Macros, Markets and Munis

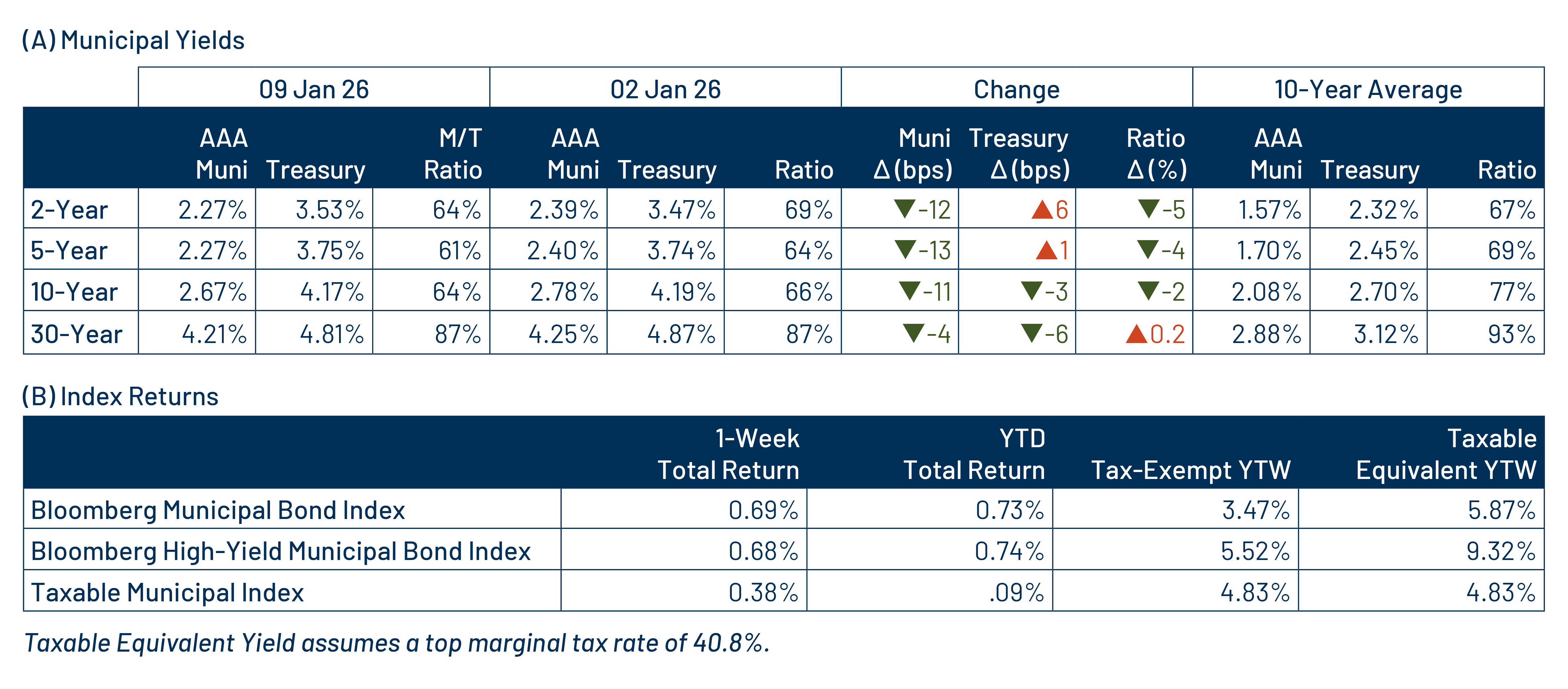

Munis rallied last week as the Treasury curve flattened, with yields moving higher in short maturities and lower in longer maturities. The high-grade muni curve moved lower across tenors, decreasing 12-13 basis points (bps) at the front of the curve and moving 4 bps lower in longer maturities. Muni technicals were supported by strong demand amid a limited new-issue calendar. Markets were focused on geopolitical developments following the US action involving Venezuela last week, while incoming data pointed to a softening economy. Manufacturing activity slowed and fell below expectations. December nonfarm payrolls rose by just 50,000, down from the prior month and below expectations. JOLTS data showed job openings falling to the lowest level in over a year. Meanwhile, consumer sentiment as measured by the University of Michigan improved and exceeded expectations. This week we provide a 2026 outlook for the muni market.

