Macros, Markets and Munis

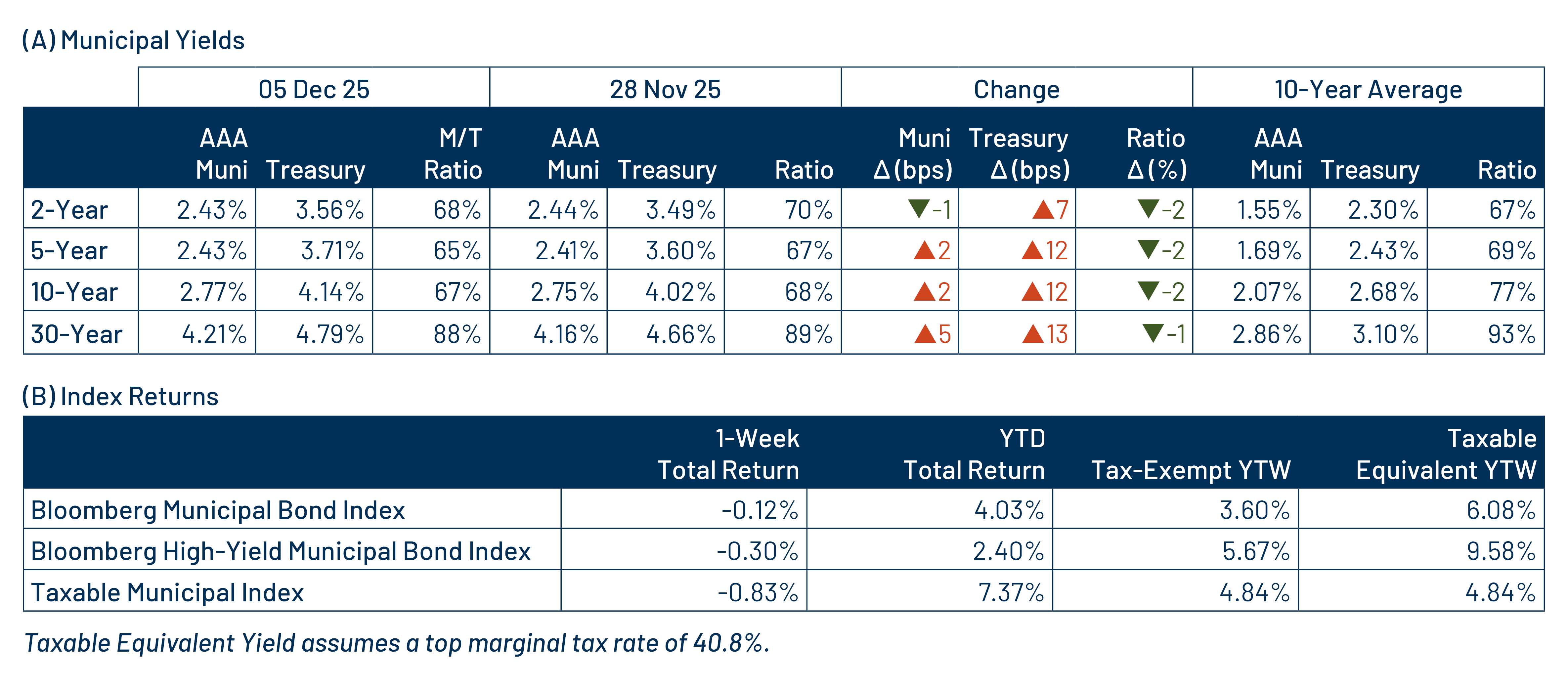

Munis posted positive returns last week and outperformed Treasuries. The Treasury curve sold off during the week, moving 7-12 basis points (bps) higher across the curve. Elevated muni supply was well absorbed by steady demand. The high-grade muni curve outperformed as demand remained steady, with the high-grade muni curve steepening, moving 1 bp lower in short maturities but moving higher in longer maturities. Meanwhile, economic data improved last week with jobless claims coming in lower than expected, the University of Michigan consumer confidence reading moving higher, surpassing expectations, and personal income data also exceeding expectations. On the inflation front, the core Personal Consumption Expenditures (PCE) Index was steady, growing 0.2% month-over-month, in line with expectations. This week we provide a market update for the month of November.

