Macros, Markets and Munis

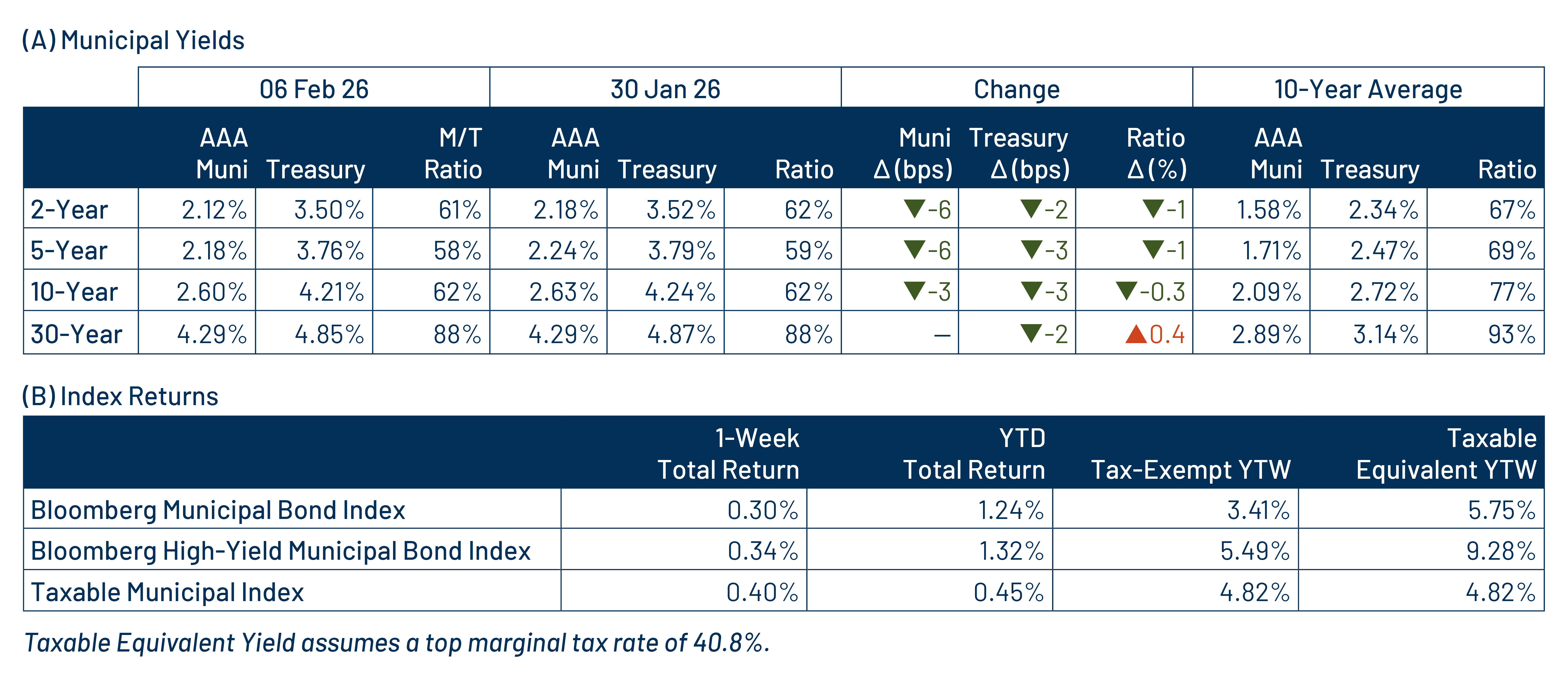

Munis posted positive returns amid heightened market volatility last week as fixed-income markets also advanced. Equity markets sold off early in the week due to skepticism around the returns of AI investment before recovering Friday following the release of weaker than anticipated labor data. All told, the Treasury curve rallied 2-3 basis points (bps). Municipals outperformed, with yields moving 3-6 bps lower in short and intermediate maturities amid heavy demand, as indicated by strong muni mutual fund flows. This week we address early-year muni outperformance and the January effect.

