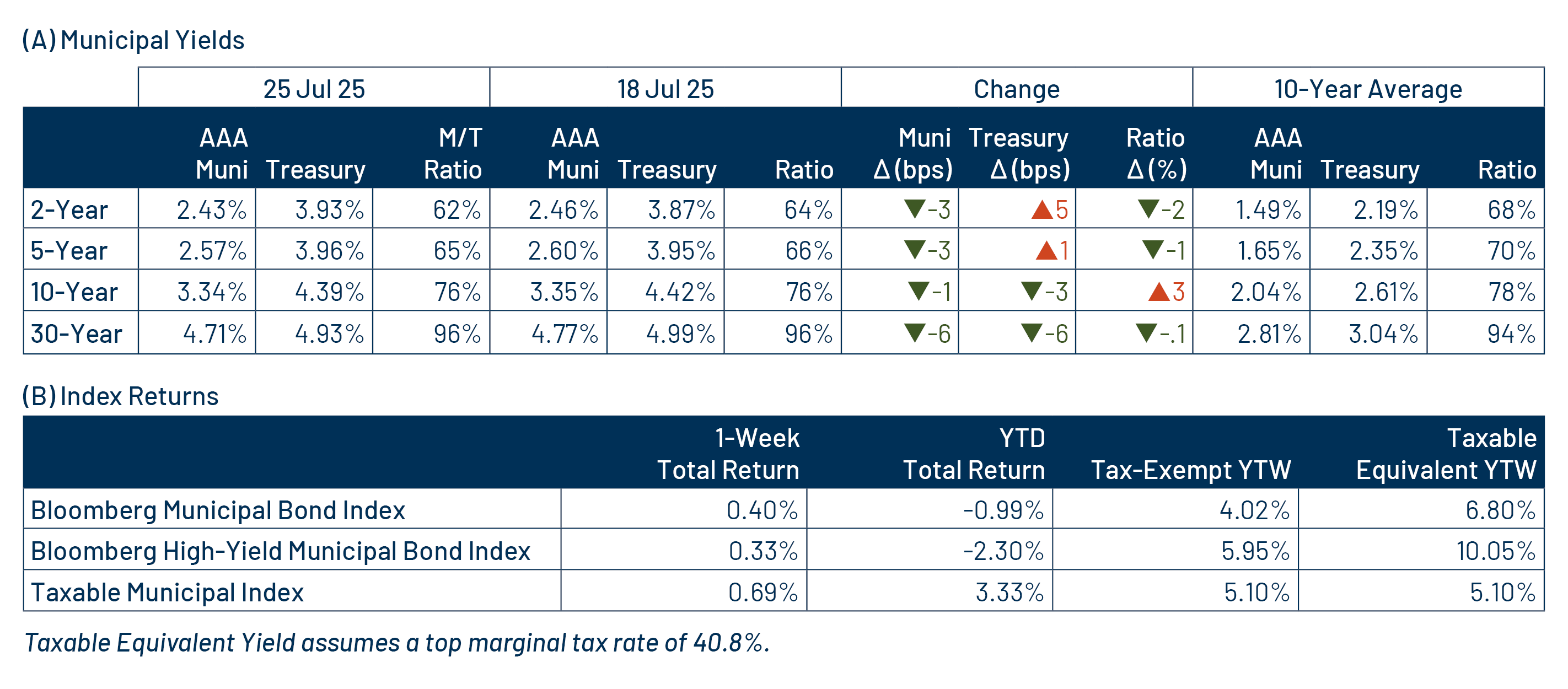

Municipals posted positive returns last week and outperformed Treasuries as the Treasury curve flattened, with yields moving higher in short maturities and lower in longer maturities. High-grade muni yields moved lower across the curve, also generally outperforming Treasuries. Markets were focused on tariff rhetoric ahead of this week’s August 1 deadline. The agreement between US and Japan regarding 15% tariffs was welcomed by markets as less severe than expected, and a potential framework for other agreements. This week’s economic calendar is much busier with JOLTs, payrolls, GDP and consumer confidence data as well as the Federal Open Market Committee (FOMC) meeting. Meanwhile, technicals strengthened as funds recorded inflows. As most states closed out fiscal year 2025 last month, here we review the health of state budgets heading into the new fiscal year.