Steady Demand Absorbed an Elevated New-Issue Calendar

Fund Flows ($736 million of net inflows): During the week ending December 3, weekly reporting municipal mutual funds recorded $736 million of net inflows, according to Lipper. Long-term funds recorded $320 million of inflows, intermediate funds recorded $133 million of inflows and the short-term category recorded $162 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $48 billion.

Supply (YTD supply of $552 billion; up 19% YoY): The muni market recorded $18 billion of new-issue supply last week, picking back up to elevated levels following the holiday-shortened week. YTD new-issue supply of $552 billion is 19% higher year-over-year (YoY), with tax-exempt issuance up 20% YoY and taxable issuance up 3% YoY. This week’s calendar is expected to increase to $11 billion. The largest deals include $960 million Black Belt Energy and $688 million Newton, MA transactions.

This Week in Munis: November Market Update

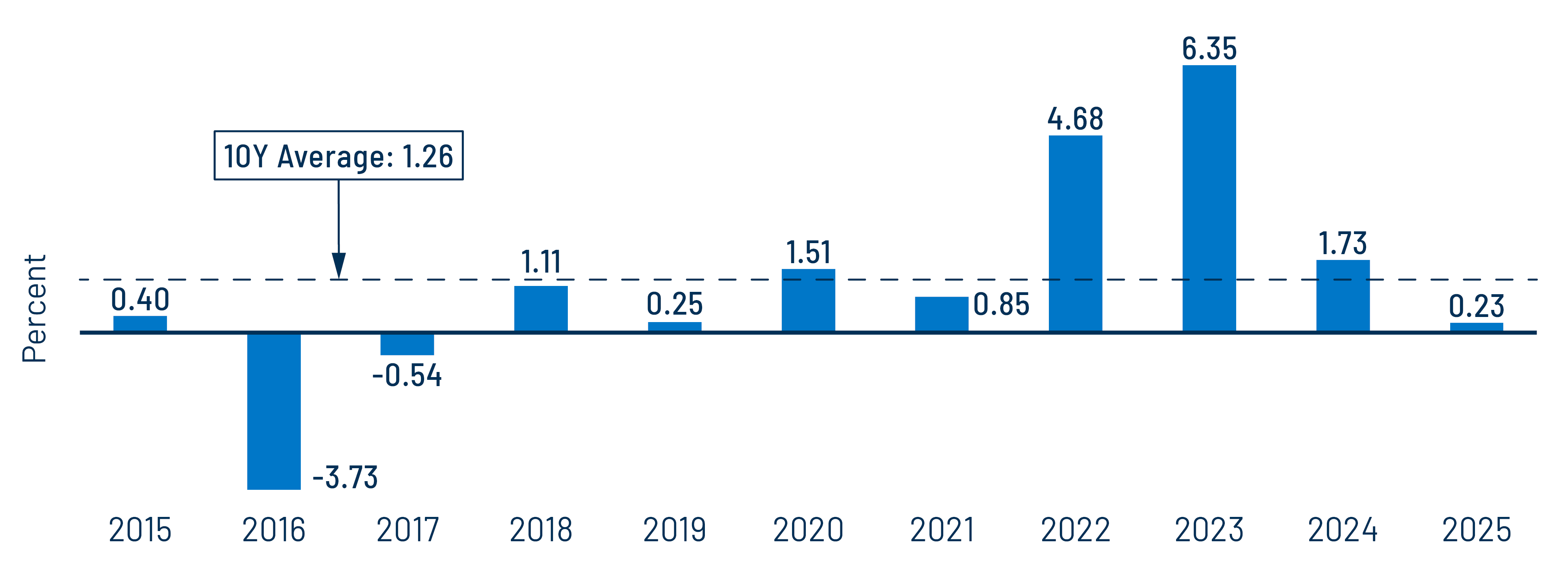

Municipals posted positive returns in November as indicated by the Bloomberg Municipal Bond Index total return of 0.23%, which was below the prior 10-year average November return of 1.16% during this seasonally stronger month. Munis generally underperformed Treasuries and corporates, which returned 0.62% and 0.58%, respectively, with those sectors reacting more favorably to weaker-than-anticipated economic data released during the month.