Supply Picked Up Last Week Amid Accelerating Demand

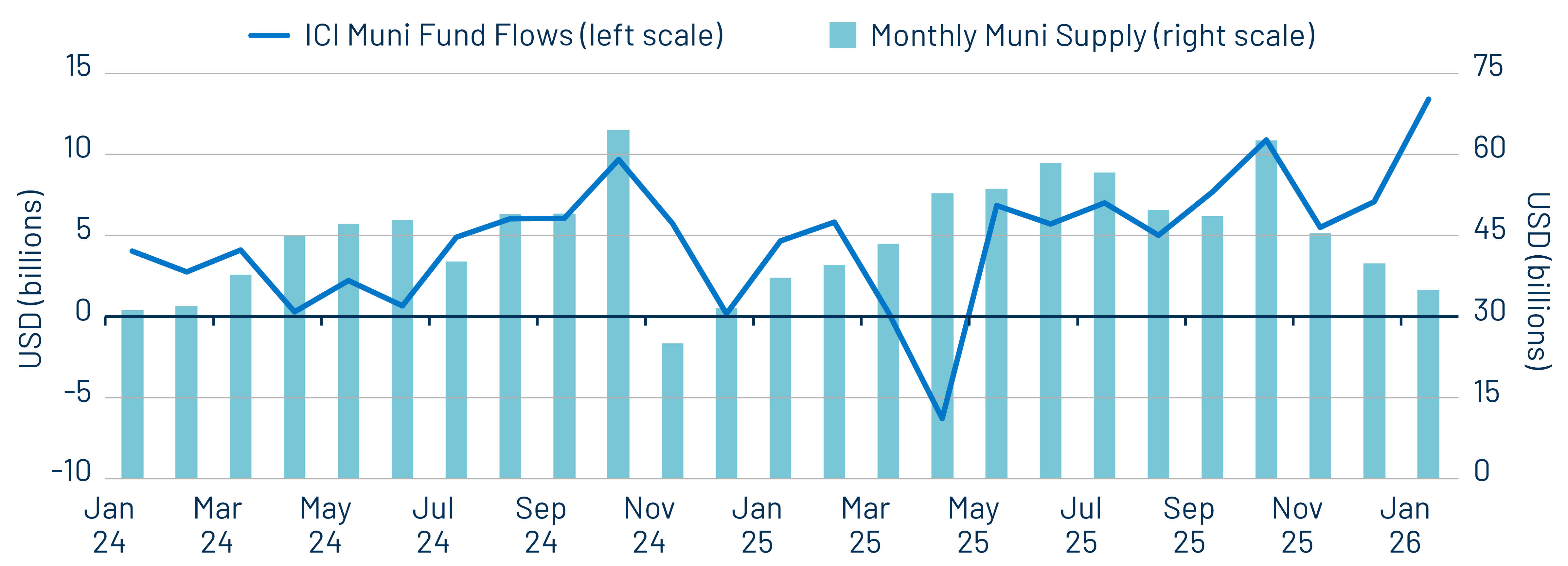

Fund Flows ($2.4 billion of net inflows): During the week ending February 4, weekly reporting municipal mutual funds recorded $2.4 billion of net inflows, according to Lipper. Long-term, intermediate and short-term categories recorded $1.8 billion, $296 million and $165 million of inflows, respectively. Last week’s inflows marked the 11th consecutive week of net inflows and led year-to-date (YTD) inflows higher to $11 billion.

Supply (YTD supply of $45 billion; up 20% YoY): The muni market recorded $10 billion of new-issue supply last week, more than double the prior week’s level. YTD new-issue supply of $45 billion is 20% higher than the prior year, with tax-exempt issuance up 21% year-over-year (YoY) and taxable issuance up 2%, respectively. This week’s calendar is expected to jump to $16 billion. The largest deals include $1.3 billion Houston Methodist Hospital Obligated Group and $553 million California Department of Water transactions.

