Macros, Markets and Munis

Municipals posted positive returns last week. The weaker-than-anticipated economic data led Treasuries lower during the week. The high-grade muni curve generally underperformed, just moving lower in shorter maturities. Muni technicals were supported by ongoing demand amid a holiday-shortened supply calendar, and economic data releases continued to rebound following the end of the government shutdown. Retail sales were lower than expected, while core Producer Price Index (PPI), which excludes food and energy, and consumer confidence data also came in below expectations. This week we break down the key drivers of the record issuance year.

Demand Remained Steady as Supply Was Limited in the Holiday Week

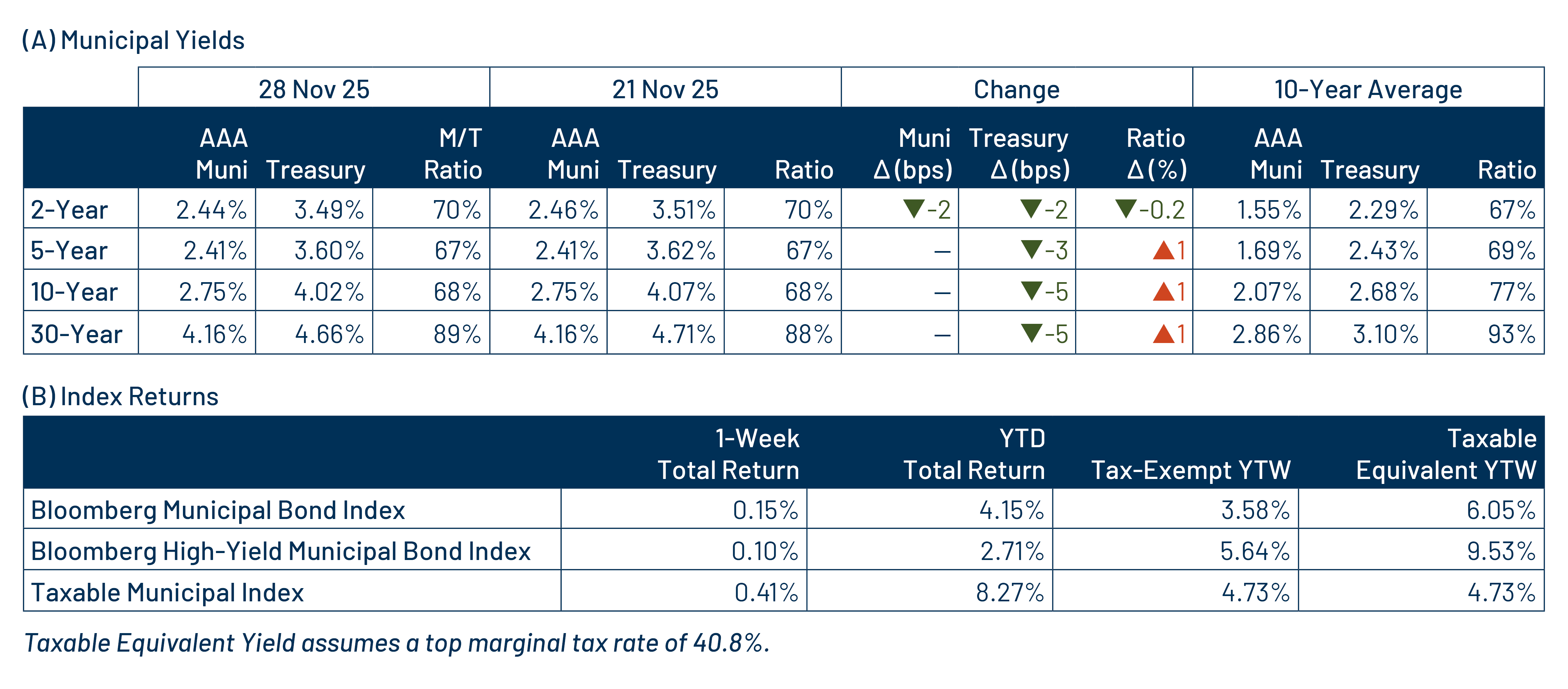

Fund Flows ($682 million of net inflows): During the week ending November 26, weekly reporting municipal mutual funds recorded $682 million of net inflows, according to Lipper. Long-term funds recorded $124 million of inflows, Intermediate funds recorded $341 million of inflows and the Short Term category recorded $142 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $47 billion.