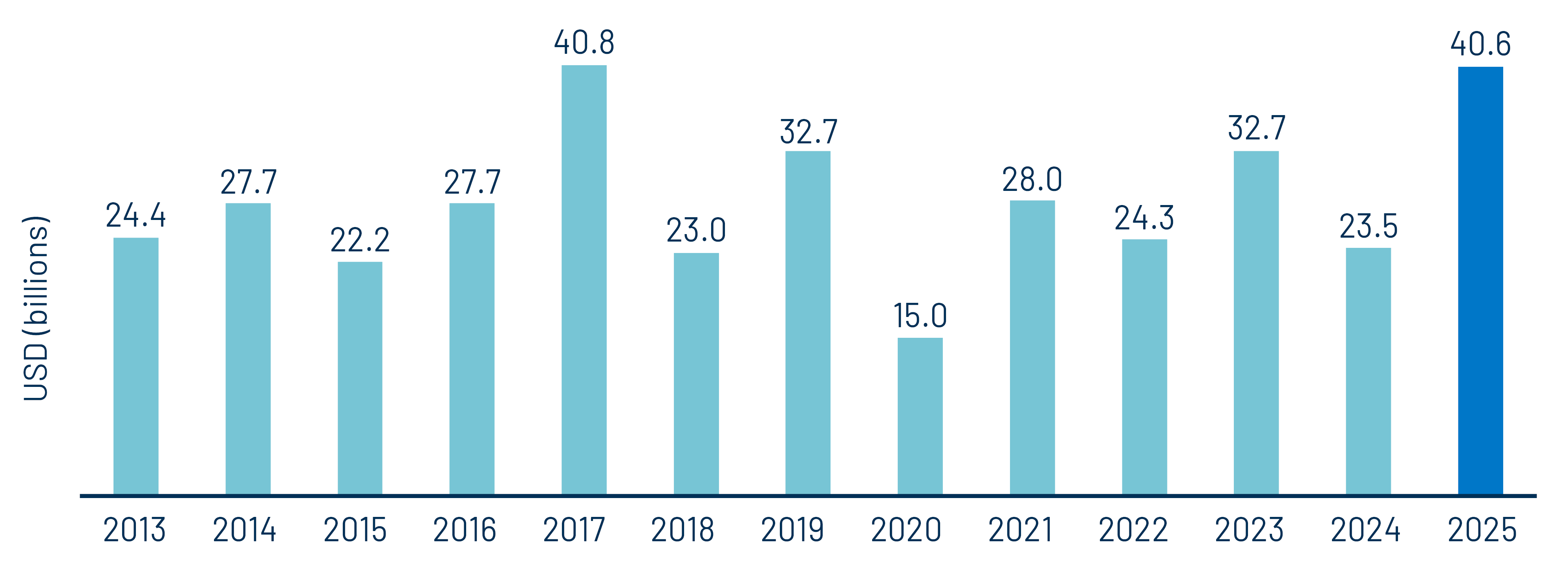

A weaker supply and demand technical backdrop contributed to the underperformance observed in November. New-issue supply maintained the elevated pace seen throughout this record issuance year with total volume reaching $45 billion, nearly double November 2024 levels. The $40.6 billion of tax-exempt supply issued during the month marked the second-highest November tax-exempt issuance level over the past decade. While issuance remained strong, demand slowed heading into year-end. According to Lipper, municipal mutual funds recorded $2.3 billion in net inflows, a notable decline from October’s $6.5 billion level.