This Week in Munis: Seasonal Strength

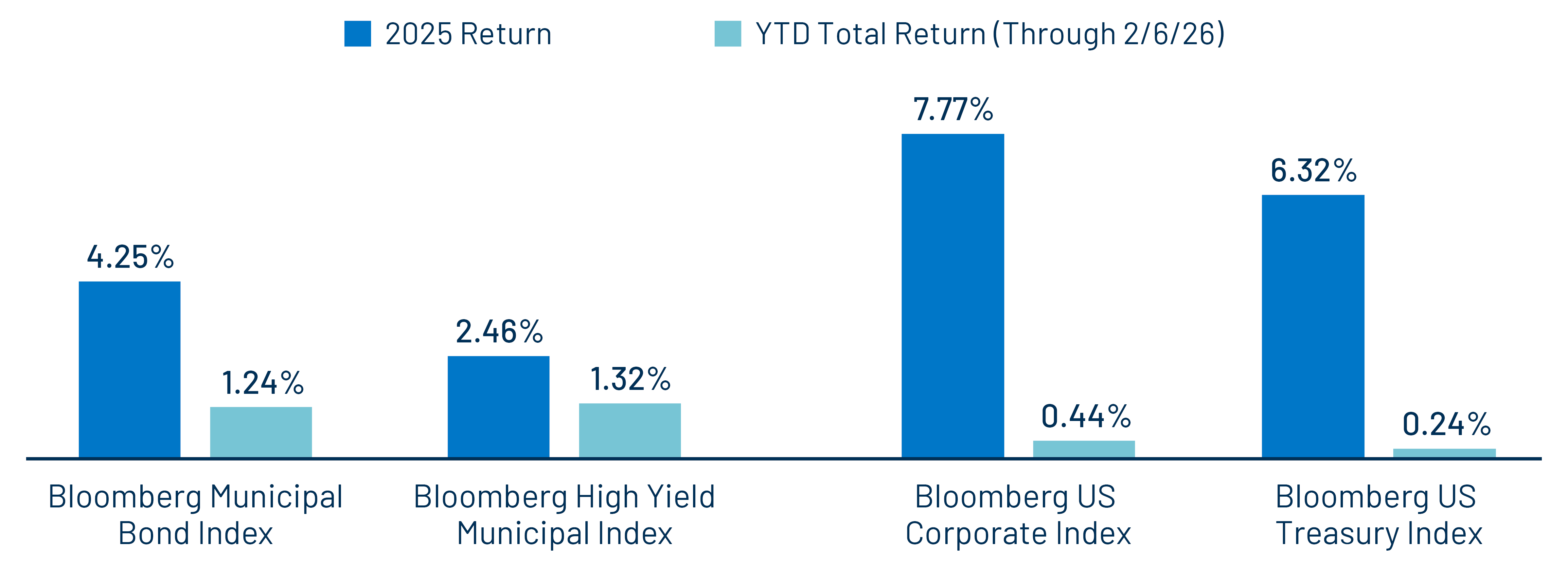

Municipals posted strong returns to start the year, with the Bloomberg Municipal Index returning 1.24% YTD through February 6. This performance notably outpaced the 0.24% and 0.44% returns observed in the respective Bloomberg US Treasury and Corporate Indices, reversing some of the underperformance observed throughout 2025.

Muni outperformance was supported by traditional ''January effect'' conditions, a period of technical strength where heavy coupon and principal reinvestment coincide with limited new issuance. ICI estimates municipal funds and ETFs recorded $13 billion of net inflows in January, the highest level since the market’s major $120 billion outflow cycle ended in early 2024. Meanwhile, the monthly new-issue supply of $35 billion was down 6% from prior January levels and down 44% from the recent highs observed in October 2025, further strengthening market technicals.