Supply (YTD supply of $548 billion; up 16% YoY): The muni market recorded $3.5 billion of new issue supply last week, limited by the Thanksgiving holiday. YTD new issue supply of $548 billion is 16% higher from the prior year, with tax-exempt issuance up 17% year-over-year (YoY) and taxable issuance up 1% YoY. This week’s calendar is expected to pick back up to $15 billion. The largest deals include the $1.6 billion State of Connecticut and $1.0 billion New York Utility Debt Securitization transactions.

This Week in Munis: Record Supply Year

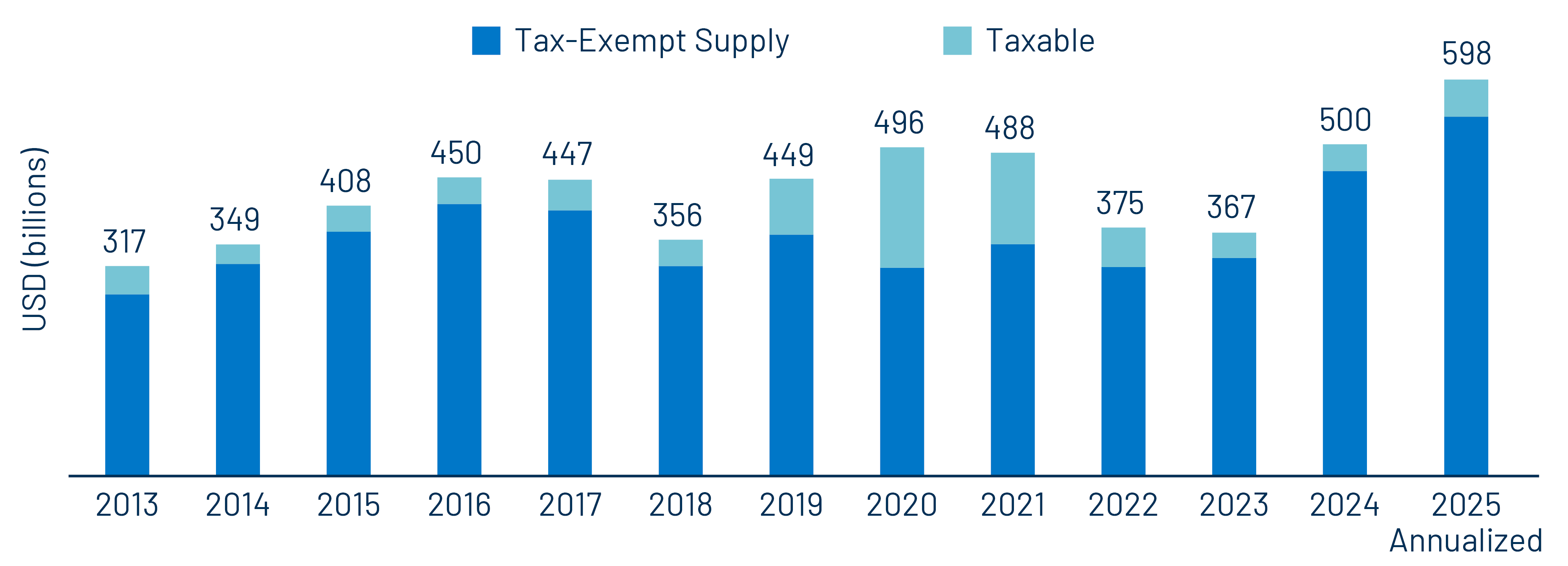

Muni supply reached $548 billion through the first eleven months of 2025, surpassing the previous calendar record of $500 billion set in 2024 and putting the market on pace to approach $600 billion by year-end. This year’s elevated issuance reflects a rebound from the muted supply environment of 2022–23, when inflation and interest-rate volatility constrained borrowing. It also reflects policy-related uncertainty, which accelerated issuance among certain sectors looking to secure market access ahead of potential changes.

