For the typical home buyer today, housing affordability is not actually as bad as the news media might lead you to believe. It is in fact affordable for the average buyer. We’ve seen demographics change over the last several decades, and the composition of who can and is buying a home today has shifted as well. As the population ages and household formations occur later in life, the average homebuyer age has increased from 32 years old in 1990 to 59 years old today, according to the National Association of Realtors.

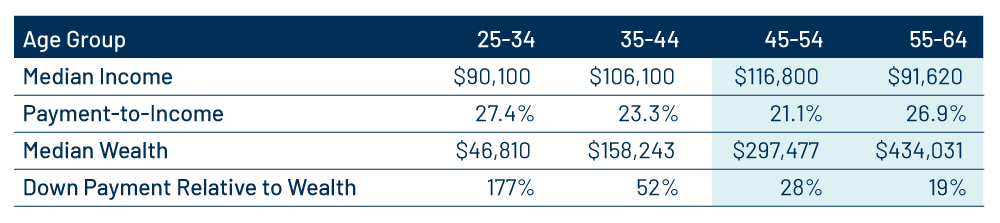

Most affordability analysis looks at median income versus median sales price, but the analysis is missing one important element: the fact that today’s buyer is not the median-aged worker. For individuals and households, wealth and incomes rise with age, generally peaking in the 50s. Currently, median households in the US in the 45-54 age group are earning $116,000 per year versus the median worker household of 25- to 34-year-olds earning $90,100, according to the Census Bureau—a 30% increase. Additionally, they have accumulated more wealth given that the average home buyer of 59-year-olds has over $400,000 in accumulated wealth or almost 10 times that of the youngest households. This makes the current buyer base well-suited to afford the typical down payment and monthly mortgage payment.

Exhibit 1 presents a hypothetical affordability scenario for four different age groups. It assumes the median home price of $414,300 in November 2025 and the average mortgage rate of 6.32%. That results in an average annual mortgage payment of $24,672 (or $2,056 per month) and a 20% down payment of $82,860.

When we look at these payment-to-income ratios and housing costs relative to wealth, adjusting for the aging population, these ratios are actually in line with or even better than historical averages at the national level.

While there may be plenty of younger households wanting to start families and wishing for the good old days of abundant supply and lack of older generations to compete with to buy those homes, the current marginal homebuyer has significantly more age and wealth than homebuyers had historically. We do think that programs for first-time homebuyers could allow younger folks to break into the housing market more easily, like down payment assistance via tax credits or subsidized mortgage rates. Additionally, the primary reason we believe that housing is unattainable for more Americans today is the lack of new supply. Tight supply has created the dynamic where buyers need to be well above the median income level to afford today’s median-priced home.

If home prices were truly unaffordable, we would have expected prices to decline, but this analysis shows that today’s buyers can afford today’s prices and why prices remain so stubbornly high. Ultimately, addressing the housing affordability challenge for younger generations will require a multi-pronged approach focused on increasing supply, supporting first-time buyers and recognizing the demographic shifts that have fundamentally altered the housing market landscape for generations to come.