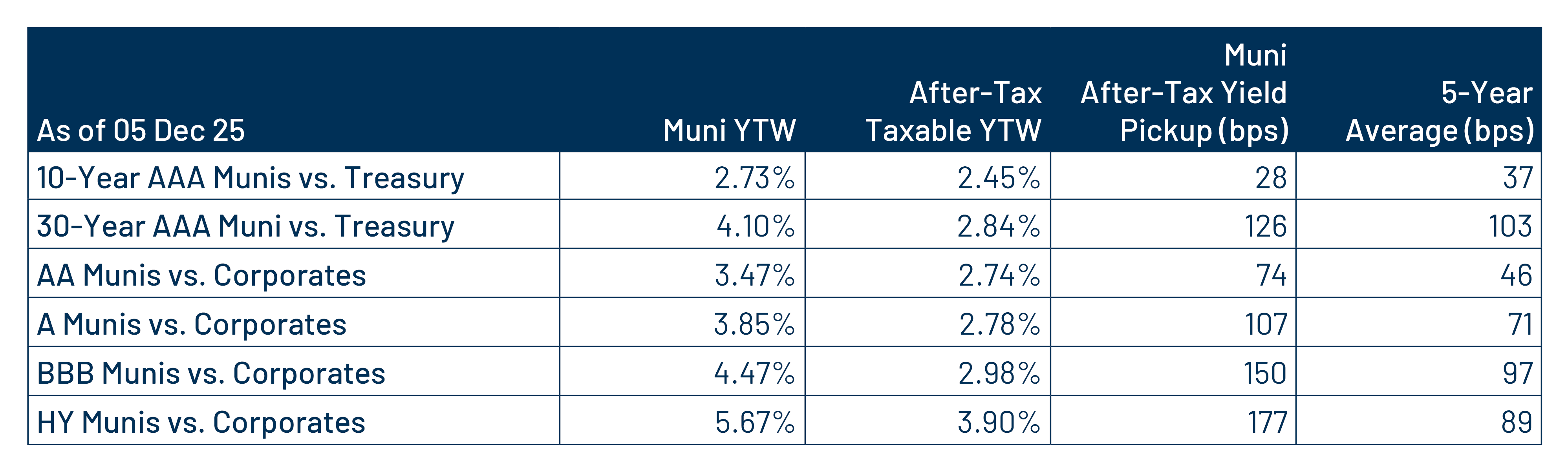

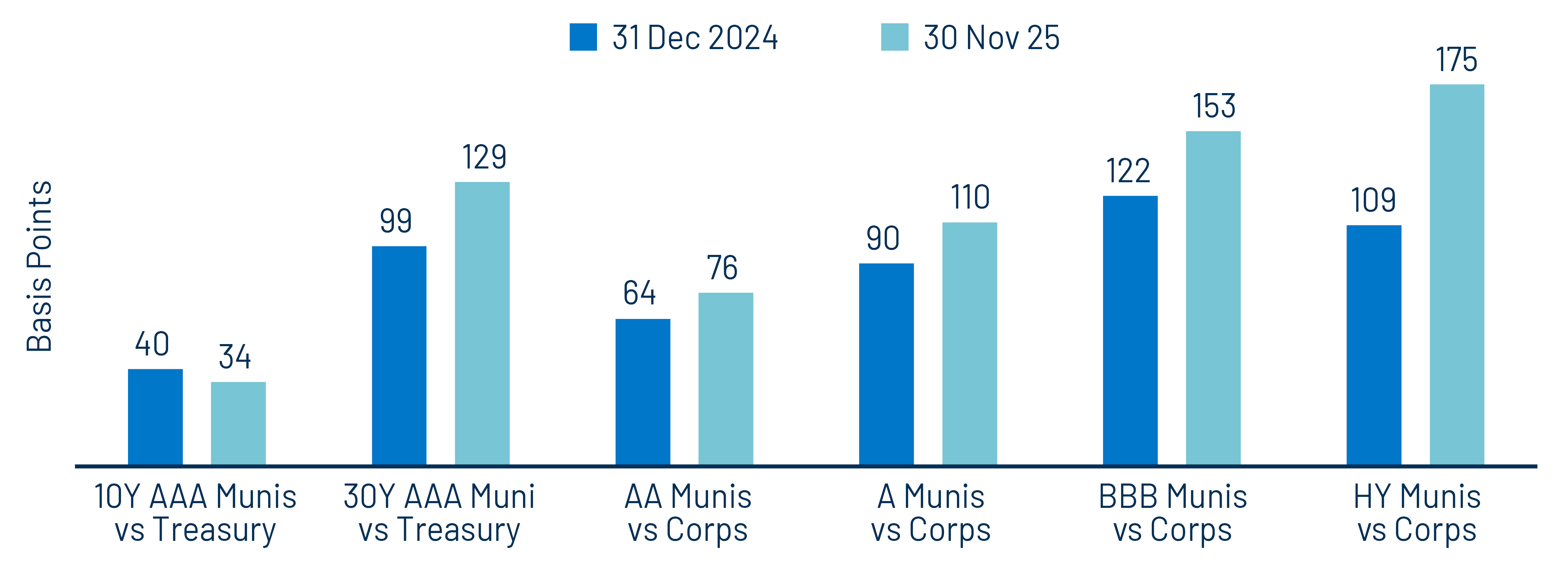

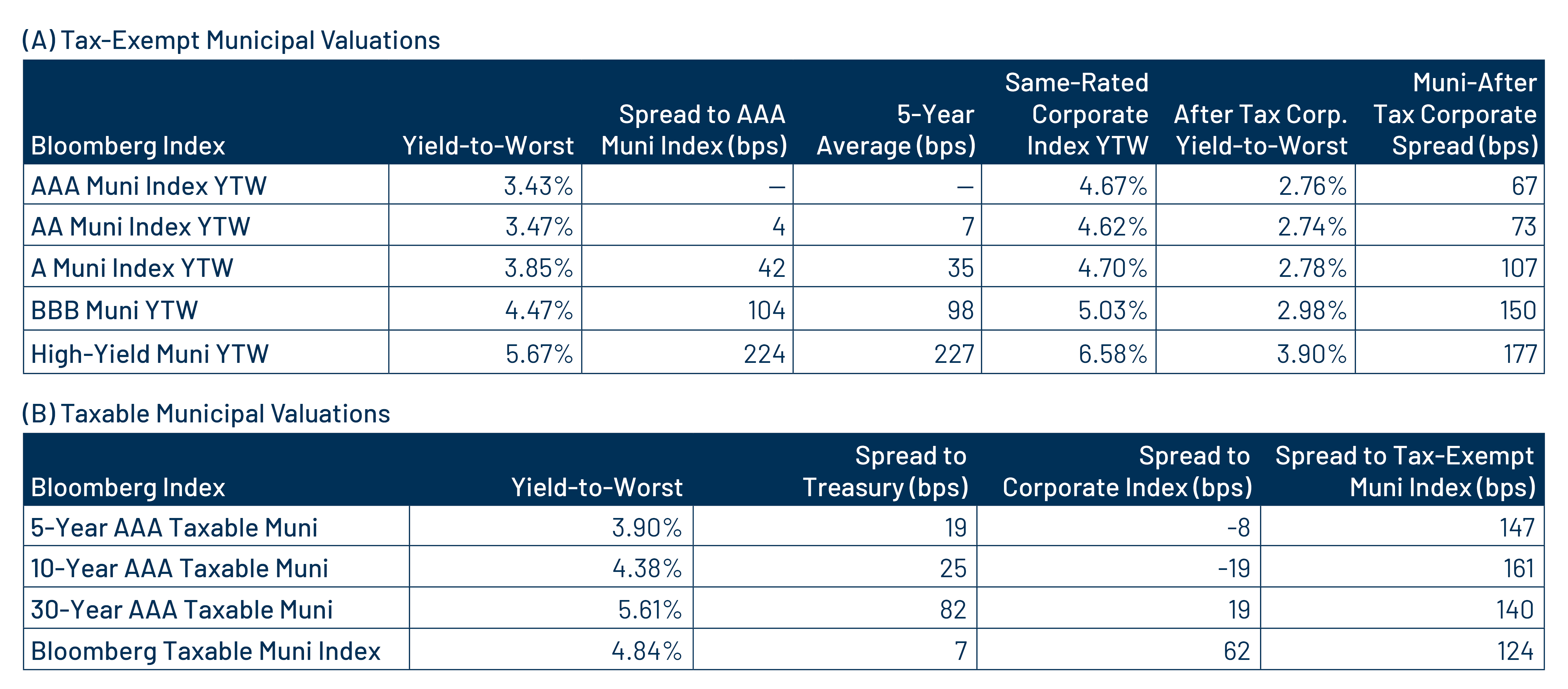

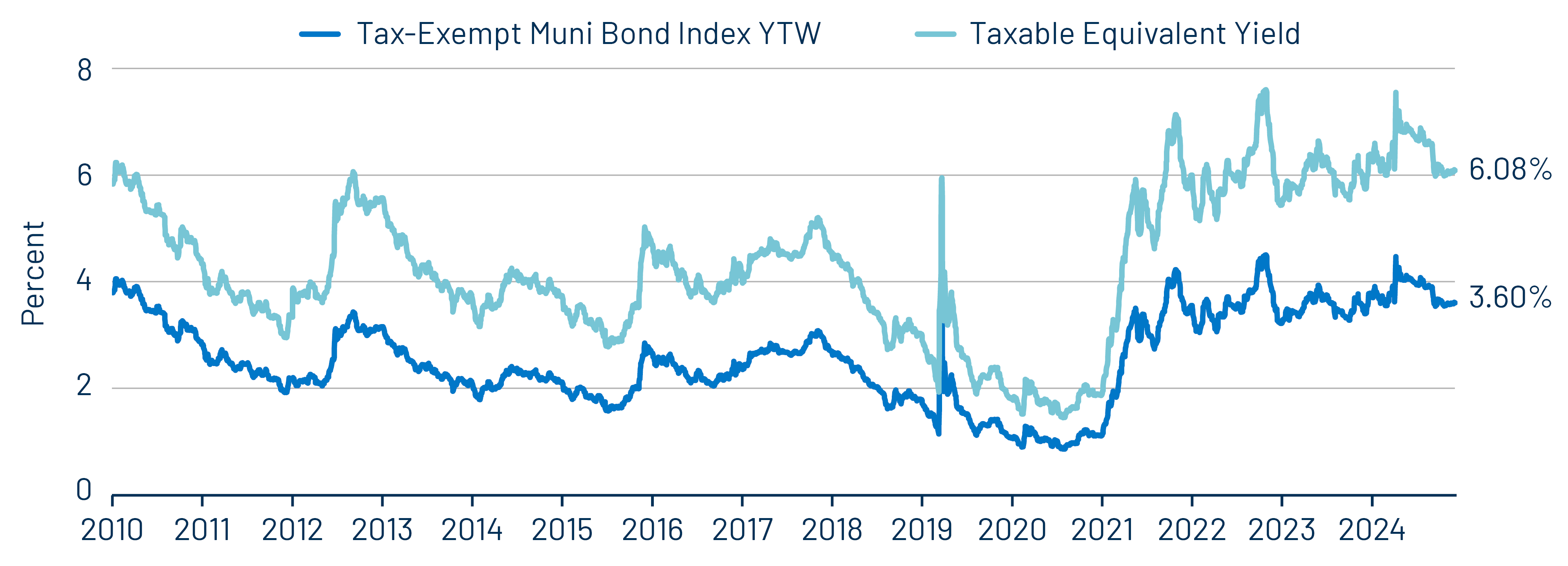

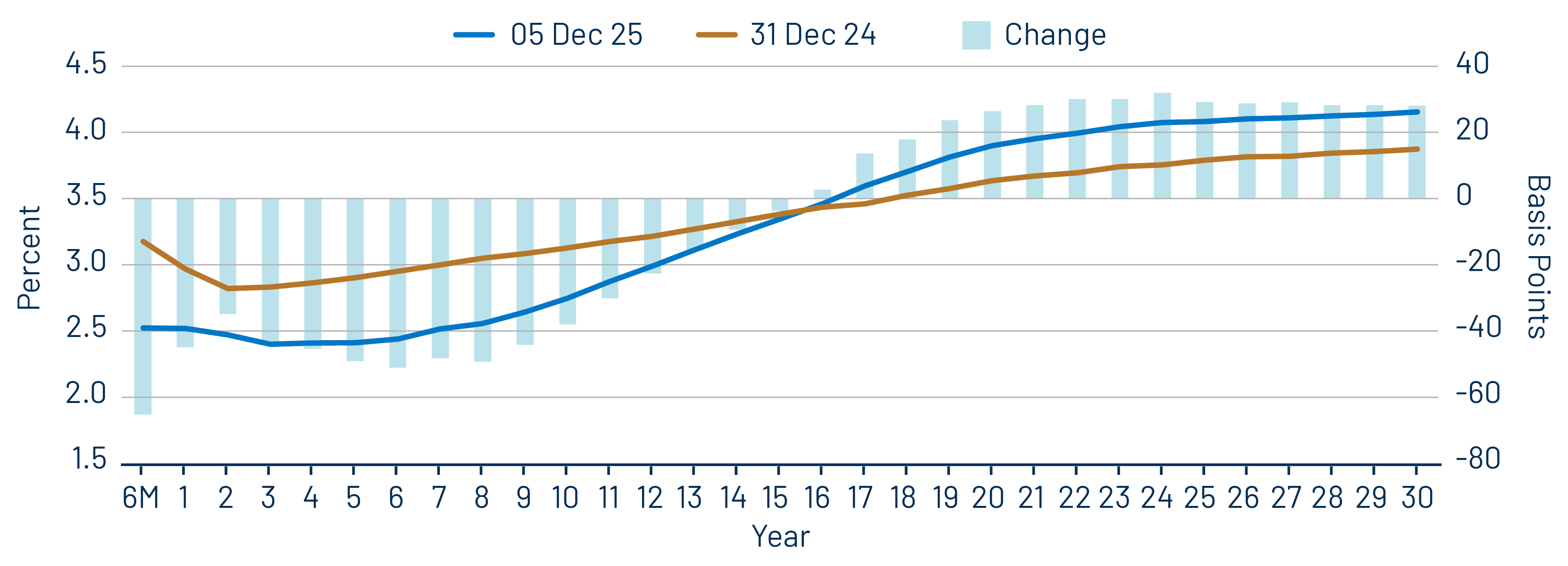

The muni underperformance in November aligns with themes observed throughout much of 2025: weaker technicals, rather than deteriorating fundamentals, have created attractive long-term income opportunities. While yields on the Bloomberg US Treasury and Corporate Indexes declined 63 bps and 57 bps YTD through November 30, 2025, respectively, the Bloomberg Municipal Bond Index yield fell only 16 bps and the Bloomberg Long Municipal Bond Index yield rose 19 bps over the same period. As a result, the after-tax income advantage of munis relative to comparable taxable fixed-income alternatives has increased across most maturities and credit quality structures. We believe this attractive relative value should continue to support steady demand, particularly if the Federal Reserve continues to reduce front-end rates in the near term.