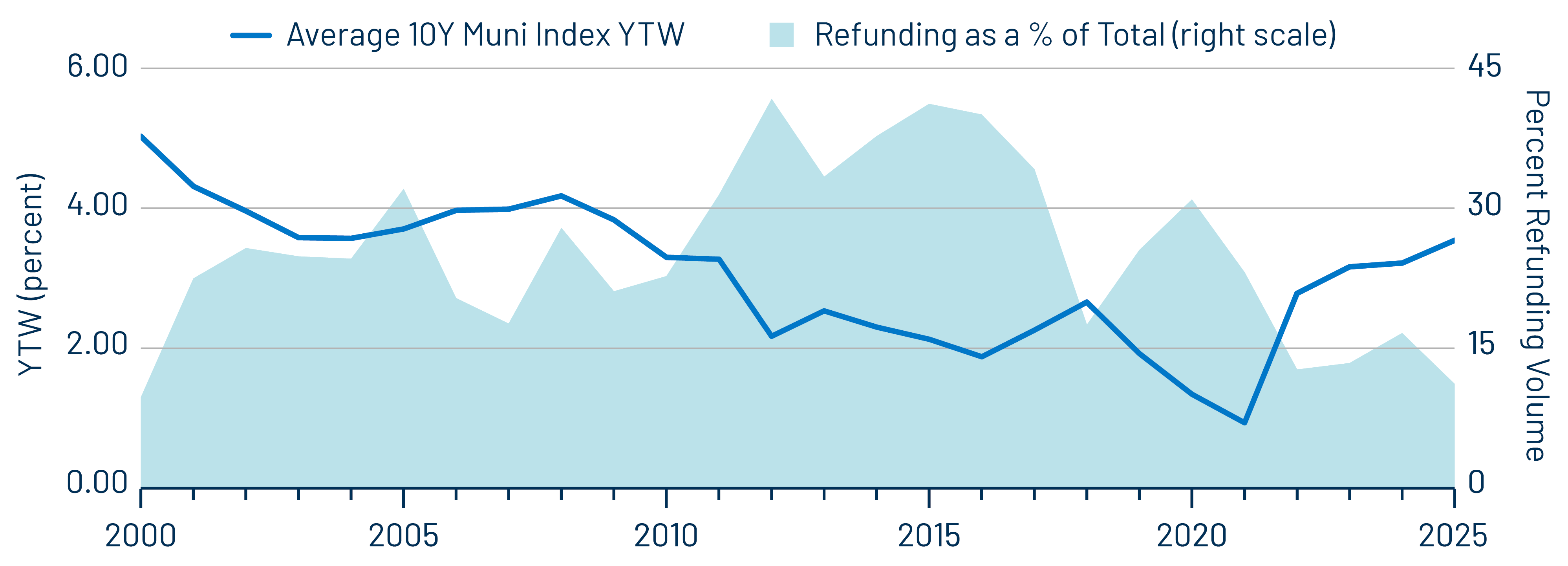

Tax Exempt vs. Taxable Issuance

YTD tax-exempt issuance of $497 billion was 17% higher than a year ago and is on pace to exceed the prior ten-year average by 27%, according to Bloomberg. The increase in volume has been driven primarily by higher new-money issuance, which accounted for 74% of total supply, per The Bond Buyer, while refunding activity has remained below ten-year norms in the current higher-rate environment. Taxable issuance totaled $51 billion YTD and is on pace to increase 38% YoY, though it remains well below the prior ten-year average, a period that included the post-TCJA spike in taxable refinancing, when issuers found more attractive economics in refinancing debt in the taxable market.