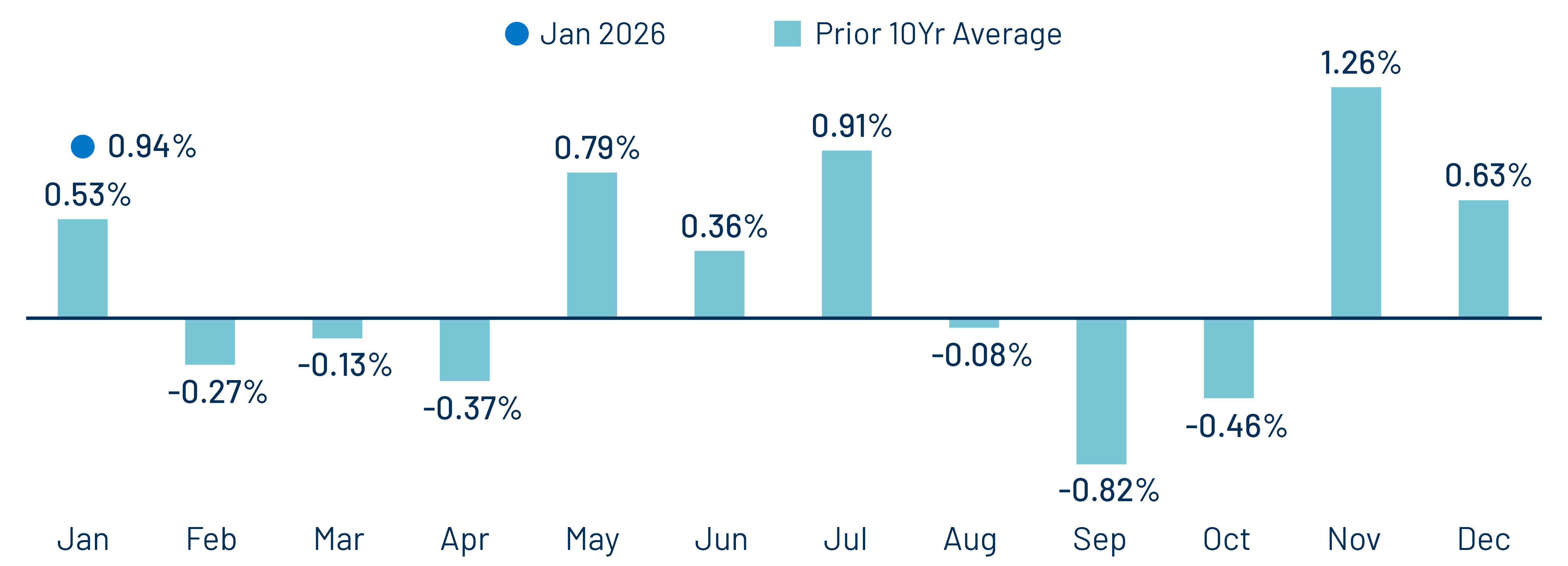

As we emerge from January effect conditions, seasonal strength often weakens ahead of tax season and provides attractive entry points for long-term muni investors. During this window, supply tends to move higher while demand softens as high-net-worth individuals often liquidate municipal allocations to fund tax liabilities. Over the past decade, the Bloomberg Municipal Bond Index has recorded negative average returns from February through May. However, given the relatively high nominal yields and after-tax relative value currently offered by the muni market, demand could remain at robust levels and challenge the seasonal weakness typically observed during spring months. Western Asset believes long-term investors may be well-served seeking income opportunities offered by any potential seasonal weakness.

