Performance Overview

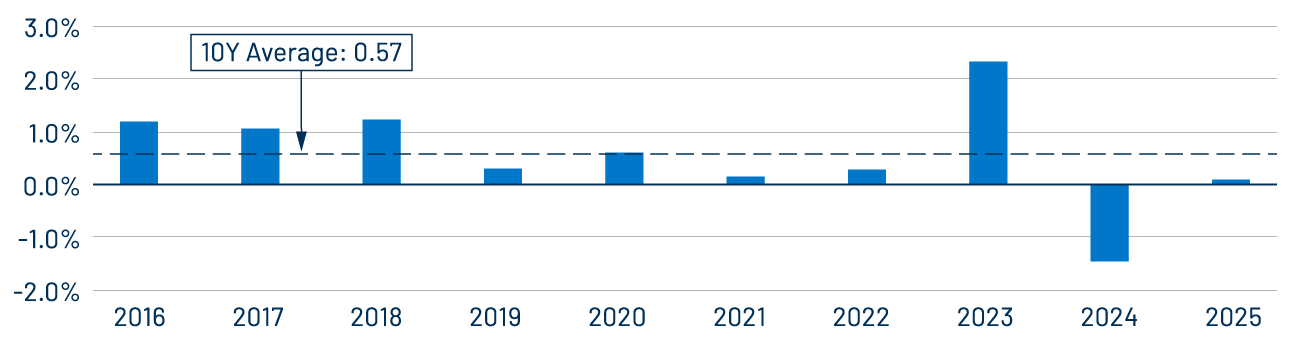

Munis posted below-average returns in December.

Municipal bonds posted positive returns in December, as reflected by the Bloomberg Municipal Bond Index’s total return of 0.09%. That is below the prior 10-year average December return of 0.57% as Treasury rates moved higher during the month amid an uptick in hawkish language from the Federal Reserve. Municipals outperformed Treasuries and corporate bonds, which returned -0.33% and -0.20%, respectively, amid improved technicals during the month.

Supply and Demand Technicals

The tax-exempt muni supply maintained an elevated pace, as observed throughout the year.

The month of December showed a strong supply and demand technical backdrop, which was a key contributor to municipals’ outperformance. New-issue volume remained robust and conclud-ed the record year of issuance. Total December new-issue volume reached $40 billion, down 12% from November levels, but up 25%from December 2024. Through 2025, municipalities issued a record $588 billion of new issuance, up from $500 billion during the prior record year.

From the demand perspective, investor flows accelerated into the end of the year. Lipper report-ed $5.9 billion of inflows into municipal funds, 60% higher compared to November’s $3.7 billion. Demand continued to concentrate in longer-maturity funds, with the long-term category attract-ing $3.0 billion of inflows.

Fundamentals

Improved credit trends were reflected in ratings activity in December.

Municipal credit fundamentals continued to show resilience despite slowing growth trends. Census-reported 2Q25 state and local tax collection estimates, which capture fiscal year-end results for most governments, showed 12-month trailing collections increased 4% year-over-year (YoY) to $2.1 trillion, a record high. Twelve-month trailing individual income tax collections rose 8% YoY, sales tax collections increased 2% YoY while corporate income tax collections were relatively flat. Rolling 12-month property tax collections, the primary revenue source for local governments, increased 2% YoY.

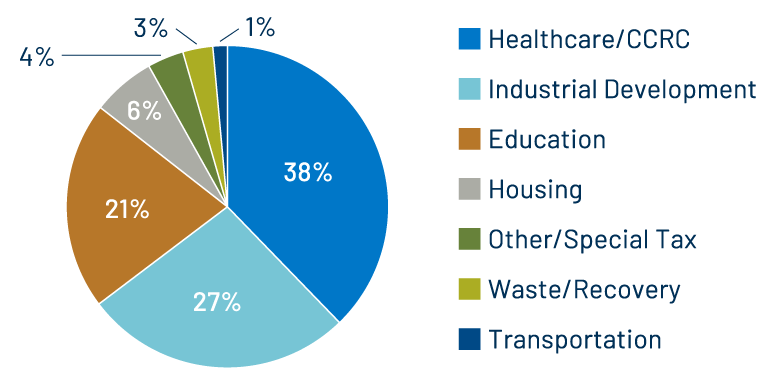

The improved credit trends were reflected in ratings activity. Public rating agency upgrades outpaced downgrades by more than 2 to 1, according to Bloomberg. Muni default activity also remained limited and largely isolated to select high-yield sectors and issuers. Through December 15, 2025, the muni market recorded 51 first-time payment defaults totaling $1.5 billion, down from 60 defaults totaling $2.1 billion in 2024, according to Bloomberg.

Valuations

Municipals generally offered higher after-tax yield advantages than at the start of the year.

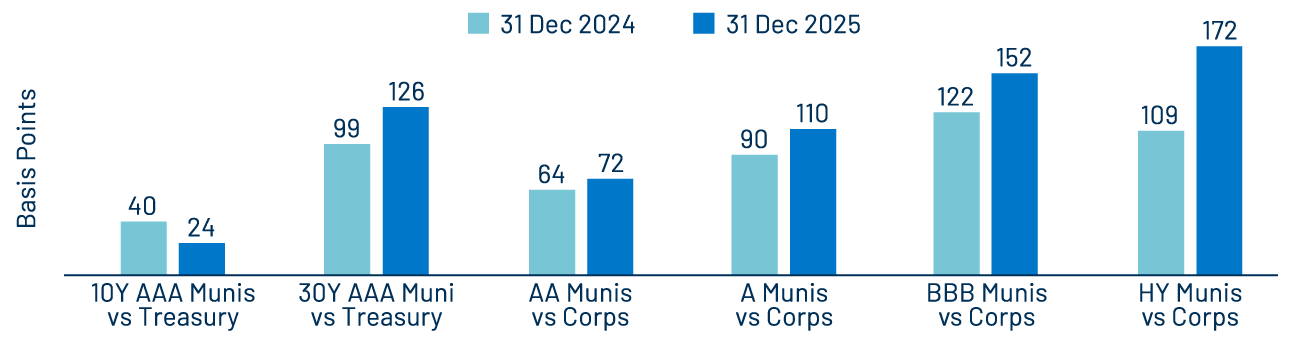

Relative underperformance and record supply conditions improved the tax-efficient income op-portunities offered by munis entering 2026. The average investment-grade municipal yield, as measured by the Bloomberg Municipal Bond Index, ended the year just 14 bps lower at 3.60%. By comparison, yields on the Bloomberg Treasury Index and Bloomberg Corporate Index declined by 56 bps and 52 bps, respectively. Given the smaller magnitude of the municipal yield decline, after-tax relative valuations improved across most segments of the curve and credit structures over the year.