Improved Demand and Limited New-Issue Supply Bolster Muni Performance

Fund Flows ($1.5 billion of net inflows): During the week ending January 7, weekly reporting municipal mutual funds recorded $1.5 billion of net inflows, according to Lipper. Long-term funds led at $854 million of inflows, while intermediate funds recorded $456 million of inflows and the short-term and short/intermediate categories recorded $144 million of inflows. Last week’s inflows marked a seventh consecutive week of inflows.

Supply (YTD supply of $7 billion; up 17% YoY): The muni market recorded $7 billion of new-issue supply last week to kick off the year, up $1 billion (17%) from the first week of last year. This week’s calendar is expected to jump to $12 billion. The largest deals include $1.5 billion New York City Transitional Finance Authority (personal income tax) and $850 million California Community Choice Financing Authority transactions.

This Week in Munis: 2026 Outlook

Munis posted positive returns in 2025 as the Federal Reserve (Fed) continued its rate cutting cycle, but the market underperformed other fixed-income asset classes due to record supply conditions. Looking at the year ahead, we believe that these headwinds can shift and bolster the muni market and contribute to improved municipal performance.

Technicals

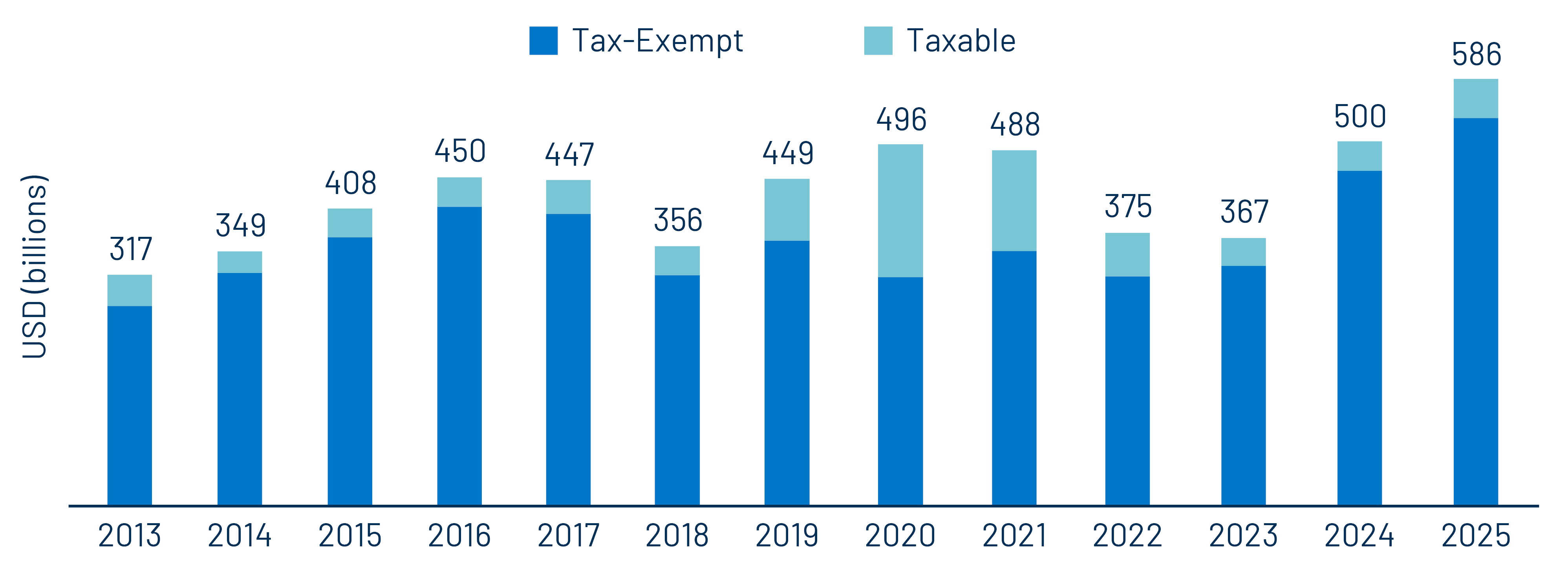

Supply: Following two consecutive record supply years in 2024 and 2025, we currently do not see major impetus for supply levels to materially decline in 2026. Inflation pressures have increased the costs of infrastructure projects, and we anticipate demand for infrastructure will remain elevated and still recover from the muted issuance observed in 2022 and 2023. We expect 2026 supply to remain in the range of what we have observed over the past two years of $500-$600 billion.