Flows Turn Positive as the Upcoming New-Issue Calendar Slows

Fund Flows (up $572 million): During the week ending July 23, weekly reporting municipal mutual funds recorded $572 million of net inflows, according to Lipper. Intermediate funds recorded $475 million of net inflows, short and short/intermediate funds recorded $332 million of net inflows. Long-term and high-yield categories recorded $235 million and $202 million of net outflows, respectively. Last week’s inflows led year-to-date (YTD) inflows higher to $15 billion.

Supply (YTD supply of $327 billion; up 25% YoY): The muni market recorded $15 billion of new-issue supply last week, which was in line with the elevated pace also observed in the prior week. YTD new-issue supply of $327 billion is 27% higher than the prior year, with tax-exempt issuance up 27% year-over-year (YoY) and taxable issuance up 6%, respectively. This week’s calendar is expected to remain elevated at $12 billion. The largest deals include $3.5 billion Georgia SR 400 Express Lanes and $1.5 billion State of Washington General Obligation transactions.

This Week in Munis: Stable Reserves Underscore State Budget Health

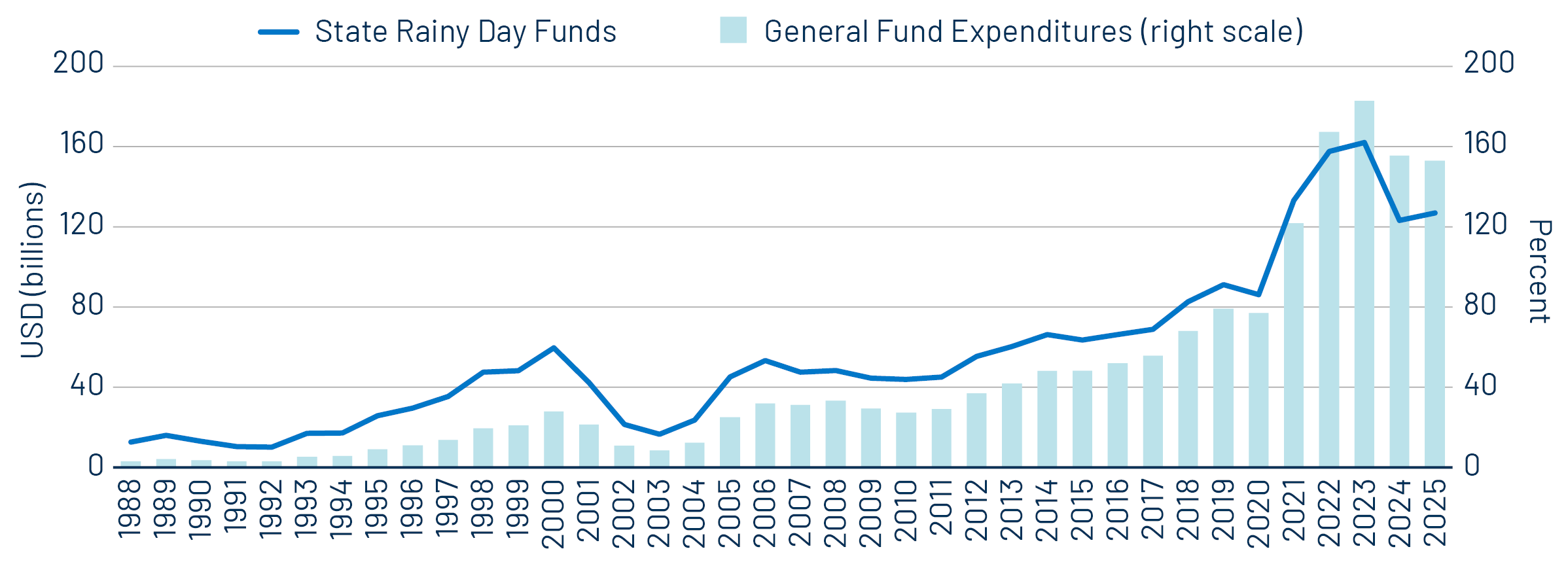

June 30 marked the end of fiscal year 2025 for 46 states and the District of Columbia. As highlighted in our recent June 17 blog, state and local revenue collections have remained near record highs, supporting municipal credit in recent years. These robust tax collections have been driven by a favorable labor market, strong consumer activity and attractive real estate values which have bolstered property tax payments.

The strong revenue projections reported by the Census were corroborated by the National Association of State Budget Officers (NASBO) Spring survey, which noted that states’ fiscal 2025 general fund revenues exceeded expectations. However, the NASBO survey also pointed out that higher-than-expected spending of prior unanticipated surpluses contributed to a modest 1.6% YoY decline in fund balances. Despite this decline, rainy day funds remain five times higher than the balances held in 2007, prior to the global financial crisis. Overall, these reserves now comprise 13% of general fund expenditures, compared to just 4.7% in 2007.

Western Asset believes that this data reflects the credit stability of traditional state and local credit and that most municipalities are better positioned to navigate a negative economic cycle than in previous downturns. As we move into fiscal year 2026, most state budgets are proposing tighter conditions in response to slower revenue growth and the winding down of federal Covid-related aid, along with other potential funding changes. We believe these considerations are prudent and may help moderate expenditure growth compared to recent years. Additionally, they provide the potential for upside surprises should growth remain resilient.