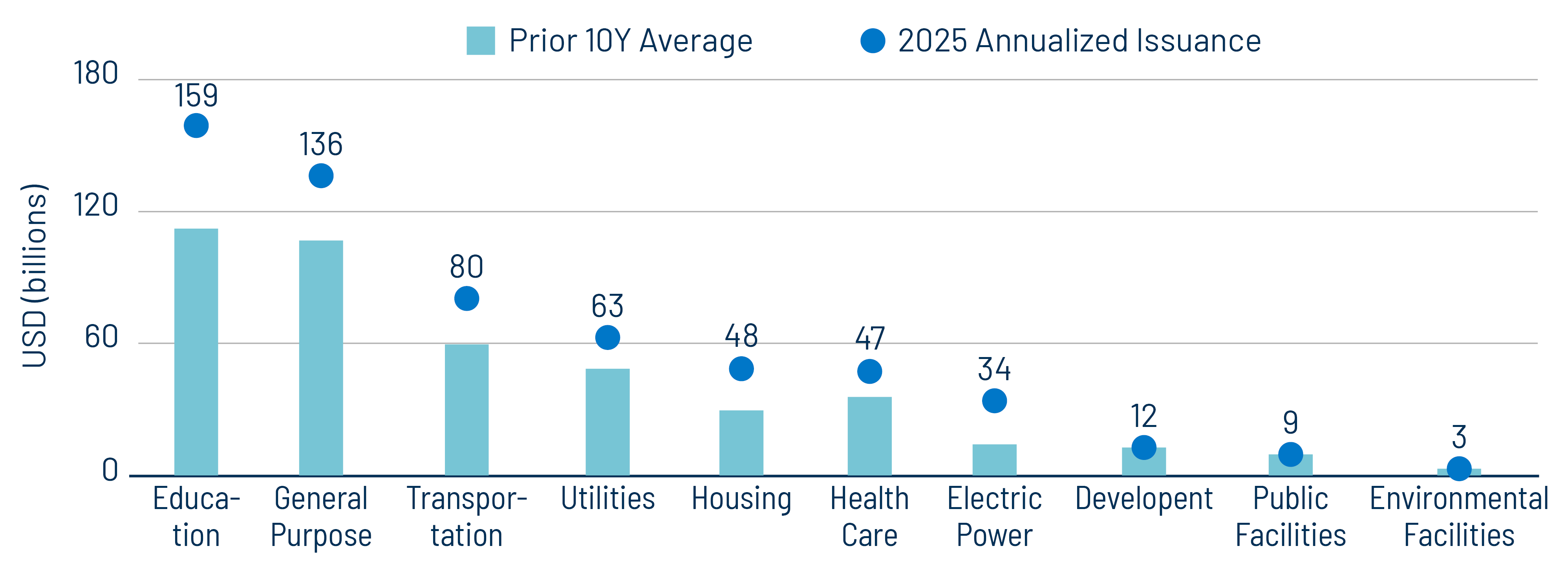

Issuance by Sector

Muni issuance has run well above ten-year averages across purpose sectors, according to Bond Buyer data through October. Notably, the Education sector’s issuance was the largest among sectors and stood 42% above its ten-year average, driven in part by early-year concerns about the sustainability of tax-exempt status.