Municipal Credit Curves and Relative Value

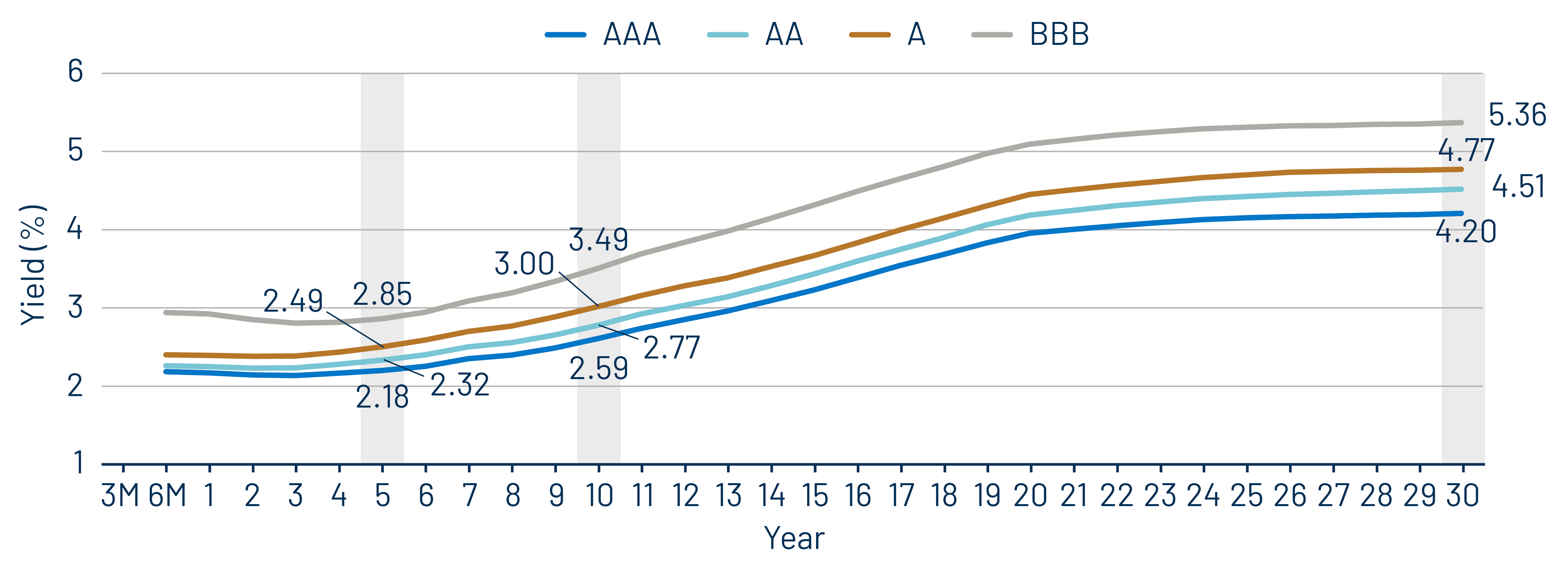

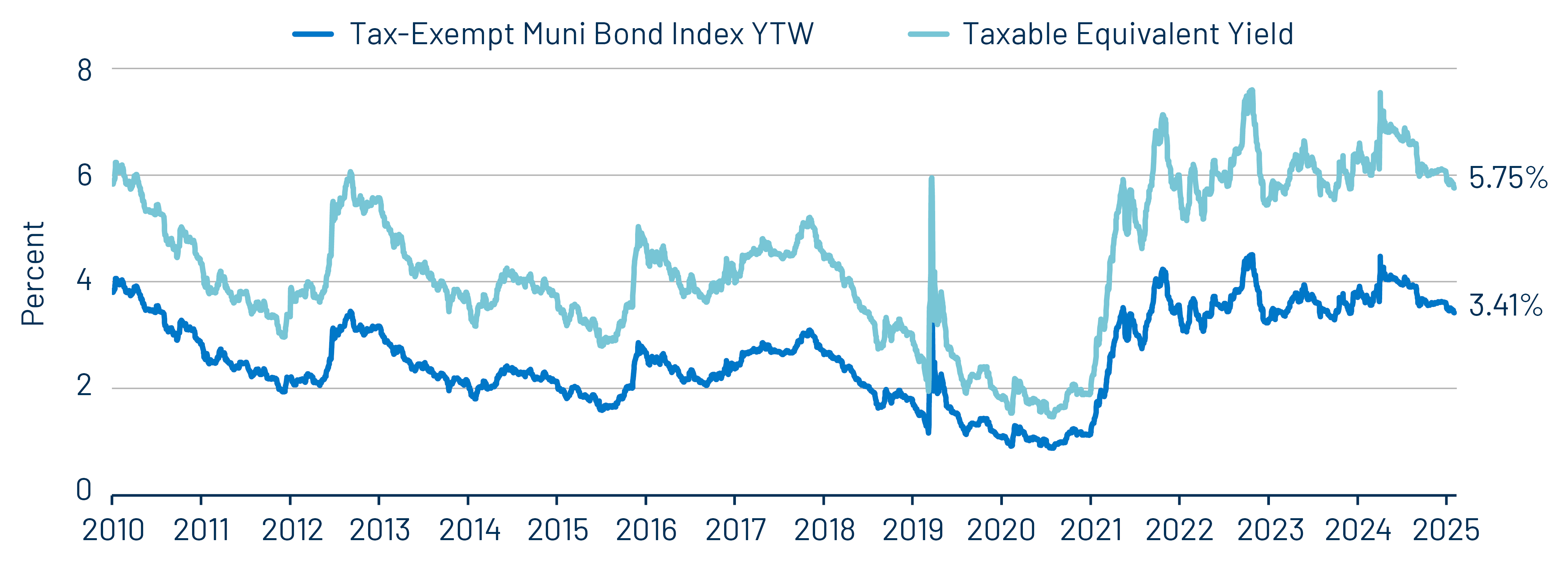

Theme 1: Municipal taxable-equivalent yields moved lower in 2025, but remain above historical averages.