Municipal Credit Curves and Relative Value

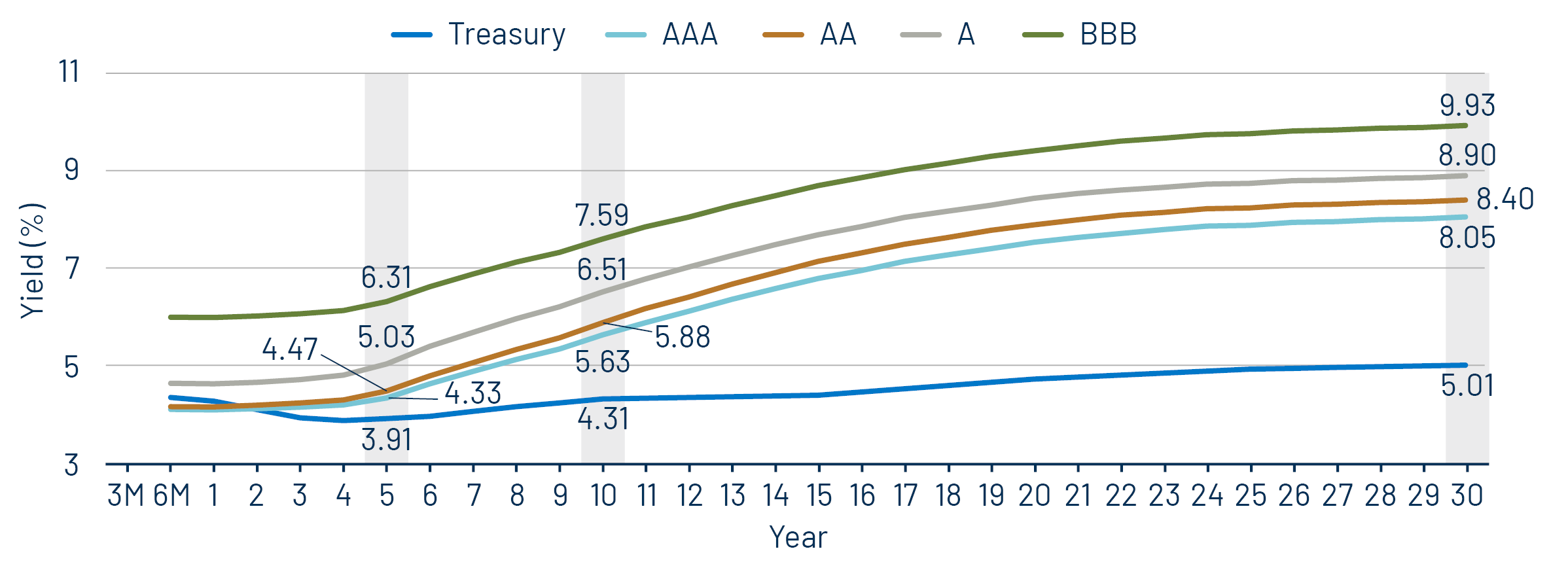