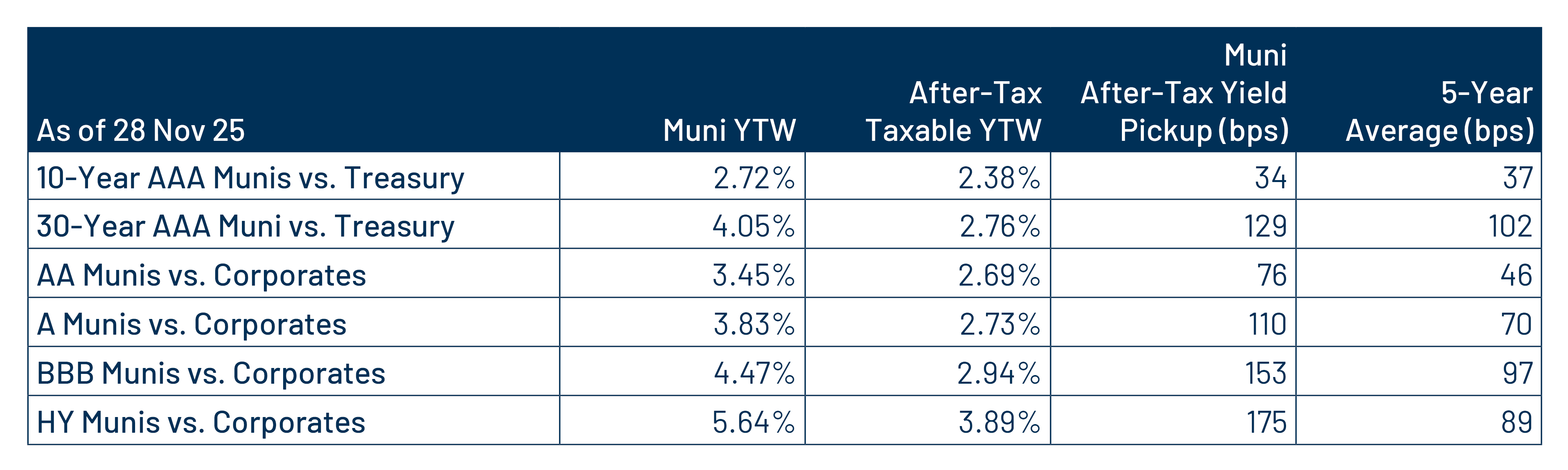

Elevated supply levels this year have contributed to municipal underperformance relative to other asset classes but also improved after-tax relative value for investors in higher tax brackets. While Western Asset expects that ongoing interest rate volatility and uncertainty around future policy changes could keep issuance elevated through the remainder of 2025 and into 2026, we also anticipate that market demand will better absorb this supply as cash deposit yields drift lower alongside expected additional Federal Reserve rate cuts. Given the attractive after-tax relative value versus other fixed-income sectors, we expect munis to capture a meaningful share of this potential demand.

