When evaluating a money market fund, investors tend to look at characteristics that help them judge the attractiveness of a fund (e.g., cut-off time, yields and returns), including risk (e.g., weighted average maturity and life) and even the liquidity (e.g., size of the fund), but one factor often overlooked is the Net Asset Value per share, or NAV. For government and Treasury funds, and also retail prime and municipal styles of money market funds, the NAV per share remains constant at $1.00. However, there is also a “shadow” NAV that fund managers publish so that investors can track the market value of the underlying fund portfolio without impacting the value of an investor’s share position, which remains stable at $1.00.

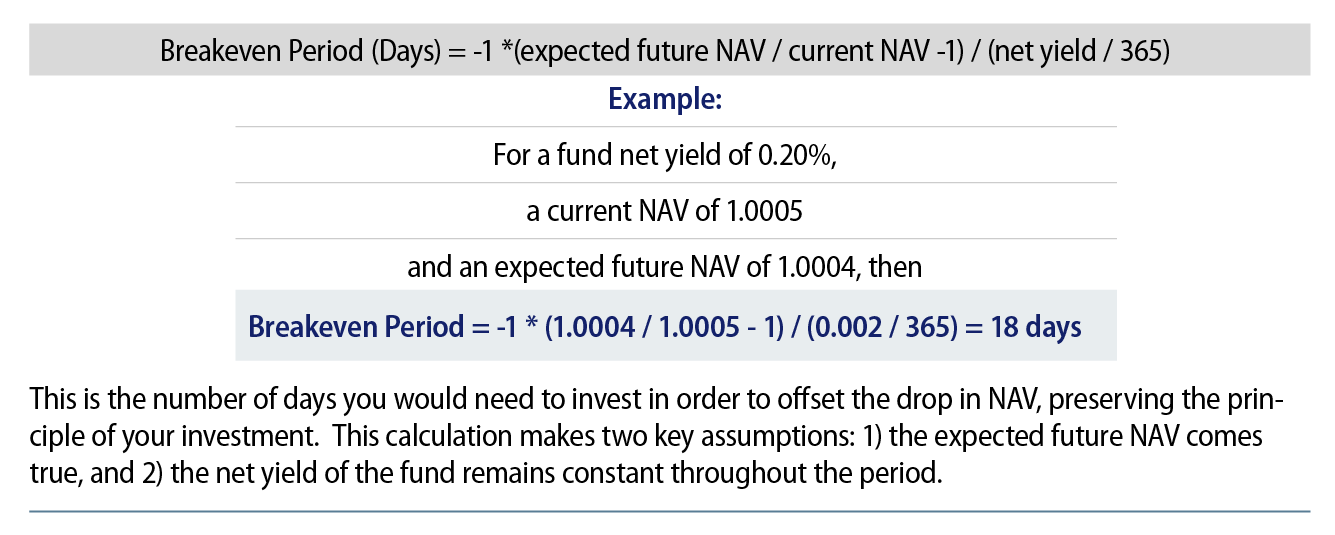

Conversely, for Floating Net Asset Value (FNAV) institutional prime or municipal money market funds, shares are priced to four decimal places (i.e., $1.0000) and may fluctuate in small movements above and below the $1.0000 mark. For these funds, the NAV has a much more elevated role, as it can directly impact the total return of a fund investment. It should therefore be an integral component of the prime money market fund decision-making process. Although an additional step, the consideration of the NAV should not in isolation be enough to walk away from the yield advantage that institutional FNAV prime money market funds may offer. By carefully considering the simple relationship between NAV movements and yield, a suitable breakeven investment period can be calculated to help avoid breaking the key objective for all money market fund investors—the preservation of principle.