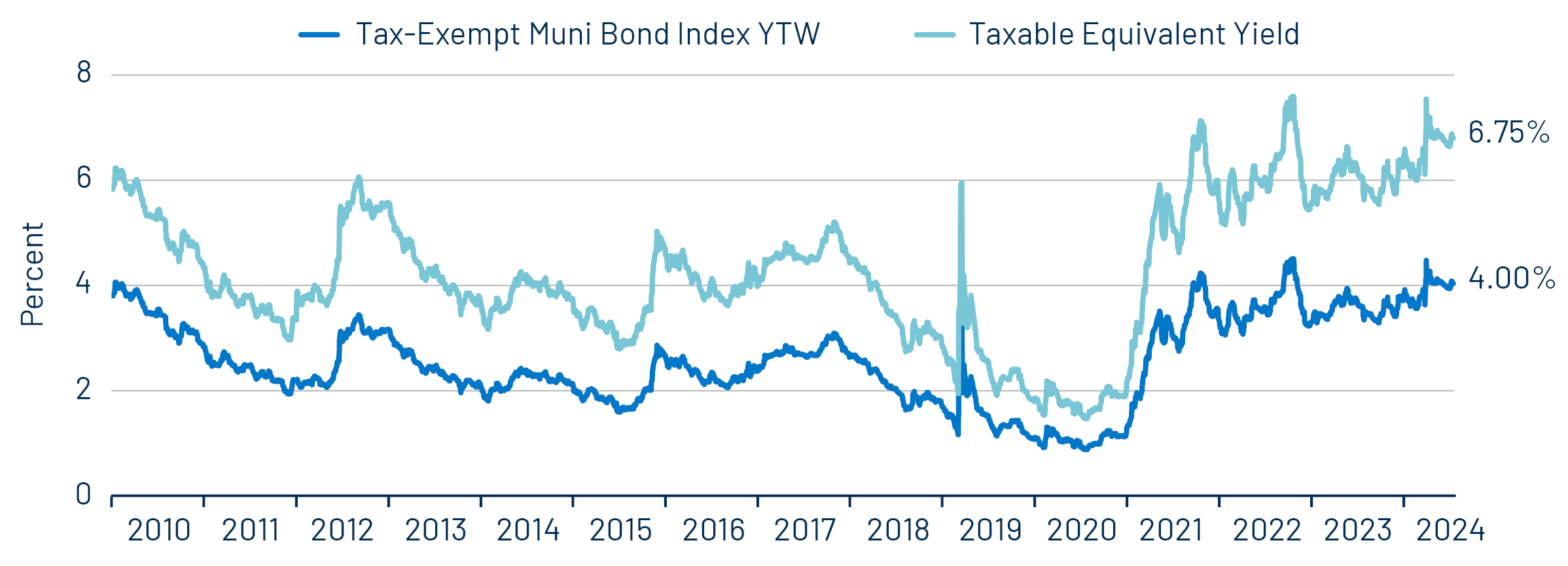

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