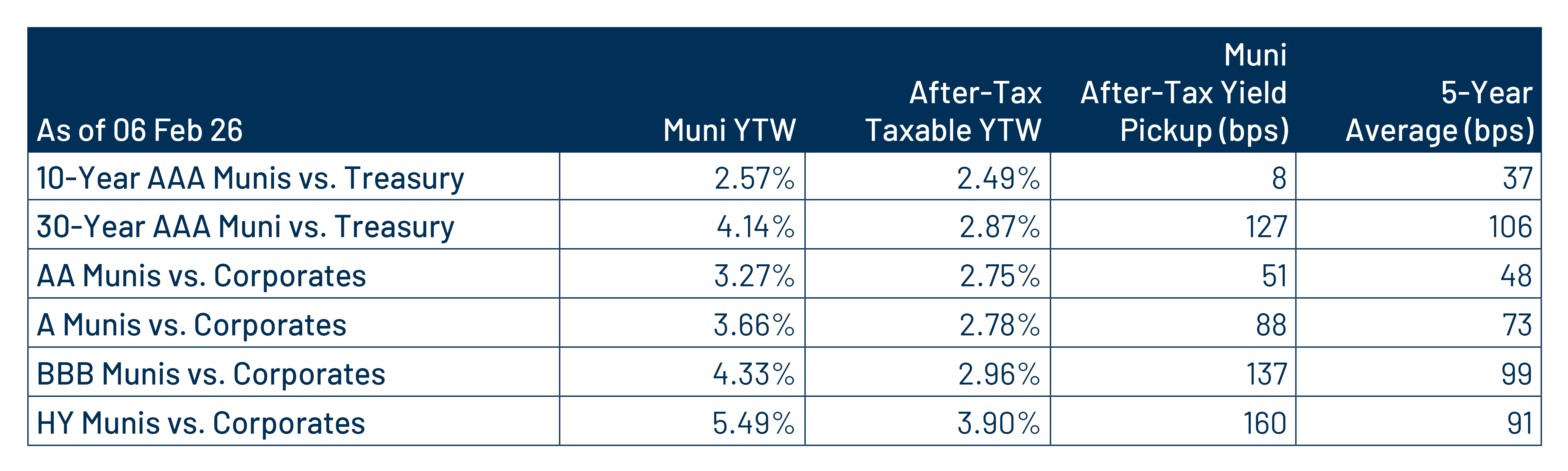

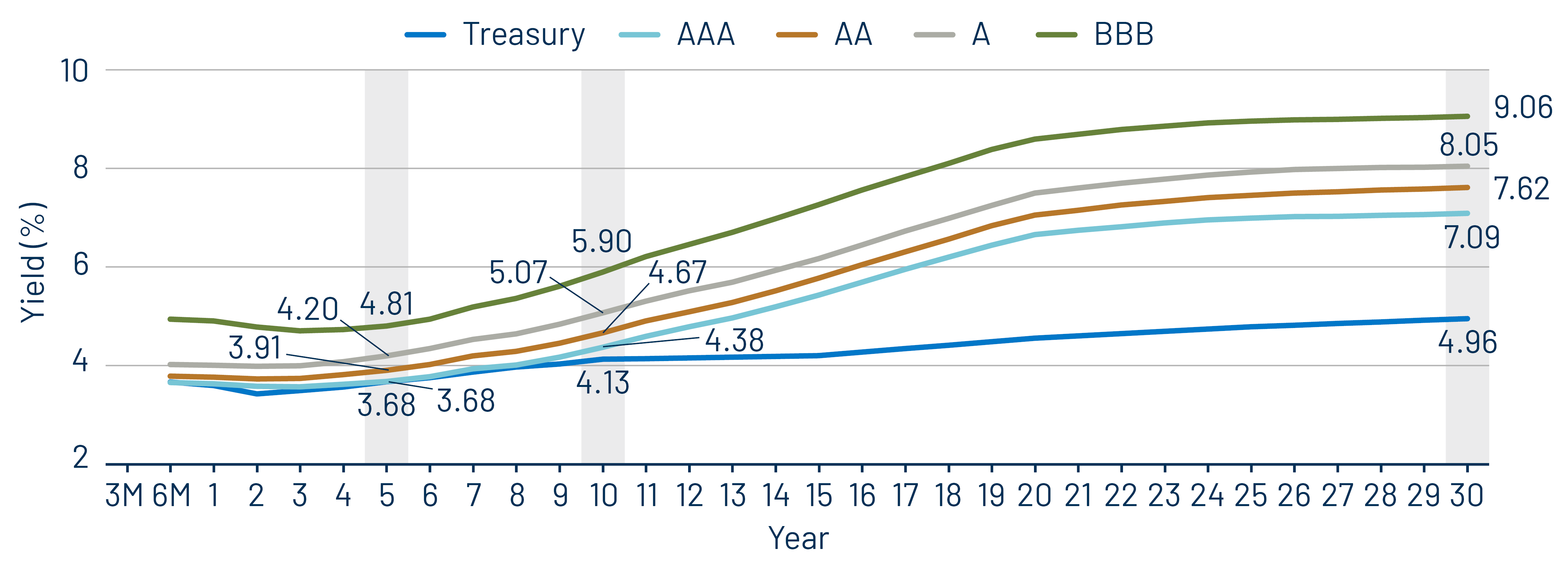

Theme 2: Munis offer