Municipal Credit Curves and Relative Value

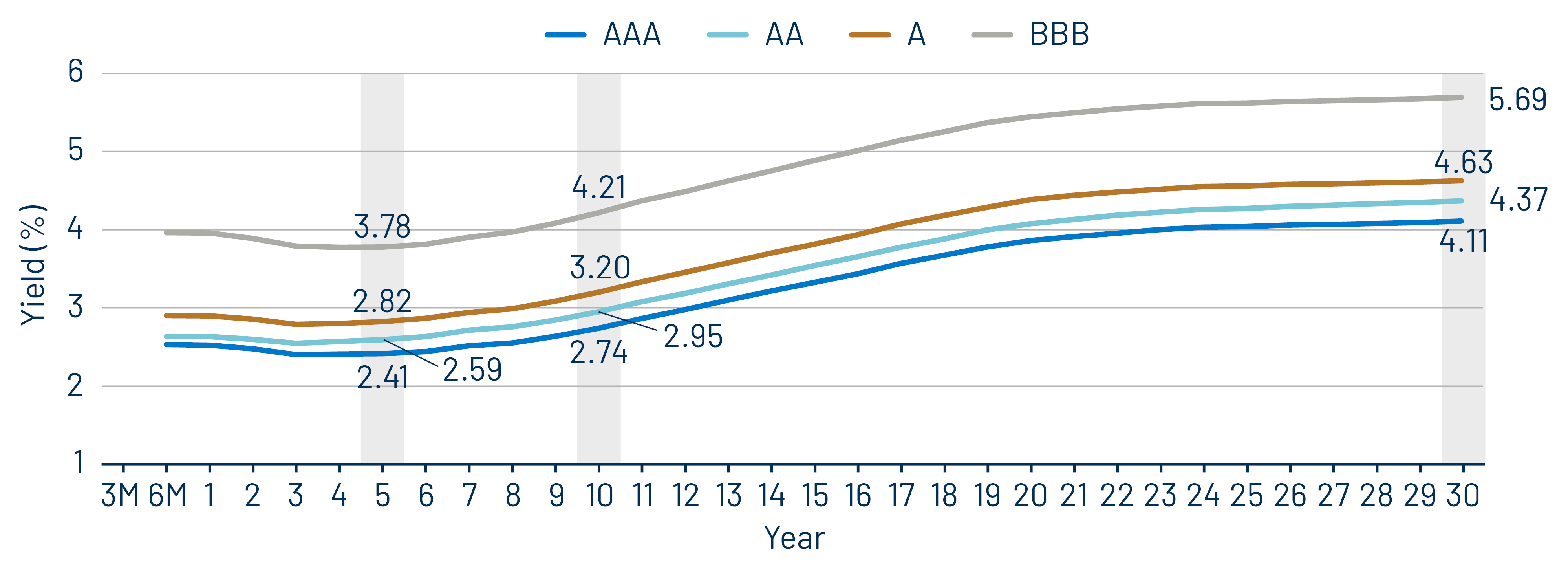

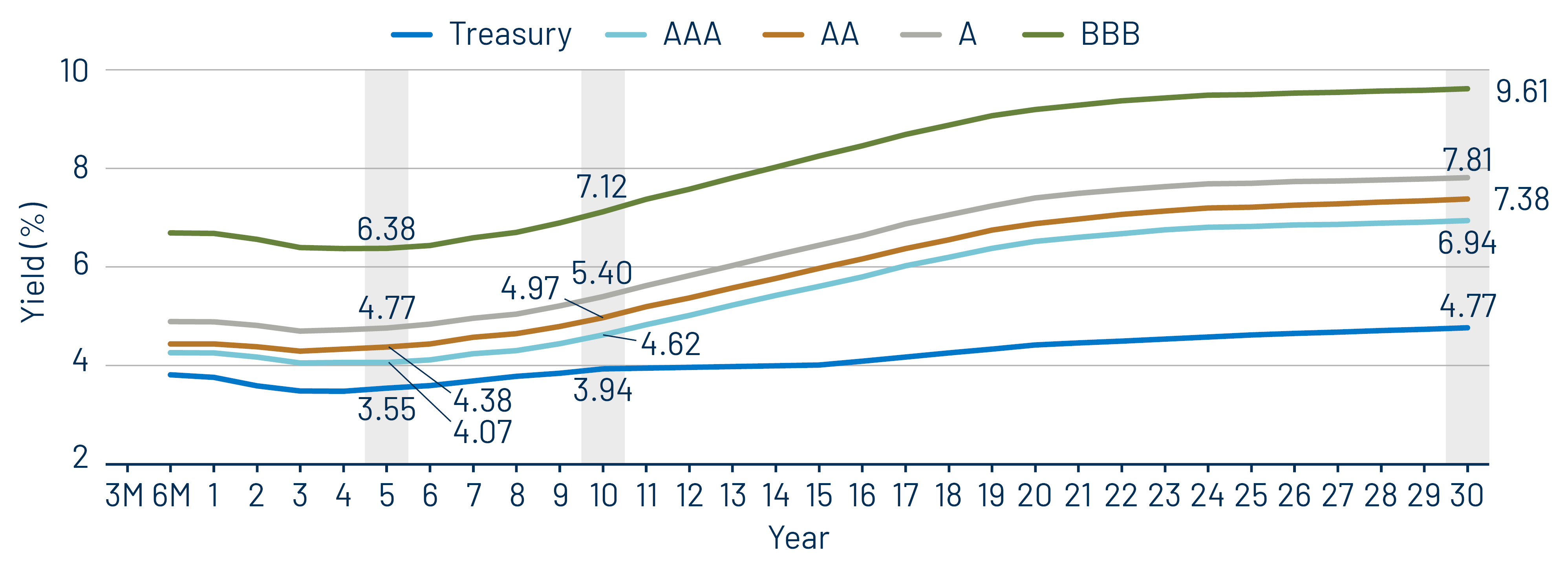