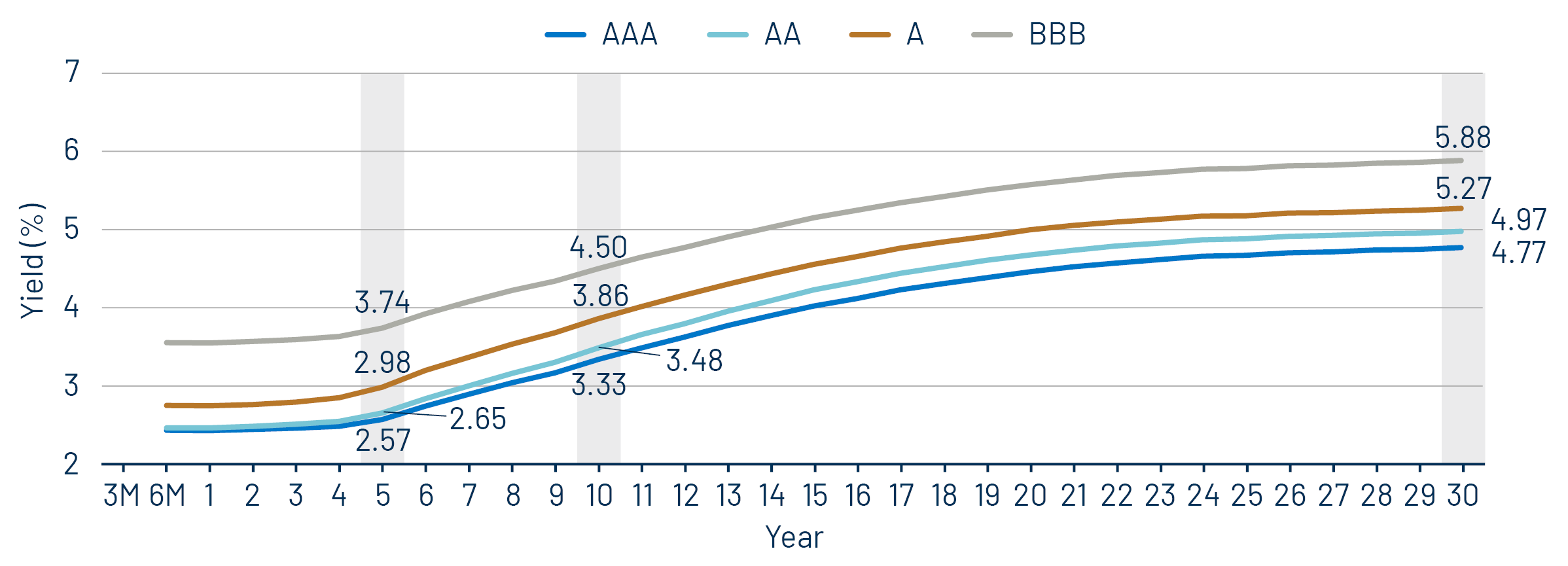

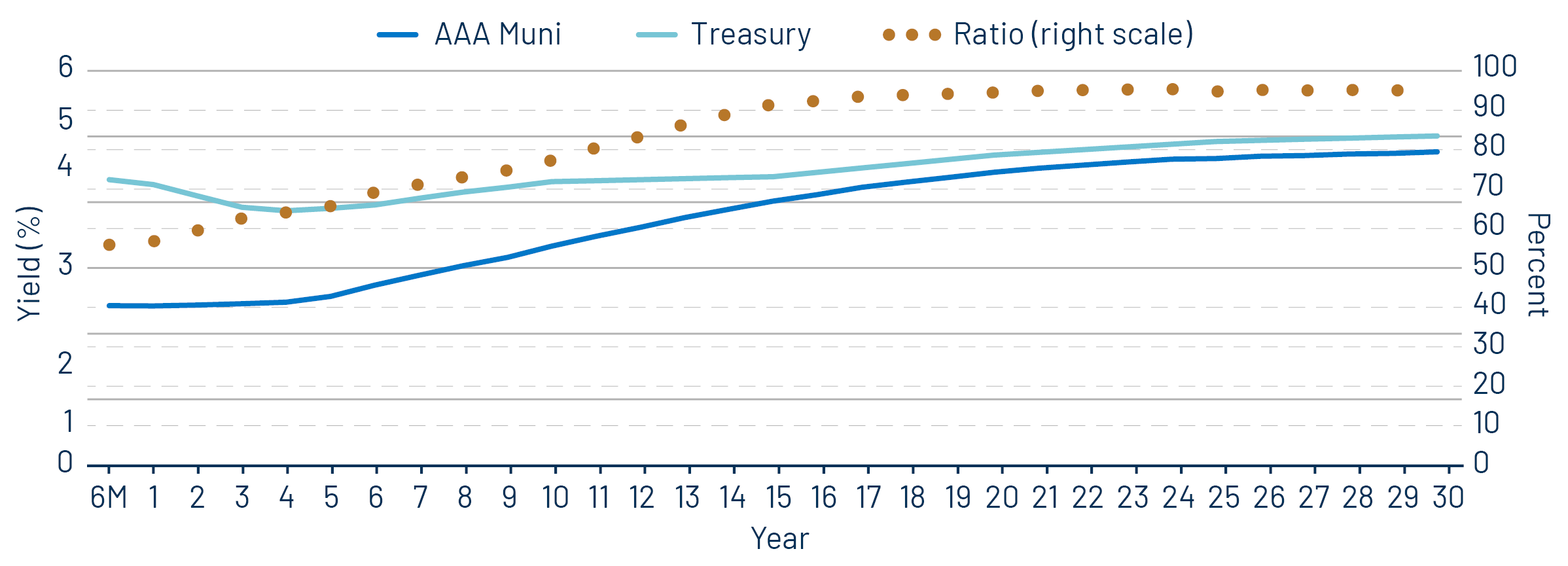

