Background

Yields on 5-year USD-denominated investment-grade (IG) Asia credits have risen to attractive levels on the back of reasonable Asia corporate spreads and aggressive Federal Reserve (Fed) rate hikes made in response to an inflation spike following the US economy’s exit from COVID-19. We believe the fed funds rate is close to a peak and sufficiently restrictive to bring the US economy in for a soft landing and to anchor US inflation expectations. Hence, we see this as an opportune time to lock-in attractive yields.

USD Asia bond issuance had been dominated by Chinese issuers, accounting for about 50% of the JP Morgan Asia Credit Investment-Grade Index (JACI IG). However, following Chinese property market downturn, a number of weaker Chinese issuers have exited the JACI IG Index (i.e., have become fallen angels). Further, the pipeline of Chinese issuers tapping the USD Asia credit markets have declined substantially as Chinese issuers find cheaper onshore funding or have little demand for USD due to reduced overseas M&A activities. Hence, the credit quality of the JACI IG Index has since improved with reduced concentration risks.

What Is a Buy and Maintain Portfolio?

A Buy and Maintain Portfolio (BMP) is a bond portfolio set up with a fixed investment period and a final maturity date of typically three to five years. Typically, BMPs are segregated portfolios customized for an institutional investor but can also be implemented in a commingled closed-end vehicle. BMPs are designed to generate income for investors through a portfolio of low interest-rate sensitivity (because debt instruments are held to maturity) and well-diversified credits to minimize individual credit default risks. Consequently, the inception level of income generation and the sustainability of the income payout are critical in assessing both a BMP as well as its investment manager.