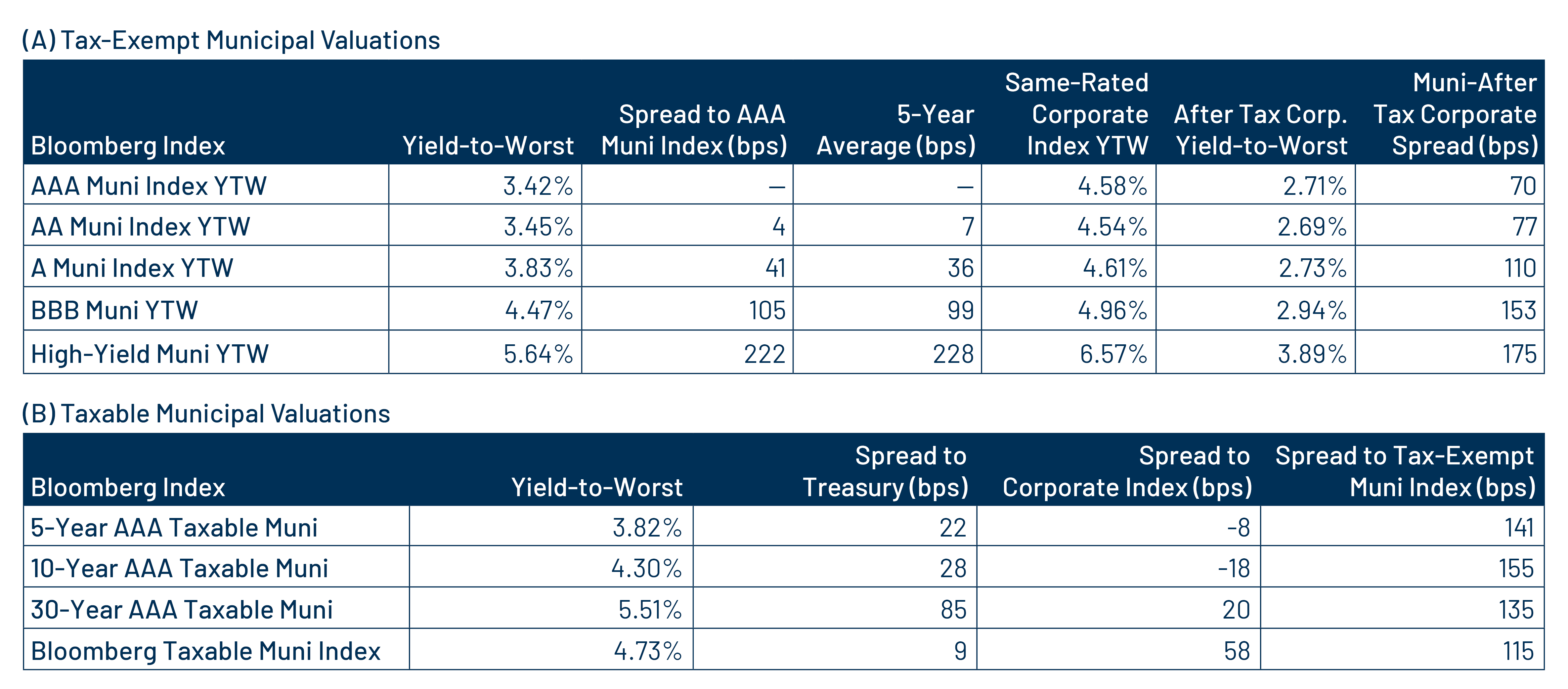

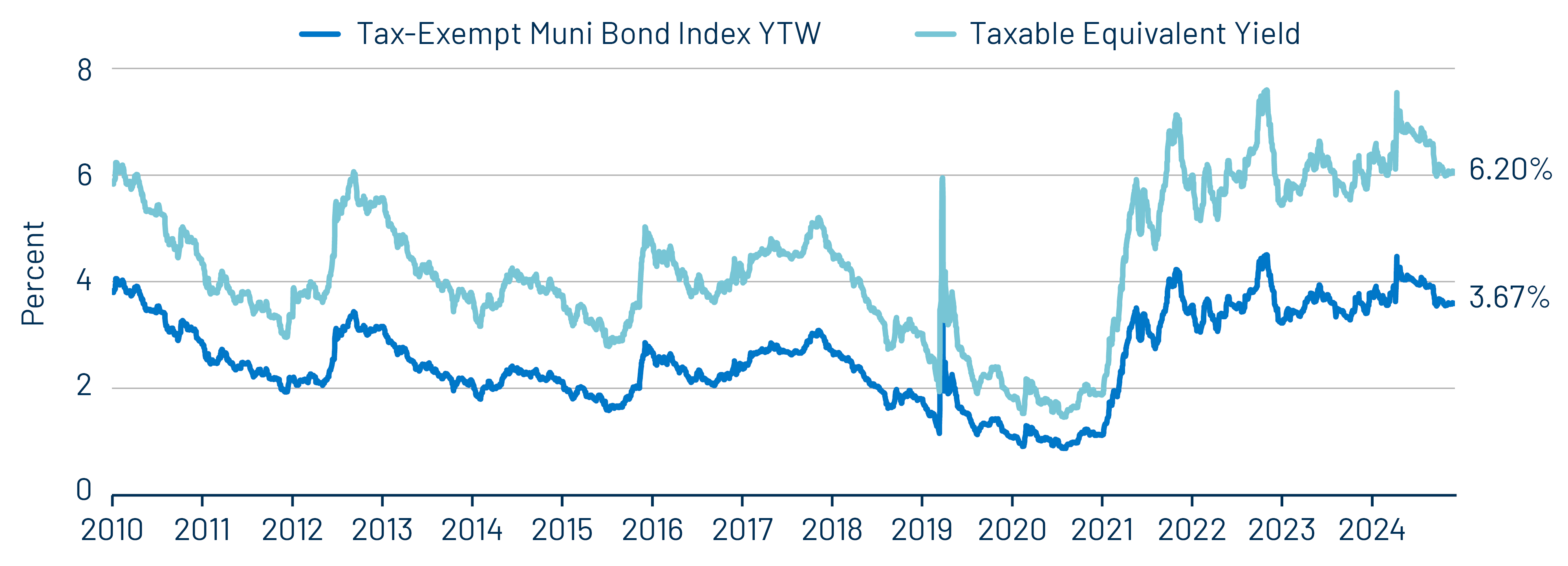

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

