New-home sales were essentially flat in June, with a +0.6% change reported, versus a monthly margin for error of 13%. This follows housing starts data released last week that showed a -4.6% decline in single-family starts, versus a margin for error of 11.4%.

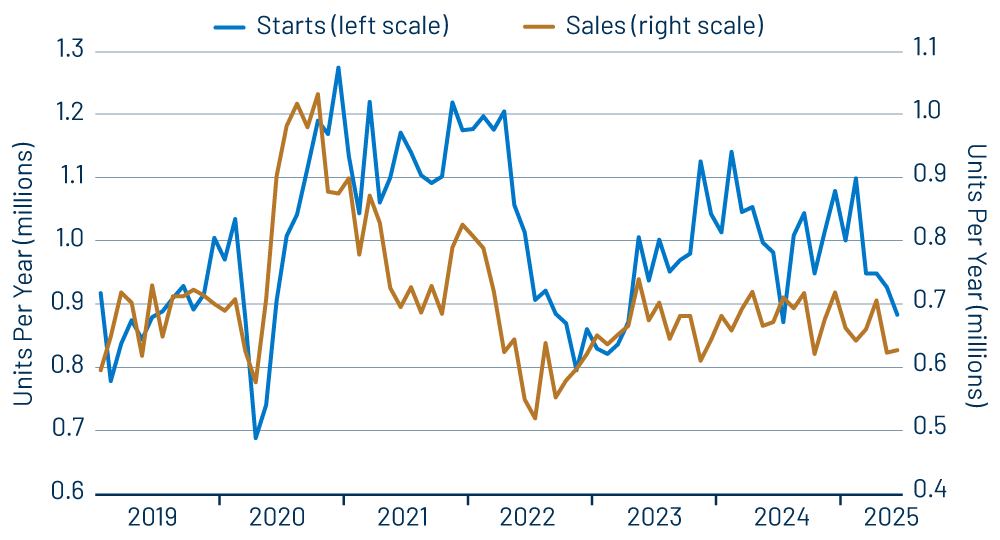

Exhibit 1 provides a succinct picture of the market for new, single-family homes. First, both demand and supply surged when the economy reopened following the Covid shutdown. Demand (new-home sales) then pulled back to pre-Covid levels over 2021 and early-2022, abetted no doubt by sharp increases in mortgage interest rates in 2022. However, supply (single-family starts) stayed elevated longer and then resurged in late-2023 despite the absence of any resurgence in demand.

As would be expected, both the elevated starts in late-2021/early-2022 and 2023-2024 led to sharp increases in inventories of unsold new homes. Indeed, despite the sustained move lower this year, start levels have remained higher than is consistent with home sales rates—as suggested by Exhibit 1—and new-home inventories have continued to rise (Exhibit 2). Through June, inventories of unsold new homes were equivalent to nearly 10 months’ sales, compared to “normal” inventory-sales ratios of about four to five months’ sales.

Where do we go from here? Well, note that single-family starts are nearly back to a rate consistent with new-home sales, and further note that despite the much-higher mortgage interest rates, new-home sales have remained at pre-Covid levels. The current problem is the inventory overhang. Will home builders and their financiers be willing to continue to carry high inventories on their books? If not, start levels will have to drop further, likely substantially so.

Meanwhile, the multi-family housing market is clearly overbuilt. Multi-family construction ramped up with the post-Covid reopening even more than did single-family construction, and it stayed elevated through the end of 2022. The gestation period for multi-family units is much longer than that of single-family homes, and those 2021-2022 multi-family starts are now hitting the rental market. Multi-family starts have dropped back to pre-Covid rates, but multi-family units completed or still under construction remain quite elevated and will be a drag on the rental market in many regions.

Finally, absent a sharp decline in mortgage rates in the near future, it is hard to see much upside potential for new-home sales. A best-case scenario for residential construction is that it holds steady at current rates, which are, again, about equal to pre-Covid norms. Alternatively, we might see both single- and multi-family construction rates decline further in coming months.

Truth in advertising: two years ago, we were looking for a sharp drop in single-family construction as single-family starts rebounded. Instead, homebuilders held up activity levels until this year. We’ll see if they can sustain these levels in the face of a severe inventory overhang.