attractive after-tax yield pickup vs. taxable alternatives

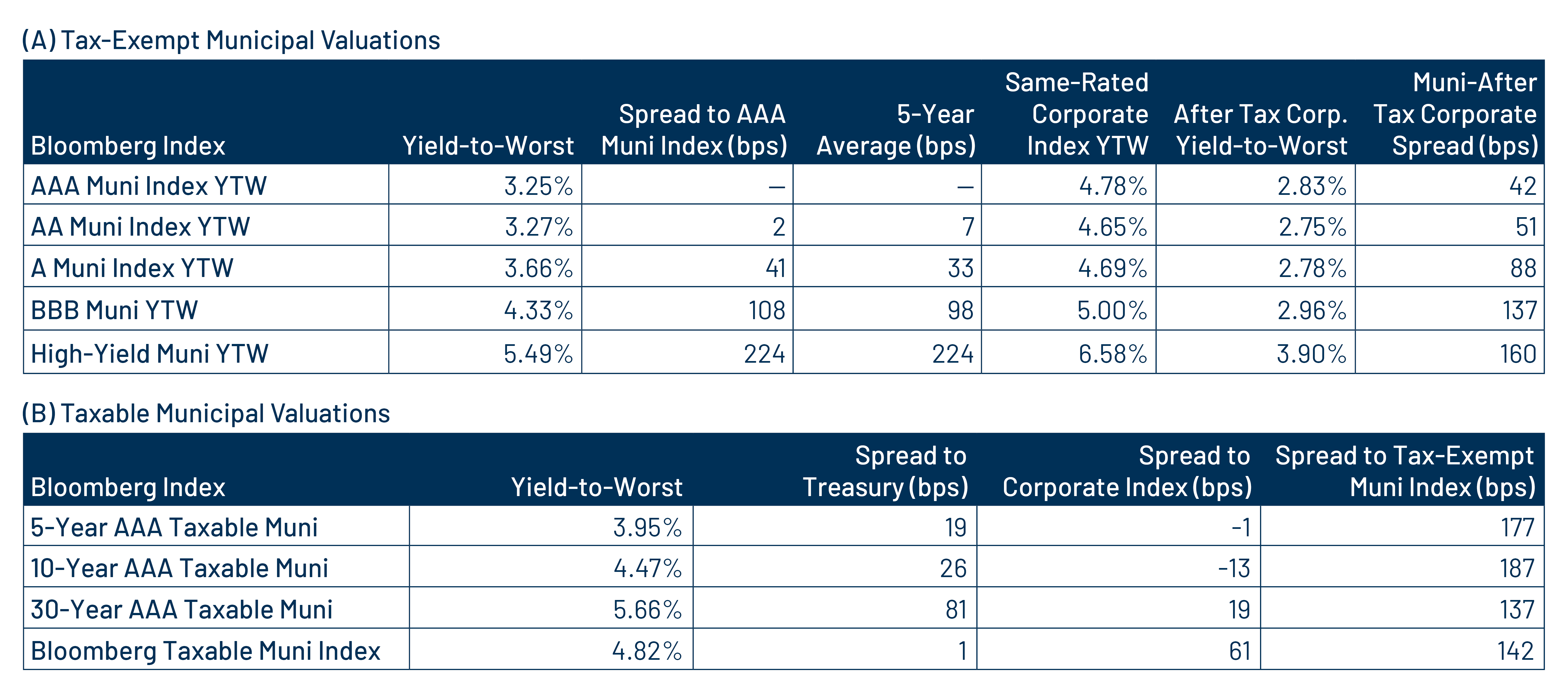