Demand: In 2024 and 2025, municipal mutual funds recovered just $100 billion of the $150 billion of outflows from funds during the 2022 and 2023 Fed hiking cycle. Many attribute the slow recovery to the lackluster recent muni performance along with the attractive income opportunities that have been available in shorter-duration cash equivalents. As the Fed is expected to move the fed funds rate closer to 3% by the end of 2026, we anticipate the relatively attractive income opportunities offered by municipals to support demand and the technical environment throughout the year.

Fundamentals

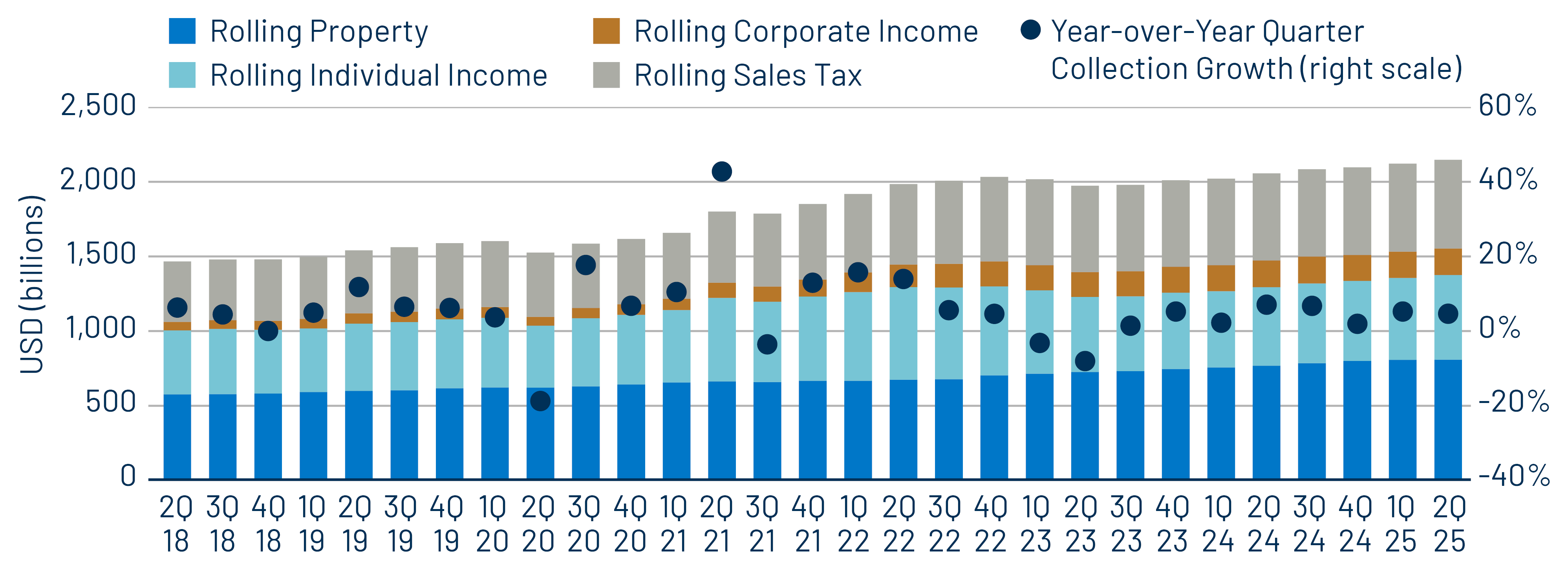

Municipal credit quality improved in 2025 as strong domestic growth contributed to record tax collections and upgrades that outpaced downgrades. Western Asset expects economic growth to continue and support traditional municipal credit quality in 2026. While the pace of upgrades relative to downgrades is likely to decelerate, we attribute much of this deceleration to the fact that many municipalities have reached peak or near-peak credit quality and anticipate credit conditions will remain strong overall. Although we expect traditional state and local credit to remain resilient, headline risks may emerge in select high-yield segments and sectors potentially affected by federal spending reductions.