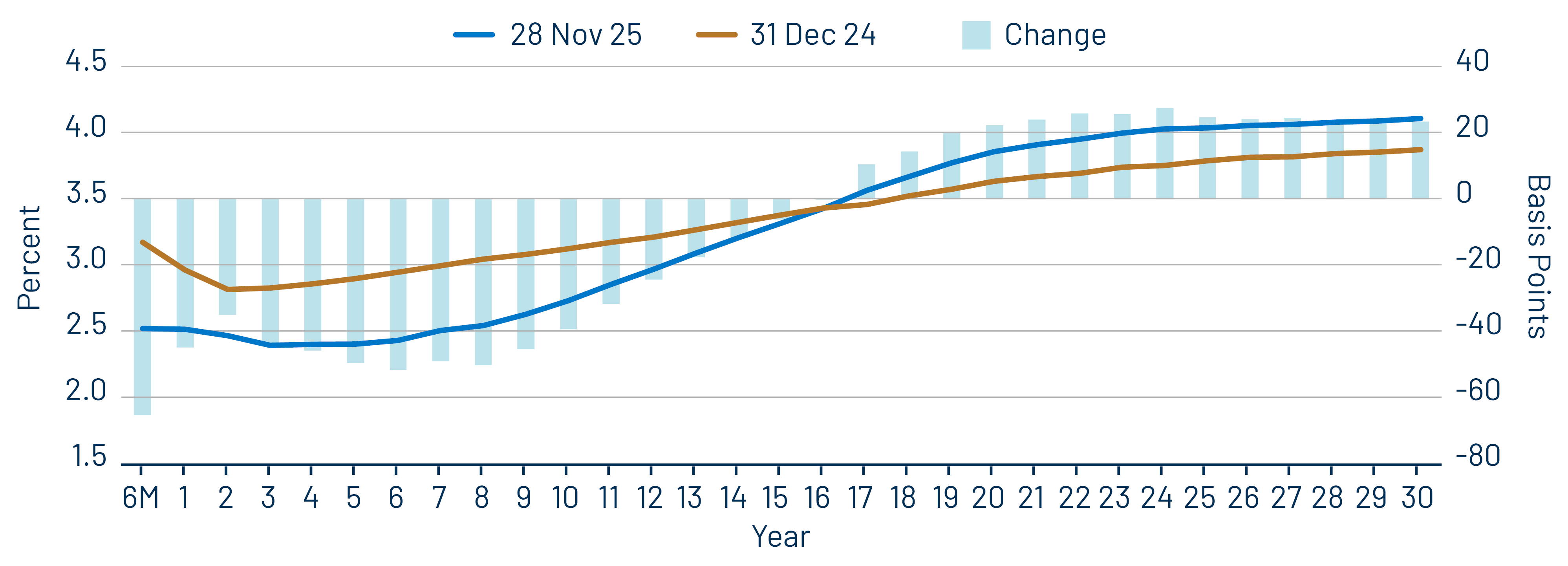

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.