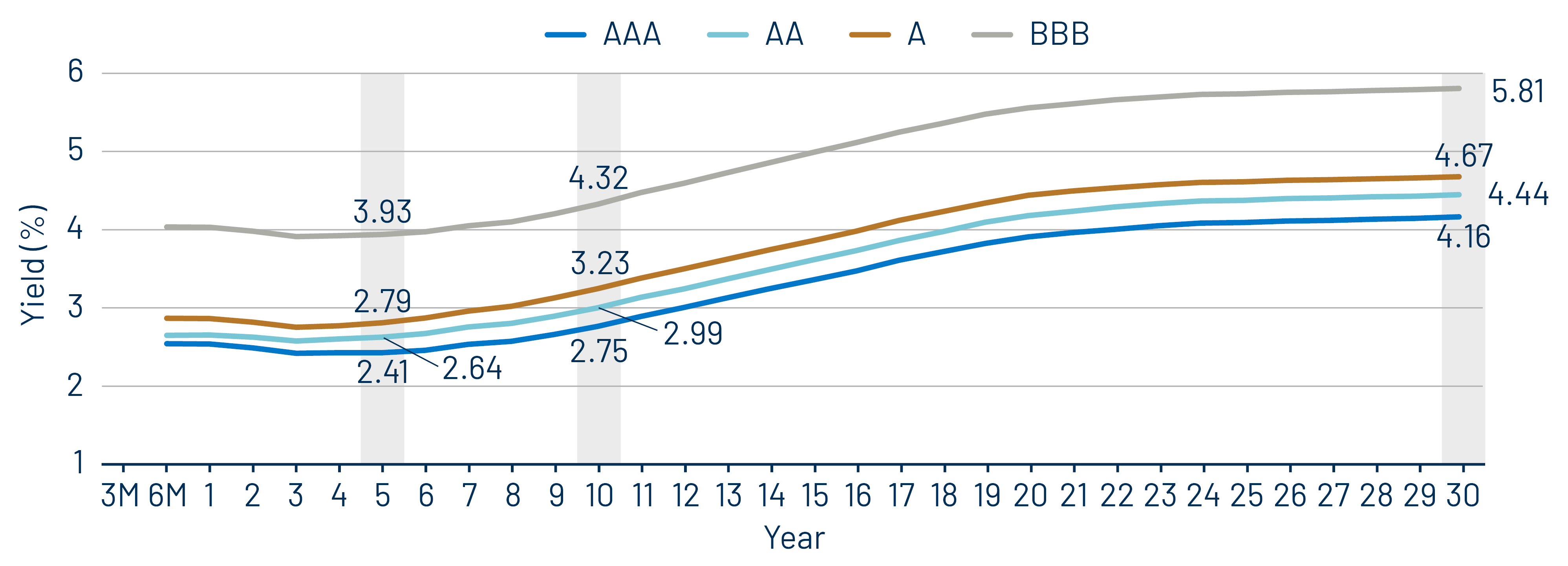

Municipal Credit Curves and Relative Value

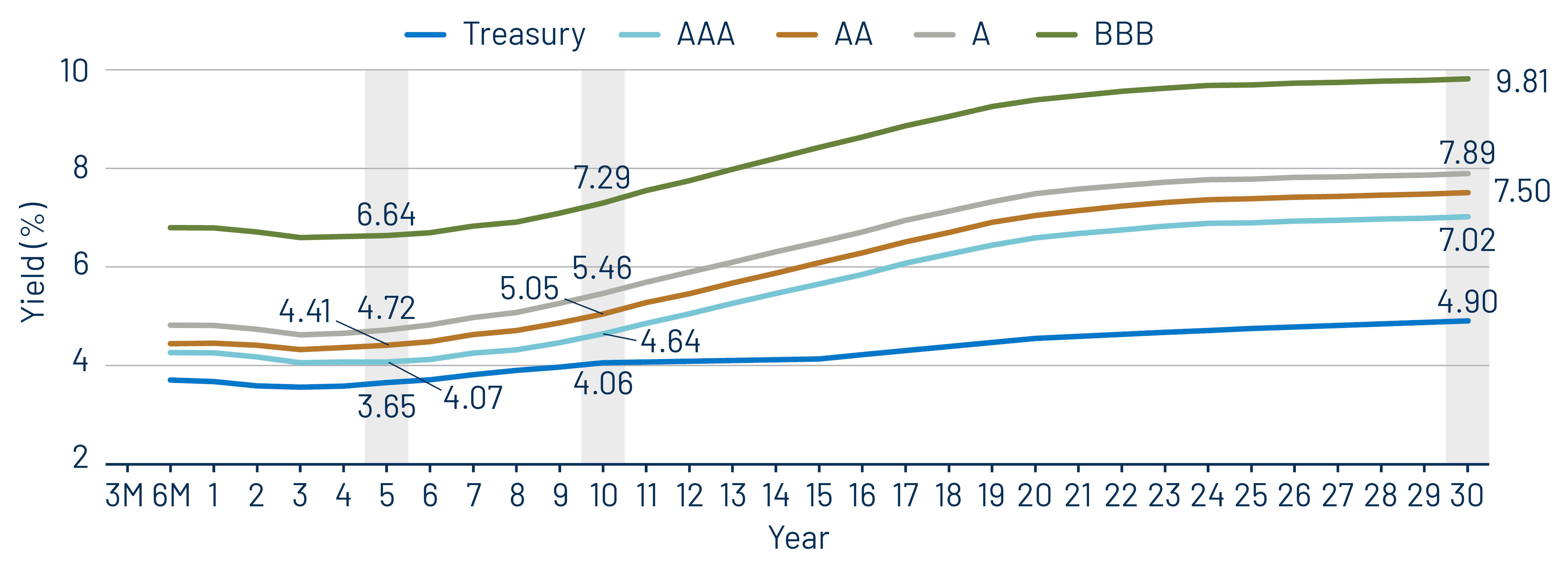

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.