Valuations

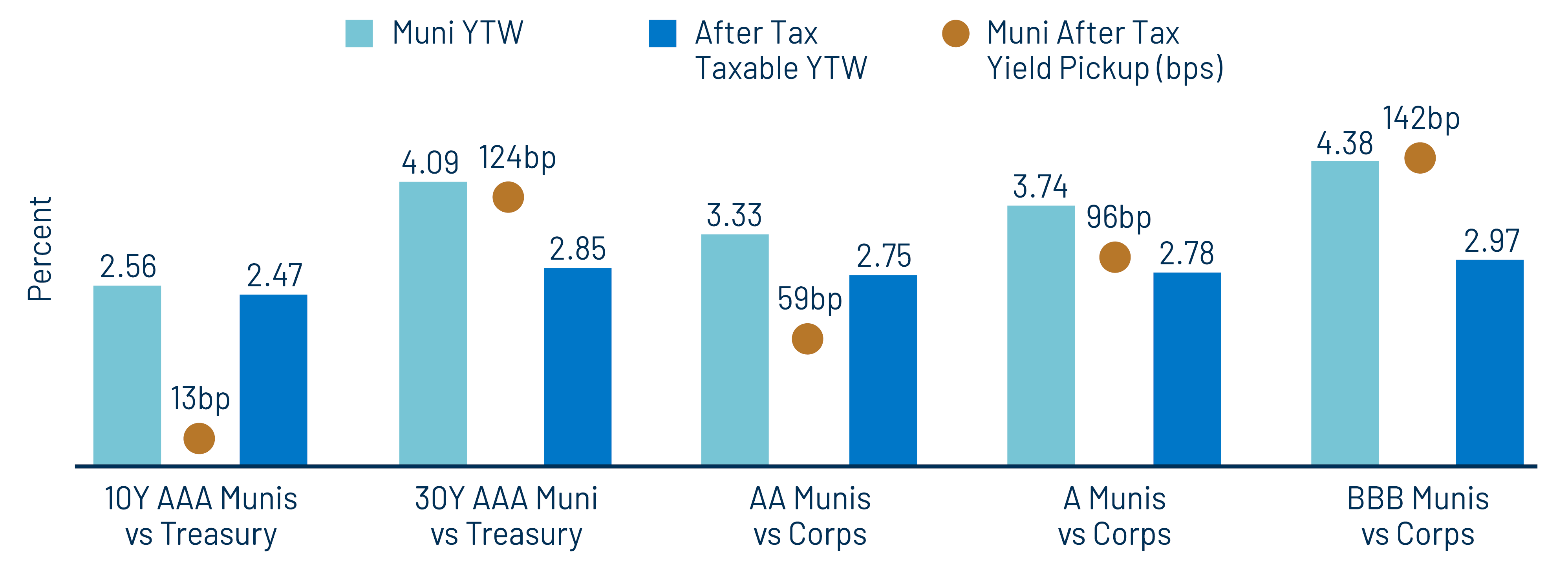

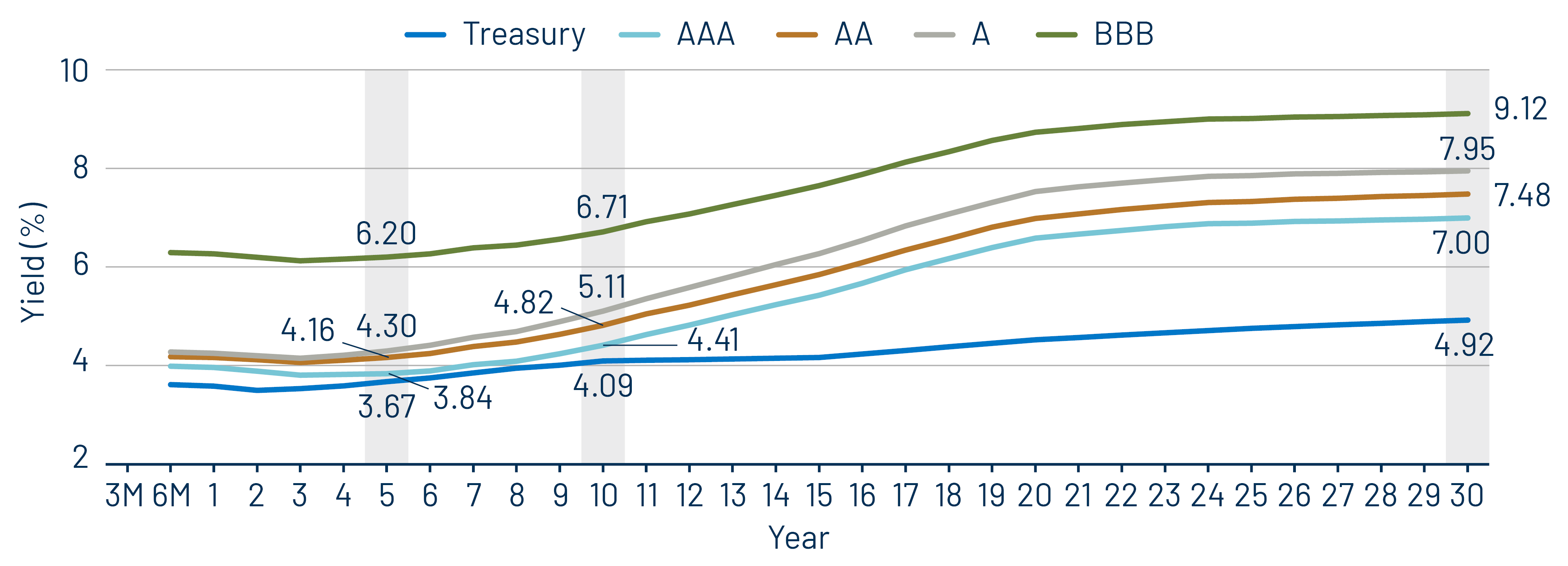

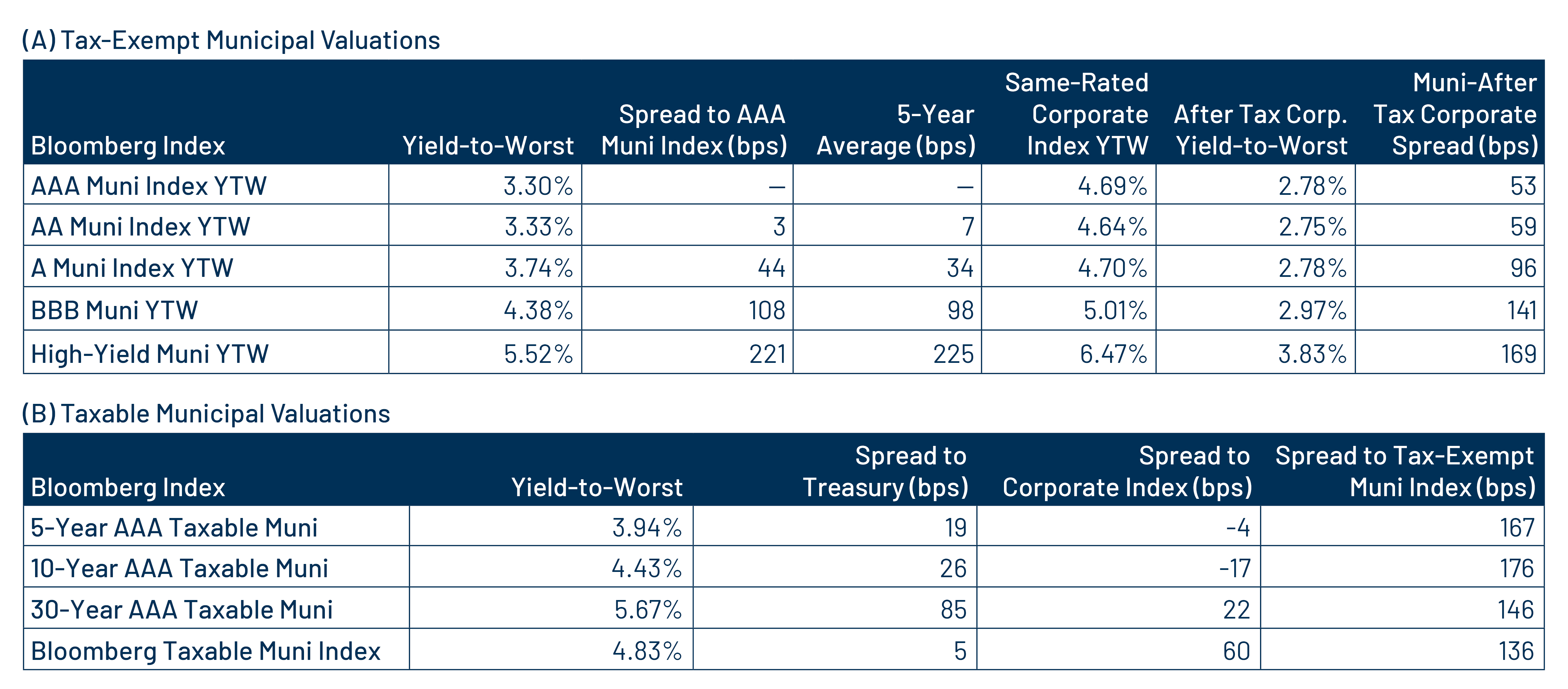

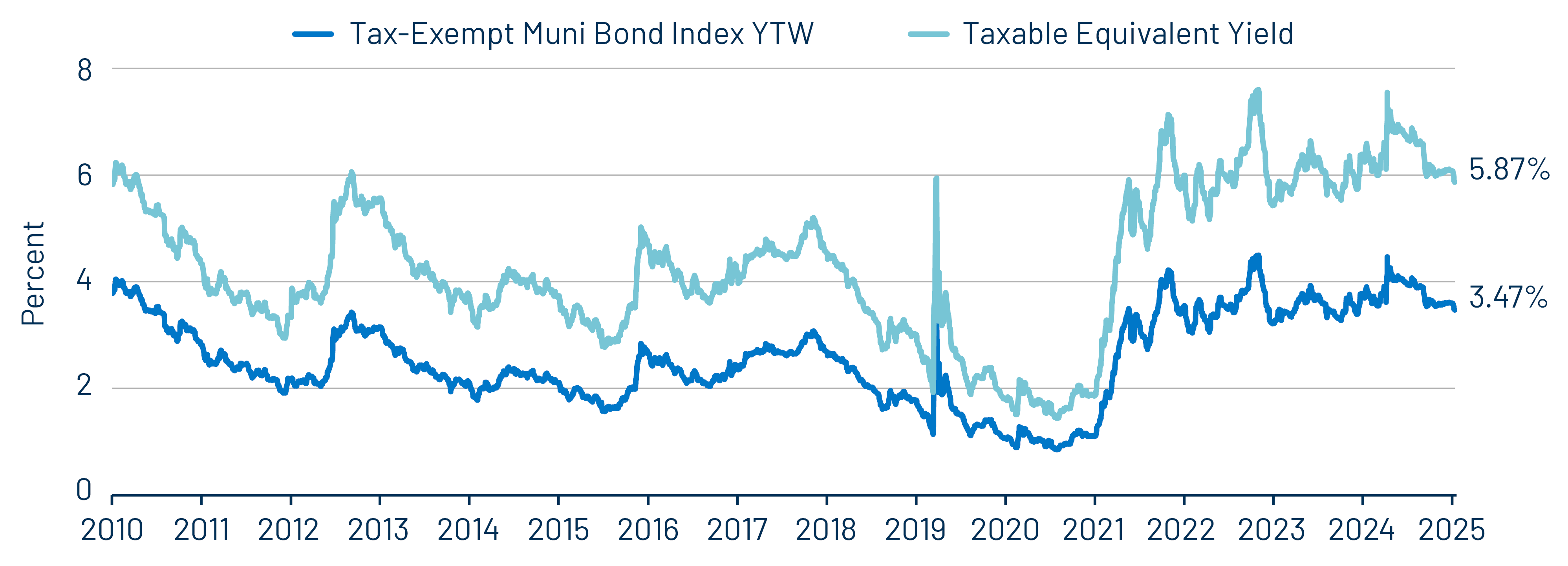

Record supply and relative underperformance in 2025 have improved municipal bond valuations heading into 2026. The Bloomberg Municipal Bond Index yield of 3.47% remains well above its 10-year average and equates to a taxable-equivalent yield of 5.87%, exceeding yields available in comparably rated taxable fixed-income markets. However, Western Asset believes this headline average masks meaningful valuation disparities across both the yield curve and credit cohorts that can be exploited through active management.