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

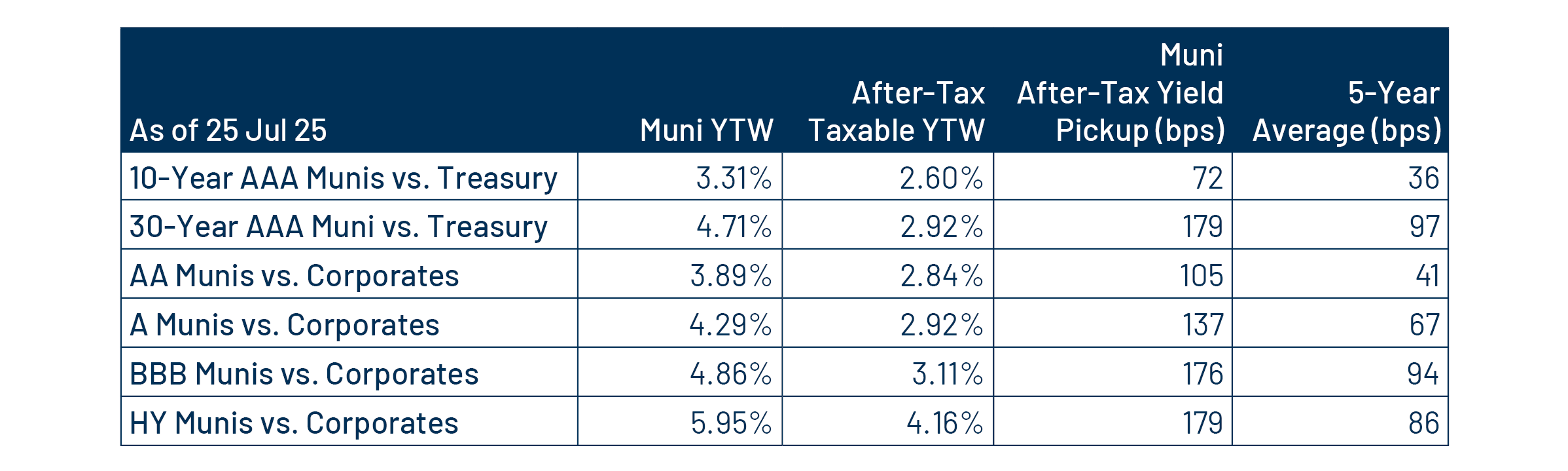