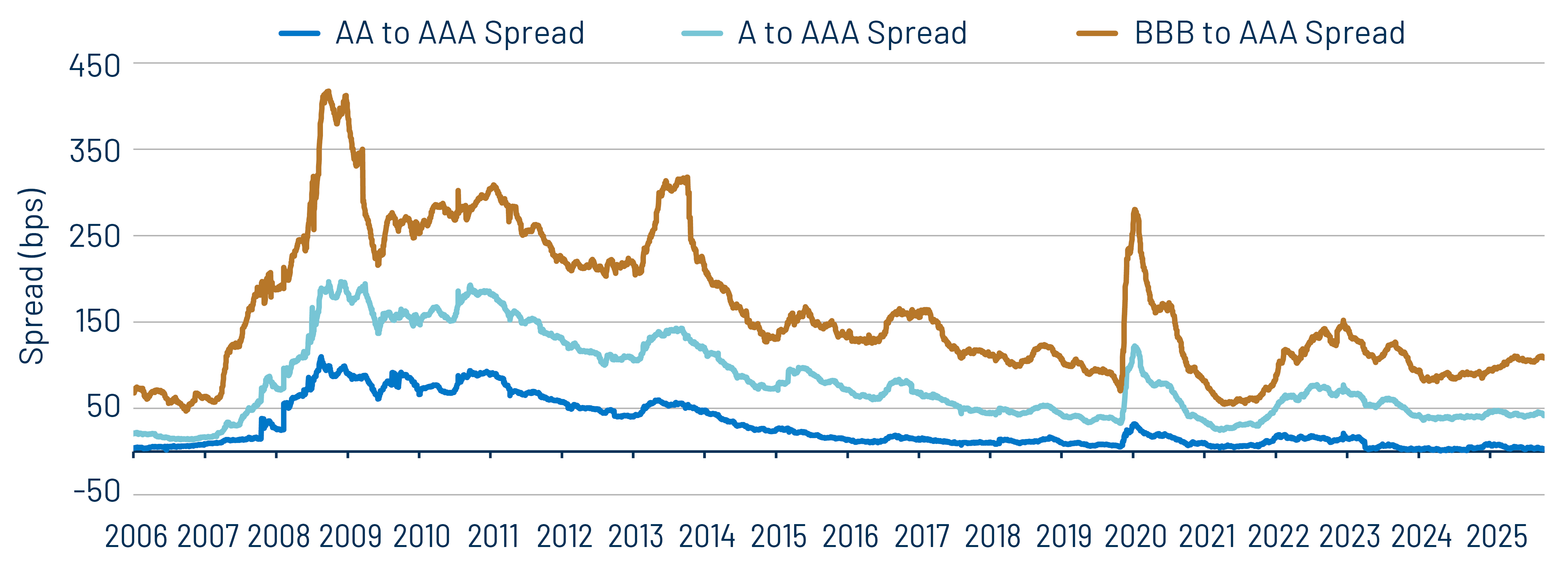

Theme 3: Tight municipal credit spreads warrant disciplined credit selection.