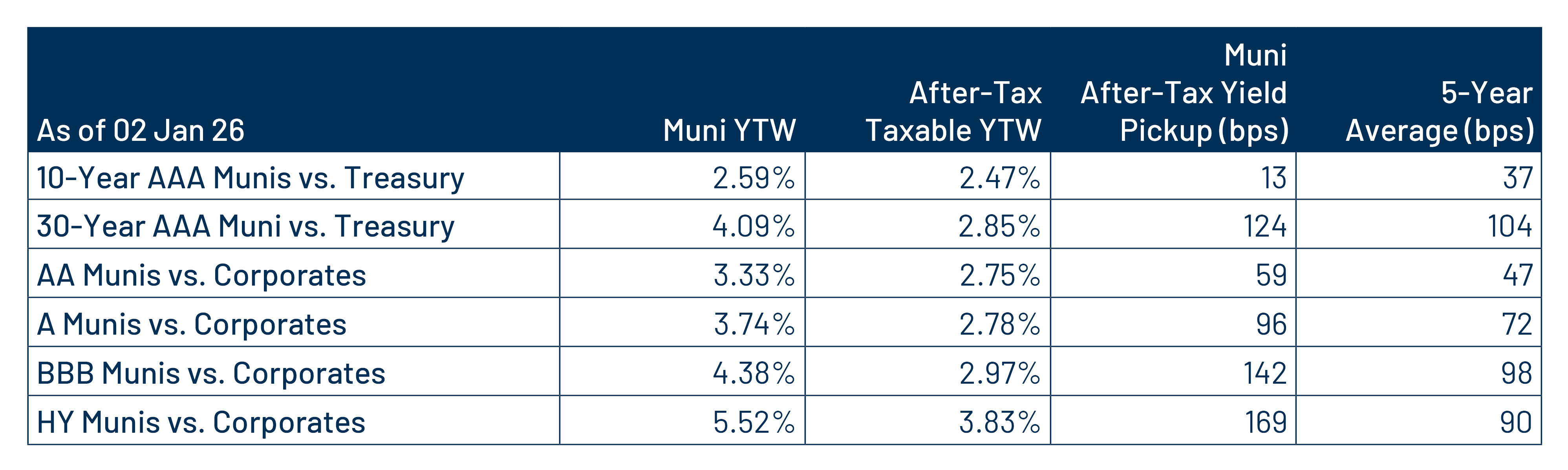

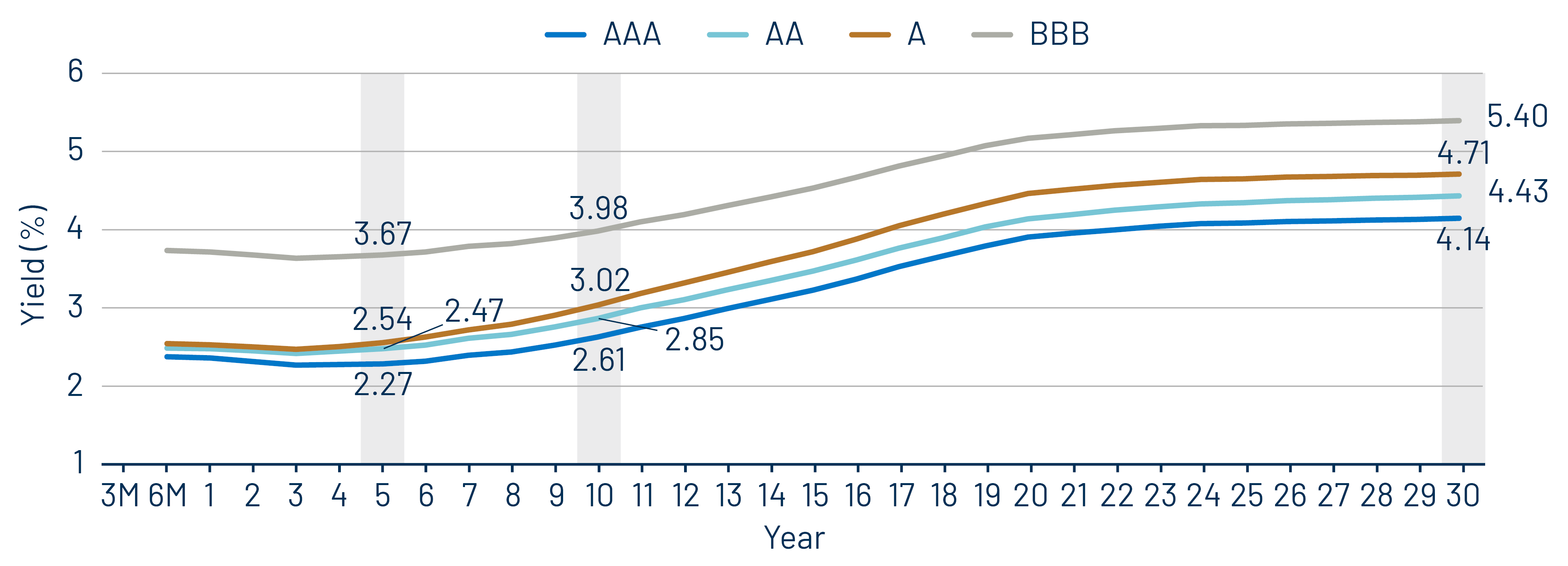

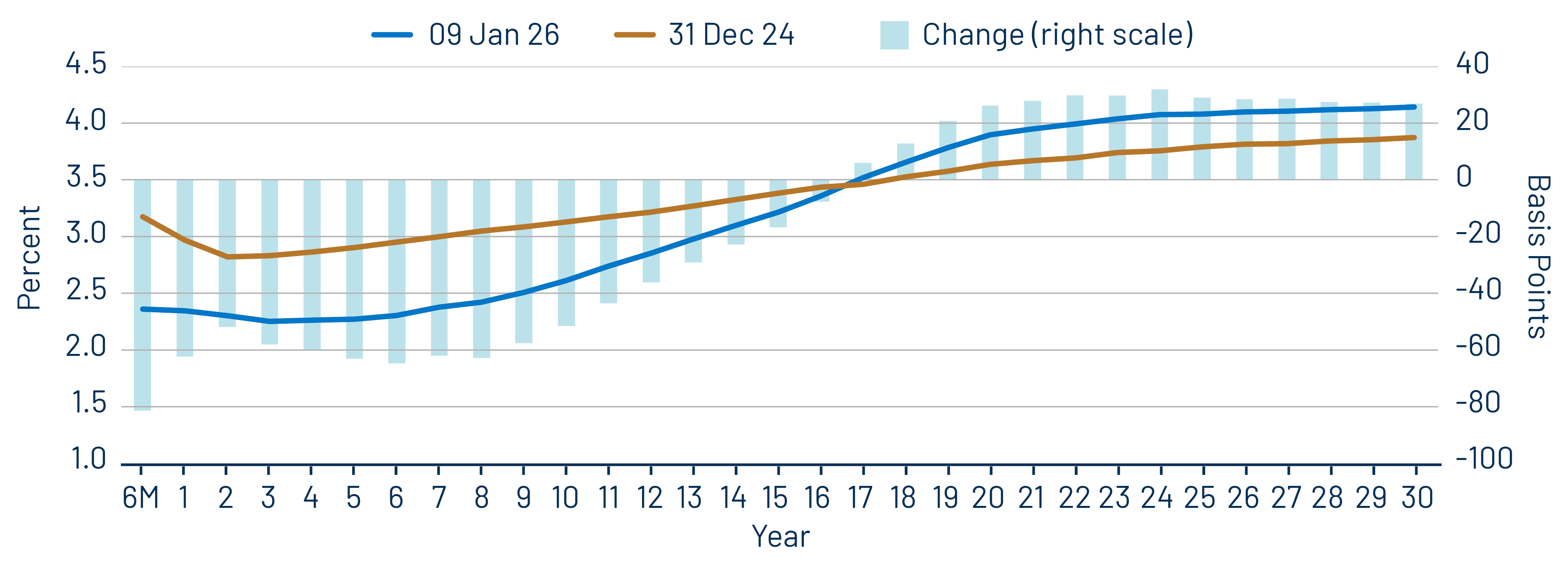

Persistent demand in short and intermediate municipal maturities, largely from separately managed accounts, has contributed to curve steepening and pressured relative value inside 10 years. The 10-year AAA municipal yield of 2.59% provides only 13 bps of incremental after-tax yield relative to the 10-year Treasury at the top marginal tax rate. By contrast, the 30-year AAA municipal yield of 4.09% offers approximately 120 bps of after-tax yield advantage over its Treasury counterpart under the same tax assumption. At the same time, relatively stronger spread tightening in corporate markets over the last year has enhanced the relative attractiveness of lower investment-grade municipal credit, as indicated by above-average after-tax yield advantages versus comparably rated corporate bond indices for investors in the highest tax bracket. Western Asset believes that active vehicles capable of navigating these valuation disparities can deliver favorable after-tax outcomes in 2026.

Municipal Credit Curves and Relative Value

Theme #1: Municipal taxable-equivalent yields and income opportunities remain at elevated levels.

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

Theme #3: While high-grade muni valuations versus Treasuries have richened, muni credit segments offer relative value compared to their corporate counterparts.