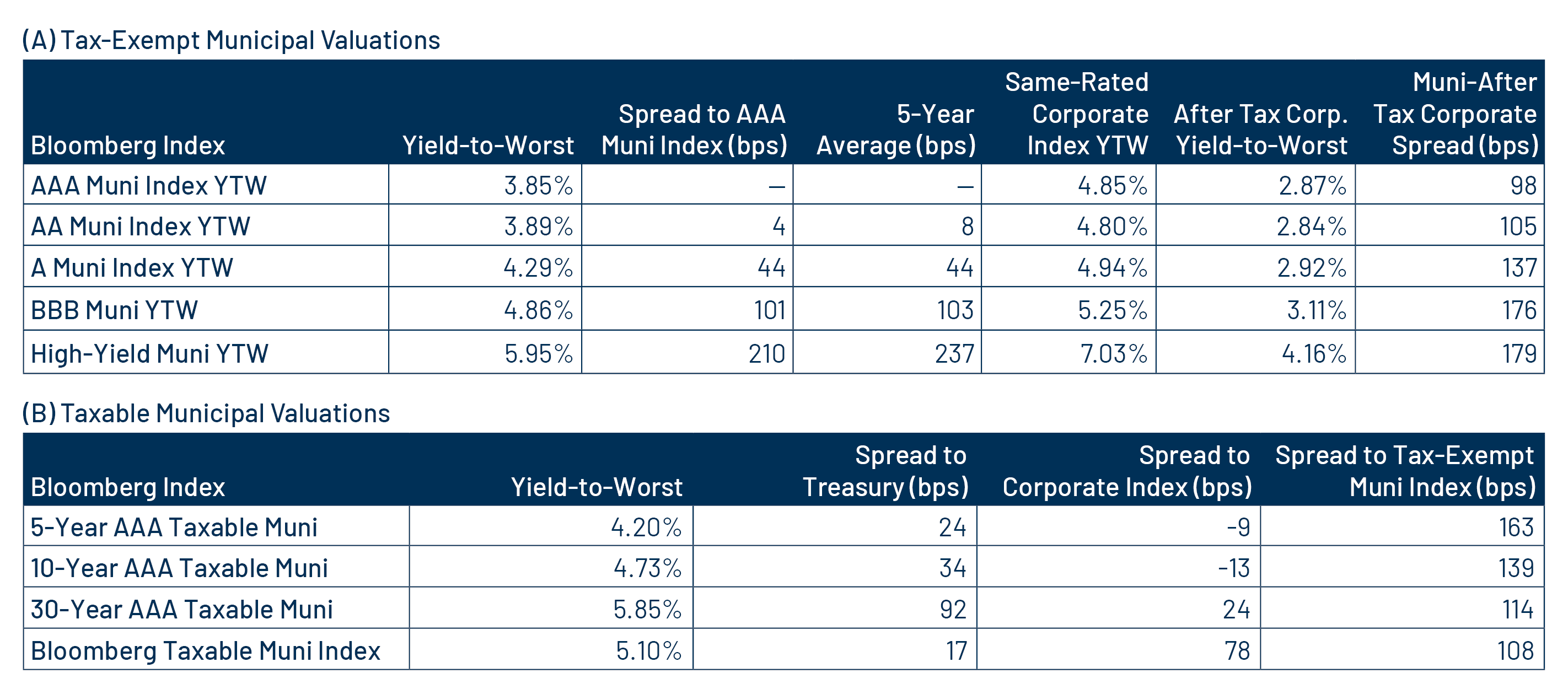

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.