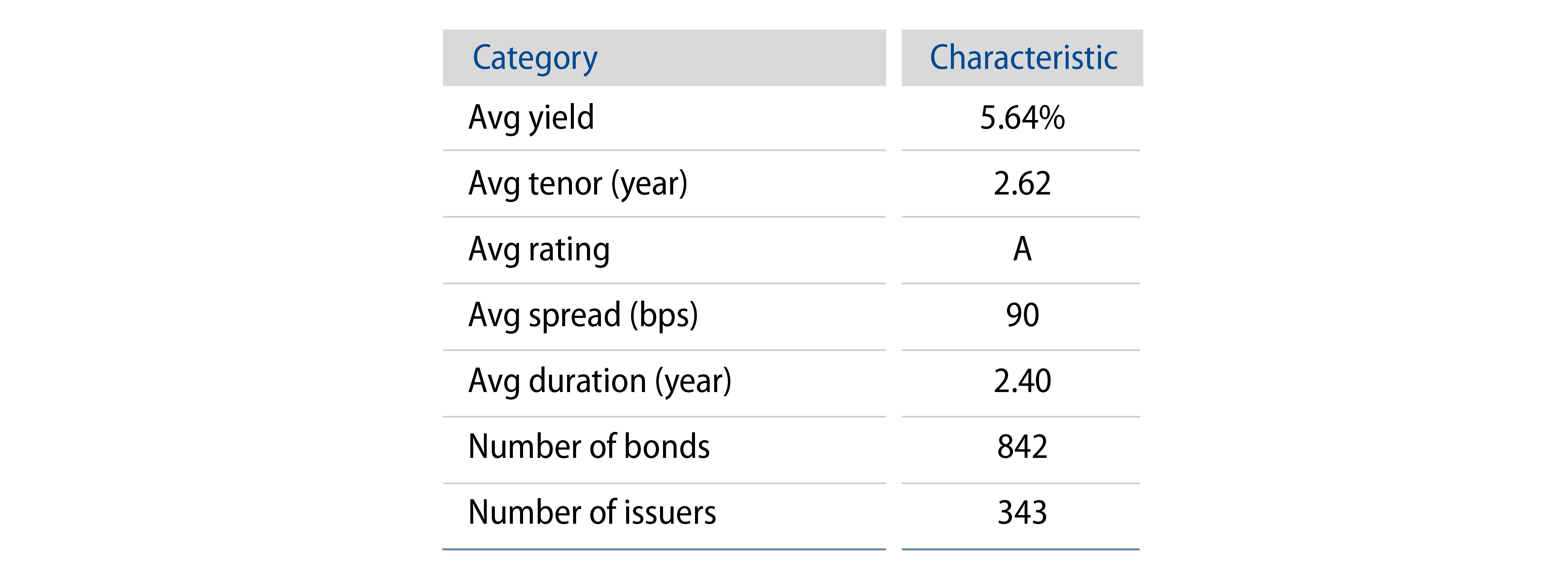

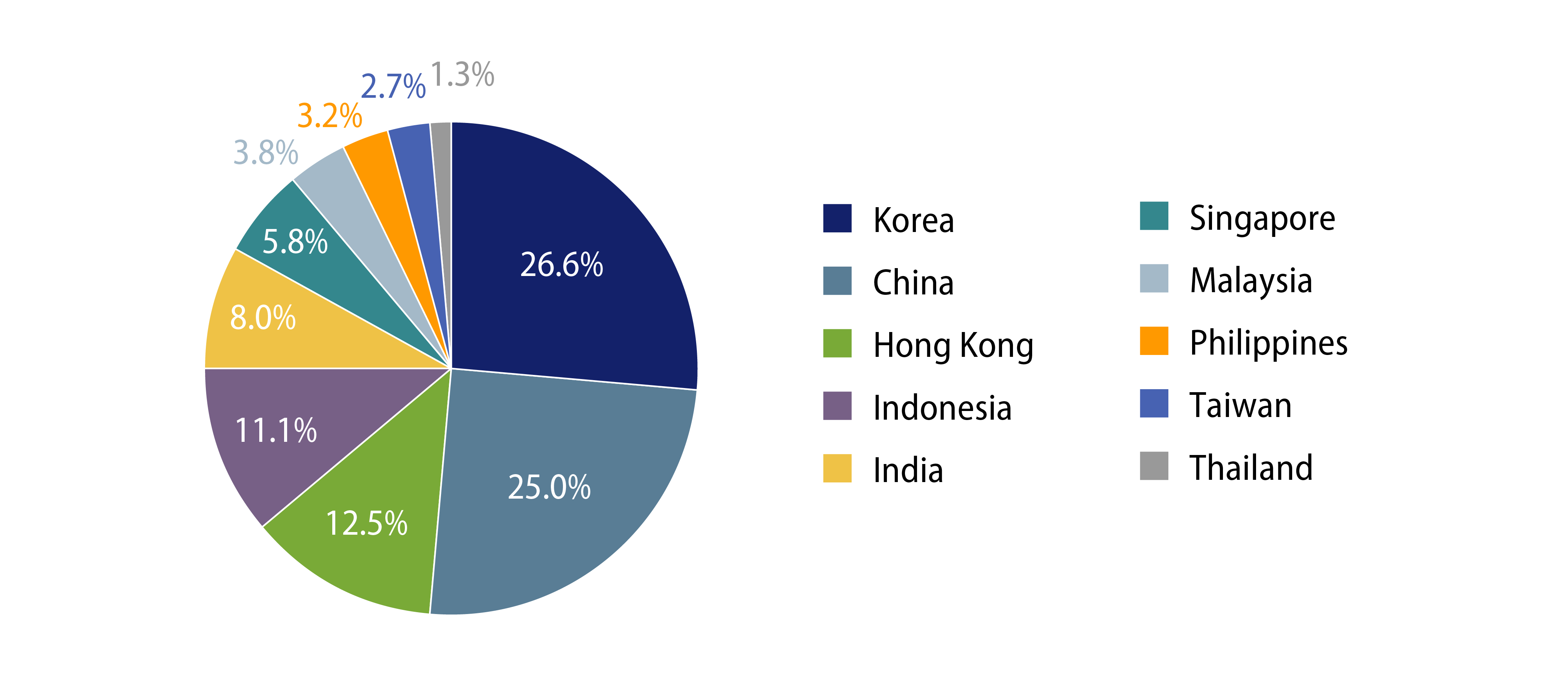

Investment managers will typically work with the client and with custom specifications that meet each client’s income needs. Examples of ways that a BMP can be customized include: maturity date, credit quality, country/sector/issuer size limits and issuer restrictions. Exhibits 1 and 2 summarize the key characteristics of a customised investment universe of USD Asia IG BMP 5-year tenure credits, with the China country weight capped at 25%. A model portfolio can be constructed from the universe via Western Asset’s credit investment process.

Western Asset’s Value-Add in Structuring Asia BMPs

Western Asset views BMPs as less focused on generating alpha through credit trading and duration management. However, the BMP’s twin goals of capital preservation and income generation require our credit analysts/portfolio managers to conduct bottom-up analysis of individual issuers and industries in order to select “safe” credits, and to construct well-diversified portfolios that minimize future credit and reinvestment risk at the inception stage.

Risks Inherent in BMPs

At Western Asset, we consider credit risk and reinvestment risk to be the two greatest threats to a BMP’s future income, so we focus our efforts on managing both in the context of locking in and maintaining attractive yields for the investor. Credit losses obviously put both principal and interest at risk; thus, employing an asset manager with deep credit expertise and a global research footprint is critical. A more subtle problem for BMP investors is reinvestment risk, as coupons and maturities come due and need to be reinvested later in a fund’s life at potentially lower yields. As a result, structuring a BMP to maximize its individual bond maturities while still maintaining adequate portfolio diversification is key.

Conclusion

Under current market conditions, a diversified USD Asia Investment Grade Credit 3-5 Years BMP can be constructed at attractive yields. We believe that this can achieve investors’ twin objectives of income generation with capital preservation. Further, the universe of USD Asia credits has stronger credit quality and less China issuer concentration (Chinese issuer risk is capped at 25%). Western Asset has deep credit expertise in Asia as well as a global research footprint, which enables us to select and manage the USD Asia credit and reinvestment risk to help BMP investors achieve their investment objectives.

Desmond Soon is Senior Portfolio Manager and Head of Investment Management Asia Ex-Japan at Western Asset Management, a specialist fixed-income manager for Franklin Templeton.