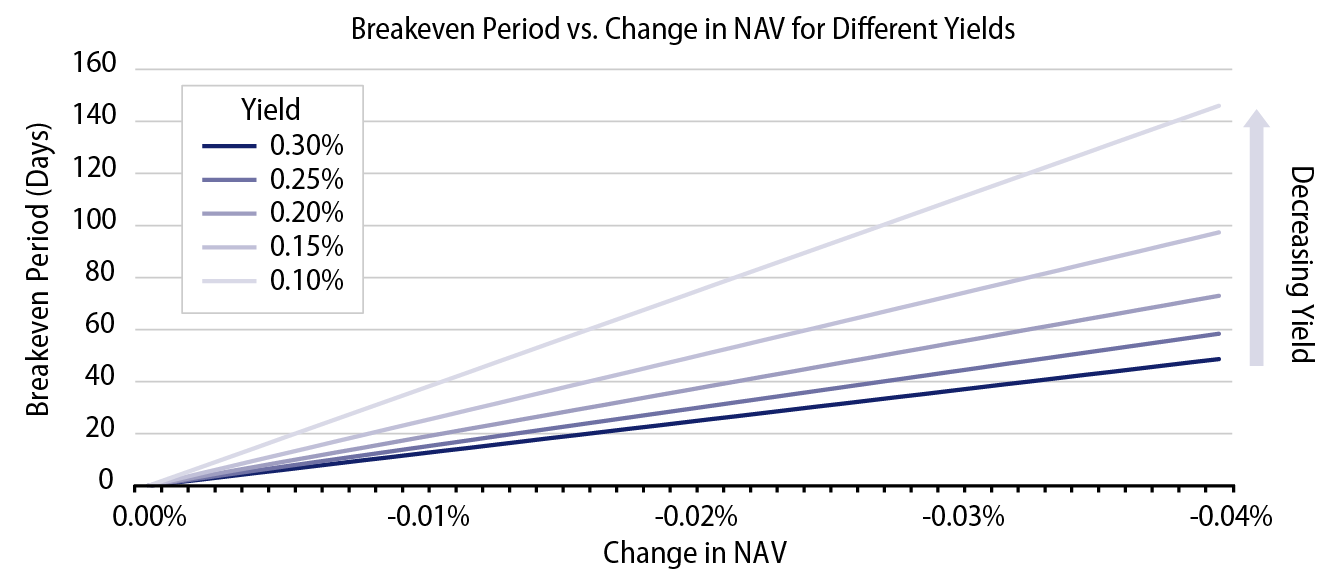

Using the calculation in Exhibit 1 you can see that the breakeven period becomes longer as yields fall, and it becomes longer as the expected future drop in NAV increases.

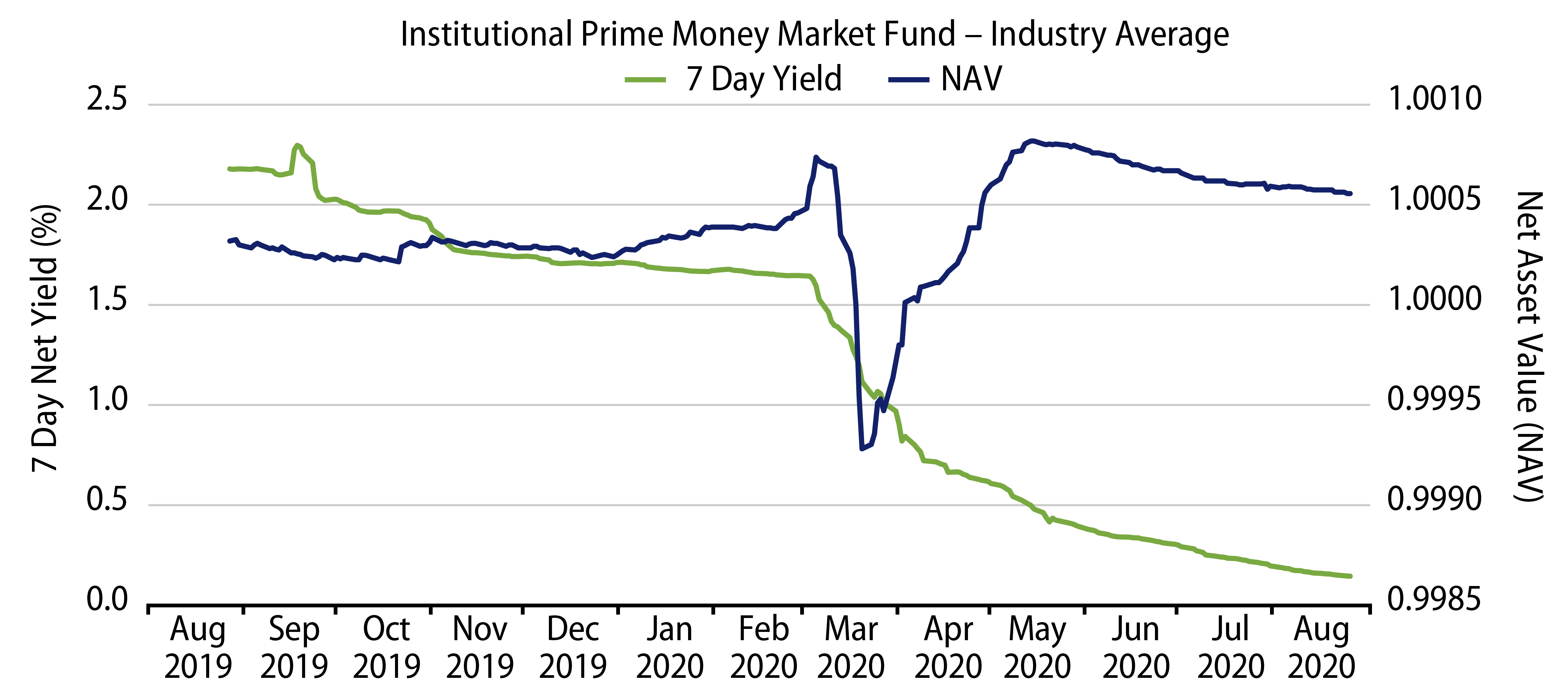

Both of the considerations of yield and NAV movements are particularly heightened in today’s market environment. First, yields have been falling considerably as the world’s central banks have cut interest rates in reaction to the economic crisis brought about by COVID-19. As yields have fallen, the amount of potential income from prime money market funds available to offset the loss from a drop in NAV has decreased.

Similarly, as the economy initially recoiled from crisis then subsequently began to heal when accommodative central bank monetary policies took effect, bond yields rose and fell while credit spreads widened then tightened, respectively, considerably increasing the volatility of the market value of securities and therefore also the NAVs of institutional prime money market funds.

Using the information presented here, investors can apply a rational and methodical approach to evaluating the NAV of prime money market funds in order to make a suitable investment decision based on their expected investment horizon. Although the yield advantage between prime and government style money market funds has come down in recent months, the potential for greater returns still remains as long as an adequate investment period can be forecast.

Overall, we believe investors should consider institutional FNAV prime funds as a useful component of their liquidity portfolios. Investors may benefit from taking a slightly longer investment horizon than offered by Constant NAV (CNAV) government funds, given the potential for relatively higher yields combined with periodic NAV fluctuations.